The next transformational innovation

- Stephen McBride

- |

- March 25, 2024

- |

- Comments

This article appears courtesy of RiskHedge.

Matt Ridley (the original Rational Optimist) and I talked about the next big megatrend over breakfast a few weeks ago.

Megatrends are ignited by transformational innovations. Matt pointed out that transformational innovations often come in 50-year waves.

His grandparents were born before cars. They lived to see a man walk on the moon. Transportation was totally transformed in one lifetime.

Matt enjoyed the digital revolution. He grew up using rotary dial phones. Now, he carries a supercomputer in his pocket.

- Matt believes biotech is the next transformational megatrend.

A mechanic can plug a cable into a car, instantly diagnose a problem, and fix it in an hour.

Yet the human body largely remains a mystery. There are still thousands of uncurable diseases.

That’s about to transform.

I recently told you about the first-ever gene-editing (CRISPR) therapy that was just approved in the US and the UK. This involves extracting cells, editing them in a lab, and putting them back into a patient’s body.

Now, we’re seeing new tech that allows doctors to edit cells inside patients’ bodies. This is a game-changer for two reasons…

#1: Most cells can’t be extracted for editing. So we’ll be able to tackle more diseases.

#2: It’s far less expensive, making treatment more affordable.

This is a huge deal.

Diseases from breast cancer to Alzheimer’s are caused by a few rogue genes. By editing a handful of genes, we could all but eliminate today’s biggest killers.

If you’re looking for a reason to be optimistic about our future, here it is.

The medical leaps we can make over the next 50 years could make iPhones look inconsequential.

My research even shows that enhancing intelligence with gene editing will become a real “thing” in the next decade.

Say “hello” to the future.

Investors must pay attention to this industry. Chris Wood and I will be adding a world-class biotech company to the Disruption Investor portfolio next month.

- Physical AIs are coming.

Chatbots like GPT-4 are amazing, and you should be using them.

But AI’s biggest impact will come from getting “physical.”

A new demo from startup Figure AI—which just raised $675 million from OpenAI, Nvidia (NVDA), and Microsoft (MSFT)—tells me we’re on the cusp of a breakout moment for robotics.

Watch this two-minute clip. In it, a humanoid robot puts dishes away, holds a natural conversation, and answers complex questions.

Source: Figure AI

There are lots of robots already. But they’re mechanical and made for one specific task.

Figure AI is unlike anything before because it has ChatGPT for a brain.

This gives it the ability to learn from what it sees. The robot wasn’t preprogrammed to pick up trash, or even taught what trash is. It learns by watching.

For example, the guy in the demo tells the robot he’s hungry. The robot hands him the apple from the table. “Why?” he asks. “It was the only edible item I could provide you from the table” responds the robot. Impressive.

Figure’s upcoming fleet of robots will all share a centralized brain. That means when one robot learns something, they’ll all know that thing.

Imagine having a coffee-making, pancake-flipping, dish-washing assistant.

And just like AI, this is the worst robots are ever going to be.

I think these AI robots will revive “Made in the USA.”

They’ll soon do human-like work in factories. They could pluck empty bins off a shelf, then turn around and weld bolts onto a door.

Imagine a handful of people overseeing an army of robots to run a factory. We’ll have 100X—even 1,000X—more factories producing stuff for a fraction of today’s cost.

My “mental model” for this is ATMs and bank tellers.

When ATMs were introduced in the 1980s, bank tellers worried they’d be out of a job. But ATMs made it cheaper to operate a branch… leading to more branches… and ultimately more tellers.

When American factories automate, we could make quality stuff cheaper than China.

If THAT happens (it’s already started), take what’s possible and multiply it by 100X. This could create trillions of dollars in wealth for America—and the companies behind it.

But investors, beware. Robotics ETFs (BOTZ and ROBO) are duds. They’re packed full of bad businesses that barely grow.

Remember the Disruption Investor way. A megatrend alone isn’t enough. You need a great business operating within that megatrend to be worthy of your investment.

It’s no wonder these ETFs have underperformed. Continue to avoid them.

Instead, be selective and only own fast-growing, profitable robotics businesses. That’s what we’re doing in Disruption Investor.

- Today’s dose of optimism…

I’m sure you’ve heard humans are destroying the Amazon by chopping down football fields’ worth of rainforest each day.

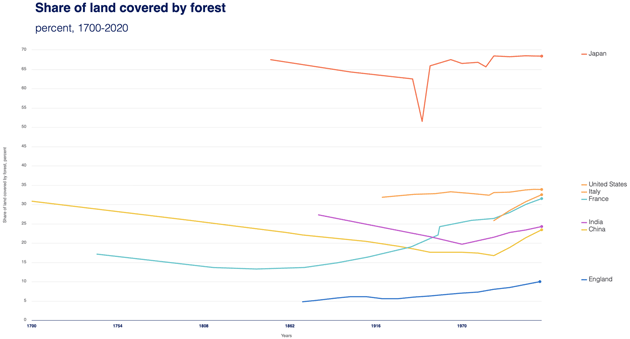

But did you know there are more trees on planet Earth today than at any other time in the past century?

In fact, an area the size of Texas and Alaska combined was added to global tree cover since 1982.

This great chart from our friends over at Human Progress shows the amount of land covered by trees in major countries. The US, Japan, the UK, and France are at or near record highs… and trending higher.

Source: Human Progress

Score one for the Rational Optimists.

Have a great weekend. See you on Monday.

Stephen McBride

Chief Analyst, RiskHedge

PS: With bitcoin recently hitting new highs, I’ve been getting more crypto questions—including what to expect with “the halving” right around the corner...

I’d like to get your thoughts, too. If you have a minute, please fill out this three-question survey. I’d appreciate it.

|

This article appears courtesy of RH Research LLC. RiskHedge publishes investment research and is independent of Mauldin Economics. Mauldin Economics may earn an affiliate commission from purchases you make at RiskHedge.com