Takeaways from the SIC

-

John Mauldin

John Mauldin

- |

- May 17, 2019

- |

- Comments

- |

- View PDF

There are these two young fish swimming along, and they happen to meet an older fish swimming the other way, who nods at them and says, “Morning, boys, how’s the water?” And the two young fish swim on for a bit, and then eventually one of them looks over at the other and goes, “What the hell is water?”

—David Foster Wallace, This Is Water

Turning and turning in the widening gyre

The falcon cannot hear the falconer;

Things fall apart; the centre cannot hold;

Mere anarchy is loosed upon the world,

The blood-dimmed tide is loosed, and everywhere

The ceremony of innocence is drowned;

The best lack all conviction, while the worst

Are full of passionate intensity.

—William Butler Yeats, The Second Coming

I told the above fish story as we opened the Strategic Investment Conference this week. Most investors and fellow citizens have no idea what water we are swimming in. They swim in a pool of agreed-upon, commonly understood narratives. And that’s all well and good until the water changes.

|

It is very important to know your water and what to do when it changes. Currently, the narrative says that central banks and governments “have our backs” and will do “whatever it takes” to make everything, including the water, go on as usual. Call it kicking the can down the road or whatever metaphor you like, but most investors extrapolate the recent past into the far future.

And that’s usually the right move. The cautious optimist usually wins, which in our current social and political circumstances means that the one most important thing to know is:

What could change the narrative?

That was the SIC theme this year. I chose almost every speaker specifically for their ability to help us “think the unthinkable.”

I think most thinking investors, whether professional or managing their own portfolios, sense a shift in the zeitgeist, what Ben Hunt calls the “widening gyre,” referring to the Yeats poem. As an artist and a poet, Yeats presaged the 1920s and 1930s trauma that led to World War II.

We understand that things are changing, but the question we should ask ourselves is, “Change to what?” We know that whatever happens won’t be rainbows and unicorns. Yet if you are truly aware of what’s going on in the world, you have to be optimistic about humanity, about the potential explosion of creativity in the midst of turmoil.

Opportunity and crisis both beckon, and I believe both will happen at the same time. This will require a particularly delicate balance in both our lives and our portfolios.

The conference itself?

First, recognize that I am writing stream-of-consciousness late on Thursday night at the end of the conference. I am emotionally overwhelmed, intellectually sated, and trying to assimilate probably the most stimulating and overpowering of 16 annual events. Dear gods, I love it when a plan comes together.

There were speakers that discussed the next 6–12 months and others who looked out over the horizon. Both were equally important. David Rosenberg was his usual brilliant self, with scores of slides making his case for recession and bear market. He has been my opening speaker for 10 years and I joked that I am going to keep inviting him back until he gets it right. His slide decks are simply brilliant.

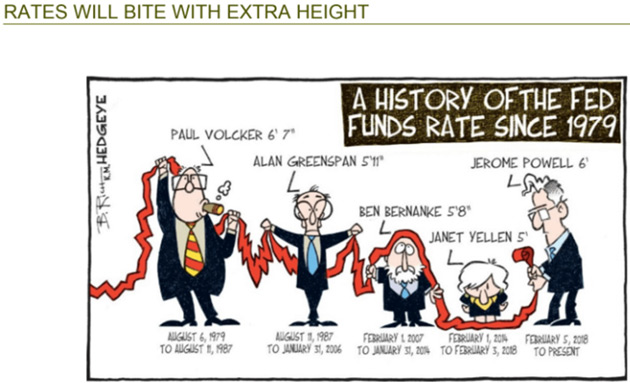

Rosie focused on the Fed overshooting the neutral rate, actually tightening as we go into recession with a combination of balance sheet reduction and interest rate increases (something I’ve also been ranting about). His deck was worth the price of admission.

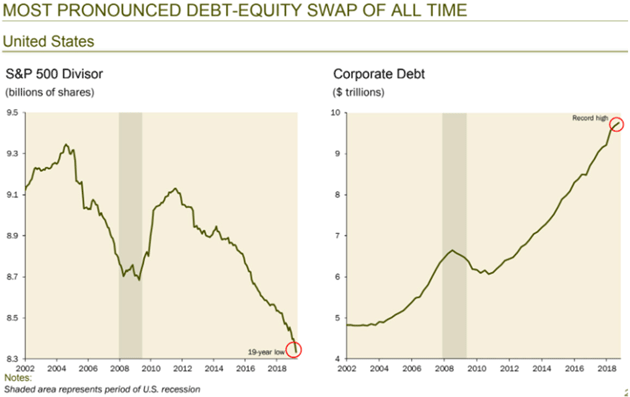

I’ll give you one more chart with staggering implications on a topic other speakers also mentioned. Corporations are using record profits to increasingly borrow cheap debt and buy back their own shares. This increases the P/E ratio and creates the appearance of strength and growth even when neither is actually happening. It is, as Dr. Woody Brock told us later, a bastardized form (his words) of capitalism that Adam Smith would not recognize.

If Rosie was a shotgun, Mark Yusko was a high-velocity machine gun with 100+ slides in his deck. It reminded me of The Joker who, on seeing one of Batman’s miraculous escapes, asked the world, “Where does he get all those cool toys?” Where does Mark get all those cool charts?

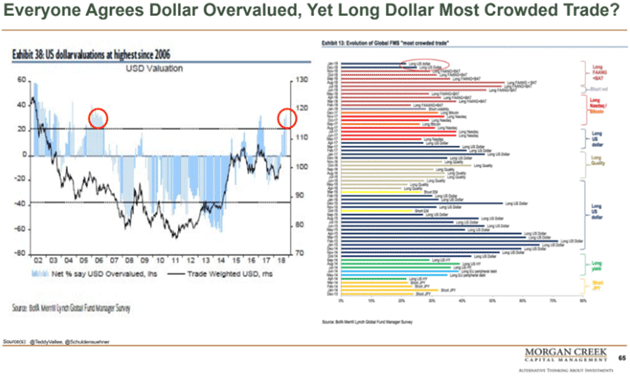

More than one speaker pointed out how the US dollar could go higher, but not necessarily for good reasons and not for ones that we would like—at least those of us in the US. But it comes with the territory when yours is the world’s reserve currency. Again, a common theme was that the dollar’s reserve status is by default, as there is no other realistic option. It’s the cleanest dirty shirt in the laundry.

Carmen Reinhart was a revelation. Arguably the world’s leading expert on government debt, she co-authored (with Ken Rogoff) the definitive book on government debt and debt crises, This Time Is Different. Now, with a different set of collaborators and what must be a battalion of grad students, she is studying every government debt issue since the Battle of Waterloo. It turns out there are similar characteristics between emerging market government debt, with all its write-downs and defaults, and high-yield corporate debt. There are ways to make a significant premium over the risk-free rate.

Like what you’re reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

In the Q&A, I mischievously asked her, “How has the fact that you arrived in the United States in 1966 at 10 years old with your mother and father and three suitcases from Cuba affected your outlook and analysis?” Her answer (paraphrasing)…

“I talk with my students and colleagues about crises. But there are various degrees of crises. There are times when the crises are cataclysmic. And we need to understand the difference. At 10 years old I watched them take truckloads of men to be executed by firing squad. That was a cataclysmic crisis.”

The audience reacted viscerally to Carmen’s thoughts. The only question I had for myself was, “Why did it take 16 years for me to get her to my conference?”

Lacy Hunt gave his best presentation ever. That was not just my analysis but that of many long-term conference attendees. He presented two theorems. First, federal debt acceleration leads to lower, not higher interest rates. This is because the economic stimulus effectiveness ends quickly, but the debt overhang causes weaker business conditions that reduce loan demand.

Similarly, monetary easing eventually leads to lower, not higher interest rates. Debt productivity falls, making the velocity of money decline so monetary policy becomes asymmetric and inefficient.

These are not intuitive to most people, so Lacy walked through algebraic proof of both theorems. He also showed empirical evidence, comparing government debt to interest rates in the US, UK, eurozone and Japan since 2007. All the graphs looked almost identical.

These theorems are ominous if true, because they show it is almost impossible for higher savings to both absorb the debt load and sustain consumer spending and business investment. The only solution is prolonged austerity. But the slightly good news is that in this scenario the US will likely stay the world's strongest economy, simply because it has the best combination of debt productivity and demographics. Somewhat analogous to the cleanest dirty shirt in the laundry.

I was actually blown away that Bill White, the former chief economist for the Bank of International Settlements, had never met Lacy. They were both fans of each other. When Lacy finished, I had Bill come on the stage and they engaged in a vigorous conversation about Lacy’s analysis. It was one of the intellectual highlights of not only that conference but my life. I can only say 47 wows.

Bill gave his own presentation on Thursday, along with Carmen Reinhart and the inimitable Howard Marks of Oaktree Capital. The final panel really was the fitting ending to a soaring conference.

I could go on and on about the other speakers. The panels on China and Europe were simply amazing. Housing? Emerging markets? Lots of China? Louis Gave was his usual brilliant self. George Friedman forced us to step back and look at the bigger picture. Real estate? People were begging for more after that session.

I moderated a conversation between Neil Howe and George Friedman on the political outlook for 2020 and beyond. I know both of their underlying cyclical arguments so I expected some fireworks. I didn’t realize they would both describe (for different reasons) the same kind of social tension in our near future. On realizing this, I just sat there stunned for a second. I literally was speechless, and I guess it showed on my face as the audience laughed.

I genuinely try not to be surprised on stage, as I do a lot of prep work with each speaker. They still left me reeling. I can guarantee you that I’m going to review Neil Howe’s slide deck and George’s speech more than a few times trying to assimilate it into my outlook.

I don’t want you to think the conference was more bearish than it was. There were actually numerous positive investment themes and opportunities. Attendee reaction was the most positive any of us from Mauldin Economics can remember. Every year, long-time attendees (and more than a few have been there 10+ times) say that it is the best conference ever. But 2019 seems to have set a new high bar.

I can guarantee you that you will see the impact of this SIC in my writing. I also know I will read every transcript at least once and probably several times. Some of the presentations were so insightful that you need a few passes to be able to really absorb the information.

At the end of one panel, which did not mention cryptocurrencies, the implications of what they said hit me so hard that I quipped, “Almost thou persuadest me to buy bitcoin.” That was just one of a dozen portfolio-changing takeaways that I gleaned.

I will confess, as I write this late Thursday night, I’m a little tired after a week of intense presentations and meetings. I plan to sleep late for the next few mornings before Shane and I return to Puerto Rico on Saturday. I’m particularly pleased that more than 60% of the attendees at this conference were repeat. They are now old friends and all say it’s the best conference they attend every year. Many, many people told me they’ll be back next year. Talk about high bars…

I know, I am raving. But it was just that damn good. I’ve been to three hog callings and two county fairs, and no event in my life has ever touched this one. Nothing but A-list speakers. Nobody pays to get on my stage. My speaker budget would choke a horse. Or at least it chokes me. But you can’t argue with the results.

Like what you’re reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

Now, I know you wish you could’ve been there. I wish you had been there too. Your personal presence would have made it even better. But the next best thing is a Virtual Pass. Every attendee this year got a free Virtual Pass as part of their admission price. Most of them have told me they’re going to be going back and listening to their favorite speakers. Click here to order your Virtual Pass.

My friend Simon Hunt, one of my go-to China insiders, said that it was the single-best conference he has ever attended in his life. And both of us have lived a long time, and done hundreds of conferences.

I have to admit that I take a deep personal satisfaction that many SIC speakers don’t just fly in and fly out. They stay for the experience, both to meet other speakers and meet our attendees who are without a doubt some of the world’s most interesting people. And the speakers who couldn’t stay very long all wanted a Virtual Pass as part of their fee.

Personal confession: I really don’t watch speeches on the internet very often. I read faster than people can talk. Which is why I insisted that our Virtual Pass be not just video, but audio and full transcripts and slides. Depending on the speed at which you read, you could “attend” this conference in a day, but some of the presentations simply must be seen to be grasped. The nuances just don’t come out in print.

At Mauldin Economics, I am talent, not management. I don’t set prices or do the marketing. And I certainly don’t run a conference. Shannon Staton and her team are simply the best. I thank them for all their hard work. They made this happen.

And with that I will hit the send button. It is almost midnight and I’m sitting in a hotel room dictating into the computer, while my poor suffering wife Shane kibitzes on my wording and wishes I would finish so she can go to sleep. Because she has an early day and I do not. Then again, she is the Energizer Bunny and I am not.

I have had one of the most awesome weeks of my life. Next week will be great, too, as I spend time relaxing and pondering this one. I hope you have a great week, too. Take some time to think about the coming changes to our world and our own personal lives. I believe it will be more glorious and at the same time more upsetting than anything we have experienced so far. But we will do more than Muddle Through. The 2020s are going to be awesome. So much potential, so much possibility.

Sure, if you project the recent past into the future, you are not going to be happy. But if you think about it and put a plan into action, what an incredible future we are going to experience.

Your friends don’t let friends buy-and-hold analyst,

John Mauldin

P.S. If you like my letters, you'll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.

Tags

Suggested Reading...

|

|

Did someone forward this article to you?

Click here to get Thoughts from the Frontline in your inbox every Saturday.

John Mauldin

John Mauldin