The Banking Deal of the Decade

-

Thompson Clark

Thompson Clark

- |

- Smart Money Monday

- |

- April 3, 2023

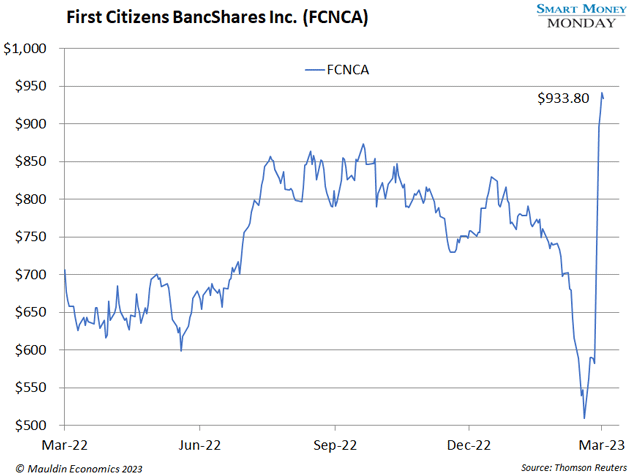

My longtime favorite bank stock just jumped 54% in one day.

On March 27, First Citizens BancShares Inc. (FCNCA) acquired now-defunct Silicon Valley Bank’s deposits and loans from the Federal Deposit Insurance Corp. (FDIC) in what I believe is the banking deal of the decade.

As a result, the stock surpassed its 52-week high—and it’s been climbing ever since.

Before the deal, First Citizens had $100 billion in assets. Afterward, its assets rose to $200 billion.

So, it doubled assets overnight in this transaction!

From $50 billion in 2020 to $100 billion in 2022 to $200 billion today, First Citizens is now one of the largest banks in the country.

One of the Craziest Agreements I’ve Seen

When the government sells, you usually want to buy. That’s because governments are not always money- or profit-motivated. They see a problem (in this case, Silicon Valley Bank) and want it solved quickly and discreetly.

Now, the deal terms for what First Citizens paid are a little opaque.

Here’s what we know…

It assumed $110 billion in assets, which includes loans and cash. It also took on $93 billion in liabilities, which includes $56 billion in deposits and a $35 billion loan from the FDIC for five years at 3.5%.

The net effect is approximately $17 billion in equity value, or over $1,000 per share in value.

The only cash that appears to be leaving the door at First Citizens is a $500 million share appreciation right arrangement. Basically, the FDIC gets paid if First Citizens’ stock goes up. And that arrangement is settled in cash, not in stock.

It’s truly an insane agreement, one of the craziest I’ve seen. Again, it’s the banking deal of the decade as far as I’m concerned.

Are There Contagion Risks?

No, not for the price.

First Citizens didn’t buy a bunch of venture startup warrants or venture equity. And it didn’t buy any of the long-duration US Treasuries and mortgage-backed securities I wrote about here.

Like what you're reading?

Get this free newsletter in your inbox every Monday! Read our privacy policy here.

Of the $110 billion in assets, $70 billion is in loans. And of that $70 billion in loans, over half of it is tied to what’s called capital call lines.

Without getting too complex, these are money-good loans. They’re essentially backed by investors in venture capital and private equity funds. Think CalPERS or Harvard’s endowment or other massive institutions.

The rest of the loan book includes loans to private wealth clients and technology and healthcare companies, which, yes, are admittedly a little risky. Many of these companies make no profit.

Regardless, here’s where the deal with the FDIC gets even sweeter…

As part of the arrangement, the FDIC agreed to share 50% of the losses exceeding $5 billion.

So, even if some of the loans go bad, they won’t annihilate First Citizens… the government will share the pain.

My Favorite Bank Stock

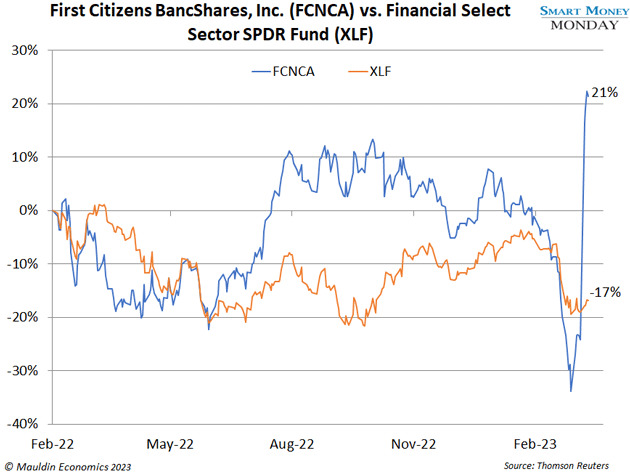

In February 2022, I called First Citizens the “only US bank stock I’m buying.”

Since then, it’s up 21%. Compare that to the Financial Select Sector SPDR Fund (XLF), which tracks an index of S&P 500 financial stocks:

First Citizens BancShares Inc. (FCNCA) remains a stock to buy and hold for many years. It’s still my favorite bank stock, and its setup today is more tantalizing than ever.

It’s the largest family-owned bank in the US… and it just got a whole lot larger.

Looking at the numbers, First Citizens is still cheap.

Even after some serious haircutting of the loan book, I get to a pro-forma book value of around $1,050 per share.

It has historically traded at a premium to book. Let’s say it trades at 1.2X book—that’s $1,260 per share, or 35% upside.

Thanks for reading,

Like what you're reading?

Get this free newsletter in your inbox every Monday! Read our privacy policy here.

Editor, Smart Money Monday

Tags

Suggested Reading...

|

|

Thompson Clark

Thompson Clark