New Research from Mauldin Economics:

You Heard It Here First: A Long Overdue Market Correction Started on Friday, September 19

Now here’s what to do next… no matter if this is a brief 5% breather or the first stumble toward Dow 12,000

Revealed Below: Details on a 6-month Mauldin Economics research project and the introduction of one of the market’s most successful traders of the last two decades.

Dear Reader,

Friday, September 19, should’ve been a day of celebration.

Instead, in the opinion of Mauldin Economics, it was the start of a long overdue market correction. Here’s what happened…

Alibaba (NYSE:BABA), the Chinese Internet titan, IPO’d to great fanfare.

Shares shot up over 30%. The banks who led the offering exercised their greenshoes and dropped millions more shares on the market. Everyone made out like bandits.

Scotland had also just voted “no” on independence—signaling near-term stability and a continuation of the status quo for the UK.

How did the Dow react to the biggest, most lucrative IPO in history and reassuring political news from the UK? It dropped 10 points.

Why did the Dow drop? It dropped because every ounce of exuberance has already been squeezed out of this market. Ultimately, there’s no place else to go… but down.

The market slide we expect could be subtle at first, and markets could grind sideways for weeks. But at least for the short term, we believe the march to Dow 20,000 is over.

Hello, I’m Ed D’Agostino, publisher of Mauldin Economics.

For the past six months, the Mauldin Economics team has examined the potential for a market correction this fall.

Now, to offer specific guidance about how to navigate this market, I’d like to share our research, our conclusions, and our recommendations for steps you can take today.

-

As you’ll see, you can use the path forward we’ve established to grow your portfolio if the correction we’re anticipating turns into a massive market slide.

-

This strategy will work equally well if a correction doesn’t come to pass and this bull market rolls on for years to come after a brief breather period.

I’ll also introduce you to Tony Sagami, a trader and writer with over 30 years of market experience. You’ve most likely already read John Mauldin’s introduction of Tony in a recent issue of Thoughts from the Frontline.

Tony has agreed to bring his outstanding trading record and actionable advice expertise to Mauldin Economics to head up a new project, which I’ll discuss in a moment.

As you probably know, Tony has also been leading our popular Yield Shark investing advisory from behind the scenes since day one. Today, as you’ll see, Tony’s research mandate has expanded.

But before I show you why the team at Mauldin Economics is so excited to have Tony on board, I’d like to discuss today’s market conditions and prove why an eye toward safety and hedging for long-only portfolios makes sense in our current investing climate.

An Urgent Warning: This Is the 3rd Most

Expensive Market in the Last 130 Years

The brewing trouble in the markets today begins with valuations. Stock valuations are higher right now than at any other point in the past 130 years, save 1929 and 2000.

Furthermore, the S&P 500 has not had a 10% correction in three years, the longest span since July 1984 – August 1987 without a pullback of that size.

In short, the Mauldin Economics team of researchers believes investors—both professional and individual—would do well to proceed with caution in today’s markets.

What took place on Friday, September 19—the failure of the market to rise in accordance with the good news of the day—could be just the beginning of the pain to come in the weeks ahead.

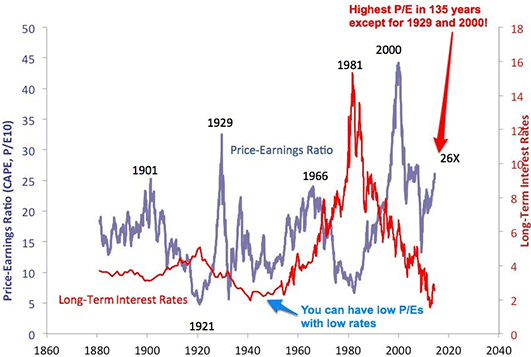

Take a look at this data from Robert Shiller, which proves just how expensive today’s markets are.

As you can see, the P/E ratio of the S&P 500 taken as a whole is currently in unprecedented territory. At both prior junctures—1929 and 2000—when valuations were this high collectively, the eventual result was a swift market decline.

All investors, whether individual or professional, are now faced with choosing one of two options.

-

First, you can keep investing like nothing’s structurally wrong with the markets. This approach leaves you exposed to a coming correction and the loss of capital, which will accompany it.

-

The second, more rational option, is to take steps now to prepare for an inevitable correction.

We recognize any correction could be small and temporary. Today’s bull could conceivably keep running for years—which requires the second part of the action plan we’ve developed—I’ll talk more about that in a minute.

At today’s valuation levels, though, history suggests the smart play is to hedge some of your long positions. Even a 10% correction over a period of weeks could decimate the gains you’ve accumulated since the market rebound on the heels of the Great Recession.

For reasons I’ll discuss in a moment, it’s easy to ignore these valuation warnings. In fact, for many in today’s market, ignoring them has been the only choice.

That’s because there’s no other investment available besides stocks that promise sustainable returns. But what does buying expensive stocks do to returns over time?

Buying Overvalued Stocks in Frothy Markets

Decimates Future Returns

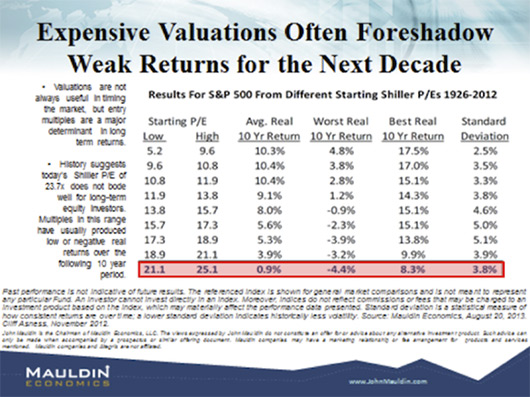

John Mauldin addressed exactly how buying overvalued stocks hurts returns going forward in his May 10 issue of Thoughts from the Frontline. Take a look at the chart below:

The point the chart makes is clear: if you buy expensive stocks, your returns will likely suffer.

At first glance, this seems exceedingly obvious. The bulls' counter-argument, of course, is that you want to buy into strength to benefit from the continuation of upward trends. But “trend continuation" has its limits.

In May, it was still an open question whether or not stocks were approaching classically defined “bubble" territory. Depending on how you looked at the data, you could come to a variety of intelligent conclusions. After Friday, September 19, however, the tide may have turned for good.

How a Contagion Effect Could Send Markets Reeling... Another Reason Why Appropriate Hedge Measures Make Sense Today

On July 31, the S&P 500 shed over 1% in a day on news of Argentina's default. Tensions in Ukraine and conflict in Gaza have not had much effect on market volatility yet-but sooner or later, any observer must accept that a global-conflict “contagion effect" could take hold and send stocks lower.

Could this contagion effect come from military action against terror group ISIS? Or political upheaval headed into the midterm elections in the US this November? Or did it already start with the market’s inability to shoot higher on September 19?

When you combine geopolitical uncertainty with historically high valuations, the need for rational, appropriate hedging measures seems obvious.

How the Market Reached This Historic Overvaluation and How Your Portfolio Can Benefit Even If the Bulls Remain in Charge

So how did we get here—to a dangerous crossroads in one of the most expensive markets in history? The answer is simple, and it goes back to the Fed’s response to the Great Recession.

Money is still too cheap. Central bankers have kept interest rates artificially low, bond rates are pinned to the floor, and yield-hungry dollars have no choice but to chase the markets.

John has written several times recently about a “bubble in complacency." When you have to be in stocks to achieve reasonable returns, the tendency is to go “all in." That scramble for yields can lead to an unhealthy reliance on margin debt.

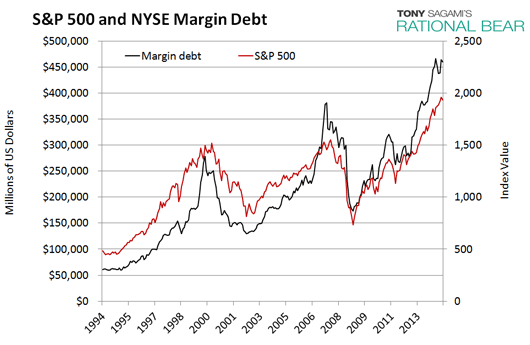

Here's a chart John published earlier this summer. It tells the entire margin-debt story:

When margin debt spiked severely in 2000, stocks crashed. When margin debt spiked again in 2007, stocks crashed. Margin debt, one could suggest, is a strong leading indicator of a coming market correction. Now look again at margin debt today.

The parallels to 2007, in fact, are striking. Here’s what appeared in Thoughts from the Frontline in July:

What was the cause of the last crisis? Everybody points to subprime debt, but that was really just a trigger. What happened was that everybody in the financial world became distrustful of everybody else's balance sheet and so decided to go to cash, but there was so much debt and so much invested in illiquid assets that everybody couldn't get out of the theater at the same time.

It is happening again today. The intense drive for yield is driving down interest rates and volatility, pushing up assets of all kinds, and setting us up for the same song, second verse of the 2008 crisis.

As assets continue to go sky high, we see ever-increasing valuations, diminishing returns over time, and a stampede to grab assets at any cost because there is no viable alternative for yield. It's a toxic mix.

Sure, several select stocks still make sense. But broad, multi-sector, long-only stock exposure, with no hedging in place, is like playing with fire.

-

The most useful solution would be a way to hedge against the possibility of a market correction of 10% or more. At the same time, however, that solution would also allow you to take advantage of and profit from weakness in individually overvalued stocks.

-

In other words, the best way to hedge is against the broad market in case the bears come to rule in the months ahead. But if a correction is small and the bulls stay in charge, you also want a way to profit from those individual stocks ready to fall.

That’s why I want to share with you the steps Mauldin Economics is taking to not only prepare for a market correction, but to help professional and sophisticated individual investors alike benefit from overvalued individual stocks regardless of what happens in the broad market.

As you’ll see, due to longtime market expert Tony Sagami joining the team at Mauldin Economics, we’ve devised a way you can profit from individual stock weakness and ALSO hedge against a coming market correction.

Introducing 30-Year Market Expert Tony Sagami—Your Guide to Upside During the Coming Market Correction

John recently introduced his friend and colleague Tony Sagami in Thoughts from the Frontline. Tony, as I mentioned, has been the “man behind the curtain” as editor of our Yield Shark income investing advisory since that service debuted in 2012.

Recently, Tony agreed to put to work his equally stellar sell-side skill and balance sheet analysis to help Mauldin Economics debut a bear-market-oriented advisory, Rational Bear.

I’ll show you how Tony’s new project, Rational Bear, works in a moment. First, I want to tell you more about Tony himself.

Tony has spent the last 30 years immersed in earnings reports and how to use them to help those who rely on his analysis. Starting as a broker with Merrill Lynch, then a portfolio manager with The Donoghue Group, and for over the last two decades as an independent stock market writer, Tony has worked just about every corner of the finance and investing world.

Tony also has the unique ability to allow math alone to guide his trading and not get weighed down by directional bias. This gives him the ability to coldly look at financial filings and spot overvalued companies due for a fall.

Tony and John have an interesting way of working together, too, which I’m sure you’ve seen in action at Yield Shark. First, John and Tony discuss big picture global macro events. John shares with Tony the views his worldwide rolodex of contacts are passing along, then Tony uses that information to inform his balance sheet and financial filing investigations.

In Yield Shark, this approach produces safe, growing dividend stock recommendations that give you capital appreciation and reliable yield on a regular basis.

In Tony’s new advisory, the combination approach he and John use is intended to deliver outsized return potential in short time frames by leveraging the weakness of ridiculously overvalued companies.

The name for Tony’s new advisory, Rational Bear, comes from the Prudent Bear fund started by Mauldin Economics friend and collaborator David Tice.

David, who reviewed Tony's investment philosophy and plans for the Rational Bear letter, said:

“Most investors are hopelessly unprepared for the next bear market, so you need someone like Tony to help you not only avoid the carnage but prosper from falling stock prices. Tony is also a great stock-picker."

Tony brings exactly the kind of trend-trading ability and market acumen investors need as we move forward into the critical last stages of what John Mauldin calls the Debt Transformation.

If you've been reading Tony over the years, you surely share my delight as I introduce him as the newest (official) voice in the growing stable of Mauldin Economics writers and researchers.

In his new Rational Bear letter, Tony will focus on three specific types of scenarios present in the environment we’re experiencing today:

- Reverse Momentum Plays. These are stocks headed down that could continue lower for some time due to trend continuation.

- Buggy Whip Companies. These are companies in structural decline, being passed by as business cycles evolve. (Buggy whips, obviously, became obsolete as the Model T rolled off production lines.)

- Enron Hunter Plays. These are balance sheet anomalies, including outright frauds-seeking out this market's Enrons and WorldComs.

The instruments Tony plans on using to guide you to profits from these declines include short-term put options, longer-dated LEAP puts as well as short sector ETFs, and only occasionally the outright shorting of stocks.

Tony has written a primer on put options I’d like you to agree to read today. It’s a how-to and a refresher, in case it’s been some time since you’ve utilized options.

This report also describes his recommendation language and outlines how instructions to trade will appear in Rational Bear issues and alerts.

If you choose to begin a risk-free membership to Rational Bear today, you’ll get this report for free.

To get you up to speed with the portfolio Tony and his team are building for Rational Bear, they have also prepared a report called “The 3 Paths to Short Selling Profits,” which provides an in-depth description of the portfolio classes I outlined above.

This report is also yours free if you agree to test out Rational Bear today.

Plus, Tony has posted a video to the Rational Bear members’ website at Mauldin Economics explaining how he uses put options to profit from overvalued companies. It’s ready and available for you to view now.

A Limited-Time Offer to Test Tony Sagami’s Rational Bear

for Yourself, 100% Risk-Free

As this is a new service, our Mauldin Economics VIP readers will receive Tony Sagami’s Rational Bear for the next year as a complimentary benefit to their VIP subscription. You may remember the mention of this “special project” in the VIP introduction letter from John in June.

The debut today of Tony Sagami’s Rational Bear makes a sell-side complement to the long-focused advisories offered by Mauldin Economics.

For those who aren’t VIP readers, the annual fee for Rational Bear will be $2,495. That price includes the full membership benefits such as monthly issues and weekly email trading alerts, plus action alerts when it’s time to exit a recommended play.

As part of this charter debut offer—to benefit for yourself from Tony Sagami’s Rational Bear—you don’t have to pay the retail price of $2,495.

Respond today and you will receive a full year of Rational Bear benefits for just $1,495.

Your response is also 100% protected for 90 days. If you find Rational Bear doesn’t meet your expectations, you can call our customer support team and get your entire subscription fee returned to you.

Should you decide to cancel after your 90-day risk-free window, you will receive a prorated refund for all remaining months.

If you’re concerned about the potential for a market decline in the weeks and months ahead… or if you agree with our position that a correction began on September 19…

Or, if you're looking to benefit from a hedge mechanism, which protects long positions in your portfolio and will generate profits from overvalued stocks taking a tumble, there’s no excuse not to test out Rational Bear starting today.

Combined with the expanding stable of Mauldin Economics advisories John first mentioned in his letter about the Debt and Tech Transformations back in June unveiling Mauldin Economics VIP, we want you to know we take seriously the mission of offering research and actionable advice that works during bull AND bear markets.

We've heard your questions and concerns over the past three months. Today, we’re pleased to provide what we believe to be the answer.

We believe this analysis is also timely. If a market correction did indeed begin on Friday, September 19, you’ll need Tony Sagami’s Rational Bear to guide you through the gathering storm.

With Rational Bear, you get the best of both worlds: Bear market strategies to protect your portfolio against market declines, as well as targeted ways to profit from overvalued stocks in uncorrected bull markets.

Your Invitation to Join the Evolution of Mauldin Economics

What I’ve revealed to you today in this letter is the next step in the evolution of Mauldin Economics. I hope you take advantage of this limited time opportunity to join us at the debut charter membership rate of just $1,495, good for a savings of $1,000.

Very soon, the charter offer to try Rational Bear for $1,495 will disappear. All new readers going forward will pay the full $2,495 published price.

In closing, I think when you review the evidence for yourself, you’ll agree the markets today stand at a precarious juncture. What happens from here is unknown, but one thing is for sure: it’s good to be prepared.

Tony Sagami’s Rational Bear is a powerful tool you can use to both protect your portfolio and keep it growing regardless of your standing as a professional or advanced individual investor and regardless of what the market throws at us next.

Tony’s outstanding market analysis and actionable recommendations could prove vitally useful to you in the weeks and months ahead.

Click below to read a point-by-point description of everything you receive when you begin your 90-day risk-free test of Tony Sagami’s Rational Bear today.

Sincerely,

Ed D'Agostino

Publisher

![]()

Use of this content, the Mauldin Economics website, and related sites and applications is provided under the Mauldin Economics Terms & Conditions of Use.

Unauthorized Disclosure Prohibited

The information provided in this publication is private, privileged, and confidential information, licensed for your sole individual use as a subscriber. Mauldin Economics reserves all rights to the content of this publication and related materials. Forwarding, copying, disseminating, or distributing this report in whole or in part, including substantial quotation of any portion the publication or any release of specific investment recommendations, is strictly prohibited.

Participation in such activity is grounds for immediate termination of all subscriptions of registered subscribers deemed to be involved at Mauldin Economics' sole discretion, may violate the copyright laws of the United States, and may subject the violator to legal prosecution. Mauldin Economics reserves the right to monitor the use of this publication without disclosure by any electronic means it deems necessary and may change those means without notice at any time. If you have received this publication and are not the intended subscriber, please contact service@mauldineconomics.com.

Disclaimers

The Mauldin Economics website, Yield Shark, Thoughts from the Frontline, Patrick Cox's Tech Digest, Outside the Box, Over My Shoulder, World Money Analyst, Bull's Eye Investor, Things That Make You Go Hmmm..., Just One Trade, Transformational Technology Alert, Tony Sagami's Rational Bear, and Conversations are published by Mauldin Economics, LLC. Information contained in such publications is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. The information contained in such publications is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. The information in such publications may become outdated and there is no obligation to update any such information. You are advised to discuss with your financial advisers your investment options and whether any investment is suitable for your specific needs prior to making any investments.

John Mauldin, Mauldin Economics, LLC and other entities in which he has an interest, employees, officers, family, and associates may from time to time have positions in the securities or commodities covered in these publications or web site. Corporate policies are in effect that attempt to avoid potential conflicts of interest and resolve conflicts of interest that do arise in a timely fashion.

Mauldin Economics, LLC reserves the right to cancel any subscription at any time, and if it does so it will promptly refund to the subscriber the amount of the subscription payment previously received relating to the remaining subscription period. Cancellation of a subscription may result from any unauthorized use or reproduction or rebroadcast of any Mauldin Economics publication or website, any infringement or misappropriation of Mauldin Economics, LLC's proprietary rights, or any other reason determined in the sole discretion of Mauldin Economics, LLC.

Affiliate Notice

Mauldin Economics has affiliate agreements in place that may include fee sharing. If you have a website or newsletter and would like to be considered for inclusion in the Mauldin Economics affiliate program, please go to http://affiliates.pubrm.net/signup/me. Likewise, from time to time Mauldin Economics may engage in affiliate programs offered by other companies, though corporate policy firmly dictates that such agreements will have no influence on any product or service recommendations, nor alter the pricing that would otherwise be available in absence of such an agreement. As always, it is important that you do your own due diligence before transacting any business with any firm, for any product or service.

Copyright © 2014 Mauldin Economics, LLC