This Prestigious Bank Is Down 90%—Is Now the Time to Buy?

-

Thompson Clark

Thompson Clark

- |

- Smart Money Monday

- |

- March 27, 2023

Bank stocks are getting slaughtered on the heels of Silicon Valley Bank’s failure.

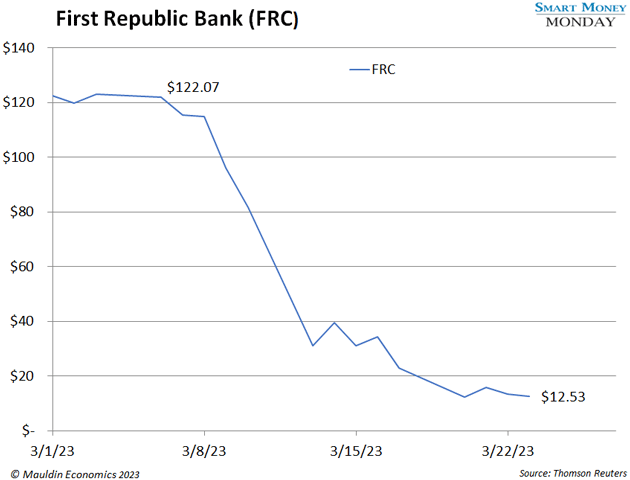

Look no further than First Republic Bank (FRC), which is down 90% since March 6, the week Silicon Valley Bank collapsed:

The banking crisis has ignited the investing world, and bargain-hunting friends of mine have been asking: “Should I buy First Republic?”

After all, First Republic is prestigious. Facebook founder Mark Zuckerberg got a mortgage there. Dozens of customer surveys rate its satisfaction scores higher than super-brands like Apple and Ritz-Carlton.

If First Republic is truly a high-quality asset that’s 90% on sale… we should be rushing to buy.

Comparing FRC to SVB

At the 2006 Berkshire Hathaway annual meeting, superinvestor Warren Buffett talked about how he and partner Charlie Munger look at investment opportunities:

“We’ve got three boxes at the company: in, out, and too hard.”

I’ve looked up and down First Republic’s capital structure. It even has some preferred stock that could be a “safer” way to play it.

But First Republic’s issues mirror the ones faced by Silicon Valley Bank…

It has a number of long-duration loans on its books. These are predominantly residential mortgages. The mortgages are fixed at around 3% and likely extend out over a decade.

Like I wrote last week, a 3% loan—were it to be sold—would be worth considerably less than 100 cents on the dollar in a 5% interest rate world.

When you adjust First Republic’s balance sheet to “fair value,” it turns out total equity in the bank was a negative $10 billion as of the end of 2022. That’s not good.

On top of that, First Republic was heavily funded with customer deposits. Customers were happy to use the bank for their deposits, just like they were with Silicon Valley Bank… until they weren’t.

As of the end of 2022, First Republic reported $119 billion in uninsured deposits. This pencils out to two-thirds of its $176 billion in deposits. That’s a big number.

Depositors ran the numbers and, en masse, pulled their money out in fear that they’d lose their money above and beyond the insurance limits.

Like what you're reading?

Get this free newsletter in your inbox every Monday! Read our privacy policy here.

The big banks like JP Morgan have injected $30 billion in cash in the form of deposits in an attempt to calm the markets and keep the bank solvent.

But it’s probably too little too late.

Toss FRC into the Too-Hard Pile

Right now, too many things need to go right for me to seriously consider FRC. That’s a telltale sign of a “too-hard” investment.

Going forward, nearly everyone will connect “First Republic” with “bank run.” I believe the brand is permanently impaired. And that means investors will choose to put their money in better opportunities.

Deposit flight (all depositors pulling their money out of a bank) is a continued risk with First Republic, and no bank stock is cheap enough to factor in major deposit flight risk and brand destruction.

In short, avoid stocks in the too-hard pile such as FRC.

You’re better off sticking with simple, easy-to-follow stories when hunting for bargain-priced stocks.

My top Smart Money Monday pick for 2023 is a great place to start. Or, if you’re looking for new small-cap ideas, consider joining my premium letter, High Conviction Investor.

Thanks for reading,

—Thompson Clark

Editor, Smart Money Monday

Tags

Suggested Reading...

|

|

Thompson Clark

Thompson Clark