These 3 Sleeping Giant Techs Are Ready to Roar Back to Life

- Robert Ross

- |

- The Weekly Profit

- |

- March 24, 2021

A friend messaged me today to say he's heading back to the office.

He works in investment banking in New York City. After more than a year of working from home, his large firm is bringing its employees back to the Manhattan office.

This company is letting employees use a “hybrid” model. This means working in the office three days a week and from home two days a week.

This company is one of thousands that is reworking its work-from-home policies. It's clear that their cost-benefit analysis showed that the benefits add up.

According to a recent Gallup poll, most American adults prefer working from home. No commutes, higher productivity, and a cleaner environment are a satisfying exchange for office parties and potentially better pay.

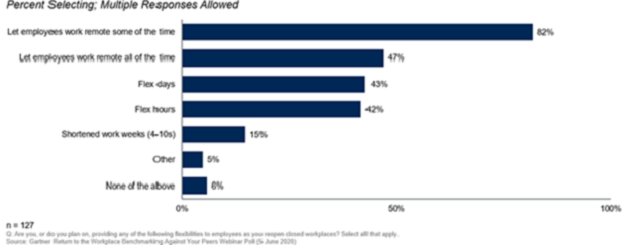

But the kicker is that the employer benefits just as much when workers stay home. A Gartner survey showed 82% of managers plan to offer flexible work-from-home policies after the pandemic ends.

Source: Gartner

Businesses can save a lot of money by having employees work remotely. And employees largely appreciate this "benefit" that saves, rather than costs, time and money for both parties.

That means the technology companies who facilitate this hybrid work model will continue to thrive.

It's just one reason why…

I (Still) Think Tech Stocks Will Be the Best-Performing Sector in 2021

I got a lot of flak after I said tech would be 2021's top-performing sector. And my inbox lights up anytime I say I’m still bullish on tech stocks.

Yes, I’m aware that technology stocks pulled back over the last few weeks. But I’m hardly shaken in my outlook.

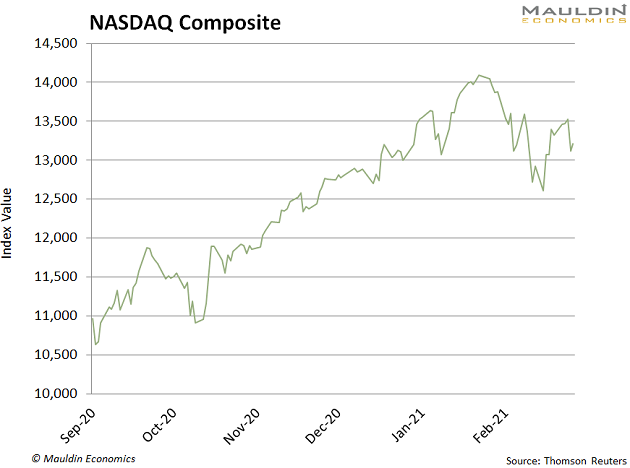

Yet, for all this doom and gloom, the tech-heavy Nasdaq index is—gasp—back to where it was in early January 2021:

Even though all US indexes are trading a smidge off their all-time highs, I think they will head much higher from here.

And I expect technology stocks to lead the way.

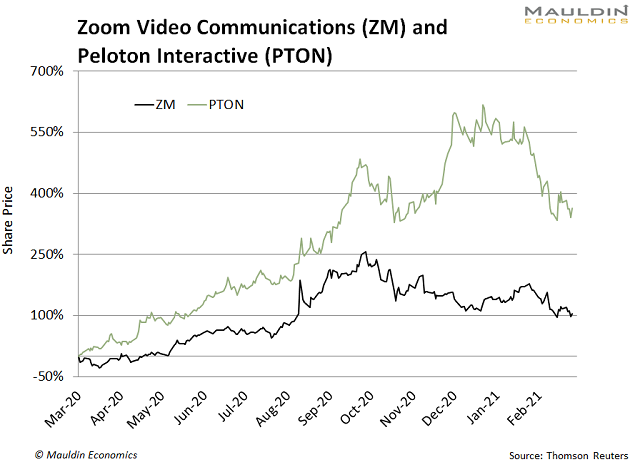

I'm not (just) talking about the “work from home” stocks like Zoom Communications (ZM) and Peloton Interactive (PTON):

Rather, I'm looking beyond the obvious winners to the largest technology stocks in the market.

Many of them lost ground throughout much of 2020 as money flowed into the "hot" names.

However, with a massive $56.8 billion flowing into equity funds just over the past week, there's plenty of money to go around.

Here's where I think it will be going…

These Sleeping Giants Will Soon Wake Up

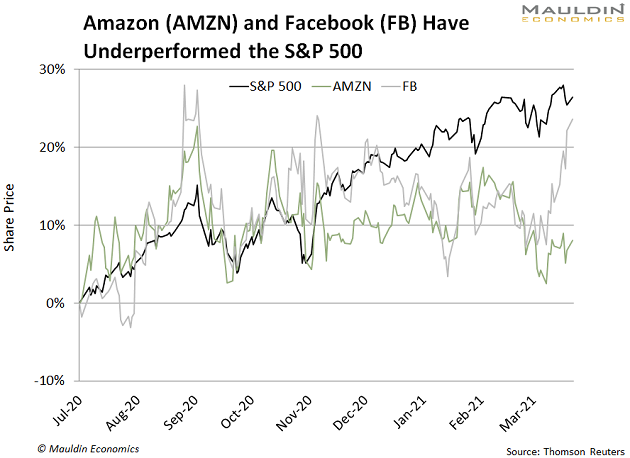

Household names like Amazon (AMZN) and Facebook (FB) have underperformed the S&P 500 and Nasdaq since July. Smart investors will see this opportunity to buy great companies at a discount to their peers.

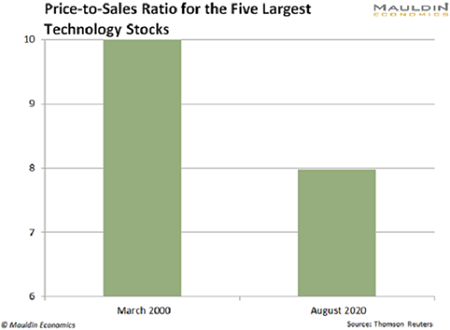

Another kicker is technology stocks are not expensive.

Compared to the dot-com bubble (when interest rates were 5X higher), the five largest US technology companies look pretty cheap:

After the recent pullback, these sleeping giants are even more attractively valued.

Remember: These are the companies that will keep letting us work from home.

That means we'll see another big year from the companies that made—and will continue to make—this possible.

That means now is a good time to start adding to some beaten-down technology names… particularly those that benefit from working from home.

These 3 Techs Look Ripe for the Picking

The worst of the COVID-19 pandemic is behind us. The coronavirus vaccine will take effect, both physically and psychologically, and the global economy will find its footing again.

We’re currently vaccinating roughly 2.5 million people per day. By summer, the “vaccine effect” should be in full swing.

But just because people are out and about doesn’t mean they will stop working from home. And that’s good news for Microsoft (MSFT).

Microsoft needs no introduction. The company founded by Bill Gates and Paul Allen in an Albuquerque garage is currently the third largest on planet Earth.

This “sleeping giant” was a leader in productivity tools, video conferencing, and word processing long before they became last year's biggest necessities. This makes it a great addition to anyone’s future-focused portfolio as well.

Microsoft is also the world’s largest dividend payer. It paid a whopping $15.4 billion in dividends last year.

Next on my list is Nvidia (NVDA). The company is the leading designer of graphics processing chips for computing platforms. Many of the services that facilitate working from home run on NVDA’s chips, making this a “picks and shovels” approach to investing in the unstoppable work-from-home trend.

The stock is also a sleeping giant, as it has been grinding sideways for the last six months. I don’t expect this to continue as the economy accelerates and demand for NVDA’s chips goes through the roof.

Also on my list is IBM (IBM). The technology giant has its fingers in many pies, but what makes it attractive is its significant exposure to cloud security.

And since the firm controls 90% of all credit card transactions and 50% of the world’s wireless internet connections, it certainly helps facilitate working—and shopping—from home. And considering the stock has been grinding sideways for months, this “sleeping giant” is ready to rip.

Robert Ross