Is Bitcoin the Future?

-

John Mauldin

John Mauldin

- |

- November 30, 2014

- |

- Comments

- |

- View PDF

Yusko’s Rule

What Is Bitcoin Anyway?

Bit by Bit

Teething Issues

The Five Phases of Adoption

Satoshi’s Revolution Crosses the Chasm

Thoughts on Bitcoin from John

Staying Close to Home

Bitcoin is a topic of discussion almost everywhere I go. My introduction to Bitcoin came when I was speaking at a gold conference in Palm Springs and three bright-eyed, bushy-tailed college students approached me with a video camera and asked for my thoughts on Bitcoin. Noting my confusion, they began to evangelistically espouse the virtues of Bitcoin and tell me how it would save us from the evils of the Federal Reserve. I kept from rolling my eyes (you do want to encourage passion in the young) and mentioned a meeting that I had to go to – at that very moment as it turned out.

Since that time Worth Wray and I and our entire team at Mauldin Economics have done a great deal of research on Bitcoin. We will soon release a video documentary that is one of the best productions I’ve ever been involved with and that does a good job of explaining both the controversy around Bitcoin and its considerable promise. We talked with skeptics, enthusiasts, and people willing to put up tens of millions of dollars betting on the future of Bitcoin.

Worth Wray has written this week’s letter as a summary of what we know about Bitcoin. Delving into its history and bringing us up to date, he also offers a glimpse of the future. At the end of the letter I offer a few of my own thoughts on the relationships among gold, fiat money, Bitcoin, and financial transactions.

If nothing else, Bitcoin offers a provocative way to think of the future of money. Now let me turn it over to Worth.

Is Bitcoin the Future?

By Worth Wray

“Growth demands a temporary surrender of security.”

– Gail Sheehy

“When people write the history of this thing, of bitcoin, they are not going to write the story of 6 million to a billion. What is truly remarkable is the story of zero to 6 million. It has already happened! And we’re not paying attention! That’s incredible. That’s what had one chance in a million, and it already happened.”

– Wences Casares, Founder & CEO of Xapo

“[Virtual currencies] may hold long-term promise, particularly if the innovations promote a faster, more secure and more efficient payment system.”

– Ben Bernanke, Chairman of the Federal Reserve, USA

Before I teamed up with John Mauldin in July 2013, I worked as the portfolio strategist for an $18-billion money manager in Houston that, among its other businesses, co-managed (with an elite team of investors from the university endowment world) one of the largest registered funds of funds in the United States.

I had a front-row seat for every investment decision in a multi-billion-dollar portfolio for almost five years, and for a bright-eyed kid from South Louisiana it was a life-changing experience that no graduate school in the world could have offered… an opportunity to learn from some of the most experienced minds in finance and hone the skills I would need to identify disruptive macro trends and build more balanced portfolios with those forces in mind.

That opportunity to learn, not just about investments but also how to think about emerging trends, continues to inform everything I do today; and Morgan Creek Capital Management’s Mark Yusko – a man who has built his career on incorporating investment talent and macro themes into highly diversified portfolios – continues to be one of my most important teachers.

In the course of his daily business (which involves bouncing around the world searching for new ideas and world-class talent), Yusko has evolved a rule for vetting new ideas:

If I hear something once, I remember it. If I hear it twice, I write it down. If I hear it three times, I do something about it.

It sounds simple, as the most valuable investment insights usually are; but Mark is not just talking about “new” ideas that appear on the front page of the New York Times or the opening segment of CNBC’s Squawk Box. He’s saying that in the course of tapping into a large pool of truly world-class thinkers – who range from hedge fund legends like Julian Robertson and Stanley Druckenmiller to venture capitalists like David Hornik and Marc Andreesson – it pays to pay attention.

Innovative ideas can grow into consensus views and missed investment opportunities before our very eyes in a world awash with information. With constant access to the web through our computers, tablets, and smart phones, it’s easy for investors to filter out valuable information in an effort to cut through all the noise; but even still, it’s possible to catch emerging trends early enough in their life cycles by holding to a homework rule: When an idea comes up over and over again – especially when it’s validated by experienced investors who command and influence vast sums of capital – it’s not necessarily time to buy, but it’s time to do your homework.

And when it comes to Bitcoin, I should have done my homework earlier.

Thank goodness it’s still early…

Like what you’re reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

Bitcoin is a peer-to-peer digital currency that trades on public exchanges and can be instantly transferred between any two people anywhere in the world with the speed of an email… and at FAR lower cost than for transactions processed through the traditional financial system.

While a lot of people have experimented with digital currencies in the internet age, Bitcoin’s mysterious creator, “Satoshi Nakamoto,” was the first person to solve the issue of “double spending” in a completely decentralized network, meaning that all transactions are made directly between parties, with no middlemen, yet in a way that is verifiable across the entire network and virtually impossible to counterfeit.

Much like the internet itself, the Bitcoin hive is essentially a distributed network of computers and people that are relying on a common technological process – the Bitcoin protocol – to confirm and validate every transaction made, using a unit of account called a “bitcoin” that can be broken down into fractions, thereby enabling previously impossible micro-transactions.

The genius behind the Bitcoin protocol is an element of the system called the “blockchain” – essentially a giant, globally shared ledger of every bitcoin and every transaction in the history of the network. Whenever two people follow through with a transaction, it is broadcast throughout the entire network, and the blockchain expands as that exchange is automatically lumped together with other transactions in a new “block.”

While it requires a MASSIVE amount of computing power to verify, confirm, and record every transaction that occurs within the network, it’s basically a self-funding system.

Bitcoins are created through a process called “mining,” which happens to be the same mathematical process that seals blocks of new transactions onto the blockchain by verifying that every exchange is valid and using real bitcoins. By rewarding “miners” with new bitcoin for devoting their time and computing power to maintenance of the blockchain, the Bitcoin protocol provides the incentive for the network to continue running in a completely decentralized manner.

In the early days, the mining process could be competitively and profitably run from a series of graphics cards linked to a home computer, but in recent years bitcoin mining has become a BIG business. Today, a lot of the mining is done on massive server farms in places like Iceland, where temperatures are cool and power is cheap.

There is an upper limit of 21 million bitcoins that can ever be minted, and the protocol is designed to release a “reward” of a new bitcoin every 10 minutes until every unit of the digital currency has been created. As of today, roughly 13.5 million bitcoins have been mined, with roughly 7.5 million to go.

Source: Coinbase

On paper, Bitcoin is an elegant and efficient way to streamline a global payments system; but in practice, the web of businesses and support structures around the Bitcoin protocol must pass a wide range of tests, from storage security and compliance to the creation of tradable derivatives and merchant adoption, before any kind of digital revolution can begin.

That said, Bitcoin – or something like it – has the potential to do for finance what the internet has done for communications and commerce… and we’re already six years into the process.

When I heard about Bitcoin for the first time, I dismissed it almost immediately. It seemed like a half-baked scheme cooked up by a bunch of technically skilled but financially naïve computer nerds to disrupt a global financial system that none of them really understood.

Early adopters espoused ideas about freeing the individual from the tyranny of a government-controlled money supply; but in order to pull off their grand vision, Bitcoin’s programming forefathers had to convince enough people to put their trust in the system – without governments shutting them down in the process. It seemed unlikely.

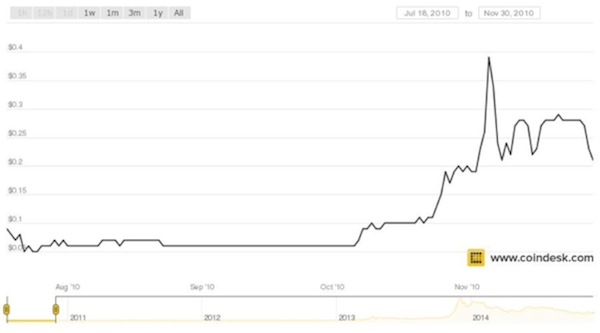

In the early days – 2009 and 2010 – a single bitcoin traded for pennies… – but its value was basically unknowable. The digital currency had virtually no daily trading volume; its price swung around wildly (volatility that only became more pronounced over time); and aside from experimental transactions within a small online community, it was virtually useless as a reliable unit of account or medium of exchange.

Like what you’re reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

Internet legend has it that the first real-world Bitcoin transaction was a long-distance arrangement made on May 18, 2010, between an American programmer named Laszlo Hanyecz and a fellow enthusiast he met on the Bitcoin Talk forum. Apparently, Hanyecz offered to pay 10,000 bitcoins to anyone willing to buy him pizza, and an Englishman took him up on the offer… making an international phone call to a Papa John’s in Jacksonville, Florida, in exchange for roughly $25 in bitcoins at the then-current exchange rate.

I can’t help but wonder if that Englishman turned around and spent his 10,000 bitcoins or saved them for a rainy day. At today’s US dollar exchange rate, they would be worth nearly $3.8 million.

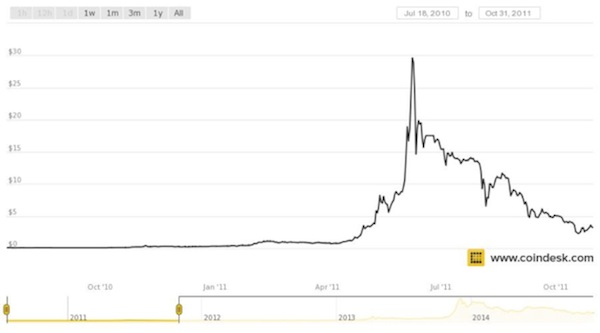

The second time I heard about Bitcoin (about a year later), it sounded a lot more interesting as a medium of exchange; but it seemed imminently doomed by regulation. The virtual currency had risen from a price around of $0.0025 the day of Laszlo Hanyecz’s pizza purchase to nearly $30 in early 2011 as Bitcoin became the basis for real-world transactions within the Bitcoin community… and the preferred medium of exchange for nefarious activities on the web.

Following the embarrassing release of US diplomatic cables to the general public in late 2010, the US government organized a financial blockade against the hacker/whistleblower Julian Assange and his nonprofit firm WikiLeaks. When Bank of America, Visa, Mastercard, PayPal, and Western Union refused to transmit donations to WikiLeaks, the nonprofit started accepting donations in Bitcoin.

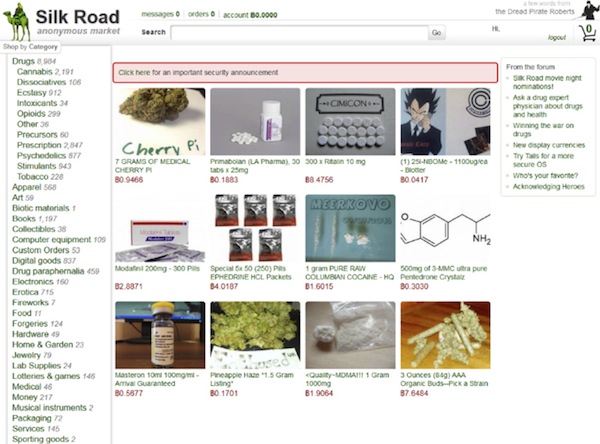

As the price of Bitcoin began to rise, it saw another big uptick in volume when an online black market named Silk Road launched in early 2011, enabling the sale of illicit drugs and forged IDs exclusively in exchange for Bitcoin.

Business boomed, and the Bitcoin community expanded from computer nerds to mischievous hackers and anonymous drug dealers who wished to skirt the financial system and/or the eyes of the law. And for the libertarians and anarchists who embraced Bitcoin as an anti-QE investment at this stage, it essentially became an enlightened bet against corrupt governments.

Source: matthabel

Within a few months the price of Bitcoin surged to nearly $30… and then Mt. Gox, the most popular Bitcoin exchange, was hacked and trading suspended for several days in June 2011.

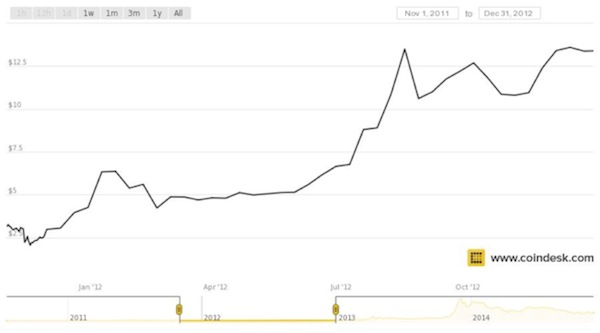

In the following months the price collapsed by roughly 90% to less than $3, but that was not the end of Bitcoin.

“Naturally there were teething issues,” my friend Grant Williams explained in his April 2013 letter, “Bit Happens,” “exchanges were hacked and wallets full of bitcoins stolen after being left unprotected on users’ computers; and [there was] much bad press… but slowly and steadily the marketplace weathered the growing pains and, as more and more merchants began accepting payment in bitcoins, the community broadened into something more than just a weird underground movement.”

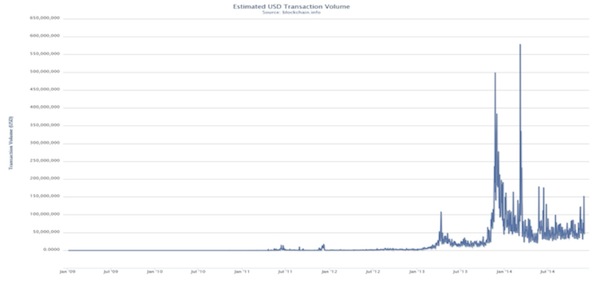

Trading volume increased in the months that followed, and the price of Bitcoin trended upward, albeit in volatile fashion with two 35%+ drops in 2012:

But Bitcoin generally stayed under most investors’ radars until March 16, 2013, when a banking crisis in Cyprus sent savers across southern Europe scrambling for a way to get their money out of harm’s way.

Like what you’re reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

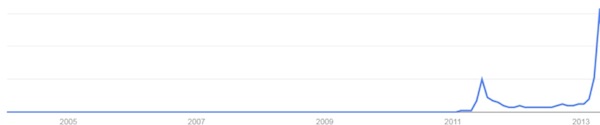

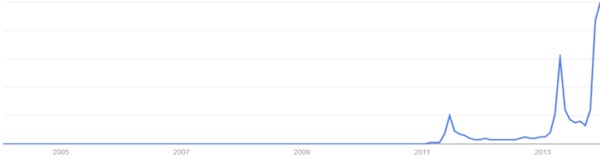

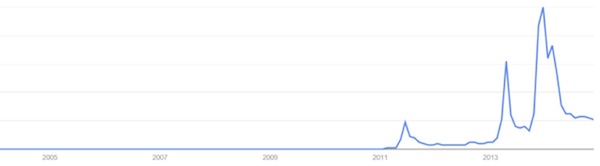

Google searches for the word bitcoin surged to all-time highs.

Source: Google Trends

Although the financial risks to the Cypriot banking system were rather obvious to economists in the months leading up to the panic, it struck almost without warning for most citizens, explains Sovereign Man’s Simon Black:

On Friday, March 15, 2013, practically everyone in [Cyprus] went to bed thinking that everything was just fine. Many had probably gone to the bank that very day to do business, or logged on to an Internet banking platform.

Yet the very next morning, they woke to a completely new reality: the nation’s banks were broke, and the government was in no position to rescue them.

All the promises they had been told about government guarantees and having a ‘well-regulated’, sound banking system turned out to be lies. The government proclaimed a bank holiday, and banks remained closed for the next several days. Accounts were frozen and ATM withdrawals were limited to only 100 euros a day.

Eventually the plan materialized [as a hard-line demand from the island nation’s German creditors]: substantial portions of deposits over 100,000 euros would be confiscated in exchange for equity in the banks. (Just imagine – Bank of America, RBC, or Lloyds takes your money and gives you stock certificates that subsequently plummet in value!)

And for everyone else, severe capital controls were instituted – some of the worst in decades.

Here again we see a peculiar property of Bitcoin: its value is bid up in a time of desperate uncertainty, and it is able to circumvent the traditional banking system and government-imposed restrictions on capital flows.

Savers in Cyprus could convert their cash to Bitcoin in an effort to escape local capital controls, but most of their funds had already been locked up in the bank holiday, aside from 100 euros a day, which in aggregate had a meaningful effect on Bitcoin’s price.

The burning question at that moment was how much Cypriot savers could expect to recover. Their fate was a warning to savers in other fragile Eurozone member states. With the rising fear that the same kind of policies could be imposed on their countries next, savers in Greece, Spain, Portugal, etc. started abandoning their euro-denominated bank accounts for the “safety” of Bitcoin.

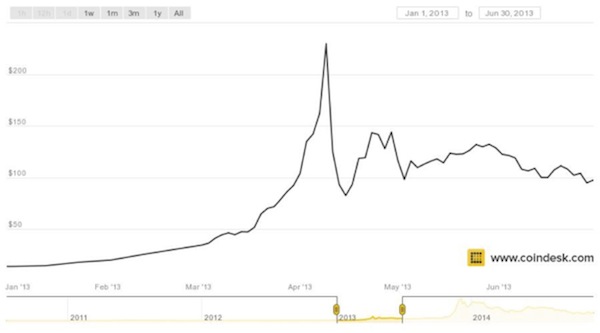

In the event of contagion and banking collapse, Bitcoin balances could be moved out of the country rather than getting clogged in the system… and so the price naturally surged to a peak of $230 by early April 9, 2013.

But with more trading volume than the exchange could handle, problems arose, and hackers attacked, forcing another trading halt and making off with over $8.5 million in customer bitcoins. Then the idea of widespread levies on Cypriot bank accounts was dropped, and fears subsided across the Euro area. The price of a bitcoin fell more than 60%, although it remained far above its pre-crisis peak of $47.

With the virtual currency in the news and on the periphery of my radar screen, this was the third time I was forced to think about Bitcoin. I assumed the price surge would be the beginning of a government crackdown and the likely legal death of the experiment… so I continued to ignore it as an investment opportunity. Wrong again.

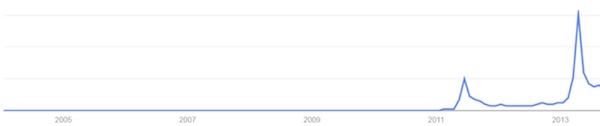

Bitcoin fell back into relative obscurity for several months, as indicated by Google searches:

Source: Google Trends

But rather than cracking down on Bitcoin itself, the US government went after nefarious dealers like Silk Road and effectively found itself invested in the virtual currency (which it later auctioned off to the general public).

Despite the price collapse, Bitcoin had caught the world’s attention, and venture capitalists started pouring real money ($88 million in 2013 compared to $36 million in 2012) into a wide range of related businesses, from wallet providers and exchanges to payment processing and other financial services. That meant not only an injection of capital but also a massive influx of expertise into an industry still dominated by inefficient and/or poorly run firms.

At that moment, it started to seem that Bitcoin might just change the world.

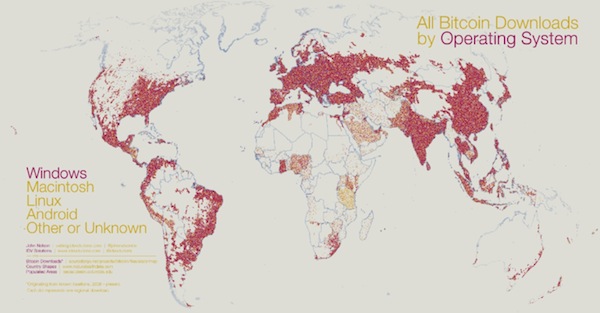

Bitcoin downloads spread like wildfire across the emerging world by the summer of 2013…

Like what you’re reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

… and the search term bitcoin was suddenly more popular than ever:

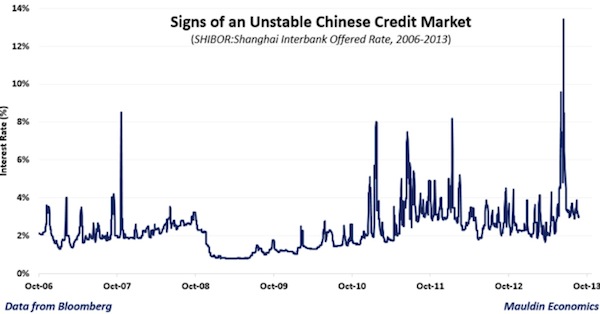

Then China’s state-owned TV station, CCTV, aired a documentary on the crypto-currency around the same time that serious cracks started to show in China’s “miracle” economy. Suddenly China’s credit markets were acting more erratically than during the global financial crisis, and Bitcoin saw its greatest surge in demand to date – again as a way of circumventing the traditional banking system and the limited mix of financial assets available to Chinese investors.

As China’s interbank market began to freeze in the summer of 2013, John and I were watching closely. Here’s an excerpt from the August 31, 2013 Thoughts from the Frontline, “How Do I Hate Thee”:

The next chart shows the recent price spike in the Chinese SHIBOR (their short-term interbank rate, more or less equivalent to LIBOR). It is difficult to trust any of the economic data (positive or negative) coming out of China, so we really do not know whether China's growth story is simply moderating or whether we are seeing a hard landing in progress; but the sudden shock in interbank lending rates is an important sign that all is not well in the Middle Kingdom. The big question: is the recent SHIBOR spike a harbinger of a banking crisis, or does it presage an RMB devaluation? Interbank rates do not spike from 3% to 13% (in about 2.5 weeks) in a healthy economy, and a big event along these lines in China would have enormous implications for global growth.

As I’ve written over the course of the past year, John and I have been nervously watching China’s slowdown and have voiced real concern over the possibility of capital flight if and when a debt crisis bubbles over; but we clearly underestimated the role that Bitcoin was already playing in China.

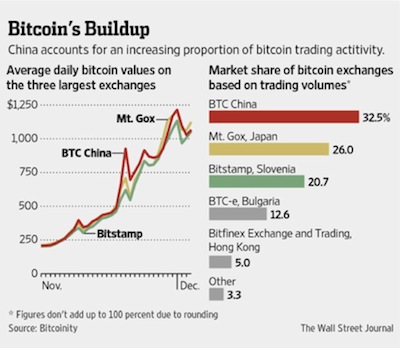

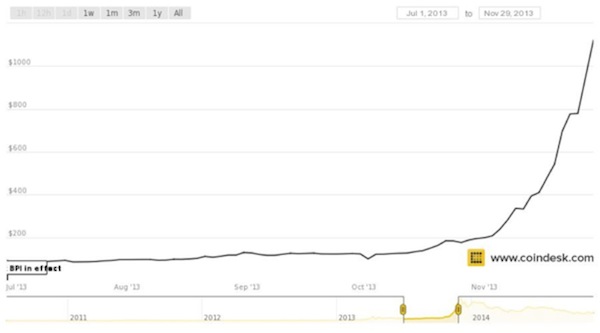

By late November 2013 demand for the virtual currency had grown so fast in the People’s Republic that BTC China quickly became the largest Bitcoin exchange in the world, and over 100,000 bitcoins were trading every day in China alone:

The price of Bitcoin surged by more than 10x, from $87 to over $1000, as Chinese savers piled in…

... until emerging-market central banks in places like China, India, Taiwan, and Thailand started to grasp the threat that Bitcoin’s rise posed in a world where US monetary policy was tightening and capital flows could reverse dramatically.

While the People’s Bank of China did not explicitly ban owning or mining Bitcoin, it issued a statement in December 2013 saying that the virtual currency was “not a currency in the real meaning of the word” and that “it cannot and should not be used as a currency circulating in the market.”

In addition to firm language intended to cool the speculative fever among Chinese investors, the State Council mandated a series of prohibitions on Bitcoin trading and forced banks and other payment institutions to refrain from dealing in the cryptocurrency… warning that virtual currencies like Bitcoin posed “a risk to the public interest and legal status of the renminbi.”

In other words, the People’s Bank of China all but spelled out that Bitcoin was an avenue by which local savers could circumvent long-standing Chinese capital controls. If Chinese investors continued to pile into Bitcoin, they could set up a situation where capital could leave very quickly in the event of a panic… or, in the meantime, the money could leave temporarily and then “round-trip” its way back into the Chinese economy, seeking the benefits afforded only to foreign investors.

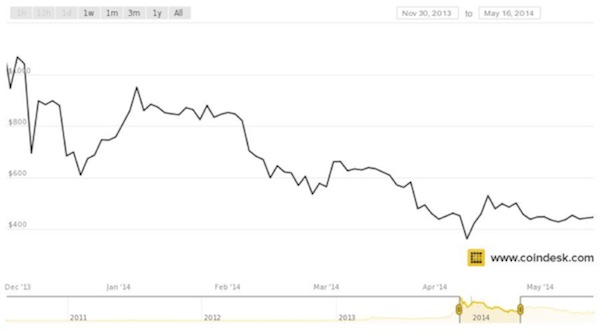

From its peak in early December 2013, the price of Bitcoin fell more than 40% before finding its bottom. And the average daily trading volume in China fell from over 100,000 in November 2013 to only 2,000 today.

Like what you’re reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

As if the crackdowns in China and other emerging markets in December 2013 and January 2014 were not enough, rumors began to swirl in February that the world’s largest Bitcoin exchange, Mt. Gox, had been hacked and more than $460 million in customer Bitcoin had been stolen.

In a Wired magazine article published in March 2014, “The Inside Story of Mt. Gox, Bitcoin’s $460 Million Disaster,” Robert McMillan explained it was not just one-time event but a “years-long hack,” dating back to the June 2011 incident. “According to a leaked Mt. Gox document… hackers had been skimming the company for years.”

Mt. Gox quickly went offline and collapsed into bankruptcy. It was a devastating blow to confidence in the entire Bitcoin system. With the shock that client accounts could be so insecure for so long, the value of Bitcoin plummeted another 60%+ in the following months.

With the successive blows, Bitcoin fell from nearly $1,200 in early December 2013 to less than $360 by April 2014 – a whopping 70% loss.

And then I really started paying attention.

At a dinner following John’s annual Strategic Investment Conference in San Diego, Raoul Pal (author of Global Macro Investor and co-founder of Real Vision TV) helped me to see Bitcoin in a totally different light. He explained that Bitcoin could be as transformative for finance as the internet has been for commerce and communication, and it could happen FAST… especially if central banks and governments mismanage the next global downturn to the detriment of a highly leveraged, highly interconnected financial system. Or, in a less extreme scenario, the Bitcoin protocol could quietly but steadily replace the decades-old payment system that underpins the current system.

Up to that moment I had never really taken the time to understand the technology behind Bitcoin or how it could change the world… but the sudden fall in valuation was interesting. I had seen a lot of chatter about Bitcoin’s wild price swings in the media and on Twitter (feel free to follow us at @WorthWray and @JohnFMauldin), and I had heard wild claims from Libertarians and anarchists that this Bitcoin would soon replace the US dollar and all other forms of fiat money. I knew Bitcoin was an interesting way that money could flow freely around government-imposed capital controls in the emerging world. But until that moment I completely failed to grasp what Bitcoin could really mean for the global financial system.

I’ll omit the finer details of my conversation with Raoul, but suffice it to say that it kicked off the six-month research project that has inspired and enabled this letter... and pushed my wife, Adrienne, and me to start buying some Bitcoin of our own… not as an all-out bet on Bitcoin’s future but as an option on its development. Either Bitcoin becomes a new foundation stone of the global financial system – delivering a handsome return in the process – or it will give way to something even more powerful. It’s a pretty binary range of outcomes, but it’s worth taking on some exposure with a small percentage of our savings.

In an effort to understand how Bitcoin could continue to mature, I sat down with Barry Silbert, founder of the Bitcoin Investment Trust. As one the most active venture capitalists in the industry (with investments in over 30 bitcoin-related portfolio companies through the Bitcoin Opportunity Corp), Barry has gone all-in on Bitcoin and Bitcoin-related businesses.

He believes the halting rise of Bitcoin from 2009 to 2014 is just the beginning… and that the virtual payment system may be approaching a big inflection point as Wall Street takes the baton from Silicon Valley.

Barry thinks about Bitcoin adoption in five general phases:

-

Experimentation phase (2009 – 2010)

- No real value associated with Bitcoin. Hackers & developers playing around with the source code. Experimenting with Bitcoin as a medium of exchange.

-

Early adopters phase (2011 – 2013)

- Interest from investors and entrepreneurs started to grow with substantial press coverage in the wake of the Silk Road bust. First generation of Bitcoin-related companies (exchanges, merchant processors, wallet providers, etc.) started. Potential began to shine through poor management.

-

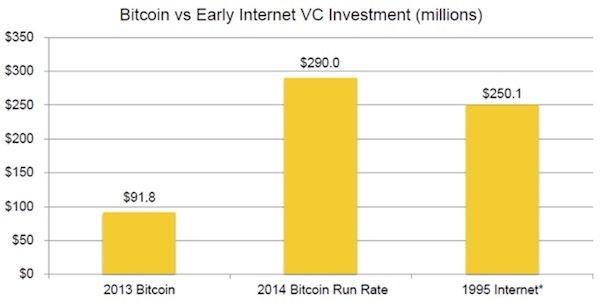

Venture capital phase (2013 – present)

- World-class VCs started investing in Bitcoin companies, and rapid ramp-up is already outpacing the early days of the internet. VCs poured more than $90 million into Bitcoin-related businesses in 2013 and are on track to invest more than $300 million in 2014 (compared to $250 million invested in internet-related businesses in 1995).

-

Wall Street phase (2015?)

- Institutional investors, banks, and broker-dealers begin moving money into Bitcoin. Rising price and volume (in addition to development of derivatives) become the catalyst for mass adoption as retail investment follows.

-

Global consumer adoption phase (?)

- Only happens if (a) companies continue to innovate and make it easier for consumers to buy, hold, and spend Bitcoin, (b) volume expands dramatically so that large merchants can start accepting payment in Bitcoin, and (c) Bitcoin awareness continues to rise with these developments.

If Barry is right, Bitcoin’s continued rise depends on (1) Wall Street money flowing in to deepen the digital currency’s trading volume and fuel the development of hedging instruments, (2) continued innovation to make Bitcoin more secure and more user friendly, (3) broad acceptance by merchants as a medium of exchange, and (4) an explosion in public awareness.

It’s impossible to know for sure yet… but it looks like all four of those are taking place.

Satoshi’s Revolution Crosses the Chasm

Like what you’re reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

While search volumes have moderated, the trend in broad public interest is rising.

Source: Google Trends

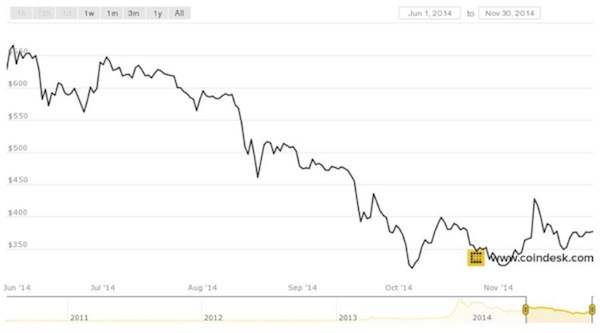

And while the price of Bitcoin has continued its downward trend, it seems that the network continues to deepen and mature.

Over time, many investors have realized that it was not a problem with the Bitcoin protocol that allowed the security breach at Mt. Gox or the frequent theft of unsecured bitcoins, it was inadequate security – basically, poor business practices – at the exchanges and wallet providers. Rather than exposing some flaw in Bitcoin, the collapse of Mt. Gox revealed the desperate need for better management and the opportunity for improving the services that surround the Bitcoin network. And the venture capital community has certainly responded.

This year, by the end of Q3 2014, over $290 million of venture investments had flowed into Bitcoin-related businesses, compared to the $250 million that poured into internet-related businesses in 1995.

Source: CoinDesk

And the trend toward greater average daily trading volume has continued to rise.

Source: Blockchain.info

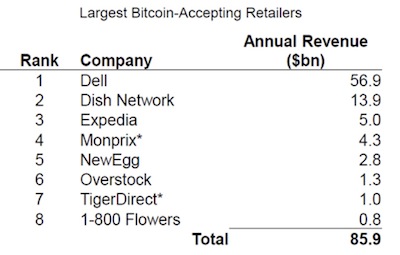

Not only is real money starting to flow into the growth industries surrounding Bitcoin, but real businesses are starting to accept bitcoins as payment. At the end of Q3 2014, the top eight companies accepting payments in Bitcoin had annual revenues totaling more than $85 billion, and among them was Dell.

Source: CoinDesk

The price of Bitcoin may swing dramatically in the coming days, months, quarters, and years. The currency may not survive in its current form… but the technology underpinning it is not going away any time soon.

If you ask me whether I truly believe that in 2050 the main medium of exchange will be paper money, the very quick answer is that I don’t. I also think there is a better than reasonable chance that it won’t be a fiat currency. But will it be Bitcoin? My best guess is that it will not be Bitcoin as currently constructed but rather an evolved version.

I know the following will be somewhat controversial, but work through with me on what I hope will be a helpful way to think about money in general. The current structure of Bitcoin carries the same inherent flaw that gold does (and to some extent the euro, too): in a world of ever-increasing abundance, gold is massively deflationary and provides unreasonable “rents” to those who hold it. Even given that inherent flaw, it has been the most stable store of value for millennia.

To think about what money will be in the future you have to shake off the chains of the past and your preconceived notions of what money is. Money is not just, or should I say, is more than a medium of exchange. It is also a medium of information. It tells us what the marketplace wants and the price it is willing to pay for a particular good or service. The (often fatal) flaw in fiat currencies is that they manipulate and distort the information contained within the currency, thereby damaging the information flows involved in the exchange of goods and services. For instance, the practice of quantitative easing engaged in by major central banks has encouraged money to go into certain markets (such as stocks), distorting the information reflected in the price.

Like what you’re reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

Rather than looking for the information provided by the market and adjusting our investments and purchases accordingly, we are forced to focus on the information provided by the Federal Reserve and its quantitative easing. To confuse the actions of the Federal Reserve with the actions of the market is to miss the point that the Federal Reserve is actively manipulating the market for its own purposes, however positively motivated.

Advocates of gold believe that a gold-backed currency would eliminate that price distortion, and they have a point. However, if we were to decide to use gold as the sole basis for our currency, we would have to value it at some order of magnitude higher than it is today in order not to create massive deflationary instability. I’m not sure that $10,000 or even $20,000 per ounce of gold would be nearly high enough, given the massive amount of sovereign debt in the world.

But even supposing that we (as a global system) could somehow manage to deal with the logistical nightmare of moving to a single, physical, commodity-backed currency, future growth in the world would soon overwhelm the limited supply of gold, and the prices of goods and services would deflate over time, creating their own backlash. History buffs will recall William Jennings Bryan and his famous cry, “We [mostly referring to farmers] will not be crucified on a cross of gold!”

Now some might see ever-falling prices as a good thing, but they would induce a different type of instability in the system. Given the overwhelming extent of global debt, I think the chances of moving to a physical currency based on gold are slim to none, and Slim left on the morning train. Go back and read the economic history of the latter half of the 1800s in the US. From one point of view it was a golden era of growth and prosperity driven by huge leaps in technology. But it created serious problems for many of those on the lower economic rungs. If you think income inequality is a problem today, then you won’t like what happened in the late 1800s.

The leaders of that era came together to try to create a new system that could prevent the frequent panics and crashes that were inherent in the financial system of the day, and eventually we got the Federal Reserve and other ostensible improvements. But that does not mean the current system of central banks and fiat currencies does not have its own flaws. We should not limit our thinking to the economic systems of the past or present as we think about a future economic system. How do we create a truly stable, equitable, and efficient basis for exchange?

While I think that Bitcoin as currently configured has limitations, the technology of the blockchain is one of the most potentially revolutionary developments of the last century. I think we evolve to Bitcoin 2.0 or 3.0, using the same blockchain technology, but with a way to make the new currency a truly stable medium of information that can be easily exchanged for goods and services.

Why not create a currency that is backed by a number of commodities, with gold perhaps as the backbone? Why even limit ourselves to commodities? Bitcoin as currently configured could be part of the basket. Anything that can be represented in a digital form and has a reasonably stable long-term value could be considered.

All I want from my currency is to be able to buy and sell goods and services, make investments, and have a reasonable expectation as to what my currency will be worth in terms of purchasing power if I hold it for months or years.

I think that some of the clever venture capitalists who are exploring Bitcoin will join forces with one or more large international investment banks and create something along those lines. And once someone shows the way, breaking the chains of the past, we will have a period of innovation rivaling the Cambrian explosion.

The vast majority of my purchases are electronic today. I think that percentage will continue to grow. Frankly, I really don’t care what happens inside “the system” after I wave my iPhone over the new Apple Pay device (or use my credit card). I just want to walk out of the store with my purchases. (In the not too distant future there will be an extremely tiny RFID chip embedded in my hand, or at least on my person, which will also serve 100 other purposes.)

The Bitcoin blockchain technology allows for the most secure electronic transactions ever devised. Its adoption and acceptance seem inevitable to me. It will be used to validate everything we purchase: stocks, homes, investments, airplane tickets, etc. It will be a far cheaper and much more secure way to validate your ownership of anything, from your home to your stocks.

The blockchain will form the basis for the perfect medium of information exchange (at least as perfect as we humans can create), which in turn will be the basis for whatever electronic medium of financial exchange we evolve in the future. The market (that would be you and me) will move to whatever new medium serves our purposes best.

Satoshi, as technologically brilliant as he (or she or they) was, was limited in his understanding of economic exchange. He was trying to create electronic gold. To some degree, he was confusing technology with money. He was trying to overcome the flaws of our current monetary system (a very laudable goal, I might add) but limited himself to thinking within the box in which the current monetary system placed him.

The next generation of Bitcoin developers are going to crawl out of that box and create whole new realms of possibilities. Once you realize that money is just information, and all you need to do is to provide the most stable mechanism of the transfer of information, you turn thinking about money on its head.

This is going to be massive amounts of fun to watch.

Like what you’re reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

Thanksgiving and its aftermath has been a relaxing time for me, letting me charge my batteries for the rather large amount of work that I must do before the end of the year. There is a lot to think about. While there are a few potential trips in December, I will spend the bulk of my time here in Dallas before my travel schedule picks up next year.

It’s time to hit the send button. I think I will close the letter without my usual personal comments. Have a great week!

Your excited about all the innovations coming in our future analyst,

John Mauldin

P.S. If you like my letters, you'll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.

Tags

Suggested Reading...

|

|

Did someone forward this article to you?

Click here to get Thoughts from the Frontline in your inbox every Saturday.

John Mauldin

John Mauldin