How to Rake in Income from This Oil Patch “Toll Road”

-

Kelly Green

Kelly Green

- |

- November 2, 2022

- |

- Comments

Cut out the middleman: to deal directly with someone instead of talking to their representatives, or to avoid unnecessary stages in a process.

—MacmillianDictionary

The dreaded middleman. Whether you’re a big corporation or small-town consumer, everyone wants to cut him out and save some big money.

In fact, much of the American economy is driven by a never-ending search for ways to deliver goods and services to buyers as quickly and cheaply as possible. Cutting out middlemen is one surefire way to get there.

But let’s not be too quick to disparage the middleman.

-

What if I show you a “middleman” that can’t be cut. Even better, it’s in a business that everyone can’t live without—the energy business.

More specifically, I’m talking about the oil business—a sector that seems to be on every investor’s radar right now.

And no wonder. The Russia-Ukraine conflict has exposed just how little energy security we actually have.

Even the Oracle of Omaha—legendary investor and businessman Warren Buffett—sees the opportunities ahead for oil companies.

Through his company Berkshire Hathaway (BRK-A), Buffett has been vacuuming up shares of Occidental Petroleum (OXY).

So far this year, Berkshire Hathaway has raised its stake in OXY to 20.9%. And it might be headed for 50% if it can.

But OXY’s dividend yield of less than 1% just doesn’t excite me.

There’s a much better way to play in the oil market and get paid a far higher stream of income.

The Oil Patch Toll Road

There are other oil giants like Chevron (CVX) and Exxon Mobil (XOM) that both pay yields of roughly 3.3%.

That’s better than OXY, but you can make double that… and do it with a company whose dividend doesn’t rely on the price of oil going higher forever.

I’m talking about companies that transport oil and gas via pipelines.

Pipelines are integral for transporting crude oil to refineries, and then the refined products to the market.

Like what you're reading?

Get this free newsletter in your inbox every Wednesday! Read our privacy policy here.

Even better, the revenue of companies that operate these pipelines are well protected against short-term movements in oil prices.

-

Whether oil is $50 or $150 a barrel, the toll to move it through a pipeline remains the same.

Pipeline companies operate on fixed-fee, volume-based contracts. So, no matter how volatile the oil price is, their cash flow will be predictable. That’s like having insurance on their revenue and in turn your distributions.

And the reason income-seekers like pipeline companies is because most of them are structured as master limited partnerships (MLPs). Being an MLP requires it to:

-

Earn at least 90% of its income from qualifying activities (real estate or natural resources)

-

Pass through 100% of its available cash to the partners (investors like us who purchase units)

This structure creates a pass-through entity that, together with some big tax advantages, can mean a high-yield stream of income paid to its partners or unitholders.

Owning shares of an MLP means you essentially become a partner in an oil pipeline company. And you can buy and sell shares of an MLP as fast and as easy as you can any other stock.

My Favorite “Oil” Stock Yields 7.6%

Many oil and gas companies will organize their own MLP so they can benefit from the best of both worlds. The pipeline assets will benefit from its tax-advantaged status while the parent company retains a stake in the operations.

For example, oil giant Hess Corp. (HES) has an ownership interest in toll road company Hess Midstream Partners (HESM).

But my top pipeline pick is Enterprise Products Partners (EPD).

EPD has 50,000 miles of pipeline and storage. The company recently reported pipeline volumes of 6.6 million barrels per day. Along with natural gas volumes of 16.8 trillion Btu per day. This is all connected to 22 natural gas processing plants, 23 liquid separation facilities, and four import/export terminals.

In short, it’s a complete crude oil and natural gas network.

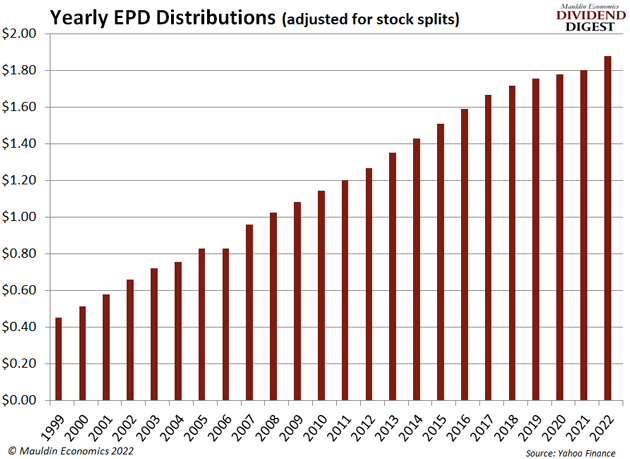

Most of EPD’s cash flow is protected by long-term contracts. And since 1998, the amount of cash available to distribute to shareholders has consistently climbed despite wild swings in the price of oil.

Just this July, EPD increased its distribution for the second time in less than 12 months.

Like what you're reading?

Get this free newsletter in your inbox every Wednesday! Read our privacy policy here.

[Please note: Investing in an MLP will result in different tax documents than investing in a stock. Instead of receiving a 1099-DIV from your broker, the company will send you a Schedule K-1. I highly recommend you speak with your tax professional to understand the full implications for your unique situation.]

I’d love to know if you have had any experience with MLPs or other passthrough investments. And remember, if you have questions or comments, please feel free to reach out to me at subscribers@mauldineconomics.com.

For more income, now and in the future,

Kelly Green

P.S. If you haven’t yet—please be sure to whitelist subscribers@mauldineconomics.com to ensure you get each issue in your email inbox.

Tags

3Suggested Reading...

|

|

Kelly Green

Kelly Green