When a law is a lie

Stephen McBride

April 22, 2019

Stephen’s note: Today we’re doing something a little different. Instead of our usual weekly essay, RiskHedge CIO Chris Wood is stepping up to explain a foundational key to disruption investing. It relates to an important idea most folks are roughly familiar with but not 1 in 100 truly understand.

* * * * *

There’s a big lie about disruption going around.

Folks aren’t spreading it intentionally...

Many smart investors I talk to genuinely believe it to be the truth.

As a RiskHedge reader, you’re in the top 1% at understanding disruption and the money-making opportunities it can create.

But if you accept this widespread lie, you’ll likely make the wrong decisions when investing in 5G and other disruptive trends.

In today’s issue, I’ll explain the real truth and why it matters to you.

As you likely know, your smartphone is more powerful than an early 90s supercomputer.

And keep in mind, all a supercomputer does is crunch numbers.

Your smartphone can do the job of a whole collection of gadgets.

It’s a phone, camera, camcorder, Walkman, watch, wallet, radio, global map, TV, VCR, and computer all in one.

We have “Moore’s law” to thank for this.

Named after Intel founder Gordon Moore, it observes that computing power doubles roughly every two years.

This has led to exponential growth in computing power.

As you may know, exponential growth “snowballs” over time. It builds momentum and eventually leads to vertical gains, as you can see here:

For the past few decades, computing power has more or less followed this path.

The driving force behind Moore’s law is this:

It holds that the number of transistors that can fit on a computer chip doubles about every two years.

Transistors allow computers to compute. The more transistors you cram onto a chip, the more computing power it has.

Again, for the past 50 years, this has more or less held true. Back in 1965, only 64 transistors fit on the world’s most complex computer chip.

More than 10 billion transistors can fit on today’s chips.

Moore’s law is responsible for many of the giant stock market gains in the past few decades. Leaps in computing power enabled big disruptors like Apple, Microsoft, and Amazon to achieve huge gains like 50,800%, 159,900%, and 111,560%.

And along the way, the companies that make the computer chips have gotten rich, too.

Taiwan Semiconductor, Micron Technology, and Intel achieved gains of 1,014%, 3,256%, and 35,050%.

Conventional wisdom is that Moore’s law will continue to snowball. As progress gets faster and faster, you can understand why many folks think we’re headed for a tech utopia.

It’s a great story. But it’s not quite true.

Moore’s law isn’t really a law.

Gravity is a law. Moore’s law is an observation and a forecast.

As I mentioned, since 1965, it has held true.

But here’s the key...

Within the next few years, Moore’s law will break down.

You see, although today’s transistors are microscopic, they still take up physical space.

There’s a limit to how small you can make anything that occupies physical space.

We are now approaching that limit with transistors. So the progress predicted by Moore’s law must slow.

In fact, Moore’s law is already slowing down. Many technologists predict it will totally breakdown between 2022–2025.

Does that mean progress will stop?

Not a chance.

New technologies will pick up where Moore’s law leaves off. There are three exciting computing technologies in development you should know about.

3D computing hits the market later this year.

What does a city do when it runs short on land?

It builds skyscrapers.

By building “up,” you can create real estate with the footprint of a one-story building, but one that holds 100X more people.

Something similar is just getting underway in computing.

You see, the “guts” of computers have always been two dimensional. Flat computer chips sit on a flat motherboard. Nothing moves in 3D. There’s no “up” or “down” inside a computer chip.

That’s now changing. In December, Intel (INTC) introduced its new 3D chip technology. It plans to begin selling it later this year.

Tech reporters are touting it as “how Intel will beat Moore’s law.”

Chips stacked in 3D are far superior to ones placed side by side. Not only can you fit multiples of transistors in the same footprint. You can better integrate all the chip’s functions.

This shortens the distance information needs to travel. And it creates many more pathways for information to flow.

The result will be much more speed and power packed into a small space. Eventually, 3D chips could be 1,000 times faster than existing ones.

DNA computing is a bit further off... but its potential is mind-boggling.

DNA, as you know, carries the instructions that enable life.

As incredible as it sounds, DNA can be used for computing. In 1994, a computer scientist at the University of Southern California used DNA to solve a well-known mathematical problem.

One pound of DNA has the capacity to store more information than all the computers ever built.

A thumbnail size DNA computer could theoretically be more powerful than today’s supercomputers.

I won’t get deep into the science here. DNA computing is still very early stage. But several companies, including Microsoft (MSFT), are working to push the technology forward.

Quantum computing could be the ultimate disruption.

The science behind quantum computing will bend your mind.

To understand its potential, all you really need to know is this:

The basic unit of conventional computation is the bit.

The more bits a computer has, the more calculations it can perform at once, and the more powerful it is.

With quantum computing, the basic unit of computation is called a quantum bit—or qubit.

Bits behave linearly. To get a 20-bit computer, you might add 2+2+2+2+2+2+2+2+2+2.

Quibits are different. Every quibit doubles computing power.

So, a ten quibit computer could do 2x2x2x2x2x2x2x2x2x2 calculations at once, or 1,024.

A 100 qubit quantum computer could perform over 1,000 billion billion billion simultaneous calculations.

Those numbers are too big for humans to comprehend.

In theory, a small quantum computer could exceed the power of a regular computer the size of the Milky Way galaxy.

With enough computing firepower, a quantum computer could solve any problem.

If we ever achieve far-out goals like controlling the weather, colonizing Mars, or reversing human aging, quantum computing will likely be the driving force.

There are no pure-play quantum computing stocks...

They’re all private or have been scooped up by larger companies.

Many of the big tech players are developing quantum computing technology. Microsoft, IBM, Google (GOOG), and Intel are a few.

Google looks to be in the lead.

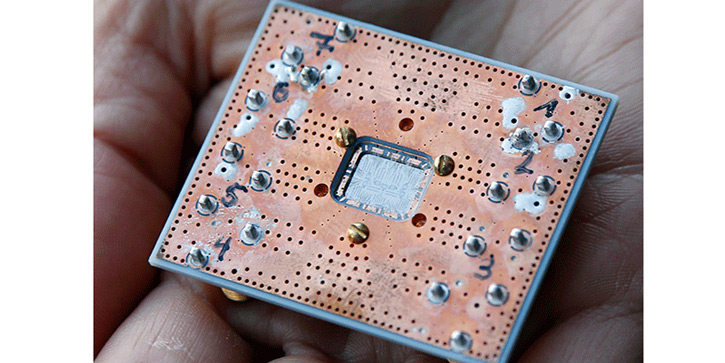

In March 2018, it unveiled its Bristlecone quantum processor, which the company thinks could achieve “quantum supremacy.”

Quantum supremacy is the “tipping point” for quantum computing. It’s the point when a quantum computer can beat a regular one in a useful task.

So far, scientists haven’t been able to crack this. But once quantum supremacy is reached, progress should take off very quickly.

This is yet another great reason to consider investing in Google—in addition to the others my colleague Stephen McBride has pointed out here and here.

Chris Wood

Chris Wood is editor of Project 5X, RiskHedge’s premium research service dedicated to uncovering small disruptor stocks with 500% upside or better. Project 5X is currently closed to new members. If you’d like to be alerted the next time memberships are available, please write us at support@riskhedge.com.

This article appears courtesy of RH Research LLC. RiskHedge publishes investment research and is independent of Mauldin Economics. Mauldin Economics may earn an affiliate commission from purchases you make at RiskHedge.com

Recent Articles

Does Elon read RiskHedge?

February 9, 2026

The “RiskHedge move”

February 3, 2026

Should you invest in data centers in space?

February 2, 2026

My #1 slam dunk AI trade for 2026

January 27, 2026

Space is on fire

January 26, 2026

Big returns on a silver platter

January 20, 2026

Dan’s dilemma

January 19, 2026

The 4 AI “subsectors” to watch in 2026

January 13, 2026

No more excuses

January 5, 2026

The #1 risk to the AI bull market

December 15, 2025

The next big AI winners are...

December 8, 2025

I was wrong about Google

December 2, 2025