Those who support free-market economics say it is the best, most efficient path to maximum prosperity for everyone.

In other words, everybody wins in a free market—not equally, but each person at least has the opportunity for a prosperous life.

I agree with all that, except the “everybody wins” part.

In fact, free markets don’t work well at all unless certain people lose. Otherwise the entire system fails and everyone loses. Which is happening right now.

Forgetting the Lessons

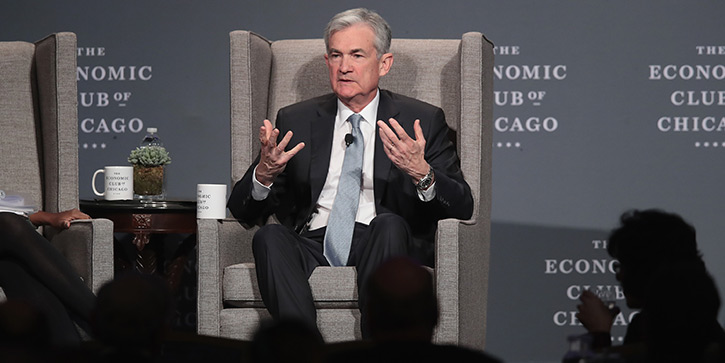

Neel Kashkari, president of the Minneapolis Federal Reserve Bank, is often in the news because he dissents from the Fed’s rate-hike decisions. He previously worked at Goldman Sachs and PIMCO and was assistant Treasury secretary overseeing the crisis-era Troubled Asset Relief Program (TARP).

After running one of the top bailout programs, Kashkari now thinks the “too big to fail” banks are, well, too big and should be broken up. I imagine that makes for some interesting conversations with the banks in his district.

Kashkari went on a little rant at a Howard University event last month. Here are some quotes my Twitter pal Pedro da Costa reported for Business Insider.

Those last two comments are important. Banks profit mainly by lending money that was itself loaned to the bank by depositors and bondholders. This gives them leverage, which makes them vulnerable to losses when borrowers default.

As a result, there’s a constant tension. Bankers want more leverage so profits will be higher. Regulators want to allow less leverage so the banks are less likely to fail. They meet somewhere in the middle.

The Fed manages this balance and does a pretty good job of it... until something like 2008 happens.

But here’s the problem: Our bank-stability apparatus—the Fed, the FDIC, occasional bailouts—encourages banks and other lenders to take unwise risks because they know (or at least believe) they’ll get rescued.

And that brings us back to free markets and losers.

Hiding the Message

We heard a lot in the crisis, and still now, about people taking out loans they couldn’t afford. Obviously, that’s a bad idea.

But every loan has two sides: borrower and lender. Both have responsibilities.

Just as borrowers shouldn’t overstretch, lenders shouldn’t over-lend. That’s partly how we get crises like 2008.

In theory, the free market imposes discipline on both sides. It certainly does for borrowers. Default on your mortgage and every future lender will either deny you credit or charge you much higher rates… and rightly so.

But on the lender side, responsibility for mistakes stays hidden. As Kashkari said, bank executives and directors who made bad decisions leading up to 2008 felt little punishment.

So, the system tacitly promotes irresponsible lending. The free-market way to prevent this is for irresponsible lenders to lose all their money. It would send other lenders a message: “Avoid doing what they did.”

Government bailouts keep that information from the people who need it. The result: an unstable banking system that builds up unsustainable debt and periodically implodes.

Raising Taxes

This isn’t just a US problem. An April 18 Financial Times story reported on some African countries slipping into a debt crisis. Here’s an excerpt:

With the number of countries already unable to service their debts doubling in the past year to eight, officials at the International Monetary Fund are urging all African countries to raise taxes to provide more scope for paying interest, which has increased to levels last experienced at the start of the century.

While we don’t know the details of these troubled loans, we can infer a few things.

First, it’s not new information that some African governments are unstable, corrupt, and have trouble servicing their debts. That has been the case for decades.

Second, anyone who lends money to those governments should know those risks and price their loans accordingly. These lenders apparently didn’t.

Whose fault is that? Not the borrowers’, and certainly not the citizens’ who the IMF now insists pay higher taxes so the lenders get their interest.

What should happen here is…

That would teach other lenders to require sustainable, realistic loan terms and interest rates. It would be short-term harder on the borrowers, but in the long run help free them from perpetual debt serfdom.

Don’t Blame Capitalism

Similar things happen in the US every day. I don’t think another banking crisis is imminent, but we’ll have one eventually.

When that crisis comes, some people will want to blame capitalism—but the real culprit will be the lenders’ lack of market discipline.

We could avoid this, or at least make it less painful, by taking the kind of steps Neel Kashkari recommends. But don’t hold your breath.

Before I go, a quick reminder: On Monday, you may have received an email from John Mauldin describing some important changes at Mauldin Economics. Please open and read it as soon as possible. It describes a time-limited action you might want to take.

Since the email went only to select readers, that’s all I can say publicly for now… but I’ll tell everyone more in next Tuesday’s Connecting the Dots. I think you’ll like it.

See you at the top,

P.S. If you’re reading this because someone shared it with you, click here to get your own free Connecting the Dots subscription. You can also follow me on Twitter: @PatrickW.