QE Infinity: Unintended Consequences

-

John Mauldin

John Mauldin

- |

- September 22, 2012

- |

- Comments

- |

- View PDF

5.5% Unemployment Is Acceptable

We Live in Uncertain Times

With Apologies to Drunken Sailors

What If They Gave a QE Party and No One Came?

The Magnitude of the Mess We’re In

Atlanta, New York, Orlando, and South America

There is an intense debate going on in the first-class cabin of Economics Airlines about the direction in which our plane should be pointed. And while those of us back in the cheap seats don't get to help decide, knowing where we will land is of intense interest to all of us. This week we listen in on the debate, in the form of speeches and academic postings passed back from first class for the rest of us to read. This type of debate also occurred when Greenspan held rates down at an abnormally low level for a very long time. The unintended consequence of that move was a housing and debt/leverage bubble. Are there potential unintended consequences to Bernanke's current monetary policy, which some are calling Quantitative Easing Infinity? I suggest you put up your tray tables and fasten your seatbelts – the ride could get bumpy as we explore QE Infinity: Unintended Consequences.

The Federal Reserve (that is, the FOMC – Federal Open Market Committee) last week gave us an open-ended quantitative easing policy. Most of the world thought they would only give us QE3, and more than a few observers expressed surprise that the Bernanke-led Fed decided not only to continue Operation Twist at its current level but also to buy an additional $40 billion a month of agency mortgage bonds. This latter easing policy will continue "(i)f the outlook for the labor market does not improve substantially…"

This rather prodigious easing will total some $85 billion per month for the rest of the year and almost $500 billion a year, for some time to come. My first thought upon reading the post-meeting communiqué and Bernanke's press release was, what exactly defines the policy? What is an acceptable rate of unemployment? This is not merely an academic question because, as we have noted in past letters, it is going to be quite some time before unemployment dips below 6%, and to reach that level will take a much healthier economy than the one in which we are mired.

The balance sheet of the Federal Reserve is now at a mind-numbing $1.5 trillion. Bernanke proposes to raise that by a half trillion dollars every year until we reach whatever is deemed an acceptable rate of unemployment, as long as it is "achieved in a context of price stability." And while Bernanke argued many years ago for a 2% inflation target, there has been no real line in the sand as to what the current target should be and what is an acceptable rate of inflation in an age of very high US indebtedness, not to mention high unemployment.

And so the Fed has embarked upon a course of extraordinary quantitative easing – or printing money, in the vulgar parlance of those of us back in the cheap seats. And it is doing so in the face of a growing chorus of economists who are clearly seated in first class and who are hollering that more QE will not have any effect upon employment and may even do more harm than good.

We have discussed William White's work, posted on the Dallas Federal Reserve's website (White is the chief economist at the Organization for Economic Cooperation and Development [OECD] and was formerly with the Bank for International Settlements). He and Professor Michael Woodford of Columbia both argued at Jackson Hole (the venue to which first-class economists get whisked off each August – my invitation seems to have gotten lost in the mail again this years) that more QE would not have the desired effect and could even be counterproductive. I should note that other papers at Jackson Hole lent support to the new Fed policy.

Last Monday an op-ed in the Wall Street Journal, penned by five PhDs in economics, among them a former Secretary of the Treasury and an almost-guaranteed Nobel laureate (and most of them former members of the President's Council of Economic Advisors) minced no words in excoriating the current policy. We will look at that op-ed in detail below. The point is that there are grave reservations about the current policy among some very serious policy makers.

But I note, again, that many others of equal stature are praising Bernanke. Martin Wolf of the Financial Times was especially effusive this week in praise of the new policy. The Fed, as we all know by now, has a dual mandate to maintain price stability while promoting full employment. These goals can clearly conflict with each other. For now, the goal of higher employment is taking precedence over the need to stem inflation that mightarise from overuse of the monetary printing press.

5.5% Unemployment Is Acceptable

At the press conference after the FOMC meeting, Bernanke would not be pinned down as to what was an acceptable rate of unemployment, except to note that the level of growth the last six months "isn't it…. There's not a specific number we have in mind…. We at least at this point have decided to define it qualitatively. I hope I am giving you at least a little color in terms of what we will be looking for.... We don't have a single number that captures that."

So I was somewhat surprised when Federal Reserve Bank of Minneapolis President Narayana Kocherlakota said in a speech that the Fed should hold the main interest rate near zero, until (in his words):

"As long as the FOMC is continuing to satisfy its price stability mandate, it should keep the fed funds rate extraordinarily low until the unemployment rate has fallen below 5.5 percent."

My first thought upon seeing that headline and news report (without reading the speech) was that Kocherlakota, who is normally thought of as one of the Fed's inflation hawks, had just advocated a policy that might mean QE Infinity for 5-6 years or more. We are talking about a potential tripling of an already bloated Fed balance sheet.

I have spent whole issues of Thoughts from the Frontlines on the topic of employment growth, so let me quickly summarize. It takes about 125,000 new jobs per month just to keep up with population growth. We need 250,000 new jobs per month for a year to drop the unemployment rate by a little more than 1%, and the economy needs to grow north of 3% per year for that to happen. This means we might reach 5.5% unemployment three years from now if, somehow, the economy started to grow substantially.

That scenario also assumes that everyone who is not considered unemployed stays that way. We have seen one million people drop from the official labor force in just the last two months. I think we can safely say that a very large majority of those people would take a job if they could find one; so if the economy does in fact begin to grow, those people are going to start looking for jobs and will once again be counted as unemployed. (For newbies: you are not counted as unemployed if you were not actually looking for a job within the past four weeks.)

Reasonable people can probably agree that at least 2% of the population not currently counted as unemployed would take jobs if they could find them. Factoring them into the equation, we need to see at least five years – in a row – of three million new jobs per year to get to Kocherlakota's acceptable level of 5.5% (give or take a few million). Achieving that would require nine years without a recession (since the end of the last recession), not an easy thing to accomplish in a world where governments are going to have to significantly cut spending.

The Fed clearly said it intended to keep rates low for another three years, although there is not universal agreement on that issue. (Note: Bernanke's term is over in 2014, so there is an assumption that this policy may outlast him.) Could inflation hawk Kocherlakota really be advocating an even lengthier easing period?

Like what you’re reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

The answer is in his speech. What he actually said was that we should hold rates low until unemployment goes to 5.5%, assuming (and here's the point) that inflation stays below 2.25%. Now that is an interesting number to choose. It's not the 2% normally used in academic circles when discussing inflation targets, and it's not 2.5-3%, where it might be set to make sure any apparent inflation is just a temporary data anomaly. No, he said 2.25%.

(Another newbie note: the Fed likes to look at something called PCE inflation [Personal Consumption Expenditures] and not the headline Consumer Price Index we see each month. Google it if you want a longer explanation.)

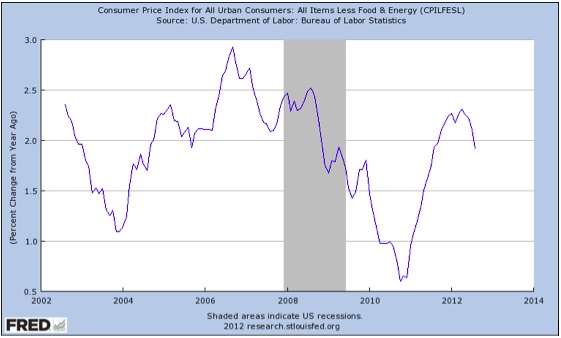

So, I decided to take a quick look at what inflation is doing. Let's look first at the Consumer Price Index without the volatile food and energy categories (since economists don't eat or drive cars). We find that inflation bumped briefly up to the neighborhood of 2.25% early this year, before conveniently falling back to under 2%.

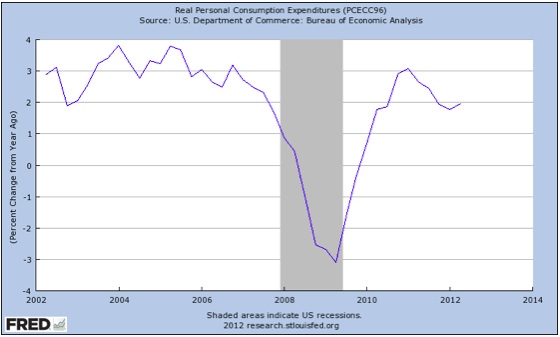

And what about the PCE index? It is also now just below 2%.

Last May Kocherlakota was talking about maybe needing to stop the easing policy by the end of this year. But after a more careful reading of his speech, I see that this is not him deciding to accept the higher rate of inflation that many on the Fed are openly espousing. It actually seems to be a very gentlemanly way to draw a line in the sand and say, "OK, I can go along with your longer-term QE, but only so long as inflation stays low. And by low I mean lower than 2.25%."

And then again, maybe I am reading too much into his speech. I think someone of the stature of Tom Keen of Bloomberg should get Kocherlakota on his show and ask him directly what he means. Why 2.25%? And for how long, before the trigger is pulled? Etc.

We Live in Uncertain Times

The Wall Street Journal op-ed I mentioned (which we will look at in greater depth in a minute) noted:

"In 2010, the number of Federal Register pages devoted to proposed new rules broke its previous all-time record for the second consecutive year. It's up by 25% compared to 2008. These regulations alone will impose large costs and create heightened uncertainty for business and especially small business."

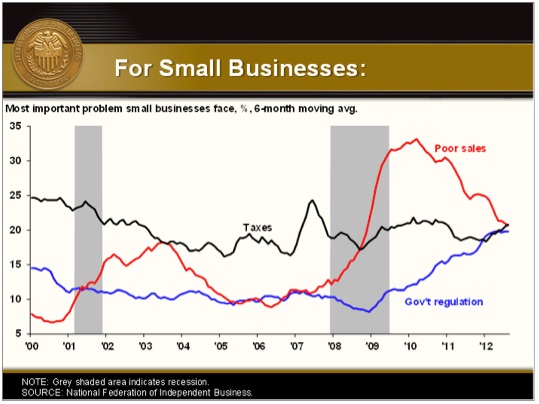

A recent survey by the National Federation of Independent Business shows that small-business concern over government regulation has risen to match the level of concern about taxes and poor sales.

Uncertainty is clearly a contributing factor to the economic malaise we are in.

"Policy uncertainty is another beast altogether. Two recent studies offer hard evidence to back the intuition that confusion about what Uncle Sam is going to do has dampened the recovery, leading to subpar job creation. Stanford University economists Scott Baker and Nicholas Bloom joined the University of Chicago's Steven Davis in using a variety of measures, such as news stories and the number of federal tax code provisions set to expire, to construct an index of policy uncertainty levels. The results show entrepreneurs have more doubts today about where policy is headed than they did just a few years ago.

"The economists estimated the rise in uncertainty from 2006 to 2011 resulted in a 16 percent plummet in private-sector investment and an employment drop of 2.3 million jobs. Their findings are consistent with earlier studies, such as the one by Harvard's Dani Rodrik, which showed uncertainty acts like a tax on investment. In fact, the literature on the depressing effects of uncertainty is vast. No less an authority than now-Federal Reserve Chairman Ben S. Bernanke argued as far back as 1983 that higher uncertainty encourages firms to postpone high-expense investment.

"In a just-released study, San Francisco Federal Reserve economists Sylvan Luc and Zheng Liu offer more hard evidence of uncertainty's depressing effect. When people don't know what government will do next, they're less willing to invest and spend. They found higher uncertainty levels during the Great Recession increased the unemployment rate by 1 to 2 percent. That is, if uncertainty levels had remained stable, they say, 'the unemployment rate would be closer to 6 or 7 percent rather than to the 8 or 9 percent it actually registered.' Each percentage point difference means 1.5 million wind up in the unemployment lines." (Nita Ghei for The Washington Times, at http://www.washingtontimes.com/news/2012/sep/21/uncertainty-and-unemployment/)

Like what you’re reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

But this political uncertainty is not something that Federal Reserve monetary policy can deal with, which is one of the main arguments of those who oppose further quantitative easing.

"The Fed is adding to the uncertainty of current policy. Quantitative easing as a policy tool is very hard to manage. Traders speculate whether and when the Fed will intervene next. The Fed can intervene without limit in any credit market – not only mortgage-backed securities but also securities backed by automobile loans or student loans. This raises questions about why an independent agency of government should have this power." (WSJ)

With Apologies to Drunken Sailors

Which brings us to a speech this week by my favorite FOMC member, Dallas Fed President Richard Fisher. (Note: Fisher, though a Texan, did run for the US Senate as a Democrat before he was named Dallas Fed president, so forget that stereotype you have in your mind here of Texans and Republicans.) We are going to look at a few paragraphs of his speech to the Harvard Club of New York, which he kicks off on a nautical theme, noting his matriculation at the Naval Academy and then explaining why he is against further QE when the majority of the committee is bent on pursuing the policy. It boils down to the dual mandate from Congress, which leaves the Fed in a conflicted position. Which policy to make primary?

"It will come as no surprise to those who know me that I did not argue in favor of additional monetary accommodation during our meetings last week. I have repeatedly made it clear, in internal FOMC deliberations and in public speeches, that I believe that with each program we undertake to venture further in that direction, we are sailing deeper into uncharted waters. We are blessed at the Fed with sophisticated econometric models and superb analysts. We can easily conjure up plausible theories as to what we will do when it comes to our next tack or eventually reversing course. The truth, however, is that nobody on the committee, nor on our staffs at the Board of Governors and the 12 Banks, really knows what is holding back the economy. Nobody really knows what will work to get the economy back on course. And nobody – in fact, no central bank anywhere on the planet – has the experience of successfully navigating a return home from the place in which we now find ourselves. No central bank – not, at least, the Federal Reserve – has ever been on this cruise before.

"This much we do know: Our engine room is already flush with $1.6 trillion in excess private bank reserves owned by the banking sector and held by the 12 Federal Reserve Banks. Trillions more are sitting on the sidelines in corporate coffers. On top of all that, a significant amount of underemployed cash – or fuel for investment – is burning a hole in the pockets of money market funds and other nondepository financial operators. This begs the question: Why would the Fed provision to shovel billions in additional liquidity into the economy's boiler when so much is presently lying fallow?...

"One of the most important lessons learned during the economic recovery is that there is a limit to what monetary policy alone can achieve. The responsibility for stimulating economic growth must be shared with fiscal policy. Ironically, and sadly, Congress is doing nothing to incent job creators to use the copious liquidity the Federal Reserve has provided. Indeed, it is doing everything to discourage job creation. Small wonder that the respondents to my own inquires and the NFIB and Duke University surveys are in 'stall' or 'Velcro' mode.

"The FOMC is doing everything it can to encourage the U.S. economy to steam forward. When we meet, we consider views that range from the most cautious perspectives on policy, such as my own, to the more accommodative recommendations of the well-known 'doves' on the committee. We debate our different perspectives in the best tradition of civil discourse. Then, having vetted all points of view, we make a decision and act. If only the fiscal authorities could do the same! Instead, they fight, bicker and do nothing but sail about aimlessly, debauching the nation's income statement and balance sheet with spending programs they never figure out how to finance.

"I am tempted to draw upon the hackneyed comparison that likens our dissolute Congress to drunken sailors. But patriots among you might take umbrage, noting that a comparison with Congress in this case might be deemed an insult to drunken sailors.

"Just recently, in a hearing before the Senate, your senator and my Harvard classmate, Chuck Schumer, told Chairman Bernanke, "You are the only game in town." I thought the chairman showed admirable restraint in his response. I would have immediately answered, "No, senator, you and your colleagues are the only game in town. For you and your colleagues, Democrat and Republican alike, have encumbered our nation with debt, sold our children down the river and sorely failed our nation. Sober up. Get your act together. Illegitimum non carborundum; get on with it. Sacrifice your political ambition for the good of our country – for the good of our children and grandchildren. For unless you do so, all the monetary policy accommodation the Federal Reserve can muster will be for naught."

(You can read the whole speech at http://www.dallasfed.org/news/speeches/fisher/2012/fs120919.cfm)

What If They Gave a QE Party and No One Came?

I worried and wrote, when QE2 was being discussed, that the Fed was in danger of wasting a bullet that it might need in the future. The longer-term effects of the previous rounds of QE have not been very significant for the economy, unless you are a banker or own stocks. Getting an extra $25 billion, as US banks have gotten from the Fed, is significant largesse. And corporations are not exactly going wild on capital expenditure programs, either. The money the Fed is creating is sitting idle.

And now the Fed has essentially shot its last QE bullet. Yes, I know that the $40 billion a month has yet to show up. But I am quite worried that at some point the euphoria the market has temporarily exhibited with each new round of QE will be replaced by the dismayed cry, "Is that all you've got?" And then what will the Fed do?

If Europe falls into deeper crisis mode, and it well could (there is just not time to deal with Europe today, and for that I am sure you are glad), then what will the Fed do? More money will not be the answer. The Fed has shot all its monetary ammo, short of actually putting money into your and my bank accounts (which might be more useful than putting it into the accounts of banks that turn right around and put it back into the Fed's coffers).

Thus, I ask the question, "What if they gave a QE party and no one came?" Maybe this QE will be different and the party will go as planned. But there is a very large and real risk that the party will turn out to be one of those that you try to escape as soon as possible. You know, the kind where the people at the party are not fun, the food is bad, and the wine is awful. The kind where the air conditioning doesn't work in summer. Time to slip out the back, Jack.

But in one real sense, QE Infinity going to put even more pressure on Congress to do something after the elections. We are going to find out the real limits to monetary policy the hard way, I am afraid, and Congress will have to act, or things could get ugly.

I am concerned that we are going to have to deal with the unintended consequences of a monetary policy that has been and will continue to be too easy for too long. The last time out, that did not end well, and I am concerned that it won't this time, either. It will be sadly ironic if in the pursuit of higher employment the Fed creates the conditions for a recession or triggers a negative market reaction that forces them to scramble to pull back hard on the free money throttle.

Like what you’re reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

But there is simply no way to know what will really happen when the Fed has to act to take back some of the liquidity it has provided. While the velocity of money is still trending down, at some point it is going to turn around. While that does not seem likely for the next few years, when it does happen, if the Fed has printed too much money, it will have to pull back sharply to check inflation.

It is a very dangerous game they are playing. They seem to be flying too close to the mountain tops, and it is making this passenger on Economics Airlines almost afraid to look out the window. Uncertainty indeed!

Finally – and I know I am quoting a lot in this letter, but there was so much that was well-done this week, I felt I needed to – we are going to look at one more piece. This is the WSJ op-ed I referred to earlier. I'll let the authors speak for themselves. The full essay can be found at http://online.wsj.com/article/SB10001424052702303561504577497442109193610.html

"The Magnitude of the Mess We're In

"The next Treasury secretary will confront problems so daunting that even Alexander Hamilton would have trouble preserving the full faith and credit of the United States.

"By George P. Shultz, Michael J. Boskin, John F. Cogan, Allan H. Meltzer and John B. Taylor

"Sometimes a few facts tell important stories. The American economy now is full of facts that tell stories that you really don't want, but need, to hear.

"Where are we now?

"Did you know that annual spending by the federal government now exceeds the 2007 level by about $1 trillion? With a slow economy, revenues are little changed. The result is an unprecedented string of federal budget deficits, $1.4 trillion in 2009, $1.3 trillion in 2010, $1.3 trillion in 2011, and another $1.2 trillion on the way this year. The four-year increase in borrowing amounts to $55,000 per U.S. household.

"The amount of debt is one thing. The burden of interest payments is another. The Treasury now has a preponderance of its debt issued in very short-term durations, to take advantage of low short-term interest rates. It must frequently refinance this debt which, when added to the current deficit, means Treasury must raise $4 trillion this year alone. So the debt burden will explode when interest rates go up.

"The government has to get the money to finance its spending by taxing or borrowing. While it might be tempting to conclude that we can just tax upper-income people, did you know that the U.S. income tax system is already very progressive? The top 1% pay 37% of all income taxes and 50% pay none.

"Did you know that, during the last fiscal year, around three-quarters of the deficit was financed by the Federal Reserve? Foreign governments accounted for most of the rest, as American citizens' and institutions' purchases and sales netted to about zero. The Fed now owns one in six dollars of the national debt, the largest percentage of GDP in history, larger than even at the end of World War II.

"The Fed has effectively replaced the entire interbank money market and large segments of other markets with itself. It determines the interest rate by declaring what it will pay on reserve balances at the Fed without regard for the supply and demand of money. By replacing large decentralized markets with centralized control by a few government officials, the Fed is distorting incentives and interfering with price discovery with unintended economic consequences.

"Did you know that the Federal Reserve is now giving money to banks, effectively circumventing the appropriations process? To pay for quantitative easing – the purchase of government debt, mortgage-backed securities, etc. – the Fed credits banks with electronic deposits that are reserve balances at the Federal Reserve. These reserve balances have exploded to $1.5 trillion from $8 billion in September 2008.

"The Fed now pays 0.25% interest on reserves it holds. So the Fed is paying the banks almost $4 billion a year. If interest rates rise to 2%, and the Federal Reserve raises the rate it pays on reserves correspondingly, the payment rises to $30 billion a year. Would Congress appropriate that kind of money to give – not lend – to banks?

"… the Fed's Operation Twist, buying long-term and selling short-term debt, is substituting for the Treasury's traditional debt management.

"This large expansion of reserves creates two-sided risks. If it is not unwound, the reserves could pour into the economy, causing inflation. In that event, the Fed will have effectively turned the government debt and mortgage-backed securities it purchased into money that will have an explosive impact. If reserves are unwound too quickly, banks may find it hard to adjust and pull back on loans. Unwinding would be hard to manage now, but will become ever harder the more the balance sheet rises.

Like what you’re reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

"When businesses and households confront large-scale uncertainty, they tend to wait for more clarity to emerge before making major commitments to spend, invest and hire. Right now, they confront a mountain of regulatory uncertainty and a fiscal cliff that, if unattended, means a sharp increase in taxes and a sharp decline in spending bound to have adverse effect on the economy.

"Are you surprised that so much cash is waiting on the sidelines?...

"In short, we risk passing an economic, fiscal and financial point of no return. The problems are close to being unmanageable now. If we stay on the current path, they will wind up being completely unmanageable, culminating in an unwelcome explosion and crisis.

The fixes are blindingly obvious. Economic theory, empirical studies and historical experience teach that the solutions are the lowest possible tax rates on the broadest base, sufficient to fund the necessary functions of government on balance over the business cycle; sound monetary policy; trade liberalization; spending control and entitlement reform; and regulatory, litigation and education reform. The need is clear. Why wait for disaster? The future is now."

Atlanta, New York, Orlando, and South America

Before we get into my schedule, I want to call to your attention an excellent white paper on investing by my friends Jon Sundt and Allen Cheng of Altegris Investments. Their topic is the convergent/divergent approach to portfolio diversification. At the recent Altegris Alternatives Forum for professional investors in Palo Alto, I listened to my good friend Matt Osborne discuss this topic. Matt stressed the importance of moving away from traditional portfolio diversification, as defined by style or asset class, and instead suggested assessing strategies based on how they tend to perform in various market environments. Convergent strategies historically perform when market fundamentals are intact. Long-short equity is an example. Divergent investment strategies, on the other hand, are those that may thrive when markets are in a more irrational state. Managed futures are a strong example of a divergent strategy. A blend of convergent and divergent strategies enables your portfolio to perform in a multitude of market environments. You can access this paper by going to www.altegris.com – it's right on the home page of the website. It really is quite a good piece on the current theories regarding diversification.

I'll reconvene with my friends at Altegris on Wednesday in Atlanta. As it turns out, Martin Truax will be in town, as will Jeff Saut of Raymond James, whom I have not seen for way too long. Then Sunday night I will be in New York with some of the team from Mauldin Economics, and Kiron Sarkar will be coming over from London. The following day is packed with meetings, capped by what shapes up as an awesome dinner with a great group that is gathering to hash over current affairs. Then I'll be with Tom Keene the next morning on Bloomberg, at 7 AM! Then it's on to Orlando as the guest of UBS, in an event hosted by Altegris. Finally, I'll enjoy a quick get together with Pat Cox and then head back home.

Care to join me election night, November 6 … in Argentina? From October 28 to November 8 I'll be in Brazil, Uruguay, and Argentina, speaking to regional chapters of the CFA Society. As part of the trip, I'm stopping by for the season-opening celebration, November 5-10, of friend and partner Doug Casey's lifestyle and sporting estate, La Estancia de Cafayate, where I'll host the group at a café on the scenic town plaza and watch the election results roll in. If you'd like to join me and a group of interesting folks from around the world in what promises to be a unique experience, drop Dave Norden a note at LiveMore@LaEst.com. David Galland has promised nonalcoholic beers for me for the evening. The recent polls suggest I might want something stronger, but I think I can hold out.

Wednesday evening I did a speech in Chicago for John Arthur of the RDA Financial Network. He was kind enough to take me, Mike Shedlock (the #2 or #3 financial blogger), and Steve Blumenthal to Ditka's for dinner afterwards, and the conversation was invigorating. We do live in interesting, if uncertain, times.

It really is time to hit the send button. Look for a VERY special announcement from me this week. There are some rather big changes coming up, and you will get to be part of them. I am actually quite excited about everything. Have a great week.

Your getting more comfortable with uncertainty analyst,

John Mauldin

P.S. If you like my letters, you'll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.

Tags

Suggested Reading...

|

|

Did someone forward this article to you?

Click here to get Thoughts from the Frontline in your inbox every Saturday.

John Mauldin

John Mauldin