My Brother-in-Law Wants to Buy the Rally. Here’s What I’m Telling Him

- Robert Ross

- |

- The Weekly Profit

- |

- April 15, 2020

“Did you see stocks had their best week in almost 100 years?”

My brother-in-law texted me this over the weekend.

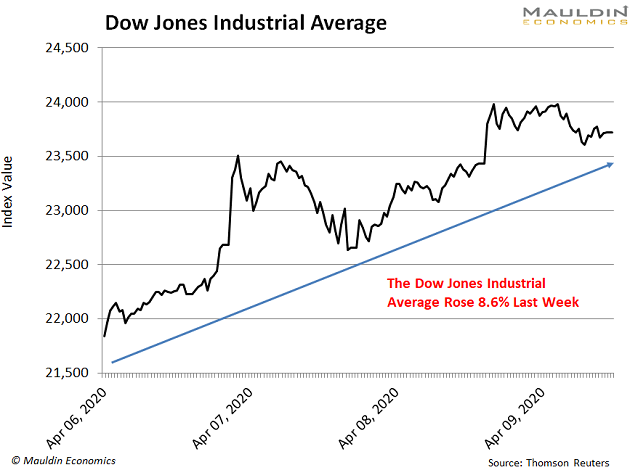

Like many of you, he was happy to see a spark of good news amid all the coronavirus coverage. And it was refreshing to see the Dow Jones Industrial Average rise 11% last week.

This was its best week since 1938.

Lots of people saw this as a sign that investor confidence has returned after stocks got crushed in the first quarter of 2020.

It also sparked a not-so-small sigh of relief that the global economy—which has all but ground to a halt—will start moving in the right direction again.

But all this historic upside trading action doesn’t mean the bear market is over. In fact, major stock market surges happen more during bear markets.

The Bear Is Only Social Distancing Right Now

Here’s another history-making statistic that’s much more notable right now: The Dow Industrials fell into a bear market in only 22 days.

That’s the fastest such decline in history.

At its lowest, the Dow was down as much as 33% this year.

Stocks have reclaimed some of this lost ground. And after last week’s rally, the index is down only 15%.

But if history is any guide, this rally will not last.

More Good News… and More Bear Rallies… Ahead

The bear market in US stocks was born of the coronavirus pandemic. It caught a lot of people off guard. Even some of the brightest minds on Wall Street.

Ray Dalio, whose $160 billion Bridgewater hedge fund took a 20% hit, told the Financial Times, “We did not know how to navigate the virus and chose not to because we didn’t think we had an edge in trading it. So, we stayed in our positions and, in retrospect, we should have cut all risk.”

Everyone from Wall Street to Main Street has been waiting for some encouraging news about the COVID-19 outbreak. And last week, we finally got some.

- The Centers for Disease Control and Prevention reduced the projected deaths by 20%.

- The World Health Organization reported that there are two coronavirus vaccines in human trials in the US and a third in China.

- And the Federal Reserve said it will provide $2.3 trillion in loans to Americans.

That’s why the Dow had its best week since 1938.

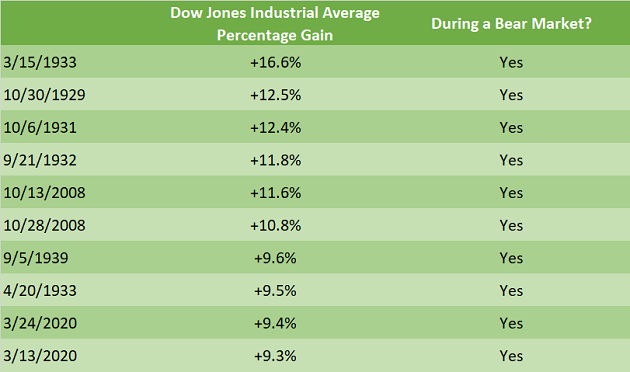

It even included one of the best single days for the stock market ever. The Dow rose 7% on April 6. But major market moves to the upside almost always happen during bear markets:

The table shows the largest percentage gains in history. As you can see, every entry in the top 10 came during a bear market.

Good News for People Who Like Bad News

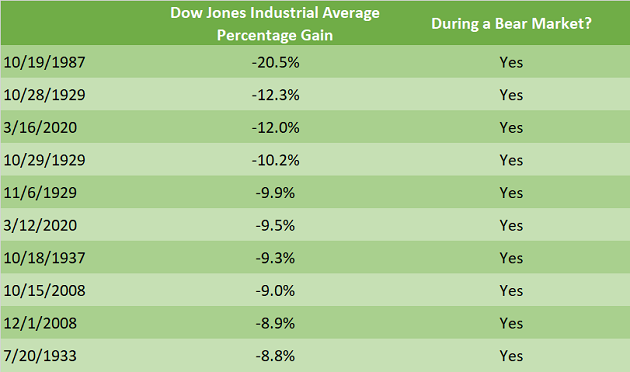

Don’t get too excited, though, because this pattern cuts the other way.

Take a look at this table:

Again, history shows us that the largest one-day market declines are much more common during bear markets.

So, investors should expect higher stock market volatility—both to the upside and downside—during a bear market.

This fact has major implications for your portfolio.

Being Prepared Is Paying Off

Everyone’s portfolio is at least partially in the red this year.

But if you practice risk management—like I do in my premium investing service In the Money—you’ve been making money on the way down as well.

And not just in positions that benefit from bear-market rallies. In fact, while the market was rallying, we grabbed a pair of double-digit gains in what you could call anti-investments…

- I had readers close their short position in American Campus Communities (ACC) for a 53% gain last week.

- And that’s not all. Our position in gold mining company Newmont Goldcorp Corp. (NEM) is up a whopping 33% this year.

Not bad for the worst stock market action in a decade.

How We’ll Go for Even More Gains

Look, big one-day market spikes are nothing to cheer about. They aren’t telling us the downtrend is over.

What they DO tell us is that we must prepare for more market gyrations, and that the market could head even lower.

That’s why, in addition to using options to bet on (or against) certain stocks and sectors, I’ve had my readers buying ultra-safe stocks that are uncorrelated to the market.

Together, these strategies have been working… and should keep working, no matter what happens next in the markets.

Overall, you don’t want to own the market right now. You want to own individual, safe stocks, bonds, and other assets that will hold up in stormy markets.

I’m sending my best ideas to my premium readers every single week. If you want to be among the first to get my next round of trading ideas, sent straight to your inbox, don’t wait. Sign up for a risk-free 30-day trial of In the Money today.

Robert Ross