Panicked by the Yield Curve Inversion? Time to Load Up on This Sector

- Robert Ross

- |

- The Weekly Profit

- |

- April 24, 2019

If you blinked, you might have missed a once-in-a-decade event.

For about a week last month, a closely watched indicator called the “yield curve” inverted for the first time since July 2006.

Prior to that, this rare event happened in July 2000 and April 1989.

There’s a pattern here… each inversion hit about 18 months before a recession. In fact, the yield curve has inverted before every recession over the last 50 years.

That’s one of the reasons we’ve been talking about it lately. Recession-proofing your portfolio is imperative for income investors.

Recall that the yield curve inversion also means stocks should perform well in the short term. That’s the good news.

The even better news is that I’ve pinpointed a sector that consistently outperforms the broader market—and does so by a wide margin—after every yield curve inversion: transportation stocks.

All Americans eligible to receive $15,420 Congress bonus this yearYou’ve probably seen the headlines about the current state of Social Security. Newsweek recently sounded the alarm saying “the program is running out of money”. And The Wall Street Journal has declared “the Social Security trust fund goes bust”. Congress knew this would happen even back in 1960. So they created a $1 trillion emergency fund to distribute to Americans when Social Security went under. Now they’ve just green-lit the first round of payouts – sign up today and you could receive a $15,420 ‘Congress Bonus’ this year. Get the full details right now by clicking here. |

This Overlooked Sector Can Buoy Your Portfolio

The transportation sector includes railroads, airlines, and shipping companies.

It might seem counterintuitive that these stocks would do well when a recession is looming. After all, these companies make money by moving people and things from point A to point B.

This tends to happen a lot less during a recession.

People stay home and buy less stuff. So there’s less for transportation companies to do. That’s simply what happens during an economic slowdown.

In theory, this should hamper transportation stocks. But the data tells a different story.

I’ll tell you why in just a moment (hint: It all comes down to oil). But first, let’s take a closer look at the numbers.

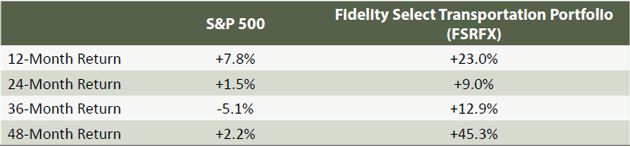

The table below compares the average performance of the Fidelity Select Transportation Portfolio (FSRFX), which holds a basket of large transportation stocks, to the S&P 500 after the last three yield curve inversions.

As you can see, transportation stocks crushed the S&P 500 at 12, 24, 36, and 48 months post-inversion.

An Outright Transportation Boom

Now let’s take a closer look at how this plays out.

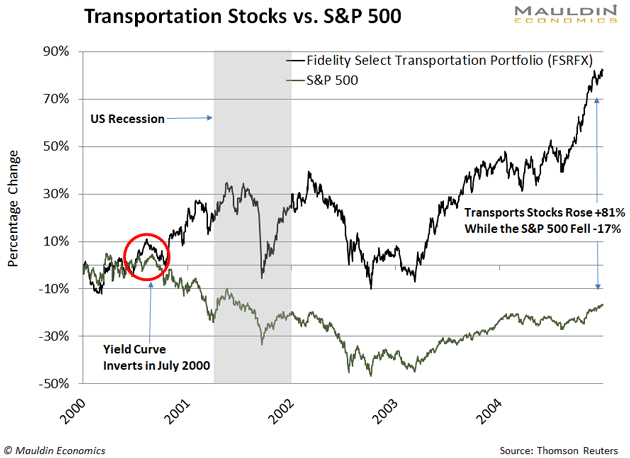

Back in July 2000, the yield curve inverted for the first time in 11 years. A recession struck the US economy nine months later.

Meanwhile, the S&P 500 started to creep lower almost immediately after the inversion. During the depths of the recession in 2001, it was down 17%.

Yet, at the same time, the Fidelity Select Transportation Portfolio (FSRFX) was up 28%.

Two years later, as the economy was recovering, the S&P 500 still hadn’t found its footing. The index was down as much as 31%. But transportation stocks were still on a roll, with FSRFX up 29%.

All told, transportation stocks rose over 81% in the four years after the July 2000 inversion. And they almost never treaded into negative territory during this period, as you can see in the next chart.

This begs the question, “Why are transportation stocks so resilient?”

Transportation Stocks Surge When Oil Is Cheap

Transportation companies have one major cost: fuel.

For airlines, fuel made up 24% of all costs in 2018. For the shipping industry, it was 25%. For railroads, 12%.

So, when oil prices fall, one of the main costs for the transportation sector falls as well. And you know what falls during a recession?

Oil prices.

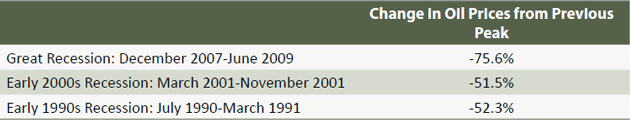

The next table shows the drop in oil prices during the last three recessions.

Bear in mind, oil prices don’t drop immediately after a yield curve inversion.

In the period between the last five inversions and subsequent recessions, there’s always been a major spike in oil prices (another canary in the coal mine for a recession).

Then oil prices come back down. That’s because companies demand less oil when economic activity slows.

When that happens, lower oil prices act as a tailwind for transportation companies. So, although demand for transportation services slows, costs for these oil-dependent companies fall as well.

This acts as a cushion for share prices. It makes them much more buoyant compared to other types of stocks. Hence the big gains transportation stocks enjoyed while the S&P 500 floundered through the 2001 recession.

I’m confident the stock market will follow a similar pattern this go ‘round. It should continue to rise for the next 12 months or so. But the party won’t last forever.

Transportation stocks, on the other hand, should continue to do well long after that. Loading up on them now could help protect your portfolio today and through the rough patches ahead.

Robert Ross