Jared Dillian is a 22 year veteran of the financial industry, the author of 2 widely praised books, and the editor of several financial newsletters including The 10th Man and Street Freak

I am a very risk-averse person, and for the first time in my career, I have put all my energy into one particular theme: Inflation.

My personal portfolio has always been organized with inflation in mind, but now every position I’m in could be labeled as an “inflation play.”

That's how high my conviction is.

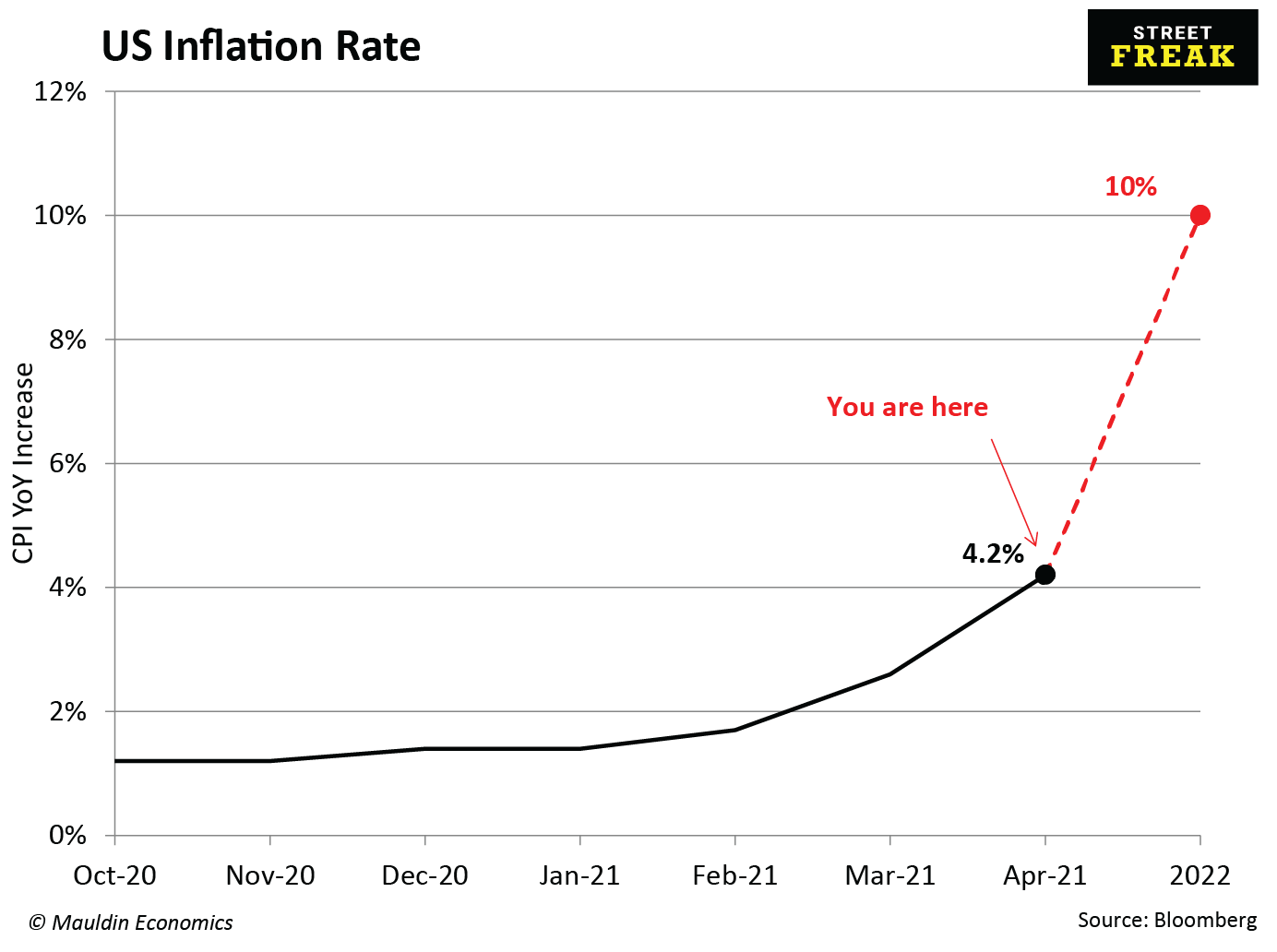

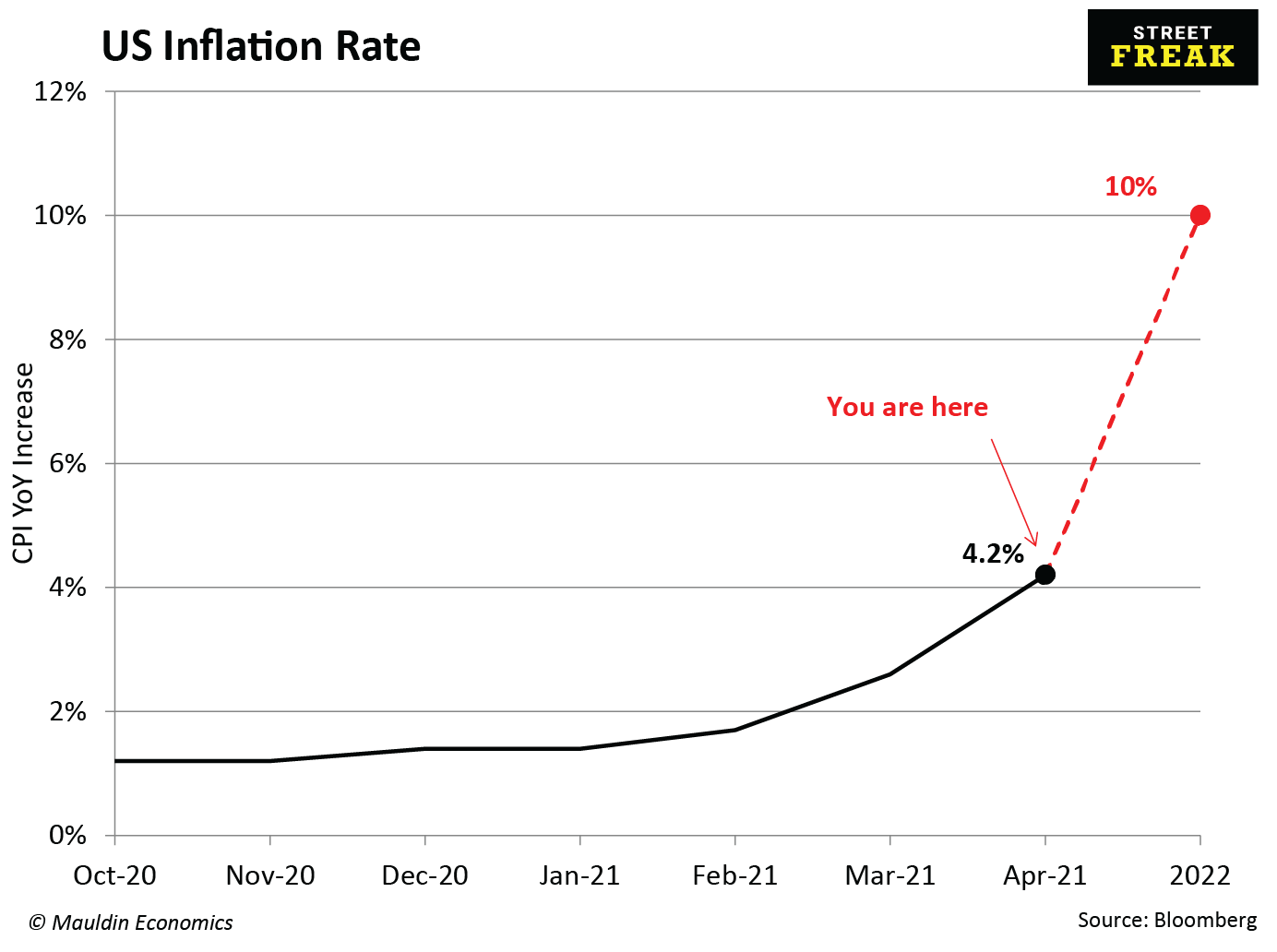

I believe we will see an inflation rate of 10% as early as next year…

Which is a number not seen since The Great Inflation of the 1970s—when prices soared so high many were priced out of simple necessities like fuel, housing, and simple grocery staples.

Not only was gas expensive, it was scarce. Sitting in long gas lines to receive your rationed fuel

is cemented into the memory of those who experienced it.

Source: federalreservehistory.org

I want to challenge the assumption that inflation is a slow-moving phenomenon.

We started 2021 at a rate of 1.4%.

Six months in and we’re at 5%.

Not only is that rapid rise abnormal, it's dangerous.

If we hit 10% next year (and we are well on our way) that would be an increase of 8.6 percentage points from January of this year.

There are not many households prepared for such a rapid rise in inflation.

With 87% of Americans being “very concerned” about inflation, you have to ask yourself:

Should you be?

Is it finally time to start building that bunker?

No and no.”

What you should be is excited.

The coming inflation isn’t a loss to be avoided,

it’s an opportunity to profit.

If you position yourself correctly (which I can help with), there is serious money to be made.

The strategy is this: Protect AND Profit.

It’s not just about “hedging to protect what you have”—it’s about positioning yourself to profit so that you can grow your wealth—both in the near term and the long term.

I don’t sit down to write letters like this one unless it's important.

And right now, the rapid increase in inflation is screaming “TAKE ACTION NOW!”

I know, I know. Everyone says that. “Time is running out”... “You have to take action now”...

But I'm not being figurative here. I'm being literal.

We are sitting between 5% and 10% inflation.

If you want to position yourself to profit from inflation rather than “just survive it,” then the time really is NOW.

Those are the cold, hard facts.

I'm going to tell you in just one moment exactly what you need to do to both guard yourself against the ravages of higher inflation, and position yourself correctly to see impressive profits.

But first...

How did we get here?

The pandemic reinforced what the Fed and Congress have been doing for the last 30 years—responding disproportionately to crises by printing money and passing it out like the paper it is.

Here’s a “fun” fact:

30% of all US dollars in existence have been printed in the last 10 months.

This is what The Asia Times, based out of Hong Kong, thinks of our Fed policy. Ouch.

(Source: Asia Times)

The Fed and Congress have essentially messed with our fiscal policy in a way that is utterly unprecedented.

They’ve passed three record stimulus bills worth a collective $4.8 trillion dollars, and they’re already talking about a fourth $2.3 trillion infrastructure deal.

It’s very likely we’ll be handing out another round of stimulus in the fall, and then again next spring.

How many more will we have? I’ll leave it up to your imagination.

But I will say this…

Have you ever known a politician to stop spending?

We are going to be testing the limits of modern finance.

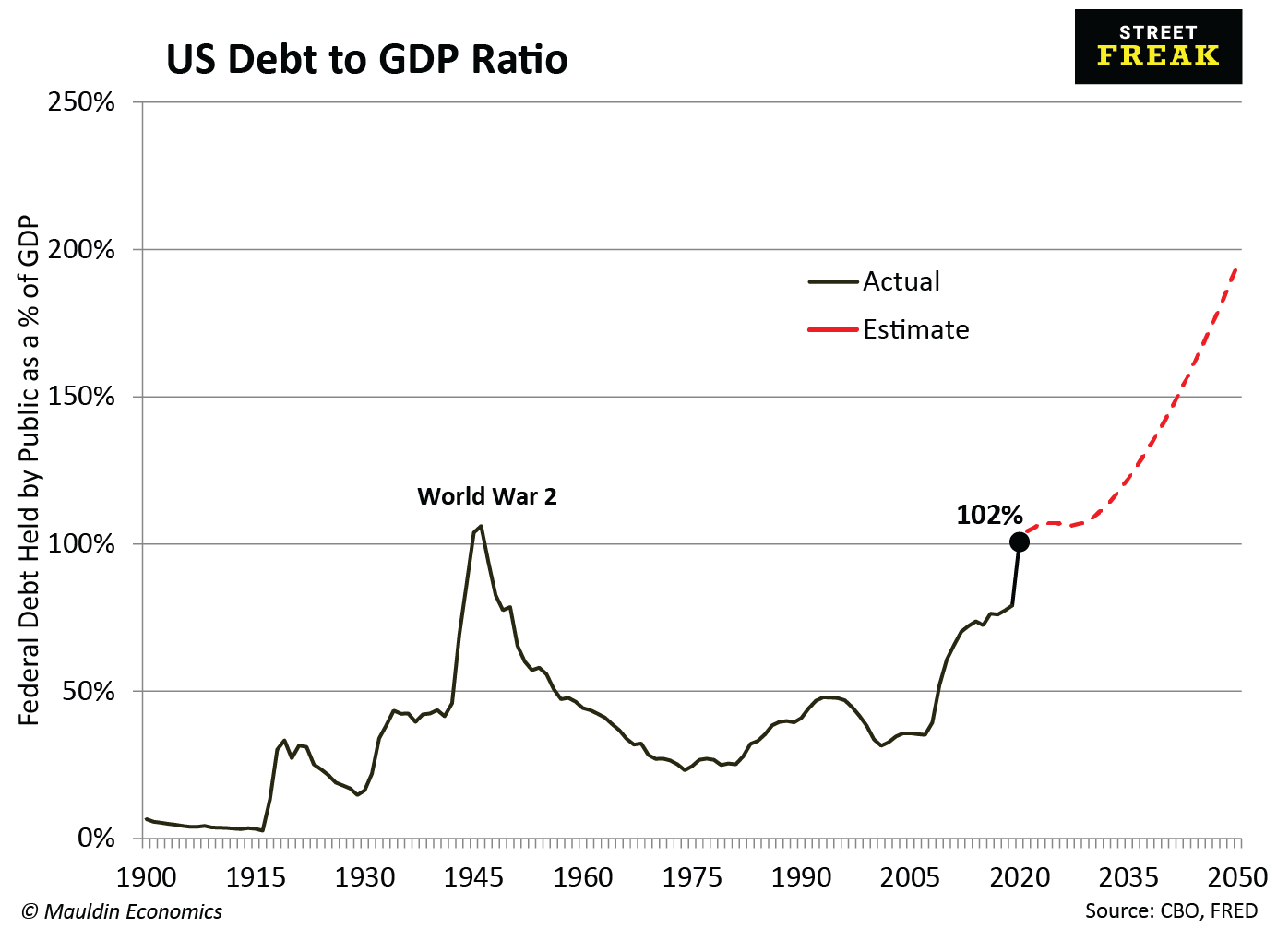

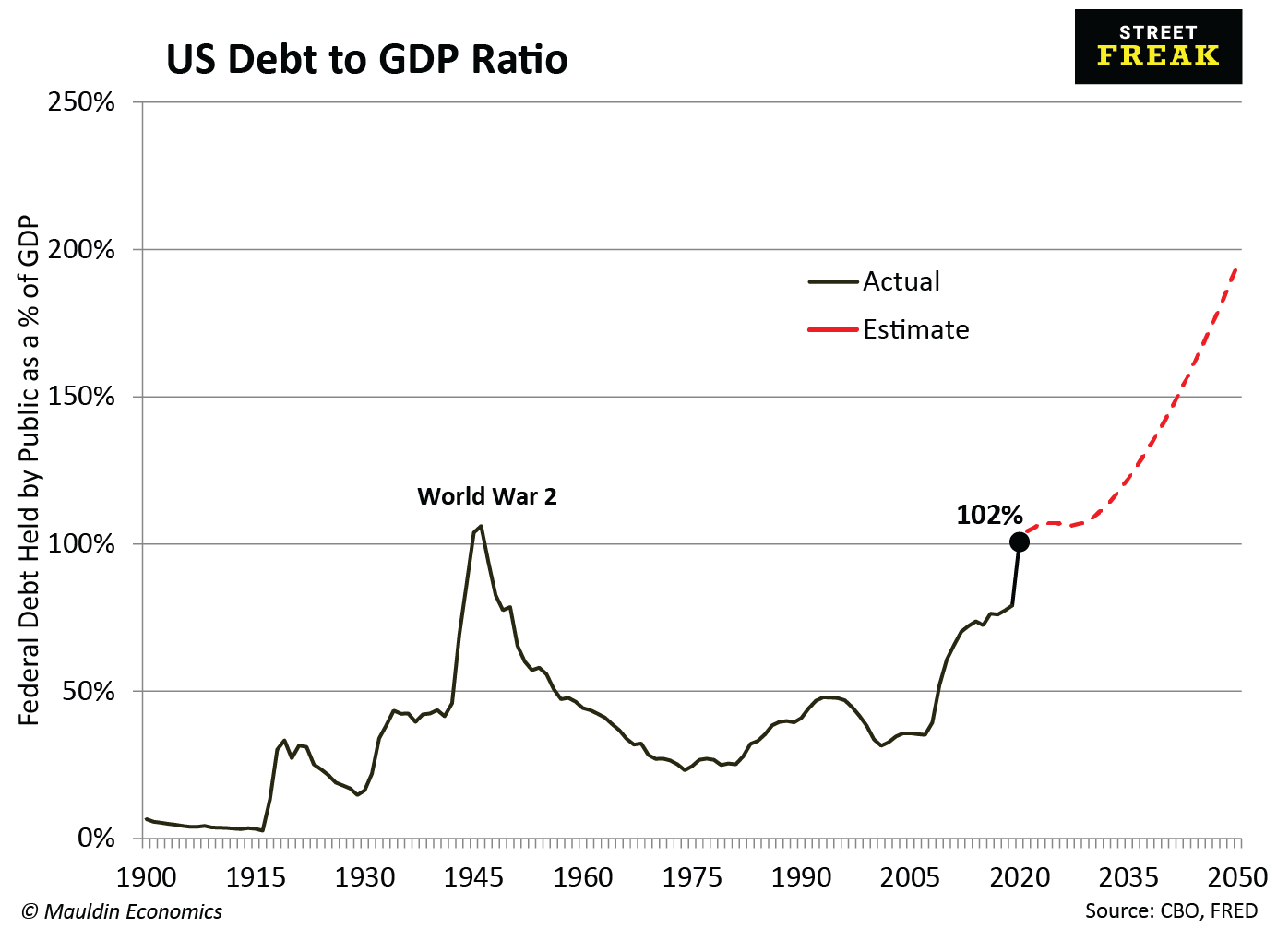

That’s evidenced by our current federal debt, which is projected to reach roughly 102% of gross domestic product this year.

We haven’t seen a ratio like that since WWII.

At least then, we built planes, tanks, aircraft carriers, and military bases—in the span of a few months.

This time we sent out 160 million stimulus checks and hoped people used the money to pay their bills and buy food… instead of what many ended up doing—gambling on the no-fee trading app Robinhood and “investing” in GameStop.

“Help Needed”

It's getting really hard to find employees.

Source: Entrepreneur

There are a lot of job openings right now, but nobody cares. And why would they? It pays better to stay home.

Supplemental federal unemployment benefits of $300 a week for laid-off workers this year are a barrier to bringing back employees, some restaurant owners and economists said. Federal and average state unemployment payments can surpass the weekly pay of an employee working 40 hours at $15 an hour. The median hourly wage for a fast-food worker in mid-2020 stood at $11.47, Labor Department data show.

I've talked with quite a few business owners in my area, and they all have the same complaint: They can't find people who want to work.

We’ve been told for 20 years that “we can’t have inflation unless we have wage inflation.”

Well, folks… we have wage inflation:

- Chipotle will pay your college tuition if you stay on for four months and work at least 15 hours a week.

- Costco raised its entry wages to $16 bucks an hour (it isn’t the only one doing this).

- A hotdog chain in Illinois is offering a $250 hiring bonus.

- McDonald's will pay you $50 bucks just to show up for an interview.

Source: Twitter

Companies are doing anything and everything they can to attract new workers.

And it's only going to get worse. Employers are basically trying to outbid the government. If you're on enhanced unemployment benefits, you're essentially making $21 an hour. So, why would you work for less than that?

You’ve seen it time and again: “Let’s raise the minimum wage to $15 an hour!” We don't even need to have that discussion anymore. We've effectively raised the minimum wage.

What you're going to see is a lot of low-skilled jobs paying $25 to $30 an hour.

Once you pay that higher wage? It’s not going down. Ever. We're stuck here.

And that increased cost of labor? It’s going to get passed to the consumer—to you.

It’s already happening

All of those dollars our government printed and handed out?

They are all chasing the same goods.

Add a breakdown in the supply chain, a labor shortage where it counts, and a good dash of “panic hoarding” and you’ve got this…

Source: Forbes

In the market for a used vehicle? Well, used car and truck prices (a key inflation indicator) are up 21%, including a 10% increase in April alone.

And if you want to fill up that expensive used car you just bought, you’ll be paying 49.6% more at the pump than you would have this time last year.

Lumber? It's up 124% just this year. That adds about $36,000 to the price tag of a newly constructed home.

Which isn’t great because home prices are already the highest they’ve been in 30 years.

And where does inflation hurt the average American the most?

At the grocery store.

From 2019 to 2020, groceries went up an average of 3.5%, which doesn’t sound too bad, until you realize that’s the “average”...

- Ground beef went up 14%

- Pork chops spiked 15%

- Tomatoes jumped 10%

- Milk rose by 7%

- And for some reason, potato chips shot up by 17%.

One analyst offered this cheery commentary in a recent Bloomberg article covering rising food prices,

“People will have to get used to paying more for food. It’s only going to get worse.”

Source: Bloomberg Wealth

Don't be surprised to see these essential needs—and many more everyday items—head even higher.

And you won’t be able to look to the Federal Open Market Committee for help, because...

The Fed is Full of It

The Fed used to say it had a “target” of 2% inflation. Well, it has changed its language. It is no longer looking to target a flat 2% year over year.

Now, it is looking for an “average” of 2% but is willing to let it “float above 2% for a while.”

I called the Fed B.S. in August of last year.

It seems to be operating under the assumption it’ll be able to just snap its fingers and stop at the percentage point it likes and then take action to bring it back down.

It is already finding out that’s not the case.

When consumer price inflation hit 4.2% in April, Richard Clarida, the Fed’s vice chairman, had this to say:

“I was surprised. This number was well above what I and outside forecasters expected.”

I guess he’ll really be “surprised” when it hits 10% next year. (You and I won’t be. By the time it hits 10%, we’ll be firmly positioned for what should be some impressive upside.)

And if you’re expecting this Fed to raise interest rates to put us in a better position, keep waiting.

It won’t act until inflation has reached the point of maximum pain.

When I say “won’t act,” what I mean is “can’t act.”

Simply put, given the size of the Federal debt, higher interest rates would be devastating to the government’s budget, triggering something akin to a death spiral.

It knows this, so it won’t be raising rates any time soon.

This current round of inflation

could destroy your retirement

Most people don’t account for regular inflation, let alone periods of higheror volatile inflation.

For many of the unprepared, this will wreak havoc on their retirement.

John Mauldin, founder of Mauldin Economics and respected financial expert, put it this way,

“Central banks all over the world, including the Federal Reserve, have an aspirational goal of 2% inflation.

If you are age 30–40, that means every dollar you save today will lose half its value by the time you need it for retirement.

They literally plan on destroying the value of your dollar. The only real debate is over how fast to destroy it.”

-John Mauldin

If we’re looking at 10% inflation next year, you won’t have to wait 30 years to see your hard-earned nest egg cut in half.

At 10%, it would only take one decade to destroy it.

For example, if your goal was to have $1,000,000 set aside in 10 years... you would now need $2,593,742 to achieve that same lifestyle…

If that’s not a reason to take action against inflation today, I’m not sure what else I can tell you.

A smart investing strategy will be crucial to your future.

So, how do you protect yourself from inflation? Better yet… how do you profit from it?

During periods of rising/extreme inflation, there are portions of the market that do really well.

Specifically, commodities, core services, and real estate.

If you want to profit—and set yourself up to outpace inflation—that’s where you need to put your cash.

These investments work because they're hard assets and essential services that hold their value in an inflationary environment.

And during times of higher inflation (which is where we are now)... they explode in value.

We talked about the surges in lumber, real estate, fuel, and food earlier. But check this out:

Palm Oil (the world’s most consumed edible oil)... YTD ⬆ 135%

Iron… YTD ⬆ 22%

Hogs (yes, the kind that go oink)... YTD ⬆ 63%

Corn... YTD ⬆ 59%

Copper... YTD ⬆ 28%

Wheat... YTD ⬆ 16.7%

Speaking of essential services: Want to rent a car? It'll be 30%–50% more. A last-minute car rental might cost you $700 a day (and that's not a sports car you're renting, it's a dopey Kia Soul).

Special Note: My readers just cashed out of a rental car position that brought them 88% profits. (Position Exited in May 2021, held for just three months.)

Inflation is about NEED not WANT.

It doesn't care about Peloton or Zoom or any other speculative tech/growth stock.

Which is exactly why I culled all growth and tech-related stocks from my readers’portfolio back in February and went 100% on inflation-related investments.

This was the right move.

Not only did my readers just cash out of a silver play for a gain of 121.95%....

But they're sitting on multiple double-digit gains (93.08%, 32.41%, 66.30%, and 87.11% to list a few).

The strategy I'm employing for my readers is one that smart, successful individuals have been using for hundreds (if not thousands) of years, through extremely challenging inflationary periods, to create insane wealth.

At this very moment, 10 of our 13 positions are firmly in the green. And I fully expect the other three (which are only down 0.10% to 5.59%) to shape up soon. If anything, this gives you a lower entry point into the inflation trade. But I’d act quickly because this slight downtick is extremely temporary.

If you think it's odd that I'm being so upfront about this, I'll give you an explanation: I've always had a bone to pick with newsletters that only highlight their successes and sweep the rest under the rug. No one gets it right 100% of the time, and I’m not the kind of person who hides my mistakes, or worse yet, claims he never makes any.

There is one thing you can be certain of as a member of Street Freak. We take profits as they come, and we NEVER go down with a sinking ship.

There is no room for hubris when it comes to investing. If a trade isn’t working, it isn’t working. The goal here is make money, not lose it.

All you need to do is follow

The Inflation King's Playbook.

Back in the 1920s, Germany suffered the worst hyperinflation experienced by a major industrial economy in modern times.

It was bad, bad.

Like a monthly inflation rate of 322% bad.

“We burn our money for warmth” bad.

But one guy, Hugo Stinnes—they called him “The Inflation King”—didn't care one lick how bad inflation got, because...

The Inflation King: Hugo Stinnes

He was invested in those hard assets and essential services I’ve been talking about—the ones that explode in value and increase your wealth.

He not only owned coal mines (which create energy, an essential commodity), but he operated shipping lines that transported other integral commodities like lumber and grains.

Now, granted, he was super-wealthy going into hyperinflation. But because of what he owned and invested in, he not only kept his riches, HE INCREASED THEM. His peers, well.... they got poor real quick.

Know who else is taking a page from the Inflation King's playbook?

Warren Buffett and Bill Gates.

I don't bow down at the altar of Buffett or Gates, but I do keep an eye on what they do (“follow the money” as they say)...

Source: DW News

And right now, they're stacking on the hard assets in commodities, core services, and real estate–just like Stinnes did.

I didn’t need some billionaire buying up farmland to clue me in to impending higher inflation.

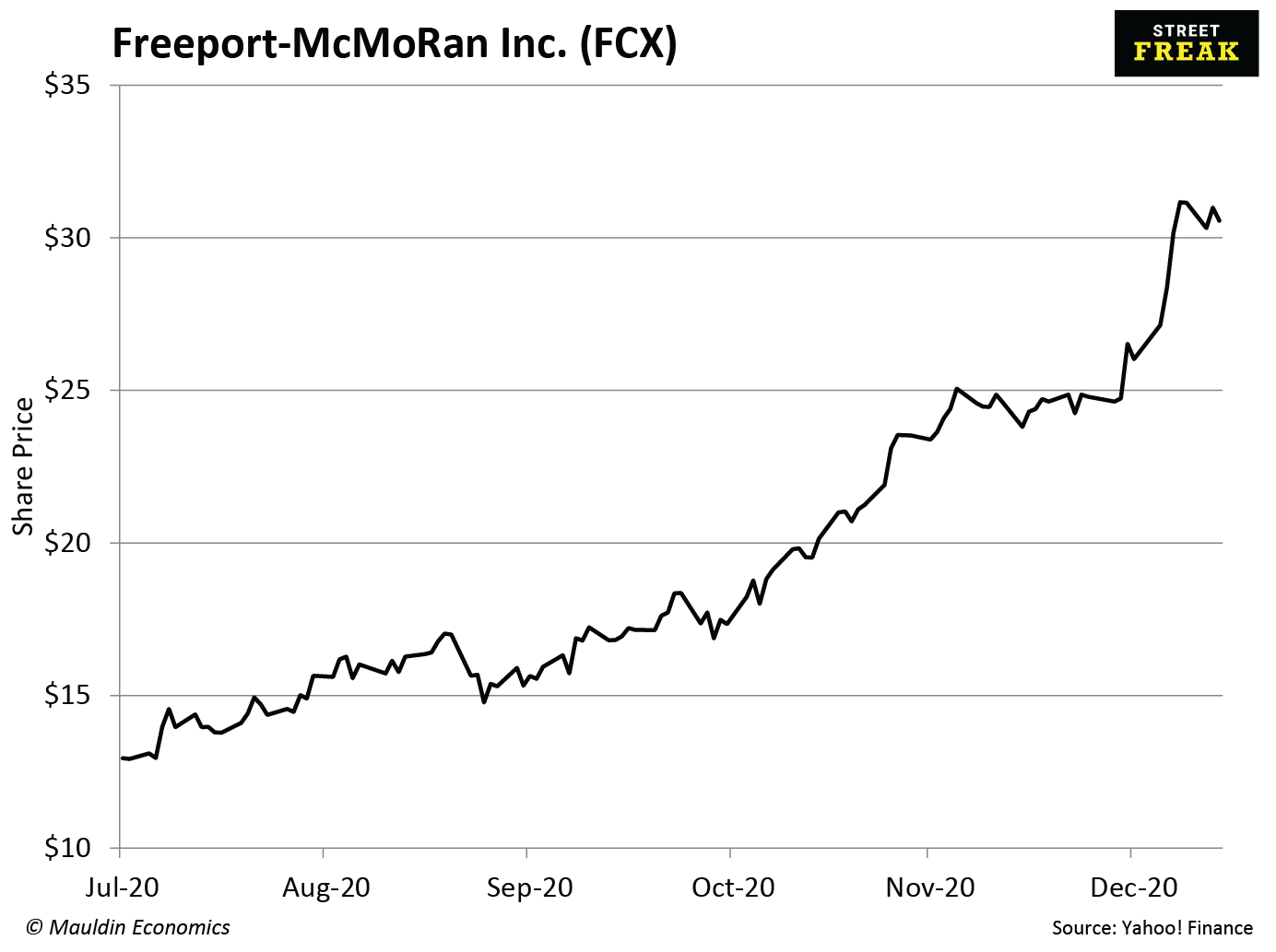

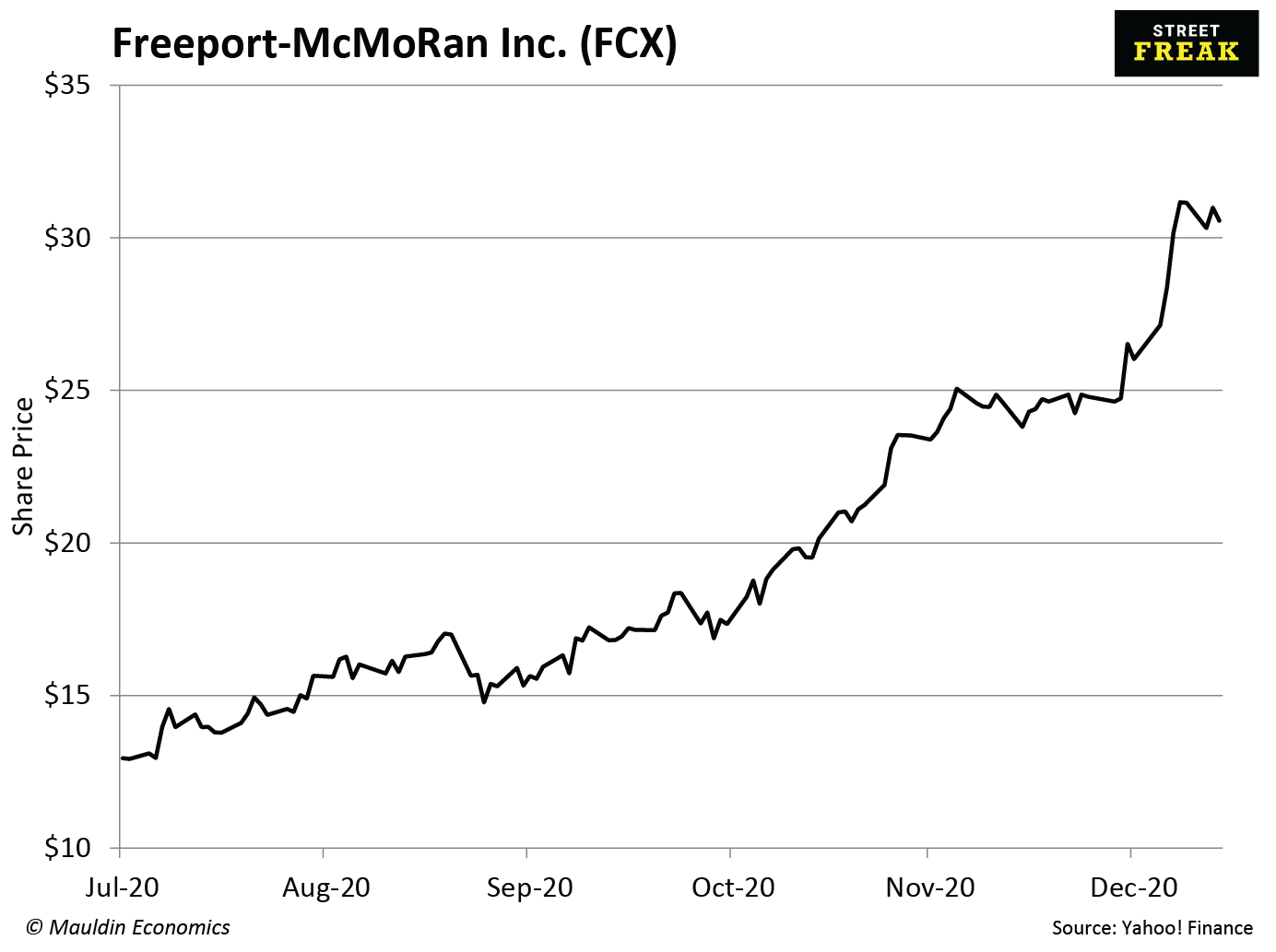

My readers depend on me to be ahead of the curve, and in July of 2020, I told them...

Yah, I warned them in July of 2020.

If you remember, that's when the markets were so hot all you needed to do was throw a dart and you hit a winner.

But it was also when the government was creating an unprecedented amount of money to combat the economic impact of the COVID-19 pandemic.

A lot of people thought I was crazy to make that call.

I didn’t care...

I added an inflation play that very month (never listen to the haters).

That play was Freeport-McMoRan Inc (FCX), and it brought my readers an impressive 136.17% in just seven months.

And now? Every play we are in is based on increasing inflation.

You don't have to be a billionaire to make money off inflation, you just need to be strategic.

And that’s why…

Street Freak is your Inflation King Playbook.

If I wanted everyone to know my strategy for profiting from inflation, I would just write an article for Bloomberg or Forbes, list all the company names and tickers, and let all the “Joe Schmoes” flood it.

But I’m not doing that for one very important reason: I share my best trades and my best investing ideas with my readers FIRST.

And today, I’m inviting you to become a reader of my returns-focused research letter, Street Freak.

Street Freak is for smart, careful investors who want to grow their wealth in both the near term and long term.

Yes, we're in this to make serious money, but you won't find me advertising “4,000% on this ONE STOCK if you sign up now.”

That's for the pikers… not real investors.

Street Freak is 100% contrarian. My readers know that the good trades are always the ones no one is talking about, or the ones that have fallen out of favor.

When I made the call to strike growth stocks from the portfolio in February in preparation for 4% inflation this year (and 10% next year)... no one wanted to believe it was possible.

Even now,the Fed is trying to convince people the massive jump in inflation is “transitory.”

But it’ll say anything to keep people calm at this point.

If you choose to become a Street Freak reader, you’ll be joining an elite group of investors who see around the corner before everyone else.

There is no “caught by surprise” in Street Freak. By the time mainstream investors start talking about a trade, we’ve already been in it for months (collecting maximum upside).

I’m opening up Street Freak to new members—but not for long.

Listen, I'll be straight with you. I don't usually offer discounts.

Street Freak is worth every penny you spend on it.

“Jared, I just want to commend you on the Street Freak newsletter. The recommendations have been spot on, the analysis solid, and I always look forward to the commentary. Well worth the subscription price!!!” –J.R.

But with 10% inflation on the horizon, I want to make Street Freak, and the critical research it offers, as accessible as possible.

So, I'm going to offer you a very deep discount.

This will not only be your last chance to enter the inflation trade before things ramp up, it may be the last time I offer Street Freak at this price.

After this, I will be forced to adjust its subscription price for inflation.

But, before the price is raised, and for a very slim window of time...

Instead of charging you a reasonable $1,795 a year (which is half of what similar newsletters charge), I'm striking $800 off the price.

You will only pay $995.

That means for a little over $3 a day, you have access to information that could save your retirement.

“I've been meaning to thank you for saving my portfolio… Your portfolio performance is amazing. [Street Freak is] well worth the price.” –Jim K.

That's 44.56% off, for a whole year of smart, high-conviction trades.

Higher inflation isn't just some blip on the radar.

Its effects will be with us for years.

We will be attacking this theme from many different angles over the coming months. There are so many ways to make money off this trade—it’s insane.

You need to be able to see around corners, and that takes a bit of divergent thinking.

That’s what I will be handing you with Street Freak.

I will continue providing my readers (you) with aggressive, upside-seeking, high-conviction ideas and research. We will take profits as they come, and we will never go down with a sinking ship.

This is a “now” decision,

not a “next week” decision

But as I said, this offer is only open for a very slim window of time.

After June 28, not only will the discount disappear, but I’m going to raise the price.

I've tried my best to convey the urgency of the situation through this letter.

If you've read this far, you probably agree with me.

There are millions of people out there who have ZERO idea how to prepare for—let alone profit from—inflation. They are going to lose a lot of money.

YOU ARE NOT ONE OF THOSE PEOPLE.

You know what you need to do, and Street Freak can help you take action.

Become a Street Freak Insider

The research I'll be sharing over the next couple of months is too valuable to share with the general public.

Because of that, I'm not offering a money-back guarantee.

Once you're in, you can be confident that you’ve joined a group of serious, and smart, investors.

People who depend on me to keep them tapped into market sentiment, share critical research, and point them to wealth-creating trades.

I'm not opening this up to people who just want to jump in, write down all the tickers, and then ask for their money back.

First, that’s not a safe way to invest, and second, it’s not fair to my long-time readers.

I know what Street Freak can do for you.

And I know what it has already done for so many others...

“I could talk about how well my portfolio looks and how I feel so much more comfortable about the risks I have to my future retirement, but that is the easy stuff and expected based on your product. (...) These are not just concepts for the wealthy, they are for every person to be able to make sure they are financially stable.” –N.C.C.

If you want to join me and the rest of the Freaks in profiting from inflation, click the button below.

When you click that button, I’ll show you everything you get when you become a Street Freak insider. I’ve also lined up some incredibly valuable bonuses—icing on the cake.

Including…

A very special Street Freak Members-Only LIVE Event

“Profiting from the Inflation Boom: What you need to know NOW”

...With Bonus Q&A...

Within days of joining, you will receive details about this very special, live event to be hosted by myself and Mauldin Economics COO Ed D’Agostino.

There is a lot of noise in the media relating to inflation and the state of the markets… We are going to use this hour to cut through that noise. It’s crucial to know what requires your immediate attention.

During this event I'll cover everything you could possibly want to know about Street Freak’s inflation strategy (and a whole lot more). You’ll find out…

... the elements that will make the inflation trade successful,

... how Street Freak readers should be positioned for maximum profit potential, and

... what you should cut from your portfolio immediately

I'll also discuss my newest high-conviction investing ideas, as well as what I have my eye on adding to the Street Freak portfolio in the coming months.

Not only will this event leave you feeling more informed (and confident in your strategy going forward), you can use it to get your questions answered. That’s because the second half of the event is dedicated entirely to what YOU want to know.

After completing your membership, look out for an email containing the exact details you need to participate in this special LIVE event.

What’s it like to be a Street Freak?

I understand that subscribing to any newsletter can feel like a leap. Even if I do have the fancy "as seen on" banner, over 200,000 monthly readers, 22 years of professional investing experience, and a bio that says I used to run the multibillion-dollar Lehman Brothers ETF Trading Desk on Wall Street back in the day.

So, let me give you a sneak peek.

Street Freak is an active service. Some investments are held over a period of years, and some only for a few months.

My mantra is “take the profits as they come.” I’m not going to try to ride something to the very top.

People who are willing to ride a play to the absolute top are the same people willing to ride the same play to the absolute bottom. That’s not really investing, that’s gambling.

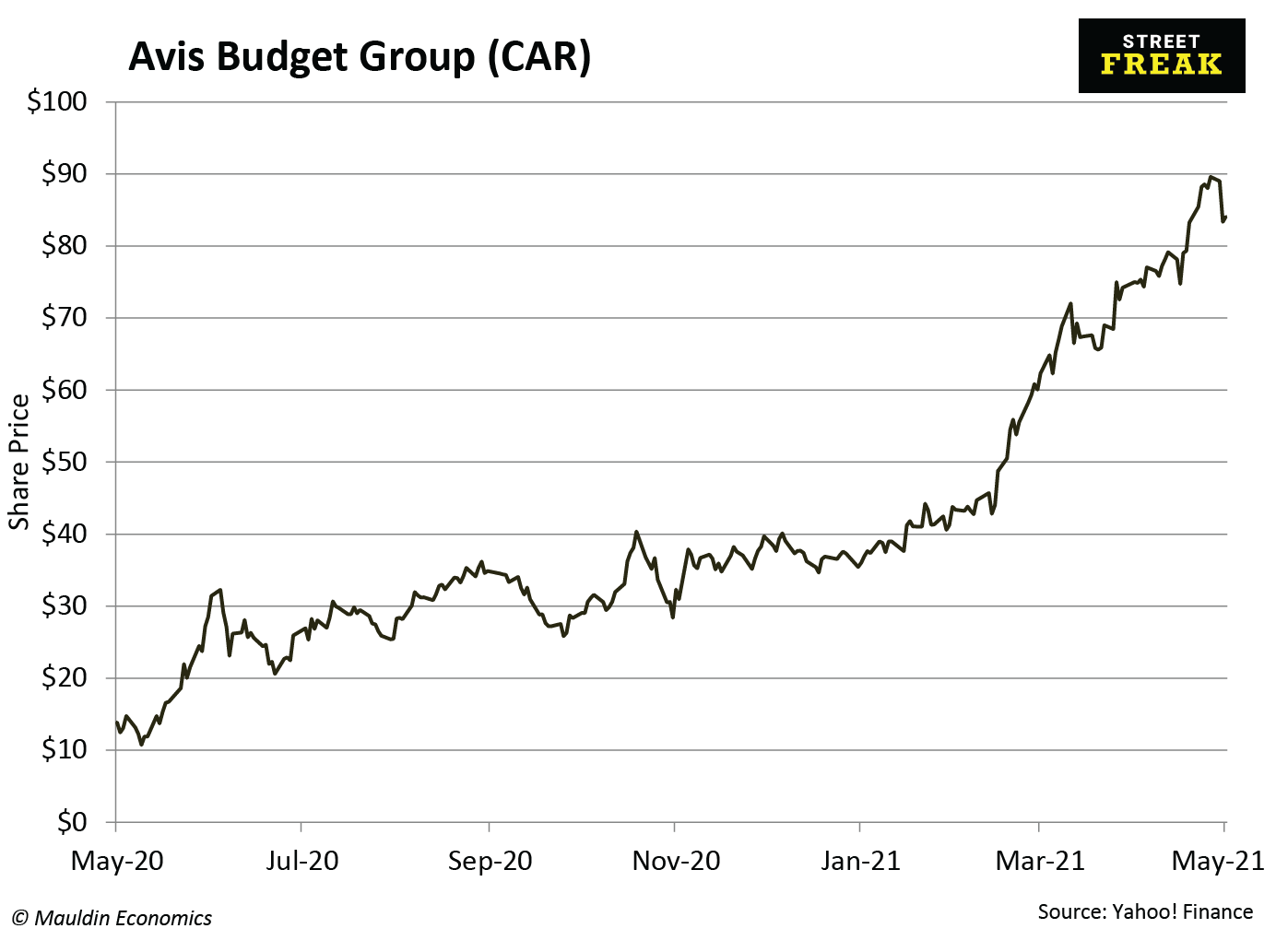

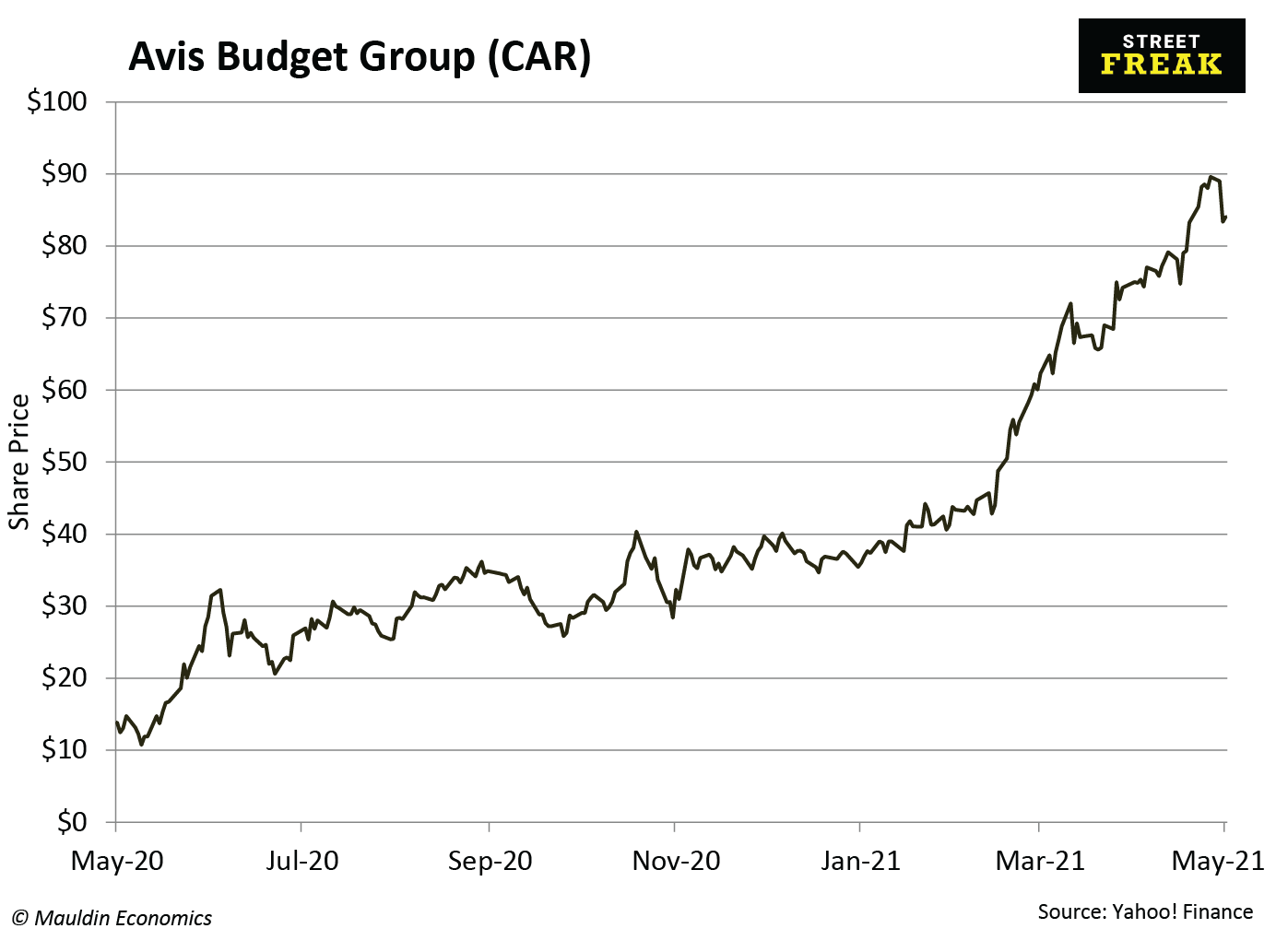

Back in February, I recommended Avis Budget Group (CAR) on the premise that as the pandemic subsides, rental car demand would return, supply wouldn't be able to keep pace with demand, and prices would go way up.

That is exactly what has happened. Today, in some vacation hotspots, rental car rates are over $300 a day.

That's pushed our position to a near 90% gain in just three months…

We took advantage of a smart play, collected our profits, and exited.

I asked my readers how the CAR trade went for them, and this is a sample of what they had to say:

“Did exceptional—it paid for the Street Freak Subscription and then a whole lot more.” –J.J.W.

“I took your recommendation and bought $10,000 of CAR at $43 on the day you recommended it. And I sold all of them at $81 for a 86% return in 3 months.” –C.R.

“Thanks for the Avis recommendation. My TD Ameritrade account had me up 104% when I sold. Just on that trade, I covered the cost of my subscription many times over and am extremely pleased with your work.” –Chris J.

“102%. Thank you!” –Ray

“84% gain for me on this trade. Not complaining.” –Tom

“We had a 93% gain on Avis, great job! (...) Pleased to be a Street Freak customer.” –R.D.B.

“97% on CAR. Great trade!” –Richard R.

I don’t recommend complicated trades. You don’t have to have a degree in finance to invest with Street Freak. You only need two things: intellectual flexibility and a passion for investing. That’s it.

I really hope you’ll join me. I’ve been pounding the table on inflation for months. And I don’t set aside days to write a letter like this unless the message is urgent and you have the opportunity to make a sizable amount of money.

You will not regret becoming a member of Street Freak, but I’m willing to acknowledge the first step is the hardest.

Like I mentioned earlier, I’ve prepared some pretty sweet welcome gifts for you. You can read about everything you get when you become a Street Freak member by clicking the button below.

Here’s what current subscribers have to say about Street Freak:

“Jared provides a viewpoint that is always fresh and a bit more than slightly off of the mainstream BS. His is generally on target. I have recommended Jared to others. Jared is real. Jared is fresh. Jared tells the why of what's happening.” –R.L.

“I hate to clutter your inbox, but it's hard to restrain myself after a day like today and a year like this year. Your recommendations, insights, and wisdom are such a gift. You're the best. Thank you for all you do, and Happy New Year!” –S.M.

“[I read Street Freak for its] non-mainstream thought process, [and] interesting long-term investment ideas.” –K.S.

“You have a way of cutting through the BS.” –C.P.

“Jared Dillian gives me wisdom.” –S.G.

I hope you’ll join me and the other Freaks as we position ourselves to profit with Street Freak’s Inflation King Playbook.

Jared Dillian