Japanification—Coming to America by 2031?

-

Ed D'Agostino

Ed D'Agostino

- |

- October 3, 2025

- |

- Comments

The newest member of the Federal Reserve Board, Stephen Miran, recently outlined his reasons for wanting interest rates to come down by roughly 2 percentage points—far more than any other Fed member.

Underpinning his argument is a concern about the consequences of shifting immigration policies—or what he calls ‘population shocks.’

We already know that demographic projections in the US are bleak. Our population is aging while the birth rate is declining. That’s true for much of the Western world—and most strikingly for Japan, where people 65-plus are projected to top 30% of the population by 2030. Together, fewer productive young people and more non-working older people make it difficult for an economy to grow.

This has implications for housing, Social Security, Medicare, our healthcare system, tax revenue, and beyond.

Let’s look at what Miran said in his speech at The Economic Club of New York.

Stagnant Population = Stagnant Economy

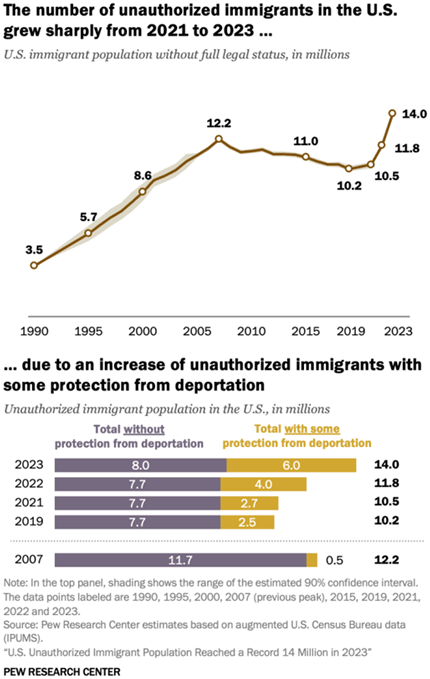

Miran noted that US population growth is declining quickly due to changes in immigration policy. He described President Biden’s immigration policy as resulting in the biggest positive population growth shock of his lifetime. He said the US population had been growing at approximately 1% annually in recent years, with much of that growth attributed to illegal immigration.

Data from Pew Research seems to confirm.

Source: Pew Research

Miran went on to say that President Trump’s policies are now reversing the trend, resulting in one of the biggest negative growth shocks. Here’s Miran:

Already in the first half of this year, roughly 1.5 million of these immigrants have left the country, according to the Current Population Survey, though this number may be an overestimate due to nonresponse issues.8 Assuming some overcounting, it is plausible to me that 2 million illegal immigrants will have exited the country by year-end, thereby reducing annual population growth from 1 percent to 0.4 percent.

This is a big deal, for reasons we’ll get to shortly.

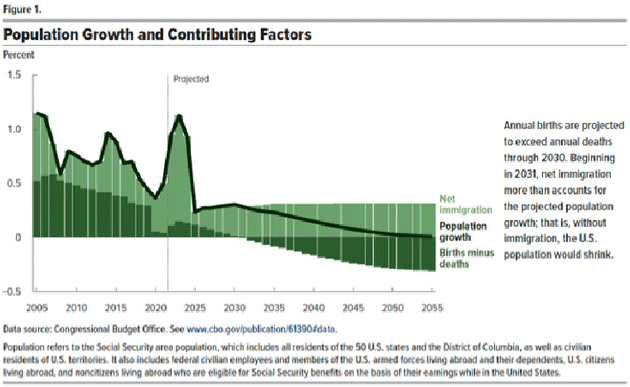

Now let’s look at the Congressional Budget Office’s most recent projections, published in September. Here’s their chart:

Source: CBO.gov

Note that the historic data ends in 2022. The projected spike in 2023 shows population growth of 1.1%, net immigration of 1.0%, and births minus deaths of 0.2%.

For 2025, the CBO projected population growth of 0.2%, net immigration of 0.1%, and births minus deaths of 0.1%. Even these low estimates may overstate population and immigration growth this year.

I am not going to weigh in on whether the current immigration policies are right or wrong. I’m simply asking us all to consider, “How will a further reduction in population growth impact the US economy?” I’d argue that projected negative trends will arrive sooner than we’d anticipated.

Back in January the CBO noted that “without immigration, the population would shrink beginning in 2033, in part because fertility rates are projected to remain too low for a generation to replace itself.” Without immigration, the CBO now expects the US population to start shrinking in 2031.

|

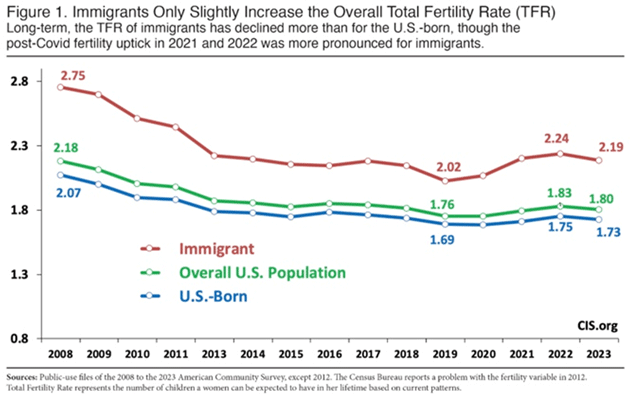

Part of this comes down to immigrants having more children than US-born Americans. Not a lot more, according to this 2023 data from the Census Bureau’s American Community Survey—but enough that immigrants land above the replacement rate, while US-born Americans fall below it.

Source: cis.org

With zero net immigration happening sooner than previously projected, all the other negative demographic projections can likely be pulled forward, too. That includes a larger proportion of Americans 65-plus—a group that was already projected to top 20% of the US population by 2030.

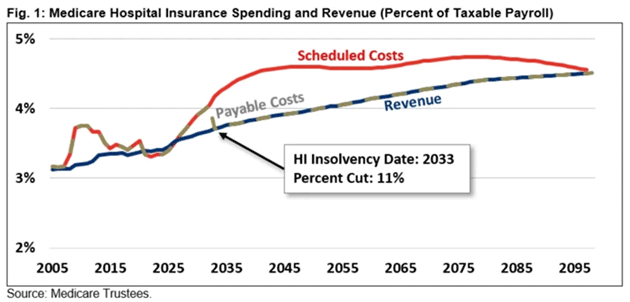

This is an expensive group. As of August, the Committee for a Responsible Federal Budget projected Social Security insolvency by late 2032—just seven years from now. It’s also projected Medicare Part A (hospital care) will become insolvent just one year later.

Source: crfb.org

Net zero immigration will also impact the cost and availability of home healthcare workers, who are critical for an aging population. Nearly 40% of these workers are immigrants, and a shrinking pool would further exacerbate the strains on our healthcare system. It’s difficult to find non-immigrants who are willing to do this unglamorous work for $14.50 per hour.

With net zero immigration arriving sooner, we will feel the impacts on healthcare as well as our Social Security system earlier. Consumer consumption should also drop. And worker productivity is a wildcard, given AI.

Viewed in this light, Miran’s case for lower rates becomes understandable, if not more compelling. The long-term outlook for the economy also becomes more concerning, as a stagnant economy can get trapped with low rates that don’t effectively stimulate growth. Just look at Japan over the past two decades.

The economic Japanification of the US may be happening more quickly than we’d previously projected.

|

Thanks for reading.

Ed D’Agostino

Publisher & COO

P.S. I noted the AI wildcard earlier… We’re eager to hear how AI is impacting you, both personally and professionally. If you could take a moment to complete our AI survey, I would greatly appreciate it. It won’t take long, and we want to hear your perspective.

Click here to complete the Mauldin Economics AI Survey now. Thanks in advance for your input.

Ed D'Agostino

Ed D'Agostino