No More Recessions?

-

Patrick Watson

Patrick Watson

- |

- April 16, 2024

- |

- Comments

Unexpected questions are valuable. They force you to think fast, which helps new ideas emerge.

Last month, for example, I was on a webinar for Mauldin Economics clients. Our publisher Ed D’Agostino asked the panel what popular ideas about the economy we thought most people were getting wrong.

When my turn came, I said (paraphrasing), “I think we will never again see the kind of mass unemployment that used to happen in recessions.”

In hindsight, maybe “never” was too strong. Another COVID-like scenario might do it. But barring that, we have a different situation than existed in 2008, 2000, and other modern recessions. The new demographic balance is producing a chronic labor shortage.

Thinking about it later, I realized the implications go far beyond employment.

People debate when the next recession will come. I’m not sure recessions (as conventionally understood) are even possible anymore. And if we do get one, it’s not clear if the Federal Reserve’s traditional tools would still work.

This is just a theory. But if it’s right, some big changes are coming.

Ending the Cycle

Like what you're reading?

Get this free newsletter in your inbox regularly on Tuesdays! Read our privacy policy here.

Quick review: The economy grows in a repeating cycle of expansions and recessions. Simplified, it looks something like this:

Source: Economics in Plain English

When the green line rises, consumers feel confident, businesses expand, and jobs are plentiful. All good. But eventually it gets overheated, often becoming inflationary.

Central banks—the Federal Reserve in our case—try to control this by raising interest rates. Usually, they tighten too much. Recession follows as companies lay off workers who then reduce their spending.

(To be clear, these are average conditions. Some people fall behind in expansions or prosper during recessions. But they are exceptions.)

|

After a painful retrenching, the economy expands again. The Fed spurs this by cutting interest rates, which helps businesses expand and rehire the people they laid off. The net effect over long periods (decades) is growth but not in a straight line.

Now, notice how jobs have a key role in this cycle.

The Fed controls inflation by reducing demand. It reduces demand by creating conditions that make businesses fire people. People who lose their income buy less stuff, which forces producers to cut prices.

The fact that inflation-fighting policies usually kill jobs isn’t coincidence. Lost job income is what produces the necessary demand destruction. Tighter credit is just a trigger mechanism.

Labor Imbalance

The business cycle hasn’t been working normally in recent years.

- A pandemic, not Fed tightening, sparked the 2020 recession.

- The 2022 inflation wave came from supply chain snags and a war-driven energy crisis, not excessive demand.

Nonetheless, people keep thinking economic weakness will raise unemployment, forcing the Fed to cut rates. It’s going to happen any month now, they’ve been saying… for years.

Like what you're reading?

Get this free newsletter in your inbox regularly on Tuesdays! Read our privacy policy here.

Yet unemployment stays stubbornly low. Why?

Here’s one reason:

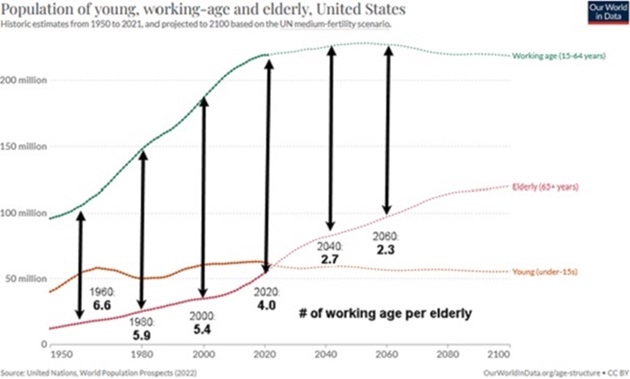

Source: Our World in Data, author’s calculations

The lines in this graph show the US population since 1950, split by working age (15-64, the green line), elderly (65+, red) and children under 15 (yellow). The lines start in 1950 and are projected out to 2100, assuming the UN’s “medium fertility” scenario.

Notice how the ratio of working-age to elderly Americans has been shrinking. That’s because people are a) living longer and b) having fewer children. The ratio fell from 6.6 workers per elderly person in 1960 to 4.0 in 2020.

The pace is accelerating, too. It will drop to around 3.6 by the end of this year.

That means today’s economy has more non-working people to support and fewer workers to produce what they need. Barring sharp changes in fertility and/or life expectancy, the ratio will keep dropping for decades.

So how are fewer workers going to support more consumers?

Labor-saving technologies are one answer. That’s happening and it helps. But many of the goods and services elderly people need—food, healthcare, personal assistance, etc.—are hard to automate. AI systems excel at processing information. They aren’t great at helping grandma take a bath.

Millions of service jobs are highly secure, almost regardless of economic conditions, because demand for them is “non-discretionary.” This is new. It also means the Fed can’t easily cool the economy by generating layoffs.

Bulletproof Economy?

So back to the original question. How do you have a recession if unemployment can’t rise?

Like what you're reading?

Get this free newsletter in your inbox regularly on Tuesdays! Read our privacy policy here.

It doesn’t seem possible. Occasional weakness in specific sectors? Sure. It happened in tech last year, for instance.

But in the big picture, an economy with…

- Structurally stable, labor-intensive aggregate demand and

- Structurally shrinking labor supply

…is kind of bulletproof. Or at least recession-proof.

That’s not entirely bad. But if it’s right, we can’t count on monetary policy to bail us out of crisis. And eventually, some kind of crisis will come.

We all gripe about the Fed. The era before modern central banks wasn’t all sunshine and roses, though. Economic imbalances resolved themselves through bank runs, hyperinflation, deep depressions, and sometimes war.

We don’t want to go back there. Yet a central bank that can’t suppress demand—because it can’t kill enough jobs—is largely powerless.

This fits what we’ve seen recently. Those aggressive 2022‒2023 rate hikes had almost no effect on employment. Inflation, while lower than it was, hasn’t gone away.

If the Fed’s main policy tools don’t work anymore… what’s next?

See you at the top,

Like what you're reading?

Get this free newsletter in your inbox regularly on Tuesdays! Read our privacy policy here.

Patrick Watson

@PatrickW

|

P.S. If you like my letters, you’ll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.

Patrick Watson

Patrick Watson