To Be a Great Investor, You Need to Be a Yankees Fan

-

Jared Dillian

Jared Dillian

- |

- April 7, 2016

- |

- Comments

“I don’t.”

New York is a pretty special place. And New Yorkers are special people. They’re the only people in the world who will root passionately for a team that has won one out of every four World Series, a team that spends more money than pretty much every teams combined, a team that is always the favorite to win. From 1996 to 2000, when the Yankees won four out of five championships, it was an orgy of winning. And for New York, it wasn’t enough.

Poor Boston doesn’t know what to do with itself since the Red Sox started winning. For 80-odd years, the Red Sox were the underdog. Bostonians thrived on their underdog status. They blamed Steinbrenner, they blamed inequity, they blamed everyone but themselves for their problems.

Everyone knows what happened next. A hedge fund winner bought the team and hired some numbers guys and revolutionized the game, winning three World Series in the process.

Now, nobody in Boston cares. They are unaccustomed to rooting for the favorite.

Boston raised underdog-ism to an art form, but as you travel around the world, it is the love of the underdog that prevails. Ever been to a pro tennis match? The crowd typically goes with whoever is losing. Look at the UConn women’s basketball team. They are so dominant that they have generated a huge backlash.

And outside of sports, we’re always rooting for “the little guy,” “Main Street,” the disenfranchised, the underprivileged.

It takes a different breed of cat to show up and root for the Yankees to win their 28th World Series, or to root for the UConn women when they are up 65-12 and pouring it on.

It’s no accident that both the Yankees and Wall Street are in New York. In the markets, you want to bet on the favorite, the winners. You don’t want to bet on the underdog.

Screw the Underdog

The first thing we need to do is to challenge and repudiate the idea of the moral superiority of the underdog—at least as it pertains to the business world.

I have a very good friend who is a real estate agent (prior to that, he was a public school teacher in a very impoverished area). When he became a real estate agent, he needed to choose a mentor who would guide him through his first five transactions. Early on, my friend would often complain about his mentor. He didn’t have his act together, he was often late, he wasn’t that smart, etc.

Finally I asked him: “If this guy is such a loser, why did you pick him as your mentor?”

He said, “I felt sorry for him.”

That was when I sat him down. “This is the business world. You don’t pick the worst guy, you pick the best guy. Got it?”

Screw the moral superiority of the underdog.

Like what you're reading?

Get this free newsletter in your inbox every Thursday! Read our privacy policy here.

Why is the underdog the underdog? Why do we never carefully examine the actions of the underdog or assign any responsibility for his behavior?

Can you imagine what the financial markets would be like if we tried to invest in the worst companies, instead of the best?

People Are Mentally Ill

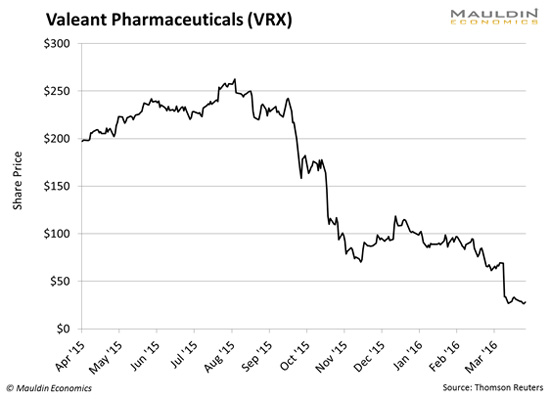

So why is it that whenever people see a chart like this…

…they feel compelled to try and pick a bottom?

It’s betting on the underdog.

Valeant Pharmaceuticals is a loser company. It has a track record of losing.

Do you want to know why stocks trend? There are a lot of great reasons why it is difficult for trends to reverse. A successful company runs into trouble, demand for its products falls, this news hits the media and causes people to sell their stock, which causes analysts to ask questions about what is really going on and publish negative reports, which causes more selling. Pretty soon the rating agencies get involved and downgrade the debt, which causes forced selling, and so on.

It is a self-reinforcing process. It is also a self-reinforcing process on the way up.

You don’t bet on the worst company. You bet on the best company.

You buy the chart that is going from the lower left to the upper right. You root for the Yankees. You root for them to win over and over and over again, and keep winning, in an orgy of winning.

The one thing I have learned in all my years in capital markets:

Turnarounds are rare.

When a company is going bad, it seldom gets better. And when I say rare, I mean extremely rare. That dog in your portfolio is very likely going to remain a dog. Or get worse.

It is different when you are talking about commodities, or countries, or commodity-related stocks. Turnarounds in commodities are more frequent because low prices stimulate demand and high prices stimulate supply. Also, in countries where things get really bad, people will get fed up and vote the bastards out, provided the political process still works. We are seeing this in Brazil and South Africa. It already happened in Argentina.

But when you talk about corporates, the idea that you can bring in some rock star CEO to turn it around… almost never happens.

Universal Application

Like what you're reading?

Get this free newsletter in your inbox every Thursday! Read our privacy policy here.

Can you think of a single movie that roots for the favorite? I can’t.

The moral superiority of the underdog is deeply ingrained in our culture. So ingrained that we have to unlearn everything we have learned in order to be good investors.

The guy that’s winning usually keeps winning. The guy that’s losing usually keeps losing. The serial correlation exists because the winning guy is taking right actions and the losing guy is taking wrong actions and generally will never figure it out.

The way you get the losing guy to figure it out is to cut off the flow of money. Works for companies. Works for people, too.

I don’t hang around with losers. I hang around with winners, in the hopes that it will rub off on me.

Two final things:

Don’t forget to follow me on Twitter. It’s free.

Don’t forget to pre-order the Kindle version of All The Evil Of This World. It costs $9.99.

subscribers@mauldineconomics.com

Tags

Suggested Reading...

|

|

Jared Dillian

Jared Dillian