It’s Time to Start Thinking about the Right Tail

-

Jared Dillian

Jared Dillian

- |

- May 14, 2020

- |

- Comments

Most of you know what a normal distribution is, and that it has a tail.

What many don’t know is that it actually has two tails.

The logarithmic returns of stock prices are normally distributed, and most people spend their time worrying about the left tail—the likelihood that stocks will crash. A reasonable thing to worry about. After all, they just crashed.

And with stocks, the high-velocity moves are typically down. Markets don’t typically crash up.

There have been certain historical examples where stocks actually have crashed up. Usually because of high inflation or hyperinflation.

In the US, people obsess about when stocks will crash again and reach lower lows. I encourage you to think about the right tail as well—the probability that stocks will crash up.

They don’t even have to crash up—they just need to do what they’ve done for the last 10 years, which is go up about 19% a year.

Everyone is confused about the price action post-crisis. The economy is basically in a depression, yet stocks keep climbing higher.

It’s not that hard to figure out—the Federal Reserve is buying everything in sight. The Fed just started buying credit ETFs this week. With the Fed buying municipal bonds, investment grade corporate bonds, high-yield bonds, Treasuries, and mortgages, it’s kind of hard for the stock market to go down.

And if stocks did go down, I would fully expect the Fed to buy stocks, too.

The left tail has been made obsolete. It is time to start thinking about the right tail.

No Argument

As for the stock market, there should be no arguments here about being bullish or bearish. This isn’t a discussion about that. This is a matter of looking at the stock market as a mathematician would, dispassionately, only considering the probability distribution. And the distribution has effectively truncated the downside.

My friend Christopher Cole, the founder of Artemis Capital, was talking about the right tail of the distribution back in 2012. It was exactly the right time to be thinking about the right tail, since the S&P 500 almost tripled over the following eight years.

Could the S&P 500 triple again in the next eight years? Maybe.

Then there is the question of what you should do about it. It’s not simply a matter of being long stocks—everyone is long stocks, anyway.

Like what you're reading?

Get this free newsletter in your inbox every Thursday! Read our privacy policy here.

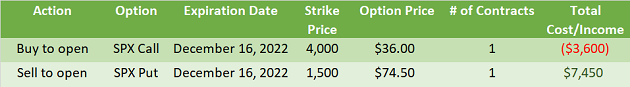

Note that this is an example, not a recommendation. This is a sophisticated investing strategy. If you are doing this on your own, do your due diligence before putting any money to work in this or any idea.

Problem is, nobody is in the mood to sell crash puts, for reasons that should be obvious. But perhaps now is the time to sell crash puts.

I have been thinking of ways to do this in a limited risk fashion. But the nice thing about the risk reversal structure is that the sale of the put pays for the call premium, so you can put it on for free, or a small credit.

If you start spreading the put to the downside, you end up buying a very expensive option. And that is the nice thing about selling far downside puts these days—the skew is very steep, so you are being compensated for the risk.

The trouble with this trade, in my mind, isn’t really the P&L, but the fact that it’s not really a hedge. In fact, if stocks do crash, you will have plenty of other stuff to worry about, and the last thing you need is to be short a put that blows up in value.

And believe me, it would blow up in value. If anything, you should buy those puts, as a hedge, not sell them. So this structure only makes sense if your portfolio does not already have a large exposure to equities.

The Morality of It

Here, in the United States, we are obsessed with the stock market. After all, everyone’s retirement savings is in it. The government and the Fed, collectively, will never allow it to fail.

That is a very cynical thing to say, but it is true, and it only became apparent after a decade of observing that the reaction function of the Fed completely revolved around the stock market. If the S&P 500 fell 20% from here, there would be even more aggressive easing, up to and including negative interest rates and the Fed buying stocks.

Sometimes, I get pushback about central banks buying equities. People point to Japan, whose equity market is still down significantly from the highs. Yes, but it is significantly off the lows it reached in 2012, when Abenomics was implemented.

Don’t overthink this: If the Fed were to buy stocks, they would go up.

Again, we’re not going to get into what’s wrong or right. These are the parameters we have been given. You have to consider all possibilities, not just the ones the anti-Fed people talk about on Twitter. The irony is, of course, that if they thought a little more about what the Fed was doing, they might come to a different conclusion.

Music

I wanted to catch you up on some music stuff. I’ve published two new mixes in the last month: The Found and Fourth Moment 2. Hope you enjoy them!

Jared Dillian

subscribers@mauldineconomics.com

Tags

Suggested Reading...

|

|

Jared Dillian

Jared Dillian