- September 15, 2025

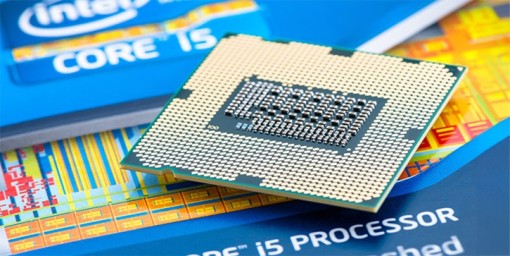

Disrupted old dog of a tech stock

The cautionary tale of America’s once-great chipmaker…

Read more

The cautionary tale of America’s once-great chipmaker…

Read more

Get ready for a completely new set of AI winners…

Read more

It’s time to invest. Don’t let this rocket ship take off without you.

Read more

Getting out of AI stocks today is like ditching internet stocks in the '90s…

Read more

It’s been taken to the AI slaughterhouse. Continue to avoid…

Read more