Bet on Red: There’s a 90% Chance This Casino Dividend Gets Cut

- Robert Ross

- |

- The Weekly Profit

- |

- April 22, 2020

Some 80% of small businesses have closed temporarily because of the coronavirus crisis. But the issue of if they will reopen has become a bigger question than when.

According to a survey by Main Street America, some 7.5 million small businesses may be forced to close their doors permanently over the next five months. However, it’s not just small businesses taking it on the chin.

You know that the energy and cruise line industries—and their stock prices—have been decimated. But there’s another sector that is going deep in the red as well.

And my bet is that their dividend payments are almost certain to follow.

Casino Companies Put It All on Black (and Lost)

Americans across the country are required to practice social distancing. This means staying home. If you do go out in public, you must wear a mask, stay six feet away from other people, and wash your hands at every opportunity.

Right now, those are just good common sense practices. Yet not everyone is on board. That’s why many states, municipalities, and essential businesses are reserving their right to enforce these measures.

Social distancing is bad news for any industry that aims to gather a lot of people in one place. And the casino industry is particularly vulnerable.

These companies—some of them are the size of small empires, really—depend on throngs of hopefuls coming to their properties to spend big money for their chance to win even bigger money.

To do that, guests have to touch machines, chips, cocktail glasses, and more. But until there is a coronavirus vaccine or other treatment, I wouldn’t bet on the casino industry bouncing back anytime soon.

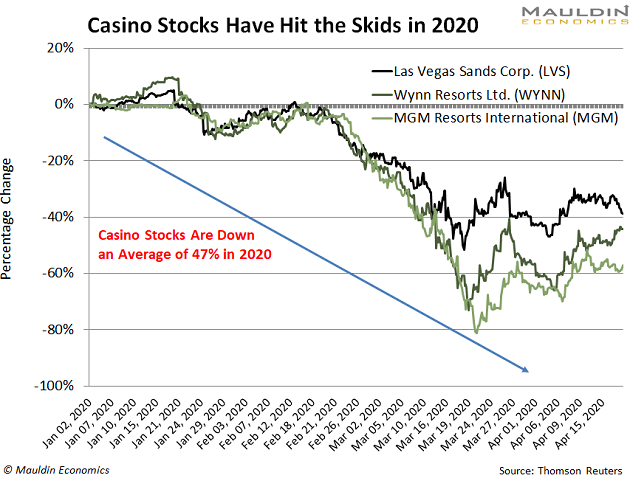

No wonder why the three largest casino stocks are down an average of 47% in 2020:

That’s five times the S&P 500 decline over the same period.

When dividend-paying stocks fall and their dividends stay the same, the dividend yield surges.

No wonder there’s a whole lot of “Fear and Loathing in Las Vegas” right now. There’s likely to be a sequel that features… you guessed it… dividends that are in danger.

High Dividend Yields Are Almost Always Risky

When companies have cash left over after factoring in expenses, they often return a chunk of that cash to shareholders as cash payments, or dividends.

The dividend yield for a company is found by taking the annual dividend paid divided by the share price.

- Let’s say Company A paid $2 in dividends in 2019. The stock trades for $100.

- That means Company A has a dividend yield of 2% (i.e., $2 in dividends / $100 share price).

- But now let’s assume Company A’s stock price falls 50%. Now the stock is worth $50.

- Because the company paid a dividend of $2, the dividend yield is now 4%. ($2 in dividends / $50 share price.)

If the company can meet its dividend payment, that’s great news for dividend investors. But more likely, companies will cut their dividends when the yield gets too high.

One Casino Already Slashed Its Cash Payout

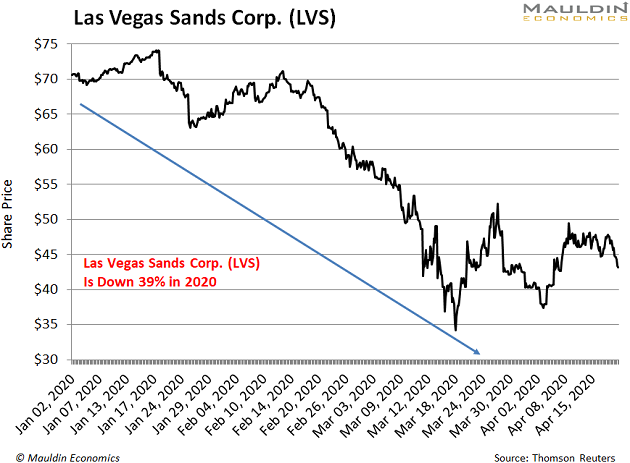

In the last 12 months, Las Vegas Sands Corp. (LVS) paid $3.08 per share in dividends.

A year ago, this payout was stable. The company’s stock traded near $67 per share. That put its dividend yield at 4.6%... more than twice the yield on the S&P 500.

But COVID-19 changed the math on this:

Las Vegas Sands (LVS) saw its stock price fall 34% in 2020. That pushed the dividend yield as high as 7%! While this isn’t as crazy as some of the other dividend yields we’ve seen post-crisis, it’s still difficult to maintain.

And since Las Vegas Sands is continuing to pay its employees during this mess, cutting the dividend is a worthwhile tradeoff.

But will the other casino companies keep their dividend payments flowing? Let’s take a look…

The Best Way to Tell if a Dividend Is Safe

As a general rule, you should always question whether a dividend over 4% is safe.

A tried-and-true way to tell if a dividend is safe is to look at a company’s payout ratio.

The payout ratio is the percentage of net income a company pays to shareholders as dividends. The lower the payout ratio, the safer the dividend payment.

When a company’s dividend rises faster than its earnings, the payout ratio rises.

As a rule of thumb, a payout ratio over 80% is usually not sustainable.

But in Las Vegas Sands’ case, the payout ratio would be in the triple digits.

For income investors, there’s an even worse bet out there…

Wynn Resorts (WYNN) Will Be Next to Cut Its Dividend

In the last 12 months, Wynn Resorts has paid $3.75 per share in dividends. At a price of $78, that’s a 4.8% dividend yield.

But maybe it should change its ticker to “LOSE.” That’s because I expect casino earnings to fall 40% in 2020.

In that case, WYNN will earn an estimated 2020 profit of $2.25. This would leave the company with a payout ratio of 167%.

Based on my rule that a payout ratio over 80% is unsafe, I’d be surprised if Wynn does not cut its dividend in the next few months.

But just to get an unbiased opinion, I plugged WYNN’s data into my Dividend Sustainability Index (DSI). The DSI looks at payout ratio, debt levels, free cash flow, and a host of other factors to see if the dividend is safe.

Readers of my premium investing service Yield Shark know all about the DSI. Every recommendation I make must pass this test. If it doesn’t, I won’t recommend it to my subscribers.

So far, not one has had its dividend cut in the five years I’ve served as analyst and editor.

And according to my index, the probability that WYNN cuts its dividend is 90%.

So unless you want to gamble on some risky dividends, I’d stay away from WYNN.

There are a few more casino dividends I’ll cover tomorrow on The Weekly Profit YouTube channel. If you want more video analysis on this beaten-down sector and others, make sure to hit the red “subscribe” button now.

Robert Ross