Could This Be the Cure for What Ails COVID-Era Investing?

- Robert Ross

- |

- The Weekly Profit

- |

- July 22, 2020

The COVID-19 virus has strangled American life in 2020.

Just look at California. Last week, Gov. Gavin Newsom sent the state back into lockdown.

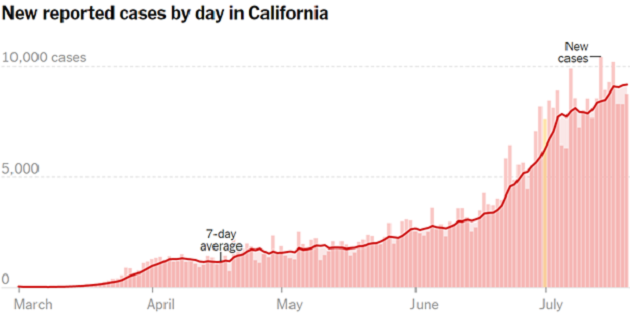

This makes sense, as cases here never stopped rising. Not even during the initial lockdown:

Source: New York Times

This is a chart of new daily COVID-19 cases. At this pace, California is set to overtake New York as having the most COVID-19 cases in the country.

With stay-at-home orders in place across the nation on and off since March, people are eager to return to some semblance of pre-COVID-19 life.

That day is still coming. A lot of people are vested in that day coming soon.

Everyone from biotechs to the US government has a strong incentive to treat the coronavirus and prevent future outbreaks.

Imagine being the first to market with an FDA-approved drug.

The bragging rights will be nice, sure. But that isn’t even the half of it…

The Marketplace Isn’t Just Big; the Entire World Is Waiting on a COVID Vaccine

COVID-19 is extremely contagious. The rapid spread of the virus to all corners of the world left governments and scientists scrambling to develop a treatment.

Because the company—and country—that makes it first will make a lot of money.

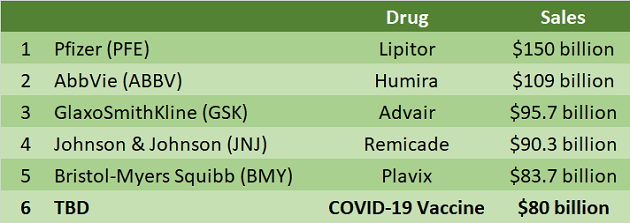

For instance, research from BMO Capital Markets expects 30% of the US population to get vaccinated every year. That’s roughly 100 million treatments annually.

With an average selling price of $80, that’s $8 billion per year. And that’s only the US.

On a 10-year time horizon, that would make the COVID-19 vaccine one of the most profitable drugs of all time:

It’s too early to bet on a clear winner. But there are several companies that are breaking ahead of the pack.

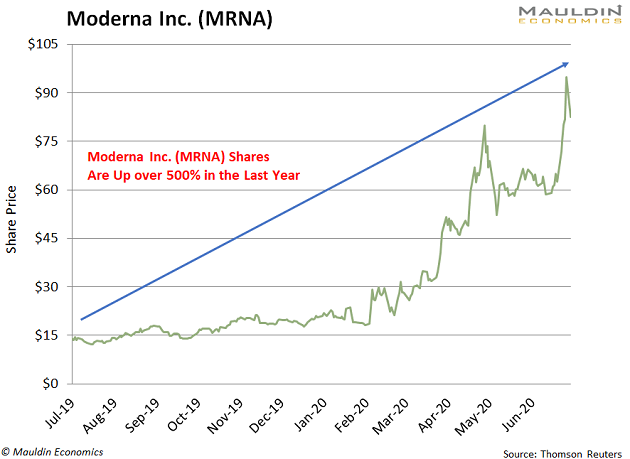

One of the firms leading the COVID-19 charge is Moderna (MRNA). The company released data on 45 patients in early July showing the drug is safe and well tolerated.

And that was music to Moderna shareholders’ ears:

After trading sideways since its initial public offering in December 2018, MRNA’s stock has surged in 2020. That’s especially true since the creation of a public-private partnership known as Operation Warp Speed.

Moderna Isn’t the Only Biotech Developing a Vaccine at “Warp Speed”

Operation Warp Speed is a partnership between the US government and a handful of biotechnology companies developing COVID-19 treatments. The program has $10 billion to distribute as it sees fit.

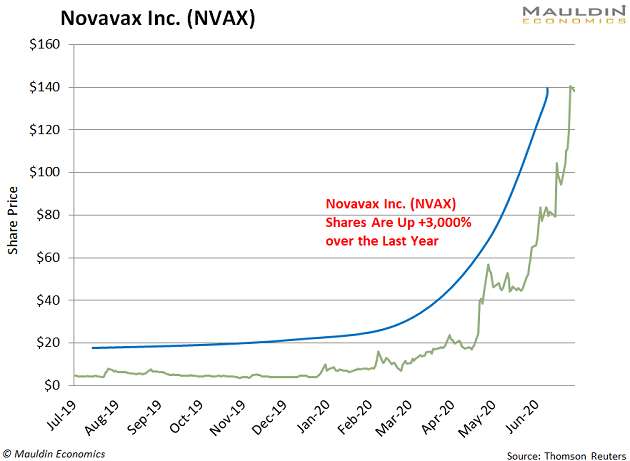

So far, the company to get the most Operation Warp Speed funding is Novavax (NVAX). This biotech received $1.6 billion in funding to support clinical trials. The company contends it can deliver 100 million doses of its COVID-19 vaccine by the end of the year.

The news recently sent the company’s stock up 40% in a single day:

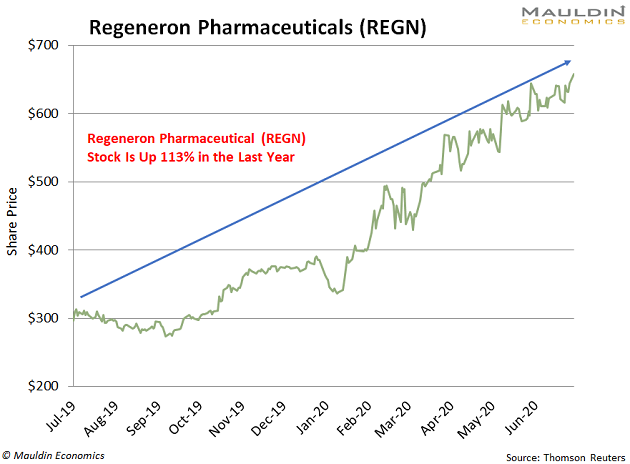

Next on the list is Regeneron Pharmaceuticals (REGN). The company grabbed $450 million in funding to support its COVID-19 treatment. While the stock popped a mere 4% on the news, shares are up a whopping 72% in 2020:

They aren’t the only companies getting Operation Warp Speed funding.

Some Major Dividend Payers Are as Well…

Longtime readers of The Weekly Profit know dividend-payers are my favorite kind of stocks.

And while Moderna, Novavax, and Regeneron Pharmaceuticals are established companies doing important work, they don’t fit in with an income-generation-focused portfolio.

If you look a little further, though, you’ll find a handful of huge dividend payers on Operation Warp Speed’s funding list.

Topping that list is the world’s largest healthcare company, Johnson & Johnson (JNJ). The company was an Operation Warp Speed finalist. It’s also been in human trials for its COVID-19 vaccine since March.

The healthcare giant expects its vaccine will be ready in early 2021. That’s great news for JNJ shareholders… especially those looking for dividend payments. JNJ pays a rock-solid 2.7% yield.

And as a Dividend Aristocrat—meaning JNJ has raised its dividend for 25 years or more—it’s one of the safest dividends on the market.

Next on my list is Merck (MRK). The company made an acquisition in May to bolster its chances of reaching the COVID-19 vaccine first. And that’s paid off, as MRK secured a slice of the Operation Warp Speed funding a few weeks later.

The company pays a 3.1% dividend yield. And with a low payout ratio of 58% and strong free cash flow, this dividend looks safe.

There’s one more COVID-19 vaccine stock that’s at the top of my list. Not only does it pay a safe 4% dividend yield, but its drug was just granted “Fast Track” status by the FDA.

Shares are rising fast… but they look like they’ll be surging even more in coming weeks. If you’d like try Yield Shark risk-free for 30 days and get the name of this COVID-19 vaccine stock, click here.

Robert Ross