Sign Up for a Trial Subscription to Biotech Millionaire

With our 30-day, 100% money-back guarantee, you can try Biotech Millionaire risk free.

Start My Trial SubscriptionMake Triple-Digit Returns from the Next Biotech Blockbuster with This 5-Point C.A.S.H. System

With our 30-day, 100% money-back guarantee, you can try Biotech Millionaire risk free.

Start My Trial SubscriptionNumber of positions, portfolio risk, and returns may vary. These are estimates based upon our track record and historical data.

Head of Biotech Research Read more about Jake Weber.

Biotech Millionaire editor Jake Weber works hard to find the best small-cap stocks in the booming biotech market. With the help of the C.A.S.H. system, he minimizes risk and maximizes returns for his subscribers... often in the triple and quadruple digits.

Timely trade alerts whenever fast-moving events present the opportunity to Buy, Sell, or Take Profits

Monthly deep-dive analysis with a new stock recommendation, plus a full portfolio review

LIVE portfolio with real-time Buy/Sell alerts

Weekly updates on the Biotech Millionaire portfolio companies and new developments in the sector

Full access to all special reports and archived issues

The biotech sector is booming—and it shows no sign of slowing down anytime soon.

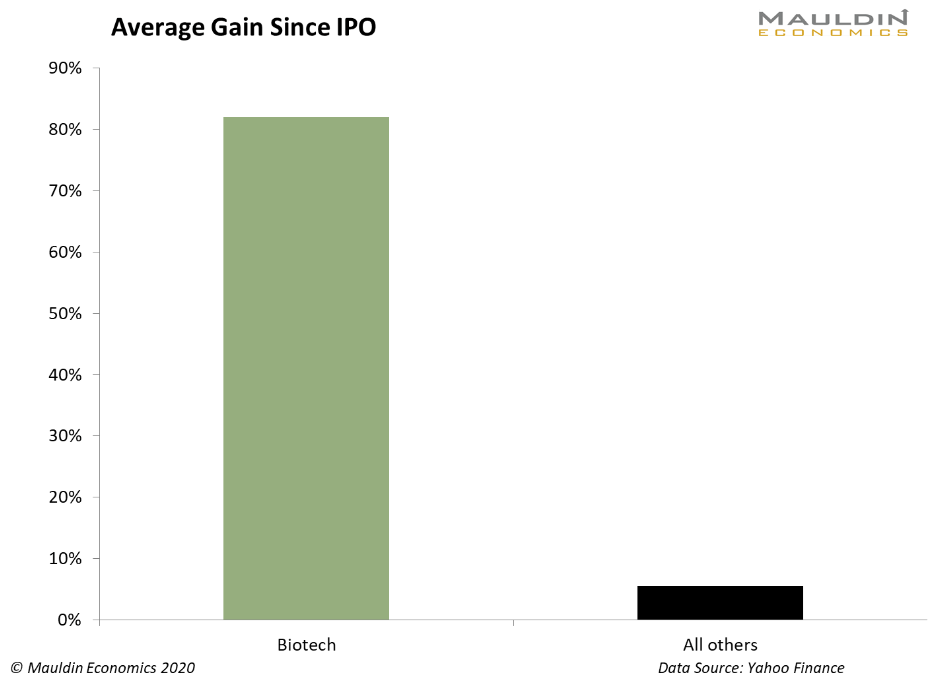

The IPO (initial public offerings) market is an important yardstick for the health of the biotech industry.

In the first five months of 2020, we saw the launch of 21 biotech IPOs... for an amazing average gain of over 82%.

There’s a common thread among the stocks that rise to the top of Jake Weber’s Buy list: Their very lifeblood is the search for treatments and cures for today’s most debilitating and deadly diseases.

And right now, the FDA’s willingness to fast-track certain vital treatments has led to an overall trend acceleration in biotech. That’s why right now is the best time in years to get into the sector.

But it won’t do to blindly jump into the biotech pool. With the industry growing faster than ever, it’s never been more important to know every detail about the companies you invest in... and position yourself in the right stocks at the right time.

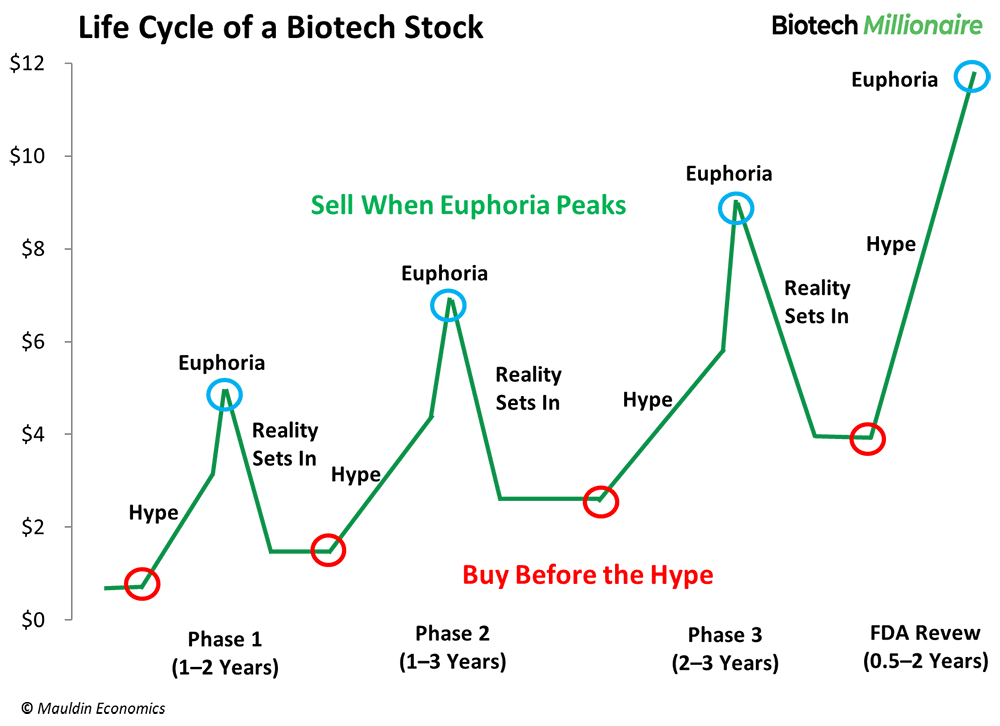

The typical life cycle of a biotech stock consists of four phases: development, early testing, advanced testing, and FDA approval. You see a lot of buying and hype when a company approaches a catalyst event—followed by “doldrum” periods without significant news from the company.

Jake’s strategy is to buy before the hype (red circles) and sell at peak euphoria (blue circles).

Biotech Millionaire portfolio company Equillium (EQ) shot up 731% in ONE DAY after its business partner received emergency-use approval in India for the treatment of one of the main causes of death in COVID-19 patients.

Enter the editors’ proprietary 5-point C.A.S.H. system that emerged from thousands of hours of research. All of its five criteria must be met before Jake will recommend a company to their subscribers.

Catalysts are known near-term events that are likely to drive up the stock price. For any company to even have a chance to make it into the Biotech Millionaire portfolio, it needs at least one catalyst.

Catalysts the editors look for are things like positive results of a Phase 1, 2, or 3 clinical trial, a possible acquisition by Big Pharma, or a pending FDA approval.

These events—or even investor expectations for the outcome of these events—can catapult a biotech’s stock price into the stratosphere.

This is the size of the potential patient population for a new drug or therapy. To be financially successful, it needs to have a good-sized potential market to move the needle on the stock’s valuation.

This doesn’t necessarily mean every drug needs a giant target market. It can be a huge plus for a company if it treats a rare disorder but is the only treatment available.

The FDA grants special “orphan status” to drugs that treat rare diseases with less than 200,000 patients... and a drug that costs $50,000 per treatment only needs 100,000 patients to have a $5 billion market.

Clinical trials are extremely rigorous. Only 10% of drugs that enter into clinical trials will eventually be approved. So part of Jake’s research is to dig deep into the science of new, promising biotechnologies.

For example, new drugs must prove they’re more effective and have fewer side effects than existing drugs. That’s especially tough in a segment like cancer drugs where the competition is huge.

Even with viable platforms, some biotech companies never get off the ground... simply because their technologies aren’t “sexy” enough or are too hard to understand for laymen.

On the other hand, a captivating story that grabs investor and media attention and creates “hype” can really drive a stock up. It is also the reason that stocks often shoot up well before a catalyst event occurs.

Cash is another important factor. It’s critical that a company has enough funds to make it through the development phase. If it burns through its cash too fast, it may have to issue new stock to raise money—thereby diluting the existing shares and driving the price down.

When the Biotech Millionaire editors see this dysfunctional pattern, they won’t recommend the stock to their subscribers.

No great loss, though, because there are currently dozens of potential winners in the sector... with no end in sight.

At the time of this writing, Biotech Millionaire subscribers were sitting on an average portfolio gain of 58.5%.

This is truly the most exciting time in years to be a biotech investor.

Join Biotech Millionaire today to take full advantage of Jake’s combined 30 years of investing experience—and receive deep-dive analysis and winning stock recommendations month after month!

You’ll never be left to your own devices. You’ll receive continuous guidance from the editors, with weekly updates on select portfolio stocks and timely trade alerts when things start to heat up.

"Monday's trading and (your recommendation’s) gain increased my portfolio in the amount of a year's wages after taxes!!!!! (...) Keep up the fantastic research!!"

"By closing 25% of my initial position I captures 90% of my base investment. In the past, when I've procrastinated in reading your recommendations and / or ignored them, it's been a mistake every time. Nice work folks!"

"I purchased at 3.34/share and sold ½ at 16.09/share.

THANK U."

"500% return in 72 hours. Definitely paid for my annual subscription."

"Thank you. Take a couple of victory laps."

A Biotech Millionaire subscription gives you...

Timely trade alerts whenever fast-moving events present the opportunity to Buy, Sell, or Take Profits

Monthly deep-dive analysis with one new stock recommendation each month, plus a full portfolio review

LIVE portfolio with real-time Buy/Sell alerts

Weekly updates on the Biotech Millionaire portfolio companies and new developments in the sector

Full access to all special reports and archived issues

Join the Biotech Millionaire community today, for outsized gains in the red-hot biotech sector.

Just one of Jake’s windfall stocks could make you back your entire subscription fee. Better yet, you don’t risk a penny when you sign up...

You can test-drive Biotech Millionaire for a full 30 days. If you’re not satisfied, simply cancel within those 30 days, for a prompt 100% refund of your money...no questions asked.

You have nothing to lose, but a lot to gain—so why not give it a try today?

Getting started is easy: Just fill out the order form below to get instant access to Jake’s best biotech recommendations.

Please note all investing carries the risk of loss and you should only speculate with capital you are prepared to lose. The fact that we have made information available to you is neither a recommendation that you enter into a particular transaction nor a representation that any investment described herein is suitable or appropriate for you. Many of the investments described by Mauldin Economics involve significant risks, and you should not enter into any transactions unless you fully understand all such risks and have independently determined that such transactions are appropriate for you. Any discussion of the risks contained herein with respect to any product should not be considered to be a disclosure of all risks or complete discussion of the risks which are mentioned. You are advised to discuss with your financial advisers your investment options and whether any investment is suitable for your specific needs prior to making any investments. Subscribing to a Mauldin Economics publication does not make us responsible for your investment results, and you will bear the risks of any investment you decide to make. Sometimes our investment recommendations may be wrong or the timing may be off. Furthermore, the investment returns described and detailed above should not be read as a promise or guarantee of your personal returns using Mauldin Economics.

By submitting this order or request, you agree to our Terms & Conditions of Use.

Questions? Need Help? Want to Order Over the Phone?

Call us now at: (602) 626-3100 or (877) 631-6311 (for international callers)