The Right Side

-

Jared Dillian

Jared Dillian

- |

- August 13, 2020

- |

- Comments

Last week, I shared a short list of things I’ve traded through:

[T]he housing bubble, the European debt crisis, the S&P debt downgrade, the flash crash, the cotton bubble, beans in the teens, rare earths, uranium, Ebola, the yuan devaluation, zero rates, negative rates, oil at 140, oil negative, COVID-19, Bitcoin, the Tesla squeeze, Volkswagen, the cannabis bubble, security stocks in 2003, Ford debt downgrade, SARS, 9/11, the Iraq War, Trump’s election, the CHF reval, Argentina (multiple times), Puerto Rico, Venezuelan bonds, and European banks. And even though I didn’t trade through the Asian Financial Crisis and LTCM, I was watching them closely in grad school.

If you’re on the wrong side of just one of these trades, you’re done. But what if you’re on the right side?

You can retire.

Now, you might look at that list of events and say, “Whew! I missed all those. Dodged a bullet.” But instead of thinking about loss avoidance, you should think about opportunity cost. These weren’t ways to lose money, they were opportunities to make money.

When I look at that list, I don’t feel happy, I feel sad. Can you imagine being on the right side of the CHF reval? A hero trade.

Sea Change

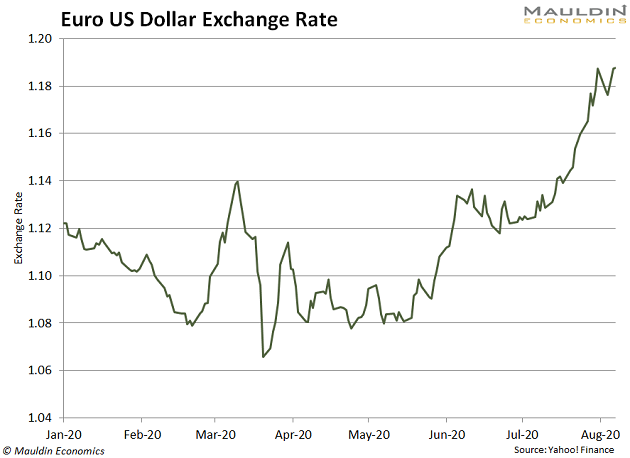

EURUSD has moved 12 cents, give or take, in the last couple of months. This is a multi-standard deviation move, and an opportunity that doesn’t come along in the FX space much these days—especially these days.

There is a well-known USD bull who has been fighting it the whole way. I doubt he’s been fighting it with actual capital—given the leverage available in the FX market, that’s a career-ender, right there.

I want to focus on the dollar specifically for a second, because I believe there has been a sea change in macro investing in the last few months. We have moved from a disinflationary regime to an inflationary regime. Everything that worked in the past, will no longer work.

The whole framework with which we analyze the macro environment has changed—and most people haven’t even noticed. They’re still fighting the last war.

You might say, why is it different this time? We printed a bunch of money back in 2008, and we never got inflation. We got asset price inflation, but we didn’t get inflation in goods and services. Stocks and bonds went up.

This time we will get inflation—because we are intervening on the fiscal side.

This is how you get money velocity going—by spending trillions of dollars and simply handing it out to people who have a greater marginal propensity to consume.

The PPP loans, the stimulus checks, and the unemployment cash have been rapidly deployed into the economy. This is not 2008, where cash from quantitative easing was held at the Fed in the form of excess reserves. This money is being spent. Rather quickly, I might add.

Sure, the savings rate has skyrocketed, and consumer credit is plummeting, and people are repairing household balance sheets. But there’s also lots of spending, and it’s the classic definition of inflation—more money chasing the same amount of goods.

People Are Coming to Expect Higher Prices

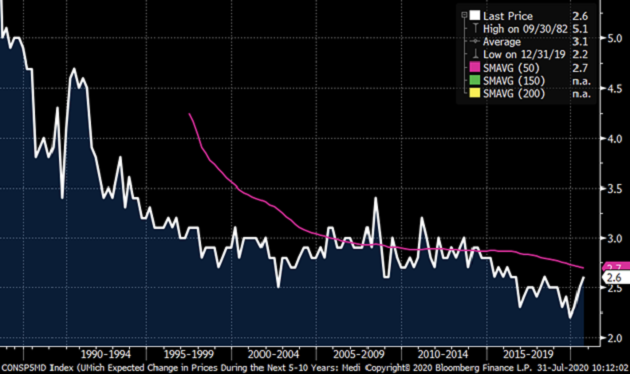

Here’s a chart of 5- to 10-year inflation expectations, which has rebounded sharply in the midst of a horrible recession. Probably nothing.

Source: Bloomberg

Like what you're reading?

Get this free newsletter in your inbox every Thursday! Read our privacy policy here.

This is a subjective determination—by me—but I’ve noticed that other people have noticed that their grocery bills are going up. And if inflation has returned, it is probably going to hit people where it counts: food, energy, and other things they need.

This will rekindle some debates at the Fed over the usefulness of “volatile” inflation statistics in food and energy, and whether they represent real inflation. Spoiler: they do.

Gigantic Opportunities

It is all about narrative, and the narrative is changing. From 2013 to 2019, all we heard about were the deflationary effects of technological progress and global trade.

Now, global trade is in retreat, and if companies are really forced to bring their supply chains home, you can count on huge cost increases. An iPhone produced in the United States will cost three times as much, and yes, that day is coming.

You shouldn’t view the coming inflation as a loss to be avoided; you should view it as an opportunity to profit. There will be gigantic opportunities for all sorts of investors, large and small. Some are obvious and some are not so obvious—we’ll dive into that part more over the coming weeks.

The Fed has made it clear that it’s willing to tolerate significantly higher inflation. It is the pinnacle of hubris to think you can goose inflation up to 4% and then keep it there.

The train has left the station, and there are no brakes.

One last thing—please check out my latest mix Suddenly Last Summer. A relaxing, chilled-out hour of music perfect for the beach or pool.

Jared Dillian

subscribers@mauldineconomics.com

Tags

Suggested Reading...

|

|

Jared Dillian

Jared Dillian