- October 13, 2025

You shouldn’t have to check your stocks in Tuscany

Last week, RiskHedge co-founder Dan Steinhart was in Italy celebrating his and his wife’s 40th birthdays.

Read more

Last week, RiskHedge co-founder Dan Steinhart was in Italy celebrating his and his wife’s 40th birthdays.

Read more

The US government just shut down. Again.

Read more

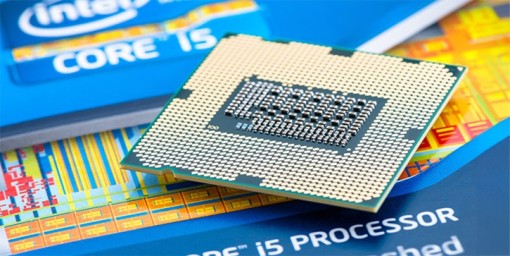

The cautionary tale of America’s once-great chipmaker…

Read more

Get ready for a completely new set of AI winners…

Read more