This Is What Behavioral Finance Is All About

-

Jared Dillian

Jared Dillian

- |

- April 27, 2017

- |

- Comments

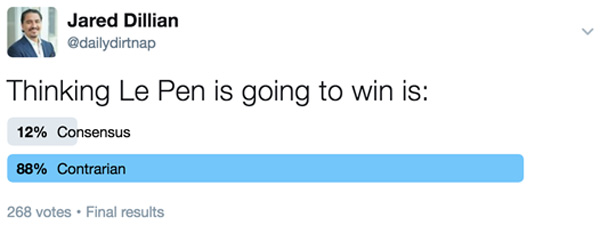

Check out this poll I ran on Twitter:

Le Pen is about a 10-to-1 dog. But that doesn’t necessarily mean that thinking she is going to win is contrarian.

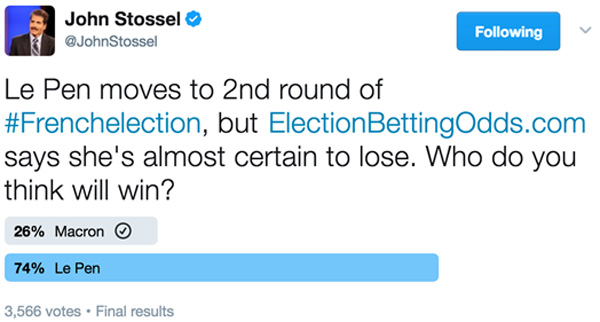

Chaser:

So the markets are pricing in a 10% (or less) chance of a Le Pen win, and yet everyone thinks she is going to win.

How the hell do you explain that?

Recency Bias

Late in the third quarter of the Super Bowl, the New England Patriots had an infinitesimal chance of winning. 99-to-1 against, at least. Would you have taken that bet? Probably not.

I think if you ran that simulation again the next day, people would have taken 4-to-1 odds on the Patriots winning.

This is what we call recency bias. Short-term memories are more powerful than long-term memories, so we tend to extrapolate what just happened out into the future. In financial terms, if a crash just happened, people will then think that crashes happen all the time, and bid up the price of crash protection.

In terms of the French Election—right-wing populists rode to surprise victories with Brexit and Trump, so everyone thinks right-wing populists are going to ride to victory again, ignoring what seems to be overwhelming odds against that happening.

Even though the polls show Macron really far ahead (much further ahead than Hillary was against Trump with two weeks to go), deep down, everyone thinks Le Pen is going to win.

That is how you can have an outcome that is statistically improbable (a Le Pen victory) actually be consensus.

Isn’t that cool?

On Being Consensus

This is the ideal setup—we can bet on an outcome that is probable, and actually be contrarian. As you know, it is better to be contrarian for the sake of being contrarian than consensus for the sake of being consensus.

This is the whole point of The 10th Man. When everyone thinks alike, nobody is thinking.

Right-wing populism has had such a spectacular run (and attracted a lot of media attention) that people think it will continue forever. But it’s worth pointing out that Hofer lost in Austria (although barely), Wilders lost in The Netherlands (quite handily, actually), and the Alternative for Germany (AfD) is nowhere in Germany. Also, Trump is not governing quite like the populist that you might have expected, based on how he campaigned.

Like what you're reading?

Get this free newsletter in your inbox every Thursday! Read our privacy policy here.

I was saying that there was a Canadian housing bubble in 2013. People were furious with me. I had about 30-40 people cancel their subscriptions. Now, it is much closer to consensus, which means the easy money in the trade has already been made (in the exchange rate).

Today, if I went on CNBC and said that AMZN was due for a 50% correction, I would get laughed off the set. Do I necessarily think that will happen? No, but the example shows you where consensus is.

If I went on CNBC and said that people should invest in actively managed funds and not index funds, I would get yelled at. On the air.

I’ll let you in on a little newsletter writer secret—if I float an idea in a letter and I get lots of hate mail and negative feedback, I know I have to do some more due diligence. I know I’m onto something. I have made a lot of money that way.

As For France

If you’re asking me who I think is going to win, yeah, I think Macron is going to win. But I’m a trader, so I assign probabilities to everything. There is a 90-95% probability that he is going to win. The markets agree. Implied volatility got annihilated and stocks are making new highs.

I’ve spent some time studying French politics. I heard someone say the other day that Clinton/Trump is a direct parallel to Macron/Le Pen. Not really. Le Pen’s economic views are actually very far left, and while Trump is sometimes associated with racism and xenophobia, Le Pen is pretty forthcoming about her xenophobic views. Most of France finds her distasteful, and it’s very unlikely (short of a massive terrorist attack) that Le Pen will amass enough votes to form a simple majority.

Meanwhile, a better comparison for Macron would be former New York City mayor Michael Bloomberg. Both of them have straight-down-the-middle politics— conservative on economic issues, liberal on social issues. Robby Soave at Reason went on TV the other day saying that Macron is a libertarian. There are no libertarians in France, but it’s an okay juxtaposition.

In the meantime, if you put on a trade and you feel pretty smug and contrarian, maybe take a poll and see where everyone else is on the same issue. You might find that you have company, which is never a good thing.

subscribers@mauldineconomics.com

Tags

Suggested Reading...

|

|

Jared Dillian

Jared Dillian