There’s Still Time to Buy These Sell-Off-Proof Gold Stocks

- Robert Ross

- |

- The Weekly Profit

- |

- March 4, 2020

It’s a bloodbath out there.

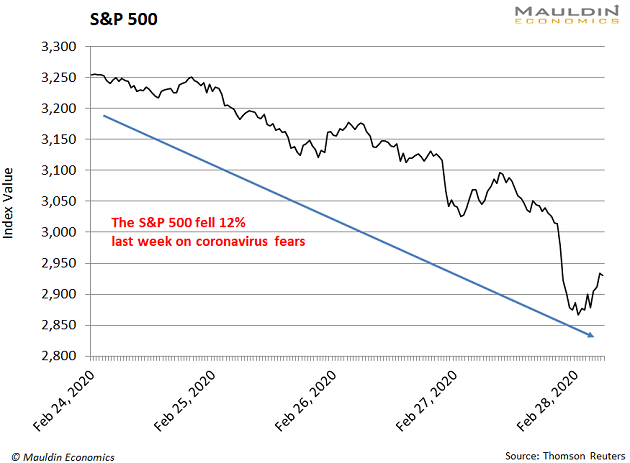

Fears that coronavirus is spreading around the world tanked global stocks last week.

In the US, markets ventured into correction territory. The S&P 500 sank 6% in just 48 hours. It was the largest two-day decline since 2015. And that was just the beginning.

By the end of Friday, US stocks had suffered their worst week since the financial crisis.

But if you bought the gold royalty stocks I shared with you back in January, you got to watch them tick higher while the market plunged.

Gold royalty stocks—which pay you on THEIR investments in gold—will soar even higher when the market resumes its uptrend, as I think it will.

The best part? You don’t need to fork over a king’s ransom to profit from this unique asset.

|

Gold Royalty Stocks 101

Royalty companies lend money to gold miners. Then the miners use that money to dig gold out of the ground. When the miner sells the gold, the royalty company gets a cut—or a royalty—of all the gold sold.

If you want an in-depth look at gold royalty companies, watch the video I made about them here.

It’s an interesting business model, but what really matters right now is how these stocks perform during times of volatility.

Your Best Friend During a Stock Market Sell-Off

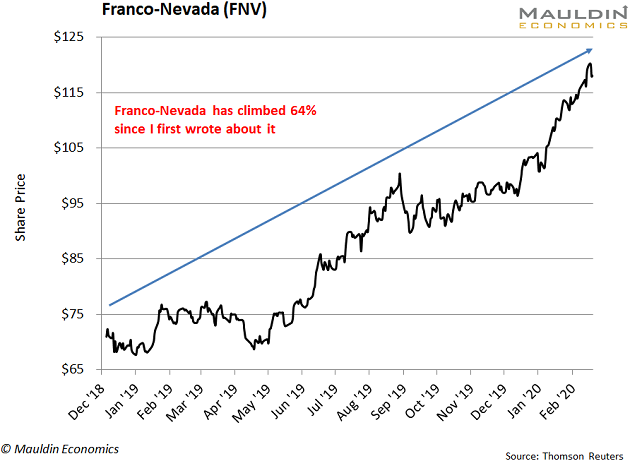

I’ve been recommending gold royalty companies like Franco-Nevada Corp. (FNV) since December 2018. Since I first wrote about the company, this position has climbed 64%:

Overall, Franco-Nevada has been a great trade. It’s more than tripled the S&P 500 return. But its performance during the recent market sell-off is even more impressive.

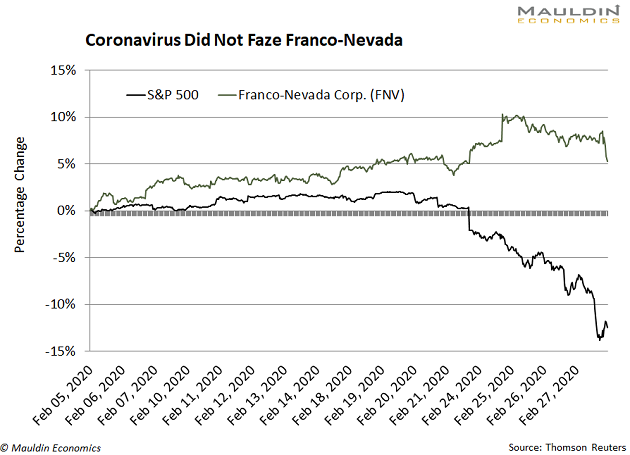

While the S&P 500 fell 11% in the last two weeks, Franco-Nevada Corp. rose 5%:

This isn’t the first time something like this has happened…

Gold Royalty Stocks Outperformed During the Last Correction

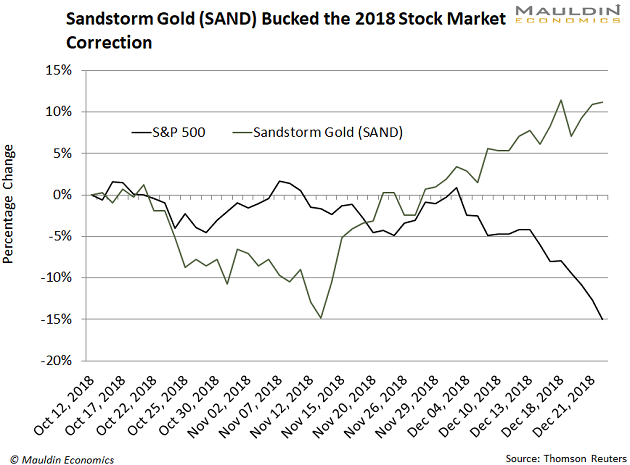

Investors were also feeling the pain back in December 2018.

The S&P 500 had fallen 19% since September. But that time, instead of a virus, quantitative tightening was driving the sell-off.

Fortunately, I’d noticed the signs that a sell-off was coming. That October, I told subscribers of my premium investing service In the Money that the stock market was headed for a major correction.

But I didn’t tell them to sell all their stocks and go to cash. No, I told them to buy gold royalty company Sandstorm Gold (SAND).

That turned out to be a prudent move. Between Oct. 12 and Dec. 24, while the stock market was in freefall, Sandstorm Gold rose 11%:

So, why do gold royalty companies do so well during times of volatility?

Because…

Higher Gold Prices Are a Boon for Royalty Companies

Gold is the ultimate “safe haven.” Investors buy it when stock market risks are rising.

For millenia, all across the world, people have used gold as money. That’s why central banks stockpile gold. It will always be a good store of value.

When you combine gold’s unique status with the royalty model, it becomes even more attractive.

See, investors buy things like the SPDR Gold Shares ETF (GLD) when they want broad gold exposure. But gold royalty companies give you something even better…

Unlimited upside.

Remember, these companies don’t dig a single hole. They don’t haggle with local union leaders or battle hostile politicians. And they don’t worry about broken mining equipment.

Instead, they lend money to companies who do all that for them. And in return, they get royalty payments.

When gold prices rise, those royalty payments rise as well. So do the company’s profits and share price. This gives gold royalty companies much more upside than something like the SPDR Gold Shares ETF.

That’s why, when gold prices are rising, gold royalty stocks can absolutely skyrocket.

Gold Royalty Stocks Will Keep Climbing

Gold has risen 34% since I turned bullish on it in October 2018.

Even without the added boost from the coronavirus panic, I would expect gold’s upward momentum to continue. Add in the hysteria, and it’s virtually guaranteed to rise higher.

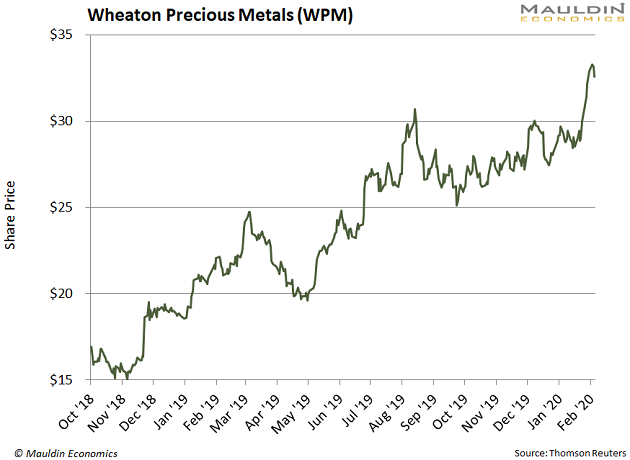

This will push royalty payments for companies like Wheaton Precious Metals (WPM) up as well.

I told readers of my premium investing service Yield Shark to buy this stock back in October 2018. Since then, it’s nearly doubled:

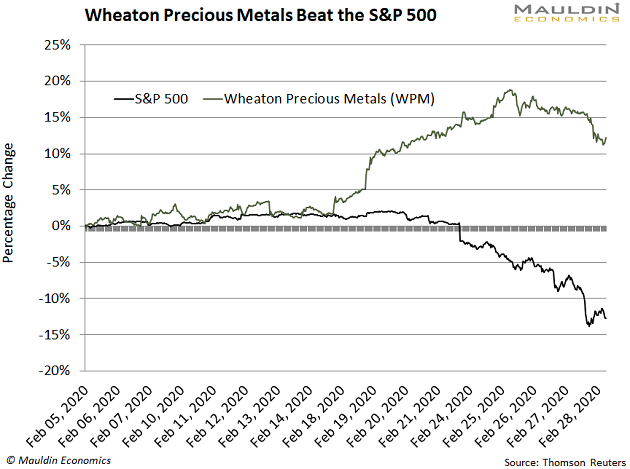

And—just like Franco-Nevada and Sandstorm Gold—Wheaton Precious Metals rises when the stock market is falling.

Between Feb. 5 and Feb. 20, when the S&P 500 fell 5%, Wheaton actually jumped 13%.

Like I said, I expect gold prices to keep rising. That’s especially true if stock market volatility continues to escalate.

This makes royalty companies a great way to buoy your portfolio right now.

I’ve already shared three great options with you. But I’m planning a potentially highly profitable gold royalty trade for In the Money subscribers soon.

I can’t tell you the exact date for this trade… we’re waiting for the green light from my proprietary trading models in order to maximize profits. And I can’t reveal the name of the stock here… my paid subscribers get first dibs on all my best recommendations. But I can give you an opportunity to try out a subscription to In the Money 100% risk-free.

Start your trial subscription now, and you’ll get access to all of the open BUY recommendations in the portfolio. I’ll also email you directly about my next gold royalty trade as soon as it’s time to act. Click here to get started.

Robert Ross