The Best Way to Protect Your Portfolio from a Contested Election

- Robert Ross

- |

- The Weekly Profit

- |

- September 23, 2020

Dear Reader,

Any investor worth their salt is always thinking, “What can go wrong?”

And when it comes to the upcoming presidential election, the answer to that question is, “A lot.”

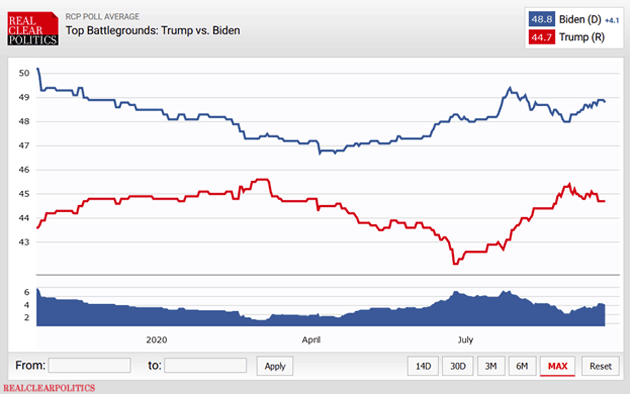

A new WSJ/NBC poll currently shows former Vice President Joe Biden ahead by 8%. But as we saw in 2016, pre-election polling doesn't necessarily predict the outcome.

Source: Real Clear Politics

Most analysts are convinced the November 3 election will be tight. They also expect some 80 million people will vote by mail—more than double 2016's number—because of the coronavirus.

That means there’s a good shot the candidate who leads on election night may not be the winner once all ballots are tallied.

We probably won't know the winner 42 days from now. This is setting up for a contested election. That’s when the results of the election are disputed and taken to court.

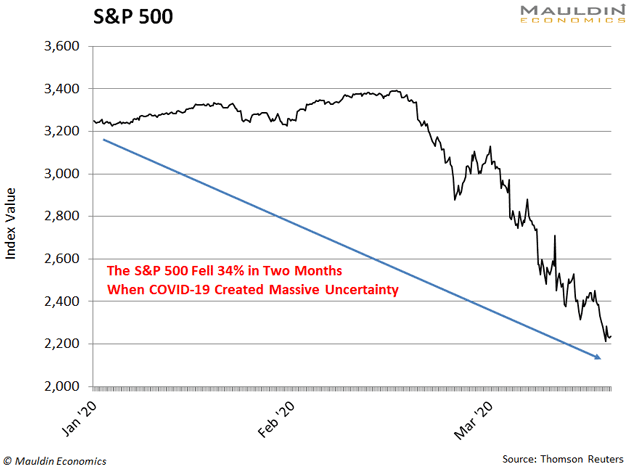

This year, we saw just how much the market hates uncertainty—it gave us a bear market at the start of the pandemic.

So today, I’m going to show you how to protect your portfolio from the volatility that would follow a contested election which, like the pandemic, may not have a defined end date.

If You Thought “Hanging Chads” Were Bad…

Having a contested election—not knowing who will be president, or president again—would create a lot of uncertainty.

Rather, it would create a lot of anxiety again.

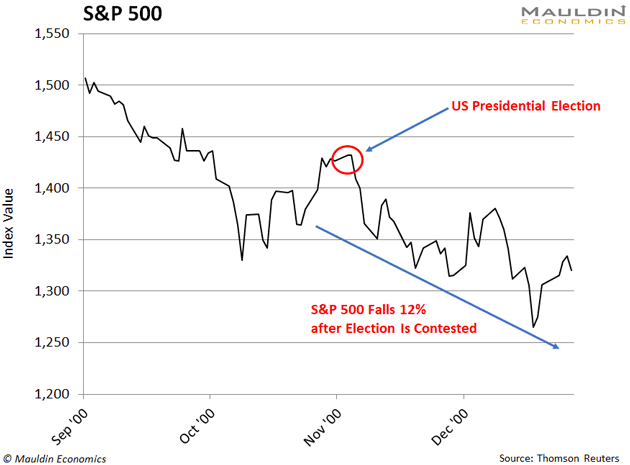

Back in November 2000, it was not clear whether George W. Bush or Al Gore won the election. In Florida, the vote was so close that state law required a recount. This led to a month-long legal battle that resulted in a 5-to-4 Supreme Court decision granting George Bush the presidency.

A month-long legal battle over the presidency—and all the policy implications—rattled the stock market. In the weeks following election night, the S&P 500 fell 12%:

So, while the S&P 500 was getting crushed, one asset was actually up on the news.

This Election Cycle Looks Like a Winner for Gold

You know that gold is a classic hedge against uncertainty. That’s because it’s considered the safest of the safe-haven assets.

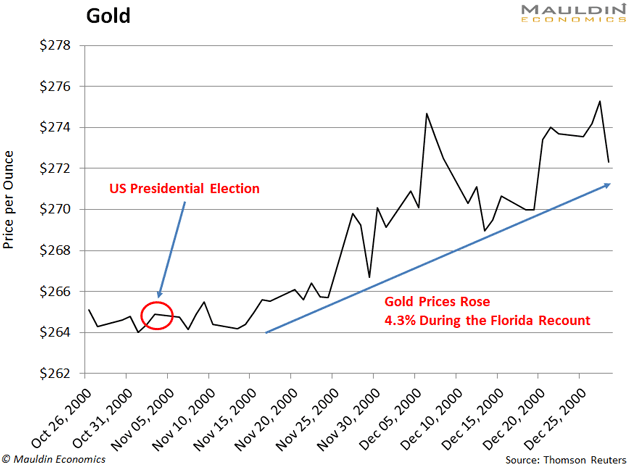

Investors pile into the yellow metal when risks are on the rise. That’s exactly what happened after election night in November 2000.

While the S&P 500 was down 8.4%, gold prices were actually up as much as 4.3%:

If we have a contested election later this year, gold should behave the same way again.

And while the election results might not get decided right away, you might not have to wait long to see your gold investments start to really shine.

Academic research from UBS shows that most of the stock market volatility should be concentrated in the first four days following the contested election.

That means it’s a good idea to add a few gold stocks to your portfolio now.

This Could Be Your Last Best Chance to Buy Gold

We don't need pollsters to tell us that the odds of this election being decided quickly are low. So with gold sitting just above $1,900, if you want to take advantage, I have three ways you can do that today.

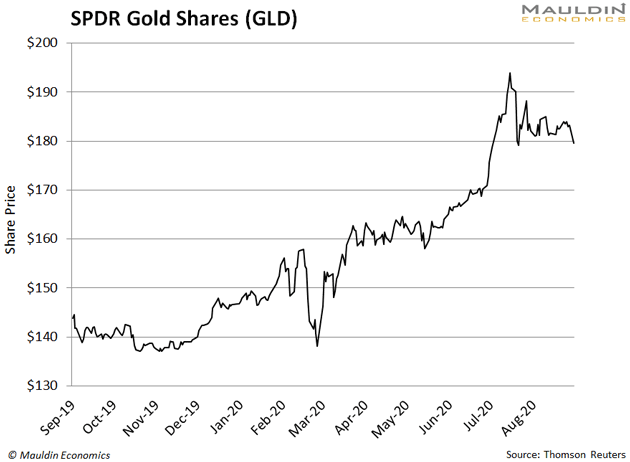

You can start by adding a gold ETF that seeks to reflect the price of gold bullion like the SDPR Gold Shares ETF (GLD).

I own GLD myself. But it’s not my preferred way to profit from rising gold prices.

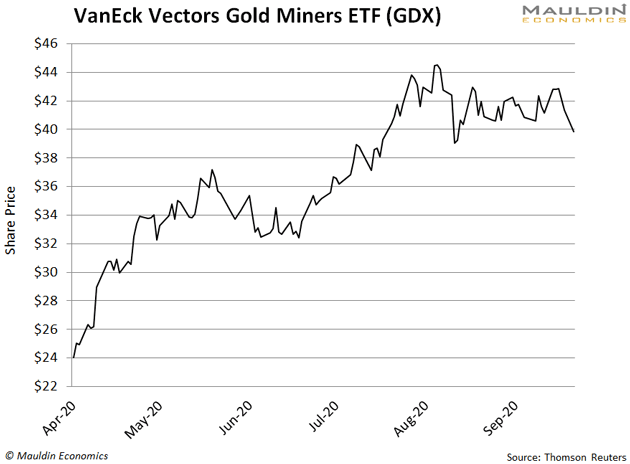

I prefer to target gold miners—the companies that get the gold out of the ground and bring it to market.

Mining stocks can be speculative, especially the smaller guys. But many of the bigger ones have a way of "mining" profits, year after year. I'm talking about stocks like Newmont Corp. (NEM), Barrick Gold Corp. (GOLD), and Agnico Eagle Mines (AEM).

And you can get exposure to them all through the VanEck Vectors Gold Miners ETF (GDX), which I told you was a good buy back in April.

But while GLD and GDX are great, gold royalty companies are my No. 1 way to profit from the gold market.

Royalty companies are firms that make an upfront payment to gold mining companies like Newmont. They become “silent partners” in the mining operation. In return, the royalty company gets a fixed percentage of a mine’s future gold production.

This gives royalty companies all the upside of the gold market, without all the headaches of actually digging the gold out of the ground

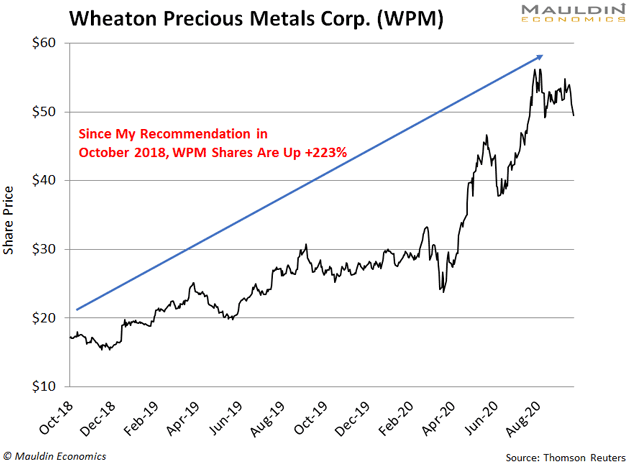

Yield Shark subscribers just took a “free ride” on royalty company Wheaton Precious Metals (WPM) last week. The "free-ride" strategy lets you ride stocks to big profits AND reduce risk by locking in gains.

Since WPM was up over 200%, subscribers only had to sell one-third of their position to pull out our original investment. We are tracking a possible 223% gain, and we expect that even more gains are in store.

The key is that we’re still holding this position for the long haul… and only using pure profits to do it!

If you’re looking to add gold to your portfolio, WPM is a great option. If you're doing this on your own, be sure to keep your position sizes manageable and try to buy on pullbacks.

If you'd rather not do this on your own, click on this link now and sign up to get my timely trading signals when it's time to make your next move in stocks like WPM that deserve your vote for their profit and income potential.

Robert Ross