The Saddest Day Ever

-

Jared Dillian

Jared Dillian

- |

- June 4, 2020

- |

- Comments

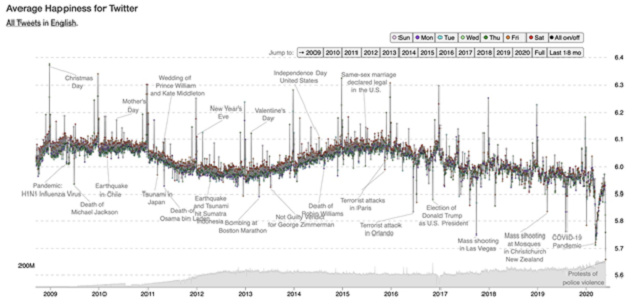

There is a Twitter account called hedonometer that measures the average happiness of everyone’s tweets.

On Sunday, it calculated that the civil unrest produced the saddest day ever on Twitter—the day with the most negative sentiment.

You can see the hedonometer chart below:

Source: @hedonometer

Sentiment has been trending lower, in fits and starts for the last 10 years. It’s much lower today than it was during the financial crisis, and it’s been headed lower since 2015 or so.

Interestingly, 2015 is when stocks really started to take off.

I study sentiment in the markets, and I know that extremes in sentiment usually mark big turning points for stocks. I think back to the early ‘90s, coming out of the recession, when sentiment was bottoming. I used to go to local punk concerts and dive into some really brutal mosh pits.

That is where we were, psychologically speaking.

And that’s where we are heading again.

If I looked at sentiment to the exclusion of all else, I would say that we are ripe for a big stock market rally in the coming years. Of course, there are a lot of other factors, including the Fed, which is doing just about everything but buying stocks.

Of course, given the civil unrest, there are a lot of discussions about inequality these days, and the Fed buying stocks would only make inequality worse... but that is the Fed for you.

Of course, it is likely, even probable, that social mood will get worse. We do have an election coming up, after all. I guarantee that social mood will be darker in a few months’ time, with the potential for even worse civil unrest.

The stock market will likely be unaffected.

Sad Days Ahead for Cities

One thing is for sure about COVID-19 and the civil unrest—it has dramatically reduced the attractiveness of cities.

Since the 1990s, professionals have poured into cities and gentrified them, reversing a long process of decay and neglect made worse by things like rent control. By the way, rent control is probably coming back.

Cities have been vibrant, diverse, affluent places to live. Now that process will run in reverse, and people will move back out to the suburbs—or further than that. “Exurbs” have been growing in popularity as cities lose their appeal and more companies tell their employees to stay home for good.

Like what you're reading?

Get this free newsletter in your inbox every Thursday! Read our privacy policy here.

I lived on Governors Island in New York City from 1979 to 1981. I went to elementary school in Manhattan. I went into the city every day and sat on subways where the graffiti paint was still wet.

One clear memory I have from that time period: lots of spitting. People spitting everywhere, all the time.

At risk of saying something obvious, one thing we learned from the lockdowns is that it’s a lot more fun to work from home. And people are more productive, not less. For many jobs, there is no reason to commute into a city for work.

Cities haven’t been well-governed, as a rule. New York is the most glaring example, where Bill de Blasio has reversed two decades of effective governance under former mayors Mike Bloomberg and Rudy Giuliani. Decades of mismanagement are coming home to roost.

Small Business Has Ceased to Exist

Things could not be worse for small business. Three months of lockdown, followed by riots and property destruction. Meanwhile, Amazon (AMZN) is stealing even more market share.

Amazon has been busy buying ad space for feel-good PSAs, mostly in response to allegations that it has unsafe work environments. But a recent advertorial said that “the country needs Amazon more than ever.” That’s true—because small business has ceased to exist.

If I wanted to think of how to destroy a country, I could not have done a better job if I’d tried. Years of zero interest-rate policy (ZIRP) and quantitative easing (QE) created the most inequality we have ever experienced. Then everyone is locked up for a few months, and all it takes is a spark.

I try to underreact to things and not interpret historical events too broadly. But this isn’t bullish.

What’s especially not bullish is our treatment of small-business owners. These are people who might not have the academic pedigrees to work at a large company. Some have minor criminal records. But they worked hard and built something of their own, and were able to join the middle class.

Now, we’re hollowing out the middle class further and creating even more inequality. As we’re finding out, this isn’t sustainable.

This makes the optics of what the Fed is doing even worse. The next tool it will deploy is yield-curve control, but it’s an open secret that it has considered buying stocks—which does nothing to benefit the people on the street. It’s a bit like a bad dream.

I don’t spend much time criticizing the Fed. (There are enough people who have made entire careers out of that.) And it may seem like a bit of a stretch to blame the riots on the QE of 2008, but I disagree.

Monetary policy indirectly bears responsibility here. If you wanted to fix all of this overnight, it is actually very easy: Raise interest rates to 5%.

Of course, that is not going to happen anytime in the foreseeable future. So you are going to have to look a little harder to find profitable opportunities.

But they are out there... like the best-in-breed energy stock I recommended in my premium monthly advisory, Street Freak last month (we’re already sitting on double-digit gains). Or our precious metals positions, which are up an average of 60% plus, and still have a lot more room to run. You can get in on these profitable opportunities, and many others, by taking Street Freak for a risk-free test drive. Click here to get started.

Like what you're reading?

Get this free newsletter in your inbox every Thursday! Read our privacy policy here.

Jared Dillian

subscribers@mauldineconomics.com

Tags

Suggested Reading...

|

|

Jared Dillian

Jared Dillian