Collect a 4.8% Yield from the Future of AI

-

Kelly Green

Kelly Green

- |

- June 21, 2023

- |

- Comments

Artificial intelligence (AI) is taking over the internet.

I can’t look anywhere without seeing the latest “how to use ChatGPT to solve XYZ” article or op-ed about the likelihood of AI displacing chunks of the workforce.

AI is here… and it’s here to stay.

-

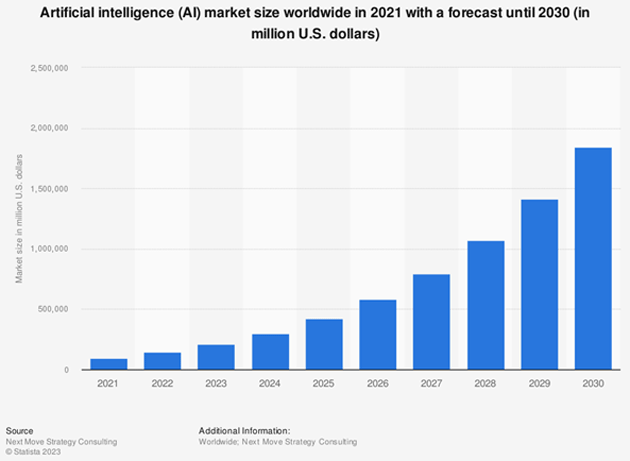

In fact, the AI market is projected to reach nearly $1.8 trillion by 2030.

Source: Statista

So, as investors, how can we prepare and make money from its inevitable rise?

We already see companies using chatbots to interact with customers. Other companies are using AI to address needs in the labor market, like jobs that are too dangerous for humans and massive labor shortages. And many companies rely on some form of AI as part of their cybersecurity systems.

Any list of the top tech trends for the next decade will have AI at or near the top. It’s an obvious area to look for promising companies. But on many of the lists I’ve seen, we dividend investors seem to be left out.

Companies such as C3.ai Inc. (AI) don’t pay out a dividend. Nvidia Corp. (NVDA) only pays out 0.037%. Even the iShares Robotics and Artificial Intelligence Multisector ETF (IRBO) only pays out 0.6%.

By now, most of you know I’m not touching a dividend under 3%. That’s why I’ve been looking for a better way to play AI…

And I found a Dividend Aristocrat that’s refocusing its 100-plus years of experience strictly on AI and hybrid cloud computing for the future.

From Hardware Giant to AI Specialist

When you think of AI, International Business Machines Corp. (IBM) probably isn’t the first company to come to mind.

The company changed history when it made the power of the 1960s mainframes available to small businesses and consumers. It would then invent the first floppy disk, creating the foundation for storage for decades to come.

But IBM is not new to the AI game…

In 1997, its Deep Blue computer beat the world chess champion after a six-game match. Then, in 2011, IBM’s Watson won against two of the greatest Jeopardy champions at the time. Watson now infuses AI and automation for integration into its customers’ current workflows using a combination of software and hardware.

IBM has even announced Watsonx, its upcoming next-generation, enterprise-ready AI and data platform. This new platform is expected to drop next month and will help businesses really scale AI workloads across all its data workflows.

Like what you're reading?

Get this free newsletter in your inbox every Wednesday! Read our privacy policy here.

-

According to 451 Research, 96% of companies are actively pursuing a hybrid IT strategy.

This combination of physical infrastructure, with both public and private cloud-based services, will really help AI capabilities integrate fully. The result is greater flexibility, more options, and faster innovation.

The Clear Pick for AI Income

AI and the hybrid cloud—two technologies at the leading edge of digital transformation—are driving the core direction of IBM. Combine that with IBM’s track record of success…

As I mentioned above, IBM is considered a Dividend Aristocrat, meaning that it has increased its dividend for at least 25 consecutive years. Having increased its dividend for the past 30 years, I expect we might see it become a Dividend King (50+ consecutive years of dividend increases) by 2043.

The payment earlier this month was IBM’s latest increase. Although just one penny, it brings the quarterly payment to $1.66. Based on current prices of $136.30 per share, that’s an annualized yield of 4.8%. This is double the average yield of all Dividend Aristocrats, as well as above the average yield for a tech company.

If you don’t already have IBM in your dividend portfolio, it’s my top pick to consider.

My Yield Shark readers were able to lock in an effective yield of over 5% on IBM. Plus, they’ve already seen some paper capital gains on their position.

If you’re interested in getting my favorite income recommendation each and every month, you can try Yield Shark with a 90-day money-back guarantee.

Kelly Green

Kelly Green

Kelly Green