Here’s Why SEC Could Trigger the Next Stock Market Correction

- Tony Sagami

- |

- May 13, 2016

- |

- Comments

BY TONY SAGAMI

The Securities and Exchange Commission finally doing its job and putting a stop to the accounting hanky-panky that artificially inflates profits.

According to Dow Jones, the SEC is getting ready to step up its scrutiny of companies’ “homegrown earnings measures,” signaling it plans to target firms that “inflate their sales results and employ customized metrics that stray too far from accounting rules.”

It looks like the SEC is waking up to the misleading picture that pro forma earnings—compared to generally accepted accounting principles, or GAAP—generate. Now the commission is launching a campaign to crack down on made-to-order earnings.

Mark Kronforst, chief accountant of the SEC's corporation finance division, said, “The point is, now the company has created a measure that no longer reflects its business model. We’re going to take exception to that practice.”

So what will the SEC do? According to the Dow Jones article:

The agency plans to issue comment letters in the coming months that critique firms that booked revenue on an accelerated basis. Mr. Kronforst, who plans to speak Thursday at a Northwestern University legal conference about the issue, declined to name them.

Mr. Kronforst said regulators also plan to challenge companies that report their adjusted earnings on a per-share basis. The results are often higher than per-share GAAP earnings and look too much like measures of cash flow, which decades-old rules prevent from being presented on a per-share basis, Mr. Kronforst said. That is because investors could confuse cash flow with actual earnings, which truly represent the amounts that could be distributed to investors.

“We are going to look harder at the substance of what companies are presenting, rather than what the measures are called,” he said.

In other words, the SEC is finally going to do its job!

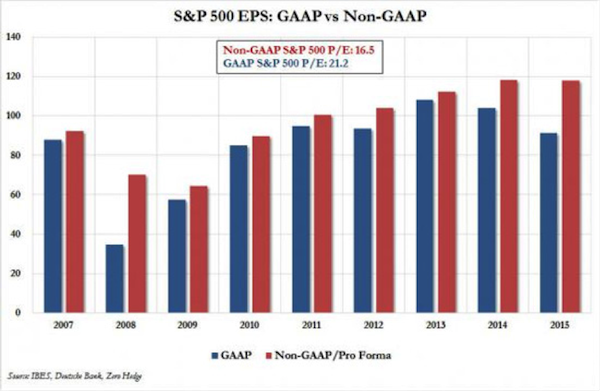

To see the impact of such a crackdown, all you have to do is take a look at the growing difference between GAAP profits and pro forma profits.

Former President of the Federal Reserve Bank of Dallas, Richard Fisher, offered this sage (sarcasm alert) advice last week: “I would be prepared when they move—and I hope they move sometime in June—there’ll be a settling in of the market place. There will be a correction. Suck it up. Deal with it. That’s reality.”

By the way, I suggest you re-read my recent column about corporate America’s accounting razzle-dazzle.

Yes, my bear market radar is on high alert, and the new SEC scrutiny could be just the thing that knocks the bull market off its feet.

Subscribe to Tony’s Actionable Investment Advice

Markets rise or fall each day, but when reporting the reasons, the financial media rarely provides investors with a complete picture. Tony Sagami shows you the real story behind the week’s market news in his free weekly newsletter, Connecting the Dots.