What I Learned at (Economics) Summer Camp

-

John Mauldin

John Mauldin

- |

- August 12, 2017

- |

- Comments

- |

- View PDF

Will Yellen Stay or Go?

Quantitative Tightening

Consensus Forecasts

Lightning Round

Chicago, Lisbon, San Francisco, Denver, and Lugano

All over America, kids who were fortunate enough to go to summer camp are busy telling mom and dad what they did. Their stories will be suspiciously incomplete, but that’s OK. We know they learned something.

Well, I went to camp this summer, too. I go every year, and I always learn more than I can manage to remember. Camp Kotok is an invitation-only gathering of economists, market analysts, fund managers, and a few journalists. It takes place at the historic Leen’s Lodge in Grand Lake Stream, Maine. We fish, talk, eat, drink, and talk some more. It’s a three-day economic thought-fest (and more rich food and wine than is good for me or anyone else at the camp). For me, that’s about as good as life gets.

(Aat the end of the letter in the personal section I’ll describe a typical day at my summer camp. Not exactly arts and crafts and games. Unless poker counts as a game.)

Come along with me as I share some of my main takeaways from the camp and then, in a “lightning round,” touch on on a few various shorter topics.

David Kotok of Cumberland Advisors started the event after narrowly escaping death in the World Trade Center on 9/11. It was a way for him and a few friends to get away from the city, appreciate life, and talk about things that matter. Now the gathering has grown to about 50 of us. We meet under the Chatham House Rule, which means we can’t quote each other directly without permission. That helps promote an open exchange of ideas. And it’s definitely open. It is interesting to see the difference in the level of communication in an environment where people are not worried about being quoted when they trot out a new idea they have recently started thinking about. Testing those ideas against one’s peers, who might have different views about the same topic, is a valuable process.

David relaxes the rule for certain parts of the event, and that’s part of what I’ll share with you today. The Saturday night dinner always includes a debate on some contentious issue, with participants who are known to disagree. Martin Barnes from Bank Credit Analyst always moderates. He is one of the few who can quiet that room, with his imposing height, his booming Scottish brogue, and his offbeat sense of biting humor.

This year’s debate topic was the Federal Reserve. Specifically, we discussed the Fed’s future leadership and policies. Both are very much in question right now, and much depends on the answers. Time will tell what happens, but here is what some experts think.

The first debate question was deceptively simple. Who will be running the Fed next year, and will it matter? How will new leadership change anything? Janet Yellen’s current turn at the chair expires in February. Trump could renominate her but hasn’t yet announced a decision or even given a hint.

This is speculation, but President Trump had some kind words for Yellen in a recent Wall Street Journal interview. Anonymous sources quoted in the media say Trump economic advisor and former Goldman Sachs executive Gary Cohn is also in the running. Other names come up, but those two are leading for now.

I am not sure what to make of President Trump’s generous remarks, especially after his less than laudatory remarks about the Yellen Fed on the campaign trail last summer. It may just be that wiser heads got to him and pointed out that she is going to be Fed chair through February. No matter what he plans to do, there is really no point in a sitting president antagonizing a Fed chair when he would like her to not turn off the easy-money spigot too soon – in spite of what he said during the campaign.

Camp Kotok attendees had mixed views. Even most of those with a preference doubted the choice would matter very much. The Fed’s policy course under Yellen will be hard for Cohn or anyone else to change. One person made a very interesting point, though. We know President Trump admires successful business leaders. That might give Cohn an edge, since he was COO at Goldman Sachs. But then again, installing a Goldman Sachs alum at the head of the Fed really doesn’t square with his campaign speeches.

It wouldn’t surprise me to see a “dark horse” emerge as the nominee. Let’s hope we get for Fed chair – and then also for the Fed governors – individuals as qualified as Trump’s Supreme Court nominee. Trump will get to fill at least six of the seven potential open seats by this time next year. No other president has been able to put his stamp this firmly on the Fed since Woodrow Wilson appointed the original Federal Reserve Board of Governors in 1913: Trump’s nominees will control the Fed. The Fed chair and vice chair plus three board governors were appointed by Obama, but as part of the normal process of governors’ terms expiring. Fed governors are appointed for 14 years in an effort to keep any one president from being able to appoint all the governors. But in recent years, because of resignations, the situation has shifted; and now Trump has a remarkable opportunity – and will own the outcome. Good, bad, or indifferent, it will be the Trump Fed.

For the record, Yellen has also left open the possibility of staying on the Board of Governors after her term as chair is over. Those are separate appointments. She can technically remain on the board until January 31, 2024. She’s 70 now, and I doubt she’ll hang around till 2024, but it’s possible. But going from being Fed chair to just another governor would be unusual, especially considering the rather large speaking fees and book royalties that ex-Fed chairs can command. Then again, we know Supreme Court justices delay retirement so that a president they like can appoint their successors. I think Yellen is reminding Trump that she still has that option.

The same is true for Vice Chair Stanley Fischer. His board term lasts until January 31, 2020; so if he chooses to stay, he could be around until either Trump’s second term or someone else’s first.

The other two serving Board of Governors members are Jerome Powell, whose term isn’t over until January 31, 2028, and Lael Brainard, whose term ends on January 31, 2026. They can both elect to stay, but the expectation is that Brainard will also resign after Yellen departs. There is really no speculation as to what Jerome Powell will do. If he likes doing what he does – and he does run some very interesting committees – he may wait until he sees who else is on the reconfigured board and figures out whether he can get along with them.

Like what you’re reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

Now, with regard to the importance of these appointments, businesspeople think differently from economists. They pay attention to market signals rather than political criteria. One person said Cohn at the Fed might “clean house,” as Rex Tillerson is doing at the State Department. The Fed has over a thousand PhD economists on staff, and it’s not at all clear that the combined weight of their expertise leads to better policy decisions. (When that point was made at the camp, the discussion got heated, more so than I recall seeing in past years, but with good reason. There were any number of economists in the room, and they had a lot of PhD-holding friends who were still at the Fed. So they squawked loudly; and, as you might imagine, Martin Barnes had to restore order.)

The bottom-line consensus on Yellen vs. Cohn: Both are tolerable. Markets might like Yellen better simply because she is at least a known quantity. Cohn might bring a different attitude and make personnel changes, but his impact wouldn’t show up in monetary policy for some time. But there were more than a few campers who preferred to see someone else appointed. Including your humble analyst.

However, when I discussed Trump’s next two probable nominees to the board (Randal Quarles, a Treasury Department official in the George W. Bush administration, and Marvin Goodfriend, a former Fed official who is now a professor of economics at Carnegie Mellon University), there was general agreement with me that those two names suggested there would not be a serious change in direction at the Federal Reserve Board next year. So when the next crisis hits, you can expect more QE and perhaps even negative rates, if you take Goodfriend’s speeches and research seriously, which I would.

The next question we dealt with was, should we be concerned about quantitative tightening? Is the market too complacent?

Here I’ll use my edited version of my associate Patrick Watson’s notes on the debate:

Jim Bianco (bond market maven/guru and analyst): Assume QT begins in September. Will not be immediate problem in 4Q, but may be in 2018. What really matters isn't the Fed but the collective balance sheets of all central banks, which are still growing worldwide for now. Problems more likely when we see net global QT. In other words, bigger market impact will come when ECB decides to start QT. This will likely raise interest rates, could get 150 bps on long end by 2019. Problematic for risk markets. [We will touch on the issue of reserve-bank balance sheets in a moment.]

Bob Eisenbeis (Atlanta Fed chief economist, who attended FOMC meetings for ten years): Thinks market can easily digest the suggested tightening levels over five quarters. Amounts are trivial to Treasury market. But part of impact will depend on Treasury choices over re-funding what Fed doesn't buy. Agrees with Bianco that international is bigger issue than Fed.

Danielle DiMartino (former assistant to Richard Fisher at the Dallas Fed and author of recent bestseller Fed Up) thinks none of this matters because QT won’t happen. We will get to recession first. Global bond markets assume the same, so Fed is performing a risky experiment if it does QT.

Megan Greene (chief economist at Manufacturers Life): Everyone worried about inflation when QE started. It showed up only in asset prices. QT might have opposite effect, which would mean a potential reversal of asset prices – but impact mitigated if Fed keeps making its plans clear. Maybe we will see a slight steepening. It depends on how much and on how long they keep going.

From the floor, Harvey Rosenblum (chief economist at the Dallas Fed for many years until he resigned a few years ago): Will we become Zimbabwe, or Japan? So far Japan winning. Is inflation being mismeasured, and is it really much lower than the Fed believes? If so, and the Fed realizes it, QT could come back off the table. If they don’t realize it, they could make a major policy error. (Many recessions can be laid at the foot of the Federal Reserve and its policy errors. Only in hindsight, of course. For the record, I believe QT is a policy error. Just saying…)

(Sidebar: You scoff at the idea that inflation is lower than anticipated? If you take out food, energy, and the oddly figured “owner’s equivalent rent,” inflation is about 0.6%. Yes, I know, if you assume away the real world, you can make your model do anything you want. But for the bulk of the economy, inflation is not a worry and is actually falling. When we get to “peak rents,” we could easily see inflation drop below 1%. And during a recession? Can you say deflation? The Fed panicking and massive QE? Get ready for an interesting ride.

Each year, most camp participants fill out a survey (and some of us place small side bets, typically five dollars a choice) on a number of different economic indicators. Let me just give you the average predictions as to where things will be one year from now.

• Three-month LIBOR: 1.64% from 1.30% today and 0.82% a year ago – that’s a doubling in the rate in two years.

• Ten-year Treasury note: 2.57%

• WTI crude oil: $50.20 (but the range was all over the place, from $30 to $76)

• S&P 500: 1,340, with surprisingly few really bearish views

• Gold: $1,340, and while there were a few outliers in both directions, people were generally looking for a strong movement upward.

• Dollars per euro: $1.14

• Dollars per UK pound: $1.23

• Yen per yollar: 115 (and surprisingly, my suggested number was not the highest prediction)

• Unemployment rate: 4.4%

• Core CPI: 1.9%

• US GDP: 2.12%, again with a very wide range, but interestingly, nobody was predicting a negative GDP or an outright recession.

In short, the average predictions pretty much repeated the current consensus of the market, which is to say, they are averages that reflect a complacent outlook. But I can tell you, there was a wide range on most of the predictions, and that disparity in views certainly came out in the discussions.

Like what you’re reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

Takeaway 1: Almost everyone expects a serious market correction before the end of the year. Most of the people I talked to were concerned about market complacency; and even if they were bullish, which many of them were, they were surprised that we’ve gone this long without a correction. Could one be starting this week? We’ll see…

Takeaway 2: In talks with people I seriously respect, I found more concern about valuations and spreads in the bond market than about valuations in the stock market. As I sat with a few people and “war-gamed” what the next recession will look like, a general agreement emerged that the credit markets will be far more volatile than they were last time, even though banks are better capitalized today than they were 10 years ago. The problem is simply that credit markets have no liquidity and valuations are extraordinarily stretched. And not just in the US.

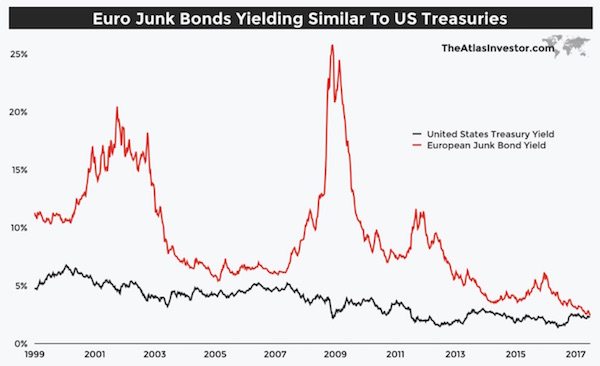

One of the participants told me to look at this chart:

Dear gods, when European junk bonds pay the same as US Treasurys do, there is really something out of whack in the world. Look at that spike in European junk in 2009 and the one back in 2002. European junk bond investors have never been more complacent. The reach for yield is staggering. The participants in that market think that Draghi and the European Central Bank have their backs. If the situation starts to get volatile, they expect the ECB to step in. But the ECB would have to change its mandate in order to buy junk bonds, and that means getting the more conservative members of the eurozone to agree. I hesitate to bet on that. This could be the European equivalent of the Big Short in the next global recession.

Takeaway 3: Much of the private discussion centered around how much the Fed will tighten this year. Some thought the Fed wouldn’t raise any further, and some thought we would get at least one or two more rate hikes. The consensus seemed to be that a December rate hike is on the table unless we get some really unsettling data between now and then. It certainly doesn’t look as though we’ll see a hike in September, though. If there is one, it will be a surprise to everyone I talked to.

Takeaway 4: There was a conversation between a very serious Fed watcher and a former Fed economist. The question was, what would happen if the Fed’s balance sheet went negative, i.e., if they were selling their bonds back into the market at a loss? The answer was that the Fed is not required to record losses on asset sales against capital. There is an agreement with the US Treasury that says the Fed can create a negative asset account, but at that point it withholds remittances until the balance sheet is positive again. The Fed would be technically insolvent, but that wouldn’t matter because it’s backed by the US Treasury.

Takeaway 5: One gentleman who has been coming to the camp for several years runs a fund and is an expert on frontier markets. Because I have been to 62 countries – many of them on the very frontier of the frontier markets, I’m always interested in talking with him. And now that I’m managing my own portfolio of managers, I’ve noticed that we have several different frontier-country ETFs in our portfolios. This piques my interest even more. So I always ask him what his favorite frontier market is, and what he sees happening in that space. For the last three or four years he has been consistently big on Vietnam.

This year he surprised me by answering “Serbia.” I probably shouldn’t have been surprised, as almost the entire Central and Eastern European sector is hot, hot, hot. When I asked why, he pointed out the country has really made itself investor-friendly but that plus is not all that easy to trade, so there’s a lot of undervalued potential in what is essentially a well-educated and growing economy. And he still loves Vietnam and also mentioned Myanmar and a few countries in East Africa.

As you might expect, he has to travel more these days and to places that really aren’t vacation spots in order to do proper due diligence. He has to do things that you and I might not want to do, which says that if you ever want to invest in those markets, you need to find someone like him to do your traveling and decision-making for you.

The takeaways don’t end here, but we’ve run out of room today.

Chicago, Lisbon, San Francisco, Denver, and Lugano

I mentioned above that I would give you a typical day’s schedule at Camp Kotok. Depending on how dedicated a fisherman (or woman) you are, you get up and have breakfast in the morning with the staff, who make you pretty much anything you want. They make extraordinarily good pancakes. I will admit that while pancakes are normally off my diet, I indulge this one time of the year along with my regular scrambled eggs and maybe some bacon.

Then you find your guide, who takes you to his boat, and you get out on whatever lake we are fishing that day. Depending on when you head out, there are friends to greet but not much real economic discussion, except on Friday morning when the unemployment numbers come out. A fair number of attendees stick around the lodge for that number and then try to get on the internet to send out quick takes to their readers and/or clients. So the fishing gets started later for some of us.

We all meet for lunch somewhere, which the camp staff has been preparing for us; and the guides clean and cook whatever we catch, which is paired with too many fattening hors d’oeuvres. We dine on lots of fried fish and every now and then some fried eel and/or lake salmon if anybody happens to catch one. For the healthy-minded among us, the staff steams some of the fish along with vegetables. And of course there’s a generous quantity of wine. Lunch lasts at least two+ hours, making for some of the best conversations around the lake camps. Some people go back out and fish a bit more, but generally people call it a day by three or four and head back to the lodge or cabins to clean up and get ready for dinner.

Attendees begin gathering around 5:00 or 6:00. Tempting hors d’oeuvres in abundance (I don’t know where they get that smoked duck, but it is awesome) take the edge off your hunger. And the conversations start. I try to make it a point to sit at every dinner with a different group of people. And while I have old friends, of course, I enjoy getting to talk with people that I don’t normally run into. I remember a particularly wonderful conversation a few years ago with a former Fed regional president that went on later than it should have because we were having so much fun sharing. Somehow the informal setting makes us all more relaxed and open. Then you go to your comfortable but rustic cabin (after all, this is a fishing camp even if it is one of the nicest in the area), and you wake up the next morning and do it again.

Some people do it for two days, but most do it for three or four. A few hardy fanatic fishermen come on Wednesday; more arrive the next day or the next. Nearly everyone stays Friday and Saturday; there are generally special events planned for Sunday (range shooting or canoeing the St. Croix River at the Canadian border were the events this year), but you can always find a guide to take you back out on yet another lake in the area. Saturday night generally sees a table or two of poker. I make it a point not to play. While there have been a few times when I’ve been one of the big winners, more often than not I reach my loss limit and bow out. I would rather sit out on the deck and talk on a beautiful evening.

Like what you’re reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

And while it may sound like the emphasis is on fishing and food, the real highlights are the conversations.

Looking ahead, I don’t do much traveling till the end of September, and then I will be in Chicago, Lisbon, San Francisco, Denver, and Lugano. I have a few more events that are being lined up. Next week I will go into more detail. Right now it is time to hit the send button. You have a great week.

Your back on a pretty strict diet analyst,

John Mauldin

P.S. If you like my letters, you'll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.

Tags

Suggested Reading...

|

|

Did someone forward this article to you?

Click here to get Thoughts from the Frontline in your inbox every Saturday.

John Mauldin

John Mauldin