Economists Are (Still) Clueless

-

John Mauldin

John Mauldin

- |

- June 15, 2013

- |

- Comments

- |

- View PDF

Economists Are (Still) Clueless

The Revenge of the Minsky Moment

Monaco, Cyprus, Croatia, Switzerland, and Las Vegas

Economists set themselves too easy, too useless a task if in tempestuous seasons they can only tell us that when the storm is past the ocean is flat again.

- John Maynard Keynes, A Tract on Monetary Reform

There can be few fields of human endeavor in which history counts for so little as in the world of finance. Past experience, to the extent that it is part of memory at all, is dismissed as the primitive refuge of those who do not have insight to appreciate the incredible wonders of the present.

- John Kenneth Galbraith

Hitler must have been rather loosely educated, not having learned the lesson of Napoleon's autumn advance on Moscow.

- Sir Winston Churchill

US GDP has been slowly ramping up, only to fall back and then try once more to bring us back to the '90s. Stocks markets are volatile but seemingly moving higher in most of the developed world, except for Japan, where the current 20% drop comes hard on the heels of one of their frequent "end of the bear market forever" rallies of almost 90% – how many of those have we seen over the last 24 years? Europe is mostly in recession or Muddling Through with very slow growth. I continue to read from those who know China intimately that there is a real crisis brewing there. And over the last four weeks I have highlighted how desperate the situation is in Japan.

The main obsession in the US seems to be whether and when the Fed may stop its current round of massive QE. Every hint of "tapering" spurs volatility in the markets. If you are a forex (foreign exchange) trader, you are left breathless at the recent moves, sometimes a whole order of magnitude (10 times) larger than average. Get used to it: currency wars are likely to be a feature of the landscape for the rest of this decade. (My friend Mohamed El-Erian, CEO of PIMCO, corrected me on stage recently, telling me the polite term du jour is "currency tensions." And compared to what I think is coming, we really are just in the tension phase. Later we will get to skirmishes and then full-fledged currency combat.)

At the same time, there are some things to be sanguine about, at least in the US. Corporate profits are at all-time highs. The housing market is finally doing well in most parts of the country, adding jobs and boosting GDP. We continue to find more oil and gas seemingly everywhere we look. There are no political races this summer to spoil the mood, since it's too early to for anyone to seriously run for president in 2016.The economic forecasts of mainstream economists are quite positive, if not enirely optimistic, reflecting the current data. Should we not take heart from that? Alas, no. I have been working the last few months with my co-author of Endgame, Jonathan Tepper, on a longer paper in which we discuss the economic affairs of the world. One of our pet amusements is to research just how bad economists really are at forecasting. (Of course, we ourselves get branded with that economist label from time to time, although most serious economists would rather not be associated with us.)

This week we look at some of our recent musings on that topic, triggered by a letter from a very serious economist who took umbrage when I wrote disparagingly about economists and forecasting a couple months ago.

But first, I announced last week that the initial group of videos from the 2013 Strategic Investment Conference is available. Well, now the final group of conference videos has also been uploaded. These videos feature some incredible speakers, including Nouriel Roubini, Charles Gave, Ian Bremmer, and my humble self. As a Mauldin Circle member, you can access the videos by logging in to your "members only" area of the Altegris website, www.altegris.com. Then click on the "SIC 2013" link in the upper left corner to view the videos and more. If you have forgotten your login information, simply click "Forgot Login?" and your information will be sent to you.

If you are not already a Mauldin Circle member, the good news is that this program is completely free. In order to join, you must, however, be an accredited investor. Please register here to be qualified by my partners at Altegris and added to the subscriber roster. Once you register, an Altegris representative will call you to provide access to the videos, transcripts, and summaries from selected speakers at our 2013 conference. My Altegris partners and I have worked hard to enhance the Mauldin Circle program, which provides exclusive access to alternative investment managers and other thought leaders.

Now, let's turn to that letter. Professor John Seater, a distinguished gentleman and economist from North Carolina State University, disagreed with my dismal view of economists and forecasting a couple of months back ("Assume a Perfect World").

I actually do read the comments to my letters (I learn a lot), and I understood his irritation. I went to his website (I find an amazing number of my readers can be found writing in their own venues and often write intriguingly) and read some of his papers. I found myself really liking them, especially the one on the relationship between growth and regulation. I would highly recommend it to all the congressional staffers who read my letter (and I know there are a lot of you). And then show it to your bosses. Make them read it. (Warning: you may have to translate it for them. It is written in a subdialect of English called academic economics. I'm not perfectly fluent in it myself, but I can get most of it if I read slowly.)

Here's a quick sample from the paper's introduction:

We find that regulation added since 1949 has reduced the aggregate growth rate on average by about two percentage points over our sample period. As usual with the compound effect of growth rates, the accumulated effect of a moderate change in the growth rate leads to large effects on the level over time. In particular, our estimates indicate that annual output by 2005 is about 28 percent of what it would have been had regulation remained at its 1949 level.

(You can read the paper here, and the rest of his recent publications are here. I should actually do a shorter letter on the regulation and growth topic, or even better, get the professor to write one.)

As a professor of economics (macroeconomics at that), I find this article multiply irritating.

First, about forecasting. It is always easy to poke fun at economic forecasts, especially because they usually turn out to be wrong, often by a large margin. However, before laughing them off, think about what is being asked of those forecasts and the economists making them by considering the following analogy. I presume that most of you reading this own a car and have a license to drive it. The license certifies you to be minimally competent drivers, sort of the way a Ph.D. certifies an economist to have a minimal command of economics. Nonetheless, it is very easy to prove that you are all incompetent fools who know nothing about how a car works or how to drive it and thus to prove that drivers' licenses are a big joke. Answer the following simple question: What will be the Mercator grid coordinates of your car exactly 2,190 hours from now (that's three months), what direction will it be traveling, and how fast will it be going? You obviously don't know. I have just proven that you are an incompetent driver and a fool deserving of ridicule because you claim to know the basics of how a car works and how it is to be used.

Asking an economist to predict where GDP (a far, far more complicated object than any automobile) will be in 3 months or a year and then ridiculing him for getting it wrong is exactly the same. An economist can tell you a lot about what makes GDP move around. Asking him to predict where GDP will be some months in the future, what direction it will be going, and how fast it will be going that way is very different. It is asking for an unconditional forecast without providing any information about what the driver (the American people and their government) wants to do, whether he will step on the brake or the accelerator, whether he will have the gears in forward or reverse, and so on. Of course economists get it wrong, and often wildly so, just the way you can't answer my question about your car.

Actually, professor, it is not the same. If I make a decision to do so, I can tell you with pretty good precision where my car will be in three months and at what speed it will be traveling. I can also give you a 98% probability of where I will be on Christmas Day, 2013.

But we do not ask economists to forecast the precise location of the economy a year hence. Just getting the direction (north or south?) right would be a good start.

The problem is that economists take these predictions so seriously, and so do politicians and investors. I think you might agree that the statistical probability that we will not have a recession in the US for the rest of the decade is quite low, yet not one budget projection assumes a slowdown, let alone a recession, which would absolutely devastate any budget as far as deficits are concerned. We act as if the business cycle has been repealed by an act of Congress.

I understand why we do forecasts. As humans, citizens, politicians, businessmen, and investors, we have to plan. I am guilty of making forecasts myself. However, if we do not want to be judged on our forecasting abilities, then we should not prognosticate, at least not in public. And we certainly shouldn't make our predictions sound so certain to the general public.

And with that as a set-up (and with apologies to the professor, who went on to list other irritating points in my April 13 letter), let's turn to a relevant excerpt from the paper that Jonathan Tepper and I are working on.

Economists Are (Still) Clueless

In November of 2008, as stock markets crashed around the world, the Queen of England visited the London School of Economics to open the New Academic Building. While she was there, she listened in on academic lectures. The Queen, who studiously avoids controversy and almost never lets people know what she's actually thinking, finally asked a simple question about the financial crisis: "How come nobody could foresee it?" No one could answer her.

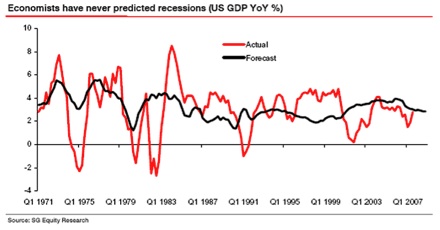

If you've suspected all along that economists are useless at the job of forecasting, you would be right. Dozens of studies show that economists are completely incapable of forecasting recessions. But forget forecasting. What's worse is that they fail miserably even at understanding where the economy is today. In one of the broadest studies of whether economists can predict recessions and financial crises, Prakash Loungani of the International Monetary Fund wrote very starkly, "The record of failure to predict recessions is virtually unblemished." He found this to be true not only for official organizations like the IMF, the World Bank, and government agencies but for private forecasters as well. They're all terrible. Loungani concluded that the "inability to predict recessions is a ubiquitous feature of growth forecasts." Most economists were not even able to recognize recessions once they had already started.

Like what you’re reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

In plain English, economists don't have a clue about the future.

If you think the Fed or government agencies know what is going on with the economy, you're mistaken. Government economists are about as useful as a screen door on a submarine. Their mistakes and failures are so spectacular you couldn't make them up if you tried. Yet now, in a post-crisis world, we trust the same people to know where the economy is, where it is going, and how to manage monetary policy.

Central banks say they will know the right time to end the current policies of quantitative easing and financial repression and when to shrink the bloated monetary base. However, given their record at forecasting, how will they know? The Federal Reserve not only failed to predict the recessions of 1990, 2001, and 2007, it also didn't even recognize them after they had already begun. Financial crises frequently happen because central banks cut interest rates too late and hike rates too soon.

Trusting central bankers now is a big bet that (1) they'll know what to do, (2) they'll know when to do it. Sadly, given the track record, that is not a good wager. Unfortunately, the problem is not that economists are simply bad at what they do; it's that they're really, really bad. They're so bad that it cannot even be a matter of chance. The statistician Nate Silver points this out in his book The Signal and the Noise:

Indeed, economists have for a long time been much too confident in their ability to predict the direction of the economy. If economists' forecasts were as accurate as they claimed, we'd expect the actual value for GDP to fall within their prediction interval nine times out of ten, or all but about twice in eighteen years.

In fact, the actual value for GDP fell outside the economists' prediction interval six times in eighteen years, or fully one-third of the time. Another study, which ran these numbers back to the beginning of the Survey of Professional Forecasters in 1968, found even worse results: the actual figure for GDP fell outside the prediction interval almost half the time. There is almost no chance that economists have simply been unlucky; they fundamentally overstate the reliability of their predictions.

So economists are not only generally wrong, they're overly confident in their bad forecasts.

If economists were merely wrong at betting on horse races, their failure would be amusing. But central bankers have the power to create money, change interest rates, and affect our lives in multiple ways – and they don't have a clue.

Despite this, they remain perennially confident. There's no overestimating the hubris of central bankers. On 60 Minutes in December, 2010, Scott Pelley interviewed Fed Chairman Ben Bernanke and asked him whether he would be able to do the right thing at the right time. The exchange was startling (at least to us):

Pelley: Can you act quickly enough to prevent inflation from getting out of control?

Bernanke: We could raise interest rates in 15 minutes if we have to. So, there really is no problem with raising rates, tightening monetary policy, slowing the economy, reducing inflation, at the appropriate time. Now, that time is not now.

Pelley: You have what degree of confidence in your ability to control this?

Bernanke: One hundred percent.

There you have it. Bernanke was not 95% confident, he was not 99% confident – no, he had zero doubts about his ability to know what is going on in the economy and what to do about it. We would love to have that sort of certainty about anything in life.

We're not just picking on Bernanke; we're picking on all central bankers who think they're infallible. The Bank of England has had by far the largest QE program relative to the size of its economy (though the Bank of Japan is about to show it a thing or two). It also has the worst forecasting track record of any bank, and the worst record on inflation. Sir Mervyn King, the head of the Bank of England, was asked if it would be difficult to withdraw QE. He very confidently replied, "I have absolutely no doubt that when the time comes for us to reduce the size of our balance sheet that we'll find that a whole lot easier than we did when expanding it." (Are central bankers just naturally more overconfident than regular human beings, or are they smoking some powerful stuff at their meetings?)

Let's see whether this sort of absolute certainty is in any way warranted.

In his book Future Babble, Dan Gardner writes that economists are treated with the reverence the ancient Greeks bestowed on the Oracle of Delphi. But unlike the vague pronouncements from Delphi, economists' predictions can be checked against the future, and as Gardner says, "Anyone who does that will quickly conclude that economists make lousy soothsayers."

The nearsightedness of economists is nothing new. In 1994 Paul Ormerod wrote a book called The Death of Economics. He pointed to economists' failure to forecast the Japanese recession after their bubble burst in 1989 or to foresee the collapse of the European Exchange Rate Mechanism in 1992. Ormerod was scathing in his assessment of economists: "The ability of orthodox economics to understand the workings of the economy at the overall level is manifestly weak (some would say it was entirely non-existent)."

When most people think of economic forecasts, they almost always think of recessions, while economists think of forecasting growth rates or interest rates. But the average man in the street only wants to know, "Will we be in a recession soon?" And if the economy is actually in a recession he wants to know, "When will it end?" The reason he cares is that he knows recessions mean job cuts and firings.

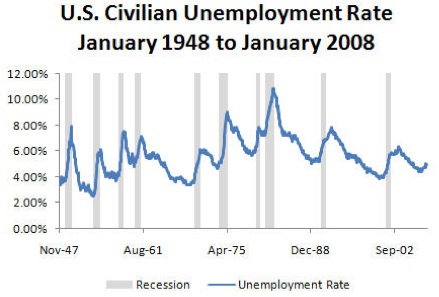

Recessions lead to falls in GDP and spikes in the unemployment rate:

Unfortunately, economists are of little use to the man in the street. If you look at the history of the last three recessions in the United States, you will see that the inability of economists and central bankers to understand the state of the economy was so bad that you might be tempted to say they couldn't find their derrieres with both hands.

Like what you’re reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

Economists have yet to corrrectly call a recession:

Let's remind ourselves what a recession is and how economists decide that one has started. A recession is a downturn in economic activity. Normally, a recession means unemployment goes up, GDP contracts, stock prices fall, and the economy weakens. The lofty body that decides when a recession has started or ended is the Business Cycle Dating Committee of the National Bureau of Economic Research. It is packed with eminent economists – all extremely smart people. Unfortunately, their pronouncements are completely unusable in real time. Their dating of recessions is authoritative and more or less accurate, but this exercise in hindsight comes long after a recession has started or ended.

To give you an idea just how late recessions are officially called, let's look at the past three. The NBER dated the 1990-91 recession as beginning in August 1990 and ending in March 1991. It announced these facts in April 1991, by which time the recession was already over and the economy was growing again. The NBER was no faster at catching up with the recession that followed the dotcom bust. It wasn't until June 2003 that the NBER pinpointed the start of the 2001 recession – a full 28 months after the recession ended. The NBER didn't date the recession that started in December 2007 until exactly one year later. By that time, Lehman had gone bust, and the world was engulfed in the biggest financial cataclysm since the Great Depression.

The Federal Reserve and private economists also missed the onset of the last three US recessions – even after they had started. Let's look quickly at each one.

Starting with the 1990-91 recession, let's see what the head of the Federal Reserve – the man who is charged with running American monetary policy – was saying at the time. That recession started in August 1990, but one month before it began Alan Greenspan said, "In the very near term there's little evidence that I can see to suggest the economy is tilting over [into recession]." The following month – the month the recession actually started – he continued on the same theme: "... those who argue that we are already in a recession I think are reasonably certain to be wrong." He was just as clueless two months later, in October 1990, when he persisted, "... the economy has not yet slipped into recession." It was only near the end of the recession that Greenspan came around to accepting that it had begun.

The Federal Reserve did no better in the dotcom bust. Let's look at the facts. The recession started in March 2001. The tech-heavy NASDAQ Index had already fallen 50% in a full-scale bust. Even so, Chairman Greenspan declared before the Economic Club of New York on May 24, 2001, "Moreover, with all our concerns about the next several quarters, there is still, in my judgment, ample evidence that we are experiencing only a pause in the investment in a broad set of innovations that has elevated the underlying growth rate in productivity to a level significantly above that of the two decades preceding 1995."

Charles Morris, a retired banker and financial writer, looked at a decade's worth of forecasts by the professionals at the White House's Council of Economic Advisers, the crème de la crème of academic economists. In 2000, the council raised their growth estimates just in time for the dot-com bust and the recession of 2001-02. And in a survey in March 2001, 95% of American economists said there would not be a recession. (John forecast it in September 2000 in this letter). The recession had already started that March, and the signs of contraction were evident. Industrial production had already been contracting for five months.

You would have thought that failure to forecast two recessions in a row might have sharpened the wits of the Federal Reserve, the Council of Economic Advisers, and private economists. Maybe they would have tried to improve their methods or figured out why they had failed so miserably. You would be wrong. Because along came the Great Recession, and once again they completely missed the boat.

The Revenge of the Minsky Moment

Let's look at what the Fed was doing as the world was about to go up in flames in 2008. Recently, complete minutes of the Fed's October 2007 meeting were released. Keep in mind that the recession started two months later, in December. The word recession does not appear once in the entire transcript.

It gets worse. The month the recession started, the Federal Reserve was all optimistic laughter. Dr. David Stockton, the Federal Reserve chief economist, presented his views to Chairman Bernanke and the meeting of the Federal Open Market Committee on December 11, 2007. When you read the following quote, remember that, at the time, the Fed was already providing ample liquidity to the shadow banking system after dozens of subprime lenders had gone bust in the spring, the British bank Northern Rock had been nationalized and had spooked the European banking system, dozens of money market funds had been shut due to toxic assets, credit spreads were widening, stock prices had started to fall, and almost all the classic signs of a recession were evident. These included an inverted yield curve, which had received the casual attention of New York Fed economists even as it screamed recession. (John had pointed to it numerous times here in Thoughts from the Frontline.)

Read these words of the Fed's Chief Economist and weep. You can't make this stuff up:

Overall, our forecast could admittedly be read as still painting a pretty benign picture: Despite all the financial turmoil, the economy avoids recession and, even with steeply higher prices for food and energy and a lower exchange value of the dollar, we achieve some modest edging-off of inflation. So I tried not to take it personally when I received a notice the other day that the Board had approved more frequent drug-testing for certain members of the senior staff, myself included. [Laughter]

I can assure you, however, that the staff is not going to fall back on the increasingly popular celebrity excuse that we were under the influence of mind-altering chemicals and thus should not be held responsible for this forecast. No, we came up with this projection unimpaired and on nothing stronger than many late nights of diet Pepsi and vending-machine Twinkies.

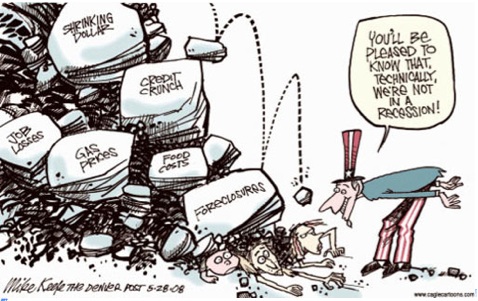

All other government economists were equally awful. The President's Council of Economic Advisers' 2008 forecast saw positive growth for the first half of the year and foresaw a strong recovery in the second half. Note the date on the cartoon below: May 28, 2008!

Unfortunately, private-sector economists didn't do much better. With very few exceptions, they failed to foresee the financial and economic meltdown of 2008. Economists polled in the Survey of Professional Forecasters also failed to see a recession developing. They forecasted a slightly below -average growth rate of 2.4 percent for 2008, and they thought there was almost no chance of a recession as severe as the one that actually unfolded. In December 2007 a Businessweek survey showed that every single one of 54 economists surveyed actually predicted that the US economy would avoid a recession in 2008. The experts were unanimous that unemployment wouldn't be a problem, leading to the consensus conclusion that 2008 would be a good year.

Like what you’re reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

As Nate Silver has pointed out, the worst thing about the bad predictions isn't that they were awful; it's that the economists in question were so confident in them. Now, this was a very bad forecast: far from growing by 2.4%, GDP actually shrank by 3.3% once the financial crisis hit. Yet these economists assigned only a 3% chance to the economy's shrinking by any margin at all over the whole of 2008, and they gave it only about a 1-in-500 chance of shrinking by 2 percent, as it did.

It is one thing to be wrong; it is quite another to be consistently and confidently and egregiously wrong.

As the global financial meltdown unfolded, Chairman Bernanke, too, continued to believe that the US would avoid a recession. Mind you, the recession had started in December 2007, yet in January '08 Bernanke told the press, "The Federal Reserve is not currently forecasting a recession." Even after banks like Bear Stearns needed to be rescued, Bernanke continued seeing rainbows and candy-colored elves ahead for the US economy. He declared on June 9, 2008, "The risk that the economy has entered a substantial downturn appears to have diminished over the past month or so." At that stage, the economy had already been in a recession for the past six months!

Why do people listen to economists anymore? Scott Armstrong, an expert on forecasting at the Wharton School of the University of Pennsylvania, has developed a "seer-sucker" theory: "No matter how much evidence exists that seers do not exist, suckers will pay for the existence of seers." Even if experts fail repeatedly in their predictions, most people prefer to have seers, prophets, and gurus tell them something – anything at all – about the future.

So, we have cataloged the incredible failures of economists to predict the future or even to understand the present. Now think of the vast powers Fed economists have to print money and move interest rates. When you contemplate the consummate skill that would actually be required to manage post-Great Recession policies, you realize they're really just flying blind. If that reality doesn't scare the living daylights out of you, you're not paying attention.

The longer the Federal Reserve sticks to its current policy, the more likely that policy will end in tears. Call it the Revenge of the Minsky Moment.

Monaco, Cyprus, Croatia, Switzerland, and Las Vegas

I leave Sunday evening for Monaco to deliver a speech at GAIM. Then, after a weekend in France, where I will meet with a few friends and associates, I fly to Cyprus, where I have a very aggressive schedule of meetings with people who are dealing with their current crisis. That should make for an interesting letter as I report back to you. Then I take a ridiculously early flight to eventually wind up in Split, Croatia, to spend the weekend with David McWilliams and his family at his summer vacation home on an island off the coast. Finally, I'll make my way to Geneva before returning home.

Then on July 6 and 7 I'll be in Las Vegas. Reid Walker, friend and recovering hedge fund manager based here in Dallas, is organizing an event during the World Series of Poker, on the theme of the intersection between investing and poker skills. This is just an entirely different world for me. I will not be entering the tournament – I know my limitations! But talking to some of the best players in the world and meeting Nate Silver and some of the other speakers will make for a fun weekend. The event is not cheap, but you can get a 10% discount by putting in the code "Mauldin10". Let me know if you're coming, and we'll get together for a meal. You can read more about the conference and register here. And here's an article in Hedge Fund Intelligence about Reid and the event.

Work on the apartment has started, although now it's demolition time. And we are still refining plans. The focus is now turning to the media room and toy department, which I am designing with the goal of making sure the kids and grandkids have reasons to come over every now and then. We have to think not just about what the latest technology is, but about what it might be in the next ten years, so we can wire for it now. It really costs a lot to go back and re-wire in a high rise after everything is done. And the choices are so varied. We are looking at a few designs and businesses that might help with them; but if you are an expert or know of one, I would appreciate a little input.

I don't want to leave you without mentioning the great highlight reel that my Mauldin Economics team has produced of our Investing in the New Normal webinar. You can view it right here, and it's not too late to register (for free) for the whole event.

OK, it's time to hit the send button. This is Father's Day weekend, and my kids are all going to be in one place for a day. I am really looking forward to that. Life goes by so fast. Tomorrow I will be going to see my mother, who will celebrate her 96th birthday in August. None of her ten brothers and sisters made it past 95, although almost all lived into their 90s, and Grandfather was 98 when he passed. Mother is getting visibly weaker, although she is mentally still quite active. And then I get to hang out with grandkids on Sunday. The cycle of life has me in a contemplative mood, but in a good way. Have a great week!

Your forecasting he won't lose money in Vegas analyst,

John Mauldin

P.S. If you like my letters, you'll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.

Tags

Suggested Reading...

|

|

Did someone forward this article to you?

Click here to get Thoughts from the Frontline in your inbox every Saturday.

John Mauldin

John Mauldin