Boomers Are Not Saving Enough for Retirement, Neither Is the Government

- Patrick Watson

- |

- October 12, 2017

- |

- Comments

Wall Street endlessly gushes about retirement. Its TV commercials show how wonderful life will be in our golden years—when we are old, yet still healthy and wealthy enough to go hang-gliding every day.

Meanwhile, out here in the real world, most working-age Americans don’t want to talk or even think about retirement. Often this is because they know they aren't saving enough and probably will have to work until they drop dead.

This is the elephant in the room. 10,000 US Baby Boomers turn 65 every day. For most, life at that milestone won’t look much like the TV commercials.

That sounds dire, but it doesn’t have to be. Let’s look at ways this problem could be solved.

But first, some more facts.

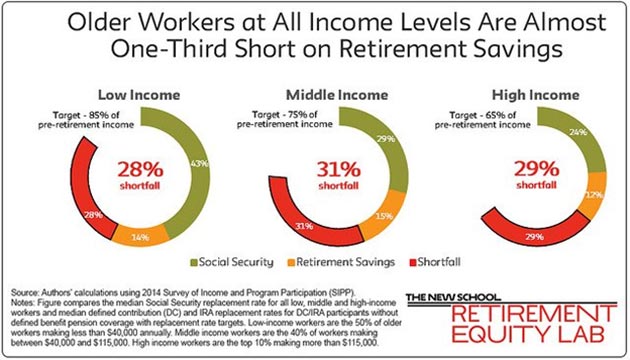

Retirement Shortfall Among All Income Levels

Lately, I’ve been working with John Mauldin to research the huge public pension fund shortfalls. But it’s not just big funds that don’t save enough—most individuals are in the same position, or worse.

Teresa Ghilarducci is a labor economist at The New School, specializing in retirement security. Here’s what she told the Washington Post last month.

“There is no part of the country where the majority of middle-class older workers have adequate retirement savings to maintain their standard of living in their retirement.”

Her research shows even high-income workers haven’t saved enough to fund comfortable retirements.

The circles in this chart show how much money people should be saving for retirement. The shortfall (the red part) is around 30% for all income levels.

The green part of the circles is what Social Security provides. The program was never meant to be a full pension, and it clearly isn’t delivering one.

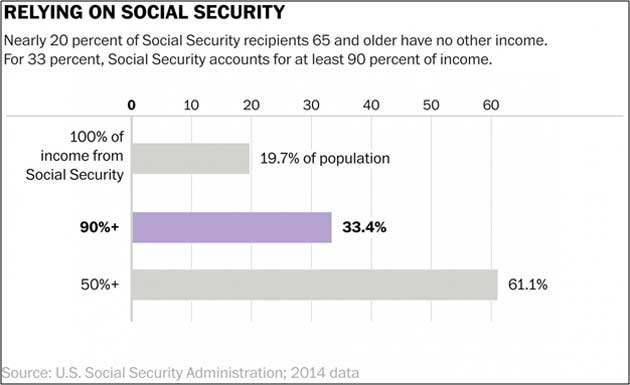

Yet a majority of the age 65+ population depends on Social Security for at least half of its income.

These are sobering numbers:

- 19.7% of retirees get 100% of their income from Social Security.

- A full third (33.4%) depend on it for 90% of their income.

- And 61.1% get at least half their income from Social Security.

Now, consider what John Mauldin wrote in Thoughts from the Frontline last weekend (I’d also highly recommend subscribing to his weekly letter here). The federal government’s unfunded 75-year liability for Social Security and Medicare combined is $46.7 trillion.

So Americans aren’t saving enough for themselves, nor is the government saving on their behalf. And the Millennial generation, whose taxes Boomers and Gen-Xers will depend on, is not exactly off to a great career start.

It’s hard to see how this story could end well. It certainly won’t end with every older American enjoying a leisurely retirement.

“I’m Going to Work Until I Die.” Yes, You Most Likely Will, So Embrace It

Unprepared retirees are filling the gap the only way they can: by working well into their golden years.

In 1986, 10.6% of the population older than 65 was still working. In 2016, it was 18.6%, and I suspect the number will keep rising.

The Washington Post story profiles some working senior citizens:

Richard Dever had swabbed the campground shower stalls and emptied 20 garbage cans, and now he climbed slowly onto a John Deere mower to cut a couple acres of grass.

“I’m going to work until I die, if I can, because I need the money,” said Dever, 74, who drove 1,400 miles to this Maine campground from his home in Indiana to take a temporary job that pays $10 an hour.

Dever shifted gently in the tractor seat, a rubber cushion carefully positioned to ease the bursitis in his hip—a snapshot of the new reality of old age in America.

Dever’s story isn’t unusual. Many older people sell their homes, buy campers, and move around the country. Some just enjoy sightseeing—but many are making ends meet as seasonal laborers. Amazon even has a formal program for them called CamperForce.

Amazon makes it sound fun: “Your next RV adventure is here,” says the website. But it’s not the kind of adventure most camping enthusiasts would prefer.

Now, the idea of working past age 65 isn’t necessarily so bad. After all, work isn’t “work” if you enjoy doing it. The problem arises when the work is physically difficult or otherwise unpleasant.

I know many people over 65 who are very happily employed. John Mauldin, for one.

He’s 68 and keeps a schedule that would exhaust much younger folks. Working past retirement age isn’t always a nightmare—though it can definitely be one if you are forced into it.

Encore Career

This problem currently affects 76 million Baby Boomers who have already entered or are about to enter their retirement years. At 53, I’m one of them.

We know most Americans in that age group don’t have enough savings to simply stop working. If that’s you, here are some tips what to do.

1. Save and invest as much as you can, even if the amount seems small. It will still come in handy. (In my recent exclusive special report, I describe one fixed income asset class that can yield up to 6-8% returns with moderate risks. Download it here for free).

2. Take care of your health. Lose weight, get exercise, eat healthy. This will both minimize your medical expenses and let you work more comfortably if you need to.

3. Think ahead about what kind of work you can do in retirement. Identify a job you can “retire into.” It should be something you enjoy, that earns real income, and that you’ll be able to continue even as aging slows you down.

4. Don’t look at it as Plan B. Think of retirement as a new stage in your career. As I said, work is only work if you don’t enjoy it. If you plan ahead, it can be a time when you work on your own terms instead of someone else’s.

In my case, there’s no reason I can’t keep writing into my seventies. Maybe I’ll take more vacations, but I don’t want to stop writing completely. I’m not sure I could stop even if I wanted to.

Meanwhile, those extra working years will let me save longer and my savings to compound, which will leave me in a better position when I can’t work anymore and have to tap my savings.

Medical breakthroughs extend what my colleague Patrick Cox calls "health spans." Not only can we live longer, we can be healthier longer. There’s a good chance 80 will be the new 60.

In that regard, watch this short video by Gary Vaynerchuk. It has a little profanity at the end, but watch anyway. He has a message that may help.

We all have more time than we think… and we can do a lot with it.

Free Report: The New Asset Class Helping Investors Earn 7% Yields in a 2.5% World

While the Fed may be raising interest rates, the reality is we still live in a low-yield world. This report will show you how to start earning market-beating yields in as little as 30 days... and simultaneously reduce your portfolio’s risk exposure.