Don’t Get Suckered into These Dangerous Energy Dividend Traps

- Robert Ross

- |

- The Weekly Profit

- |

- March 18, 2020

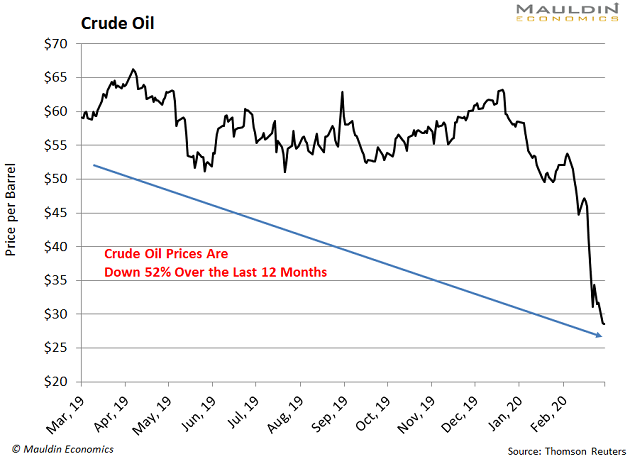

Last Monday, news that OPEC would ramp up oil production caused the energy market to crash.

This crushed oil prices. They fell as much as 30%—in just one day!

This was the second-largest one-day drop in history, rivaled only by the beginning of the Gulf War in 1991.

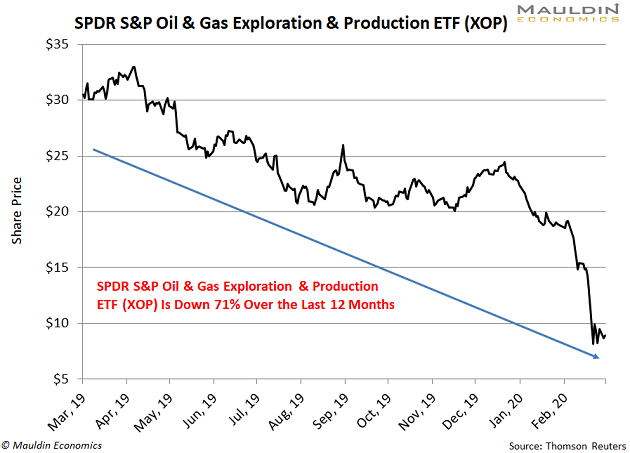

As you can imagine, US energy stocks fell in lockstep with oil. The SPDR S&P Oil & Gas Exploration & Production ETF (XOP)—which holds a basket of US oil and gas stocks—is down 49% in the last two weeks:

This is obviously bad news for energy investors. But what’s interesting is that the dividend yields for many of these companies have ballooned.

Right now, many major energy names are sporting dividend yields of 5%–10%.

But are these yields safe?

Taking a Hard Look at Energy Dividends

First, it’s important to know how dividends work.

When companies have cash left over after factoring in expenses, they often return a chunk of that cash to shareholders as dividends.

The dividend yield for a company is found by taking the annual dividend paid divided by the share price.

Let’s say Company A paid $2 in dividends in 2019. The stock trades for $100.

That means Company A has a dividend yield of 2% (i.e., $2 in dividends / $100 share price).

But now let’s assume Company A’s stock price falls 50%. Now the stock is worth $50.

Because the company paid a dividend of $2, the dividend yield is now 4%. ($2 in dividends / $50 share price.)

If the company can meet its dividend payment, it’s great news for dividend investors.

But sometimes—like we’re seeing in the energy market—companies cut their dividends when the yield gets too high.

We just saw this happen last week…

|

A Very Dangerous Game

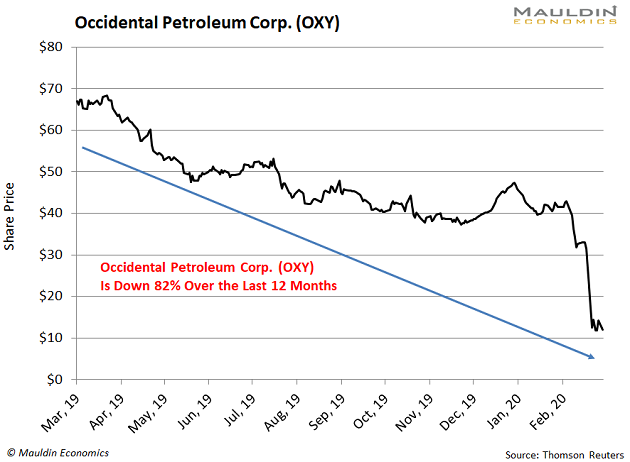

This same scenario played out with Occidental Petroleum (OXY) last Tuesday.

In the last 12 months, the company paid $3.14 in dividends. With a share price of $66 one year ago, this equaled a dividend yield of 4.8%.

But then the company’s stock started to decline. Over the last year, OXY shares have tanked 78%:

Today, OXY shares are trading at $12.

But the company still had a 12-month dividend history of $3.14. That means the company’s dividend yield was 26.2% ($3.14 in dividends / $12 share price).

That dividend yield is over 10X the S&P 500 yield of 2.1%.

So how did OXY’s management respond?

They cut the dividend by 86% to an annualized 44 cents (or 11 cents per quarter) per share.

How to Spot an At-Risk Dividend

Don’t get fooled by fat dividend yields. In OXY’s case, it was pretty obvious the company would have to cut its dividend.

Double-digit dividends are almost always unsustainable. But a dividend over 20%? Always unsustainable.

One of the best ways to tell if a dividend is safe is to look at something called the payout ratio.

The payout ratio is the percentage of net income a company pays to shareholders as dividends. The lower the payout ratio, the safer the dividend payment.

When a company’s dividend rises faster than its earnings, the payout ratio rises.

As a rule of thumb, a payout ratio over 80% is usually not sustainable.

For instance, at the start of 2019, OXY had a payout ratio of 200%. That’s already a major red flag.

But by last week, the payout ratio had ballooned to over 1,000%.

If a company pays out all its profits in dividends, there’s nothing left over to reinvest in the business.

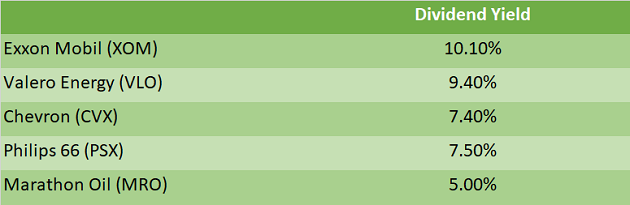

The Top 5 US Energy Company Dividends Are a Mixed Bag

Like I said, it was obvious that OXY’s dividend was going to drop. But not all are so obvious.

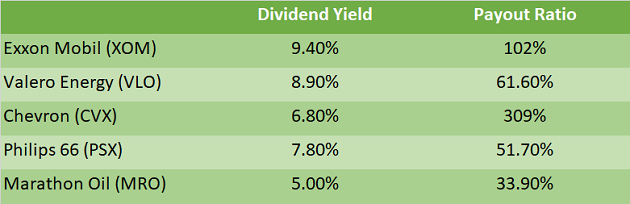

For instance, here are the dividend yields and payout ratios for the five largest US oil companies (by revenue):

There are some tempting yields here. But are they safe?

One way to tell if a dividend is safe is to plug the data into my Dividend Sustainability Index (DSI).

The DSI looks at payout ratio, debt levels, free cash flow, and a host of other factors to see if the dividend is safe.

Readers of my premium investing service Yield Shark are very familiar with the DSI. Every recommendation I make must pass this test. If it doesn’t, I won’t recommend it to my subscribers.

So far, not one has had its dividend cut in the five years I’ve served as analyst and editor.

I usually save the DSI for my premium readers. But in such uncertain times, I don’t want you to get suckered into buying any of these energy stocks.

That’s why I’m going to review three of these companies tomorrow on my YouTube channel.

If you don’t want to miss out, make sure to subscribe and tune in.

In the meantime, check out this video about stocks that are bucking the stock sell-off.

Robert Ross