People Watching from Mars Are Scratching Their Heads

-

Jared Dillian

Jared Dillian

- |

- March 28, 2019

- |

- Comments

Lot of strong feelings on gold. Some people think it has no utility and people only like it because it’s shiny. Other people have pretty reasoned arguments about how gold maintains purchasing power across the centuries.

There was a bubble in it eight years ago that sucked a lot of people in. There were some sketchball commercials for gold on Fox News. The people that missed the bubble spent the next eight years ridiculing the people who got sucked into it.

(I got sucked into it.)

Also, a lot of people think gold has no relevance in a digital world, with bitcoin and all, but crypto (as much as I am warming up to it) is an unreliable store of value, at least for now.

Now, most people are kind of neutral on gold and are off arguing about other things, like index funds and ETFs. I personally am thankful we are done yelling about gold. Because now we can talk about the real reason you should own gold.

|

The Real Reason

I have been talking a lot about portfolio construction lately. Most idiots have an 80/20 portfolio (80% stocks/20% bonds) or a 90/10 portfolio or even a portfolio that is 100% stocks. I have been making the case for a portfolio that is 35% stocks and 65% bonds. Historically (over the last 20 years), that portfolio has been giving you a little less return, with a lot less risk. In hedge fund terms, you would say that it has a better “Sharpe Ratio.”

I have been experimenting with variations on the 35/65 portfolio recently, with some incredible results. For example, a 35/55/10 portfolio (35% stocks, 55% bonds, 10% commodities) has even better risk/return characteristics. And if you have a fundamental view that commodities are underpriced, terrific.

But wait, there’s more. How about a 35/55/3/3/4 portfolio? That’s 35% stocks, 55% bonds, 3% broad commodities, 3% gold, and 4% REITs. If you think about what this is, it’s a stock/bond portfolio with a really good inflation hedge. Want to know the risk/return of that portfolio?

It gives you almost the return of the 80/20 portfolio with half the risk.

And it’s mostly because of the gold. Add gold to any portfolio (including gold mining equities) and the risk characteristics improve. In the old days, the miners used to be negatively correlated with the broad stock market. That isn’t quite true anymore, but the correlation is very low.

The 80/20 portfolio is ridiculous, with an insane amount of volatility. The main reason financial advisors put people in this portfolio is because of FOMO—they are afraid that if they put a client in a more conservative portfolio, that client will fire them in two years after watching all their friends make more money.

You actually can have it both ways. You can have a portfolio that returns a lot, with a lot less risk. You just have to get creative! And you have to be willing to own some things that you wouldn’t ordinarily own.

The Real Reason 2

Of course, there are other reasons to own gold.

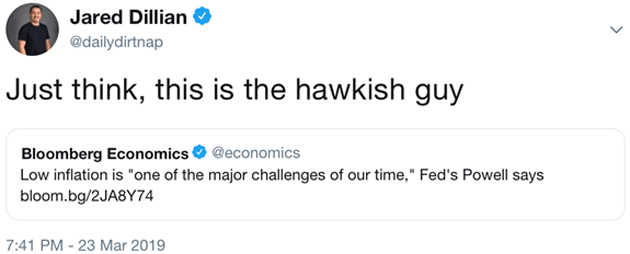

There’s been a big shift in the Fed’s thinking in the last couple of months. Big… as in, really big… as in, dramatic. At least partially because of the political pressure. There is a lot to say here, but the TLDR is that the Fed doesn’t seem to care a great deal about high inflation.

Who can blame them? It is a bit like fighting the last war. Our last bout with high inflation was almost 50 years ago, and it seems like no matter what we do, we can’t cause inflation if we try. Editor’s note: we will keep trying, and eventually we will.

Like what you're reading?

Get this free newsletter in your inbox every Thursday! Read our privacy policy here.

Off in the peanut gallery, you have this whole discussion on Modern Monetary Theory and how deficits don’t matter. Gold likes those kinds of discussions. Plus, central banks are buying it for the first time in a while.

There are also not a lot of gold discoveries out there, and the existing ones are in unhappy places that are hard to get to.

The fundamentals of gold are lining up for the first time in a while. I am not the first to observe this. I think people are being very conservative about their gold forecasts, after being burned pretty badly the last time.

I’m bullish, I own it. I think other people should own it, maybe with a bit of risk management this time around. I have a few ideas of my own on that. My latest piece, The Contrarian’s Precious Metals Portfolio, has a somewhat intelligent way to get involved in the precious metals space without getting out over your skis. Plus, you get to try out my Street Freak letter, risk-free at a 60% discount.

You can go here to take a look under the hood. Or, if you’re ready to get started, you can go here. I wouldn’t procrastinate. The Contrarian’s Precious Metals Portfolio is only available until midnight tonight. If you’re interested, you might want to click before you forget about it.

That’s the investment case, gift-wrapped for you. My work here is done.

subscribers@mauldineconomics.com

Tags

Suggested Reading...

|

|

Jared Dillian

Jared Dillian