(Limited enrollment period—see below)

FULL-SPECTRUM INVESTING

A Solution to Market Uncertainty

Find Out How Full-Spectrum Investing Could Grow Your Portfolio—Whether the Stock Market Leaps, Drops, or Crashes...

Dear Valued Client,

The world’s most celebrated investor, Warren Buffett, is bullish on the US stock market.

But superstar hedge fund manager Stanley Druckenmiller is bearish.

And most investors are simply confused.

Here at Mauldin Economics, we believe there is a better approach to today’s market uncertainty. I’m going to tell you all about it in just a moment.

It Ain’t Easy...

Anyone with even a little experience managing money knows that successful investing takes hard work.

Some combination of fundamental and technical analysis along with screening tools can and should play a role in making informed investment decisions.

But there is something else—something that far too many investors lack.

That “something” is a multidimensional perspective.

Here’s a quick example.

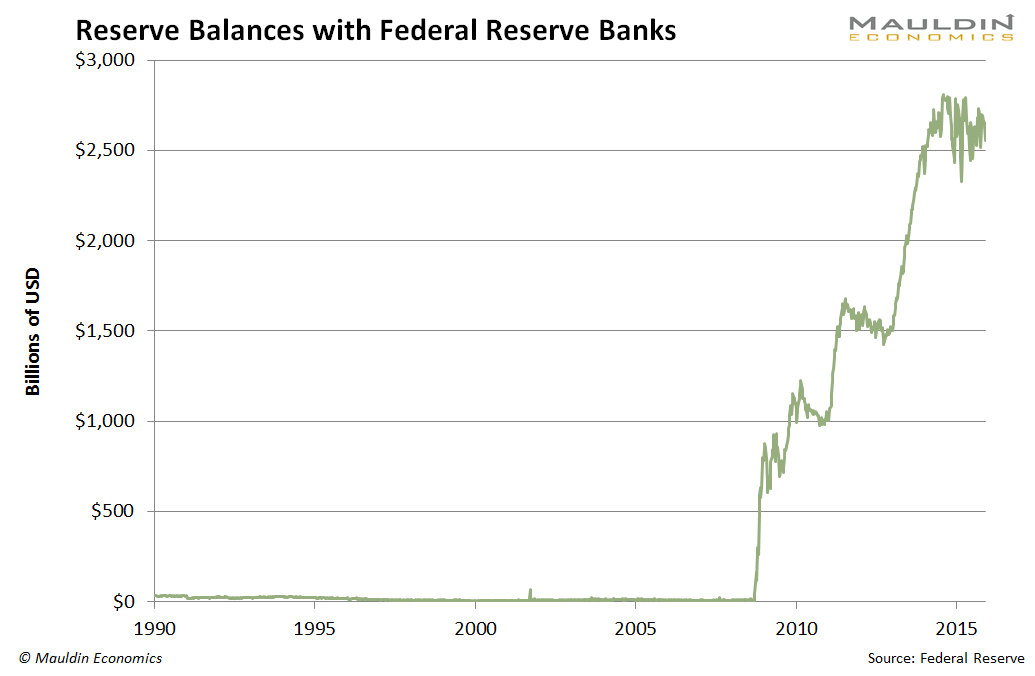

In 2008, as the financial crisis began to spiral out of control, the Federal Reserve took the unprecedented step of massively inflating its balance sheet with the equivalent of money created out of thin air.

Watching the Fed’s jaw-dropping balance sheet inflation, many market observers concluded a devastating inflation must follow...

...which would force interest rates higher, toppling the tall tower of government debt.

In short, financial Armageddon.

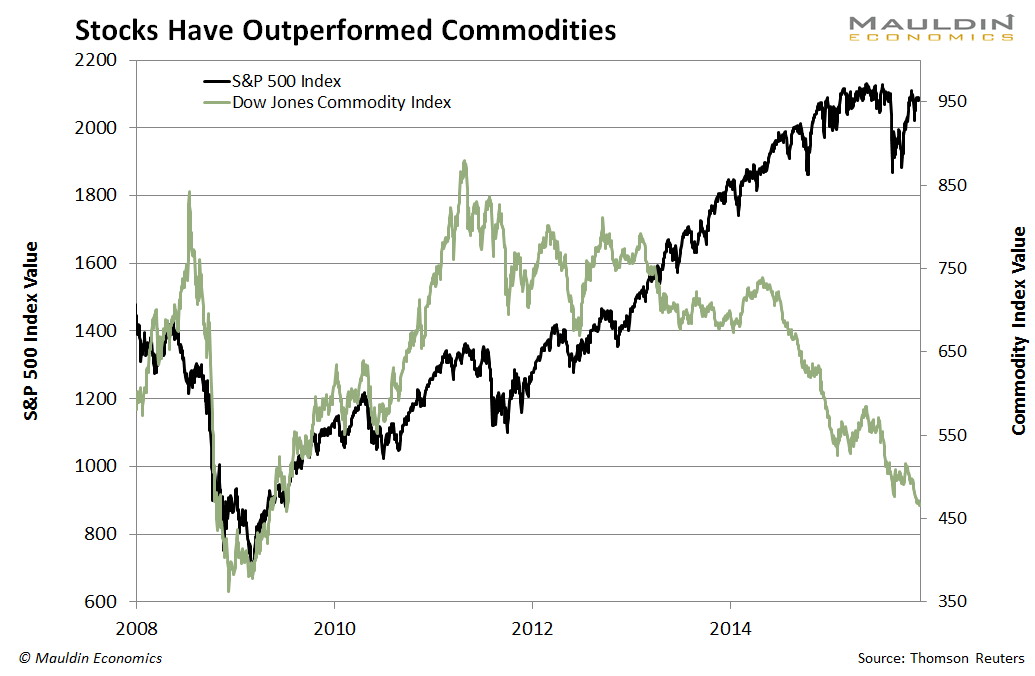

Investors who bought into this binary “If A, then B” analysis (and many did) made some very bad decisions about their money, avoiding US stock and bond markets in favor of commodities and other inflation hedges.

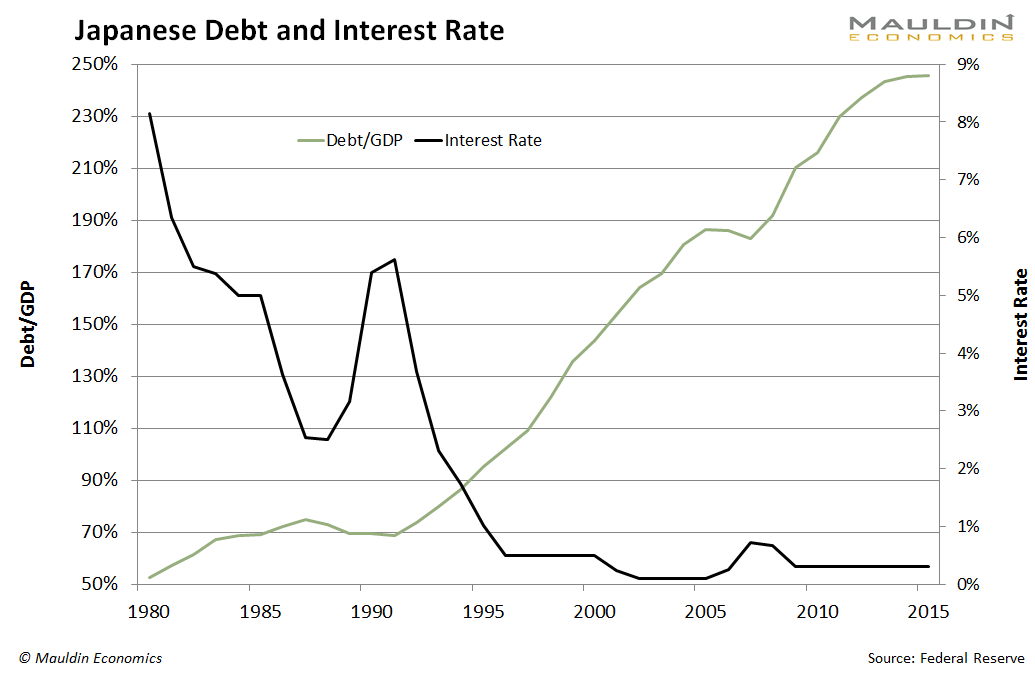

As you can see from the chart below, that would have been a serious misallocation of capital.

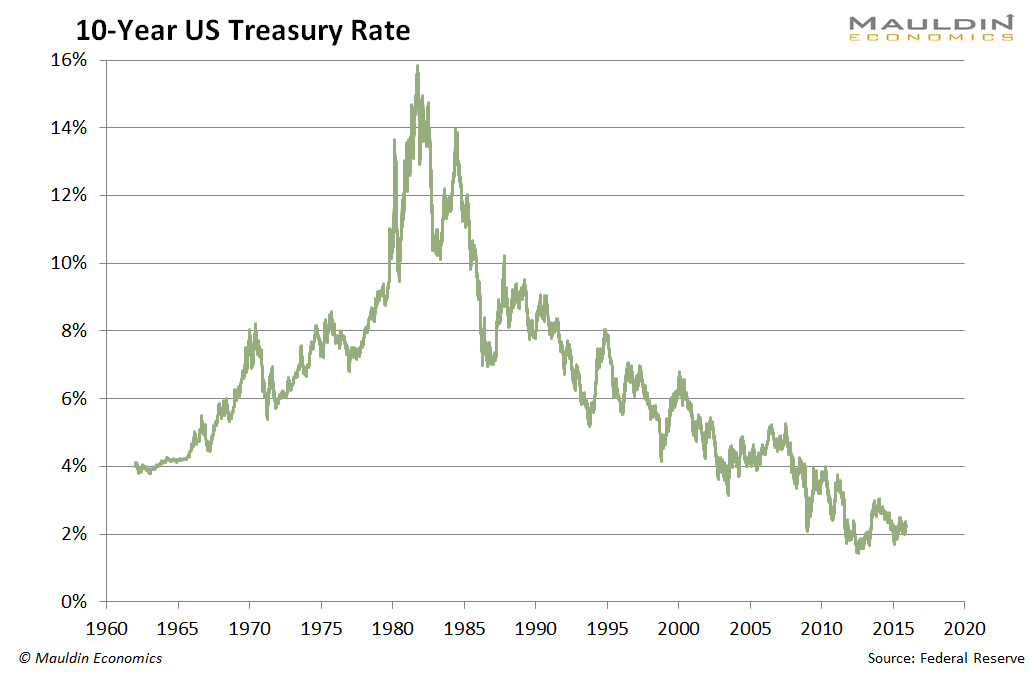

That’s because rather than rising, interest rates fell to the lowest levels in recorded US history!

Now, don’t get us wrong.

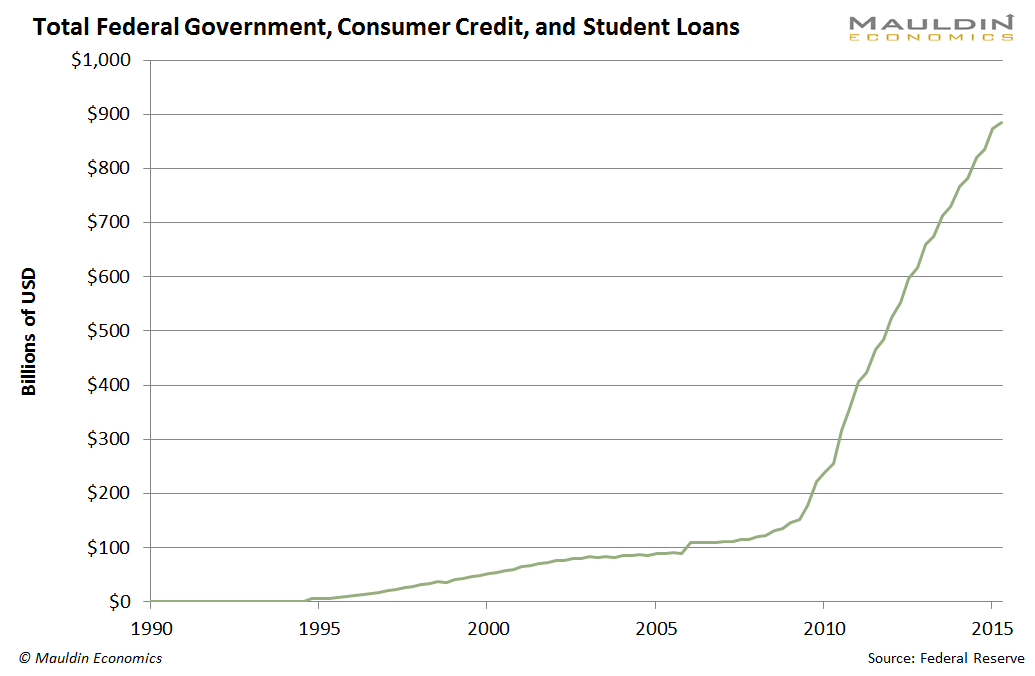

In the end, the Fed’s actions will have consequences.

Especially as the low-interest-rate policy has led to a massive increase in borrowing, making the debt bubble even worse. At some point, the debt piper will have to be paid.

But even a chart that eye-opening needs to be viewed in context. And the context is that the US economy is the world’s greatest economic superpower.

Seen in that light, we have to ponder which country is in better shape to compete for economic dominance.

Europe? China?

Maybe, someday.

For now, however, there’s no question investors feel far more comfortable with their money in US securities and in the US dollar. That changes the dynamics considerably.

Investors who think there are simple answers to complex problems are prone to costly mistakes.

That’s because the US and global economy are immensely complex. They can never be understood in black and white terms.

Sure, the size of the collective US debt could lead to significantly higher interest rates in the foreseeable future. But no one can tell with any certainty when that’s going to happen.

Consider the massive 20-year debt surge in Japan, now the world’s most indebted country by a wide margin.

Yet, as you can see in the chart here, Japanese interest rates remain at 0%!

My point is, while it is important to understand macro trends... the simple reality is that you can’t predict them with any real precision.

In an era when governments are only too willing to interfere in their economies—sometimes in rather dramatic ways—it adds a lot of unpredictability to big-picture analysis.

That means investors who form strong beliefs in one macroeconomic outcome or another are at great risk of making serious investment mistakes.

We here at Mauldin Economics make a conscious effort to always challenge our strongest convictions and are not afraid to adapt our views—even if it means accepting we were wrong.

But that’s not where the rubber meets the road, which is my point in writing to you today.

The One Thing That Can Make or Break You as an Investor

What really determines how successful you’ll be as an investor is not whether the Fed is or isn’t going to set off a cycle of higher interest rates.

Even if they do start raising rates, they could change policies on the flip of a dime. So trying to plan your portfolio around the Fed seems a waste of time.

So what does determine how successful you’ll be?

The specific steps you take to find solid investments to add to your portfolio.

Investments that, properly selected, will do well almost regardless of what happens to the broader economy.

Finding those solid investments is the mandate of and the passion behind the suite of paid research services offered by Mauldin Economics.

While we make it a point to keep a close eye on the big picture, here’s the truly important work our editors and analysts do:

-

React quickly to changing trends. We can’t know where the economy and the markets will be a year from now, but we can identify the strong trends currently in place and act in concert with those trends. Or notice they are beginning to change and reposition our portfolios accordingly.

-

Dig into important investable sectors. Many people think in terms of “the stock market,” “bonds,” or “commodities.” But those broader markets are made up of a great many subsectors that, based on the trends, may be overpriced, neutral, or undervalued. Depending on how you play it, each of these subsectors can offer compelling opportunities.

Dividend stocks, deep-value stocks, growth stocks, biotech, mining, emerging markets, long- or short-dated treasuries, corporate bonds... the list goes on and on.

-

Thoroughly vet individual securities. Within these investable sectors, there are literally thousands of possible individual securities in which to invest. Screening those investments to find the most prospective ones is a complicated and time-consuming task.

Then, when you find a great investment—and that investment may involve using an options strategy to reduce risk or maximize returns—you need to constantly monitor it for changing circumstances that require action: to sell, buy more, or buy lots more.

As much as we all wish it wasn’t so, investing isn’t easy. Especially not in today’s massively complex economic environment.

And the alternative to actively investing is sitting on the sidelines.

But there’s a solution to the dread so many subscribers feel when contemplating investment moves in today’s uncertain markets.

It’s a team approach that guides you into solid investments—investments that build net worth over time and never keep you awake at night worrying about the markets...

Full-Spectrum Investing: Covering All the Bases

In a minute, I’ll tell you about a very special, limited-time opportunity to become a Mauldin VIP.

First, however, I have to explain the concept of Full-Spectrum Investing.

Mauldin VIPs take advantage of this principle each and every day—a multidimensional approach to investing, with proven results.

If you accept that forecasting the big picture with any kind of certainty isn’t possible...

...the only logical approach to successful investing is to select our investments by using time-tested, disciplined methods.

That’s where the “Full-Spectrum” concept comes in.

To show you how it’s being done, let me touch briefly on the work Mauldin Senior Editor Tony Sagami does on behalf of subscribers.

The Spectacular Trio

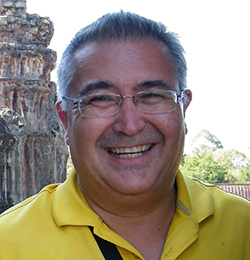

Tony Sagami, Editor of Yield Shark, Just One Trade, and Rational Bear

Tony is the editor of Yield Shark as well as two of our most successful premium Alert services.

In case you’re unfamiliar with it, Yield Shark focuses on finding undervalued, dividend-paying stocks for readers.

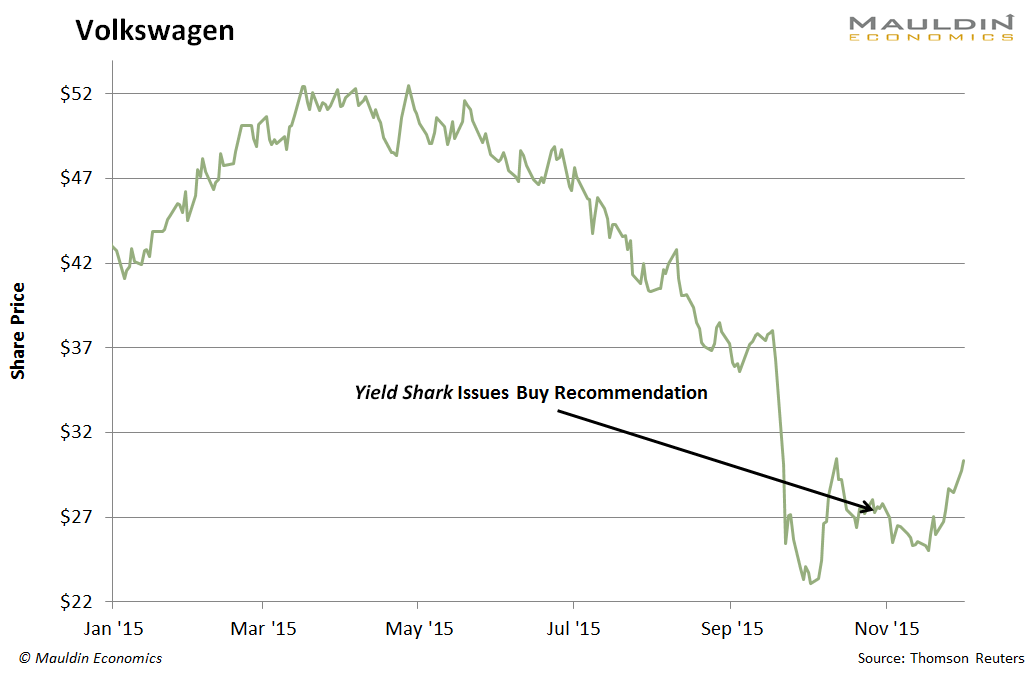

In one recent issue, Tony Sagami provided a comprehensive analysis on why you should own shares of Volkswagen.

His reasoning: Volkswagen was just enmeshed in one of the greatest scandals of the new millennium—having cheated on the tough emissions regulations imposed on car models sold in the US.

Wait... what?

He wants you to buy shares of a carmaker who was at the center of an emissions scandal and whose shares dropped precipitously in the fallout?

That’s right, and here’s why.

Tony realized the market had overreacted to the emissions scandal and that VW, now the world’s largest car company, was in no danger of losing its predominant position in the global market.

Digging in deep, he presented readers with a comprehensive analysis proving that the battered Volkswagen shares represented a compelling value...

...and he revealed a cautious strategy that not only yielded 4.6% but allowed subscribers to buy already undervalued Volkswagen shares at an additional 20% discount.

There’s a good chance that by the time Tony closes this “Fallen Angel” position in Volkswagen, he’ll have another double-digit gain to add to Yield Shark’s exceptional track record.

How exceptional? If you had invested an equal amount in each of the recommendations found in Yield Shark since its debut in June of 2012, you would have realized an average gain of 12.3%. How does that compare to your CD and money market returns?

Are you interested in earning market-beating yields with big upside in undervalued, dividend-paying stocks? Then that dimension of your portfolio is covered by Yield Shark.

But Tony and his team don’t limit themselves to scouring markets for deep values in dividend stocks. That’s because finding “Fallen Angels” in all the major markets is their particular passion. As is finding the treasures on the opposite side of the spectrum: companies that are grossly overvalued.

Tony brings this work together in two succinct premium Alert services—Just One Trade and Rational Bear—that allow subscribers to take advantage of fast-moving opportunities that won’t wait around for a monthly publication schedule.

-

Just One Trade is Tony’s options trading alert service, which also happens to provide a perfect “down-market insurance.” Just One Trade consists of a monthly report, plus trading Alerts that aren’t published on a fixed schedule, but rather only when Tony and his team uncover a particularly exciting opportunity for a quick return. If you had invested an equal amount in all the recommendations found in Just One Trade since inception, you would have realized an average annual gain of 19%.

-

Rational Bear takes advantage of grossly overvalued companies facing near-term headwinds. Sometimes Tony uses inverse ETFs, which you can buy just like stocks. And sometimes he recommends easy-to-execute put options. No matter the recommendation, Tony always tells you exactly what to do with complete and clear instructions.

But how to find the stocks and sectors heading down?

In Rational Bear, Tony employs three time-tested strategies:

- Enron Hunting. Finding mismanaged or even fraud-stricken corporations and betting against them for handsome profits.

- Reverse Momentum Investing. When stocks hit their 52-week low, chances are they will drop even further... which can bring attractive gains in a short time.

- Buggy Whip Makers. Once the first motor vehicle hit American streets, even the best buggy whip maker went out of business. Examples for modern-day technologies that became obsolete are Blackberries, fax machines, and film-based cameras. Find one of these dinosaurs in the making, and you can profit from their demise all the way down.

And in an outright bear market—which may be on the horizon as we speak—you can’t have a better companion by your side than Rational Bear, helping you insure your portfolio against disaster.

Saving the World (and Your Portfolio)

—One Biotech Stock at a Time

As readers of any duration know, John Mauldin is a big believer in the transformative technologies now turning health care on its head.

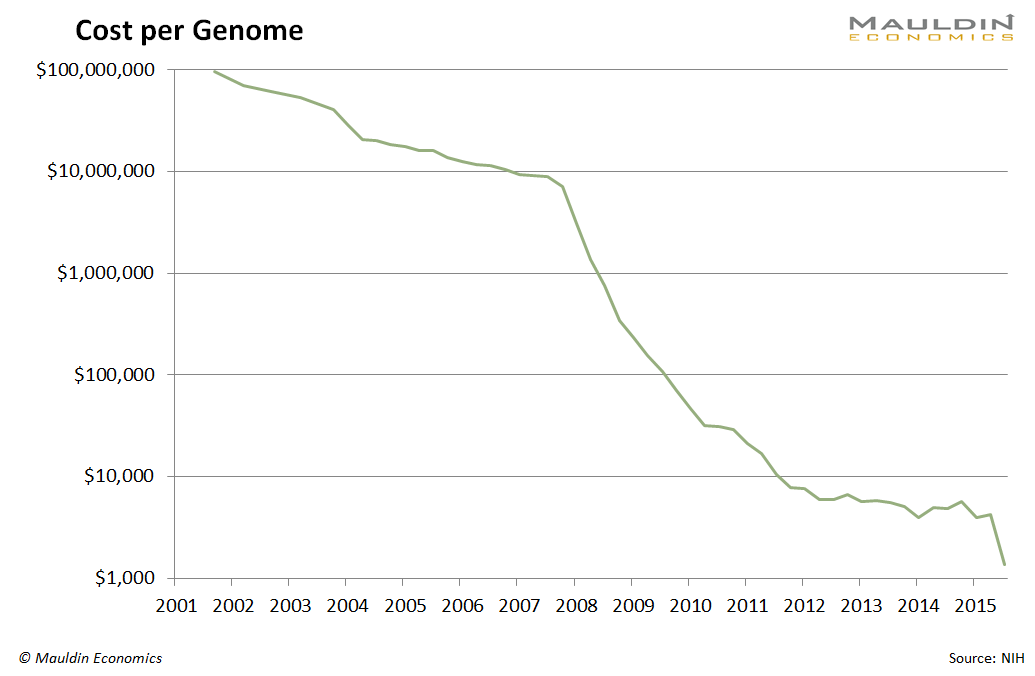

The following chart tells a powerful story. As recently as 2001, the cost of sequencing a person’s genome was upward of $100 million.

Today, the price has experienced a waterfall drop to $1,000—less than the cost of a chest X-ray—and it will continue to fall. One expert predicts that by end of the decade, sequencing your genome will cost less than $1.00!

The impact of a new breed of therapies targeting specific genetic defects can’t be overstated.

And that’s just one of dozens of equally dramatic advances underway in the biotech sector... advances that will literally change the world.

Patrick Cox, Senior Editor of Transformational Technology Alert

Here’s what Patrick Cox, Senior Editor of Transformational Technology Alert, has to say on the work he does on behalf of subscribers...

The world has reached peak babies. Overpopulation was a scam. From now on, every subsequent generation will be smaller than the last.

The financial implications are enormous and largely unrecognized.

The most important may be the dramatic increase in the aged population due to continually increasing life spans. Our entitlement programs have therefore already gone deep into debt, but they will collapse as the aged population grows and birth rates fall—unless we can shift more people from the recipient column to the contributor column.

Simultaneously, biotechnologists empowered by Moore's Law have made and are making remarkable discoveries capable of dramatically extending health spans and preventing financial catastrophe.

This will happen, making investors who participate rich, because it has to.

The analytical savvy of Patrick and his team is visible in the track record of sold stocks that have met Patrick’s return target.

Below is the complete list of closed positions and the returns they have handed subscribers since the service launched in September 2013.

| Transformational Technology Portfolio - Closed Positions | |||||

|---|---|---|---|---|---|

| Investment | |||||

| Ref. Date1 | Symbol | Current Rec | Entry Price | Sale Price | Total Return |

| Galectin Therapeutics | |||||

| 10/17/2013 | GALT | Sold | $8.50 | $13.00 | 52.94% |

| Biozone Pharmaceuticals, Inc. | |||||

| 11/21/2013 | BZNE | Sold | $0.51 | $0.64 | 25.49% |

| Inovio Pharmaceuticals, Inc. | |||||

| 9/26/2013 | INO | Sold 1/4 | $8.00 | $12.31 | 53.88% |

| Cellceutix Corporation | |||||

| 1/22/2014 | CTIX | Sold 1/3 | $1.88 | $2.93 | 55.85% |

| Cynapsus Therapeutics Inc. | |||||

| 4/24/2014 | CTH.V | Sold 1/3 | $0.50 | $0.76 | 52.00% |

| Cynapsus Therapeutics Inc. | |||||

| 4/24/2014 | CTH.V | Sold 1/3 | $0.50 | $1.11 | 122.00% |

| Anavex Life Sciences Corp. | |||||

| 7/24/2014 | AVXL | Sold 1/3 | $0.23 | $0.76 | 230.43% |

| 1Reference date is the release date of the publication when the recommendation was originally made in Transformational Technology | |||||

Just like early investors who made fortunes in technologies such as the Internet, video streaming, social media, online shopping, etc.—with Patrick as your guide, you’ll get positioned early on in the super-star companies turning health care on its head...

...investments you can make today and profit from over months and years as they transform the world.

As a bonus, subscribers to Transformational Technology Alert are among the first to learn about the new health breakthroughs with the potential to benefit themselves and their families.

Imagine Having a Wall Street Trader Working on Your Behalf

Jared Dillian, Editor of Street Freak

We here at Mauldin Economics feel fortunate to publish Jared Dillian’s Street Freak, a unique research service that leverages the lessons learned by Jared during his meteoric rise to the head of ETF trading for the world’s third-largest investment house.

At the age of 27, he was already managing over $8 billion!

Something of a legend on Wall Street, Jared is an excellent, provocative, and highly entertaining writer whose work is closely followed by top money managers. His specialty is uncovering “‘big ideas”—the powerful actionable trends that traders dream of.

A couple of big-idea examples, in Jared’s own words...

I started hearing about the Canadian housing market as early as 2009, that it was grossly overvalued. I know that I have a tendency to be early on things, so I made a mental note to wait two years. Then I decided to wait some more.

I started talking to Canadians about their housing market—the one thing I noticed was that when you talked to a Canadian and implied that their housing market was overvalued, they would get very angry with you. Very angry. When I first started writing about this in 2012, I started losing Canadian subscribers. The more I talked about it, the more Canadian subscribers I lost.

I knew I was onto something.

I shorted the Canadian dollar in 2013, at around 1.01-1.03. It’s depreciated a little over 30 percent since then. Since currencies are generally traded with leverage, the returns on this trade have been very high.

And this, about his Japan plays...

I thought the narrative around Japan in 2012 was interesting:

The Nikkei is going down forever.

The yen is going up forever.All this was happening as Shinzo Abe was being elected prime minister, who was making noises about something called “Abenomics,” which would allegedly involve a lot of yen printing. He also had the opportunity to pick a new central bank governor, someone radically different, like Hiroki Kuroda.

People were bearish on Japan for the last 30 years. I said, what if this time is different? They said, it is never different.

In three years, the Nikkei is up well over 100% and the yen is almost cut in half.

Of course, no one gets every call correct—and as a seasoned professional, Jared is the first to point this out. When he gets something wrong, he’s quick to cut his losses while letting his profits run. That’s what pros do.

In his own words...

I am not afraid of being embarrassed. I would rather be embarrassed, losing face by changing my mind, than being wrong.

His latest call is for an Argentine telecom you can buy on US stock exchanges with a click on your favorite online broker.

You may have read that Argentina is undergoing a historic shift in power with the potential to unleash one of the world’s most prospective economies.

Jared’s easily traded Argentine telecom stock is his number-one way to play what could turn out to be the world’s sharpest economic rebound in 2016 and maybe for the next five years.

If you are looking for big, long-term tradable ideas both in the US and around the globe—your odds of hitting investment home runs are hugely improved with Street Freak on your side.

The Macro Analyst Who Writes Like a Sage

Meanwhile, on the other side of the Atlantic...

...in the free-market haven of Dubai, Mauldin Economics’ scholarly Senior Editor Jawad Mian spends long hours identifying “key themes” that readers to his premium alert service, Stray Reflections, can build their portfolios around.

Jawad Mian, Editor of Stray Reflections

For example, in 2014 he presented his “New Oil Normal” theme, providing readers with clear reasons and unbeatable logic for why oil prices were headed lower for longer.

Oil was trading at $85 at the time.

As I don’t need to tell you, today oil is trading for half that number. Imagine having that sort of insight to help you in your portfolio planning.

The secret to Jawad’s success is that he is a deep thinker—a literary polymath whose tastes in reading materials advise how he thinks about the macro picture.

In his own words:

My interest in reading varies from history, politics, economics, psychology, to philosophy, poetry, and religion. I prefer to read old investment classics such as Reminiscences of a Stock Operator, The Money Game, and Market Wizards. I feel they are much better written, and the trading wisdom is timeless.

I spend more of my time reading non-investment books, though. My favorites include The Prophet by Khalil Gibran, The Fall by Albert Camus, The Alchemist by Paulo Coelho, The Forty Rules of Love by Elif Shafak, and Letters to a Young Poet by Rainer Maria Rilke (only the Stephen Mitchell translation).

The result of his thinking is encapsulated in his Key Themes document—subtitled A Thematic Approach to Discretionary Global Macro—in which he presents between 5 and 15 key themes he invests in concert with.

Other current themes he follows include “Asian Adjustment” and “Internet and Innovation Economy.”

Within those themes, he digs deep to uncover the best ways to invest.

A former portfolio manager of $250 million in assets, Jawad turned his back on his lucrative profession in order to more widely share his ideas. Since then, he has attracted a dedicated following among those in the know.

Not only is Jawad Mian an accomplished global macro investor, he is a poet of the markets. His theme-based portfolio has proven its worth, and his research is among the best in the industry. As a former hedge fund investor and subscriber to a dozen or so letters, Stray Reflections is the only letter I read from page to page. Savneet Singh, President of Gold Bullion International, Forbes 30 under 30

Jawad writes like a sage beyond his years. He digs deep down into his personal experiences to make reading about his market views interesting and with a philosophical backdrop, which is quite unique and refreshing. I like reading his market views and commentary because he presents a strong fundamental theme. ...There is no shortage of conviction in his views. Chairman and CIO of major international bank, oversees $50 billion in assets

Jawad’s popularity among the investment elite emanates from his deep thinking and its tangible results. For individual investors, his ability to divide the world into investable themes adds an invaluable dimension and provides an easily understood context for many of the major markets where opportunities are to be found.

Now, let’s get to the opportunity I was talking about earlier...

Become a Mauldin VIP Today and Get Complete Access

My favorite source of thought-provoking analysis...

“A retired entrepreneur, I invest my time and resources studying economic and demographic trends that impact my investments and my financial life. Of my many subscription resources, Mauldin Economics ... is my favorite source of thought-provoking analysis and articles that challenge me to reconsider long-held beliefs.”

—Don B.

My name is Olivier Garret, partner and CEO of Mauldin Economics.

It’s my great honor to work with John Mauldin, Ed D’Agostino, David Galland, and our many editors and analysts to publish the highest-quality investment research available anywhere.

You’ve just seen how important it is to have access to the research of seasoned investment professionals like Tony Sagami, Patrick Cox, Jared Dillian, and Jawad Mian.

Professionals who work on your behalf to identify and monitor investment opportunities (and risks) across key segments.

Today, you have the chance to access all of this amazing research:

For a limited time only, we are reopening Mauldin VIP, the single best way to take advantage of Full-Spectrum Investing...

...and right now, you can do so at a deeply discounted price.

Mauldin VIP is our way of giving our most valued subscribers full access to ALL of the Mauldin Economics research services for one low price.

As a Mauldin VIP, you receive every issue, every alert, all past and future special reports, full access to the archives for all of the research services I just listed... and more:

-

Yield Shark (a $199 value). Tony Sagami’s dividend stock research, which offers a combination of steady yields and the upside on undervalued “Fallen Angels.”

-

Street Freak (a $299 value). Big-game hunting with the original “Street Freak” multibillion-dollar ETF trader, Jared Dillian.

-

Transformational Technology Alert (a $1,495 value). Your “magnifying glass” on the best biotech companies with Patrick Cox. And as a bonus, you’ll stay closely in touch with the latest developments in health technology to benefit you and your family.

-

Stray Reflections (a $2,495 value). Jawad Mian’s unique thematic portfolio research, also read by leading money managers. This is a full-contact research service, offering you invaluable insights you won’t find anywhere else.

And that’s just the beginning. You’ll also receive Tony Sagami’s two premium alert services:

About Over My Shoulder...

“The diversity of opinion is excellent. ALL publications are a must read, or at least a perusal. Excellent value.”

—D. Hall

-

Just One Trade (a $2,495 value). Tony’s options trading alert service focuses on finding fast-moving opportunities. If you had invested an equal amount in all the recommendations found in Just One Trade since its inception, you would have realized an average annual gain of 19%

-

Rational Bear (a $2,495 value). Also from Tony Sagami, this service is designed to bet against overvalued stocks and help subscribers ride the upside of a down-trending market.

You will also receive...

-

Over My Shoulder (a $179 value). A unique service that delivers some of the world’s most valuable independent research to your email box, but only if John Mauldin himself has first determined it is worth your time.

-

PLUS, when you subscribe today, you’ll also receive an exclusive Research Report by George Friedman, founder of Stratfor: The Mess in the Middle East: Truths and Consequences.

PLUS, when you subscribe today, you’ll also receive an exclusive Research Report by George Friedman, founder of Stratfor: The Mess in the Middle East: Truths and Consequences.In this important new briefing paper exclusively for Mauldin VIP subscribers, Friedman, who has left Stratfor to form a new geopolitical research group, dissects the implications of the widespread unrest in the Middle East that is now spilling over into Europe, Africa, Asia, and the United States.

Hundreds of thousands of Middle Eastern and African refugees are on the move, the Russians and NATO are again tangled up in the region, and geopolitical alliances are shifting. Where is it all heading? Friedman believes there is no such thing as a “black swan,” because the signs are always there in advance.

Reasonably priced for excellent service...

“Broad coverage of the market, both individual stocks and sectors. Recommendations are sound. Analysts do not make outrageous claims. Reasonably priced for excellent service.”

—Paul F.

With this Research Report, you’ll get a first look at the work Friedman’s new group of geopolitical analysts is producing—and become privy to insider intelligence and analysis the vast majority of people have zero access to.

If you were to subscribe to these services individually, it would cost you $9,657 per year... and it would be worth every penny.

As a Mauldin VIP, however, you pay just $2,475... a 74% discount!

There’s more. As a VIP, you’ll also get full access to the archives of all the research services included.

-

Plus, you’ll receive the Mauldin VIP Week in Review—a short-read summary that saves you time by recapping the key recommendations from the previous week and that provides a handy link so you can dive straight into any research you may have missed.

Most of the tips have made me $$$...

“Honestly, I love your program. I read each report within 2 days of receiving it, and most of the Yield Shark and [Street Freak] tips have made me $$$. Always nice. I enjoy Transformational Technology, and it has expanded my way of thinking, which has influenced my way of looking at investments.”

—Carol L.

The only “catch” is that you must sign up to become a Mauldin VIP before midnight on December 24, 2015. At that time, this exclusive service will again close and stay closed for a minimum of 6 months.

So, why do we periodically offer such an incredible value on our most important research? Simply because we believe the best way to create lifelong clients is to help investors achieve more clarity and confidence.

Providing you with complete access to our premium services is the best way to expose you to the full spectrum of opportunities to profit, regardless of where the markets are going.

You win, we win.

And, in the unlikely event you don’t find Mauldin VIP to be everything you hope it will be, you can cancel at any time within the first 30 days and we’ll refund every penny you paid.

Quite unique in its completeness...

“It is a very comprehensive economic research and analysis tool; it includes an arsenal of data/reports/analysis that is quite unique in its completeness and breadth of subjects.”

—Georgios V.

After 30 days, you can still cancel at any time, and we will rush you a pro-rated refund on the remaining term of your Mauldin VIP subscription.

You keep ALL of the research you have received during your time as a Mauldin VIP, as well as George Friedman’s important new Research Report on the Middle East, as a token of our appreciation for giving the service a try.

You have nothing to lose, though the upside from this limited-time offer is wide open.

-

Remember, Mauldin VIP is open for enrollment only until December 24, 2015, after which it will close again.

Therefore, I would urge you to act now while this deeply discounted offer is in front of you.

Below, you’ll find the full details on the offer for you to review as well as a link to our ultra-secure sign-up form.

If at any time you have any questions, even now, please don’t hesitate to call us at (877) 631-6311 (toll-free inside the US) or at +1 (602) 626-3100 if you live outside the US.

We look forward to welcoming you as a Mauldin VIP.

Sincerely,

Olivier Garret

Partner and CEO

Mauldin VIP—Four Important Details

First, if you already subscribe to any Mauldin Economics publication or multiple publications, we’ll credit the remaining months of those subscriptions to your Mauldin VIP enrollment, so you pay less than $2,475 if you respond today.

Fits the bill perfectly...

“The Mauldin team provides me a realistic view of the economic future. I like the diversity of the investment horizons from Street Freak's long view and the philosophy of ‘highest conviction’ to Just One Trade’s shorter view. ‘Time to load up on VXX again!’ I am retired, so income investing is my primary focus, and Yield Shark fits the bill perfectly.”

—Michael H.

In short, anything you already subscribe to is deducted from the $2,475 fee to get everything for the next full year. The only way you’d pay the full $2,475 is if you don’t currently have any paid subscriptions—but even paying $2,475 is still a 74% discount off the normal retail price.

Second, your low price of $2,475 per year for all the newsletters we publish is locked in as long as you remain a Mauldin VIP.

Next year, if the added-up value of everything we publish is $11,500 instead of $9,657, you’ll still only pay $2,475.

Third, just like everything else Mauldin Economics publishes, when you sign up today you are able to try Mauldin VIP for 30 days without risk.

If at the end of 30 days, you decide you want to go back to individual subscriptions like you used to have, you can do that. There’s no pressure on you.

Fourth, and finally, Mauldin VIP is open to you right now. On December 24, the enrollment period will end and remain closed for the foreseeable future. At all other times, this offer will not be available to anyone... no exceptions.

Q&A About Mauldin VIP

Understanding the past and anticipating the future...

“The Mauldin VIP membership has provided the best and most accurate information for understanding the past and anticipating the future out of all of the reading I do. Keep up the great work and the VIP program!!”

—Robert L

Q. Why the steep discount?

Simply because we want to allow our best clients to experience the full spectrum of the premium research services we offer. That way, over the course of your year as a Mauldin VIP, you will identify the services that are most appropriate for the size of your portfolio and your preferred investment style.

However, because of the size of the discount offered—74% off the one-year price of the combined publications—we only open the Mauldin VIP program for a very short period each year and reserve the right to close it at any time once our enrollment goals are met.

Q. What is the money-back guarantee?

If at any time in the first 30 days you decide that the Mauldin VIP program is not right for you, simply drop us a note or give us a call at (877) 631-6311 (toll-free inside the US) or +1 (602) 626-3100 (if you live outside the US), and we will immediately arrange a full refund. At that time, you can also decide to retain your favorite subscriptions, in which case we’ll adjust your refund accordingly.

But don’t worry; having happy subscribers is our first and foremost goal. So it’s in our interest that, should you decide to cancel, you receive your refund immediately and without the slightest hassle.

Q. Won’t I be inundated with information as a Mauldin VIP?

Yes and no. The “yes” part is that as a member you will receive all of our premium research services.

While Yield Shark, Transformational Technology Alert, Street Freak, and Stray Reflections are anchored with comprehensive monthly letters, our editors make it a point to stay in touch with Alerts between issues should there be any substantive news on positions they are following on your behalf. So, you can expect to receive fairly regular research updates.

In addition, you’ll also receive Just One Trade, and Rational Bear, which consist of monthly reports plus opportunistic trading Alerts that are not published on a fixed schedule but only when our team identifies important information or an urgent trading opportunity. Over My Shoulder, Mauldin’s unique research service, is also published on a flexible weekly schedule as new, pertinent research becomes available.

In order to help you manage the full spectrum of information you’ll be receiving, you’ll also get—at no additional charge—the Mauldin VIP Week in Review (pictured here).

In it, our team recaps all the key recommendations for the week, with convenient links to the research service making the recommendations.

-

It’s like having a super-easy-to-use “dashboard” giving you instant access to the best ideas of the week from the senior editors and analysts of Mauldin Economics.

It’s all part of the Mauldin VIP service and your ticket to a more rounded, informed way to invest.

Plus, our 30-day money-back guarantee means you have nothing to lose by giving Mauldin VIP a try.

All we ask is that you sign up during the enrollment period that ends December 24, 2015.

Ready to get started? We are standing by to welcome you as a Mauldin VIP...