Here’s Why Warnings over Brexit Were Wrong

- Customer Support

- |

- September 21, 2016

- |

- Comments

BY LILI BAYER AND JACOB SHAPIRO, Mauldin Economics

In May, the British Chancellor outlined the short-term impacts of a vote to leave the European Union (EU). The report stated Brexit would cause “an immediate and profound economic shock.” This would push the UK into a recession and lead to a loss of jobs.

The British Treasury was not alone in its fears.

Investment banks and consulting firms across the globe also forecasted doom. Headlines claimed the impact would be profound. The Financial Times reported that banks were starting to look at real estate in Frankfurt. London was no longer a suitable place to do business.

The European Central Bank (ECB) said it had prepared for the Brexit and was ready to provide more liquidity.

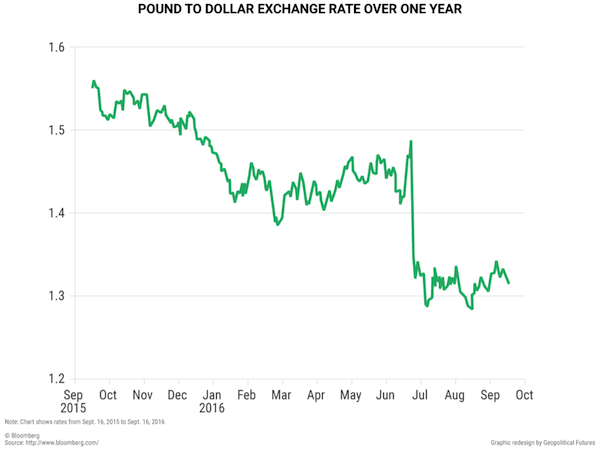

After the vote, Brexit fear exploded. Global markets reeled. The British pound plunged to a 31-year low.

But there was no doom.

In fact, July 14 marked the beginning of the calm. The Bank of England held its benchmark rates steady. A week later, the bank reported there was no clear evidence of a sharp slowdown in business activity in the UK.

Explaining the hysteria over Brexit

There were three common misunderstandings about Brexit.

First, the effects of either a “leave” or “remain” vote were important. Some claimed they knew what the effects would be. Their claims usually backed up their political positions against (or for) leaving the EU.

The UK is part of Europe whether it wants to be or not. The economic ties it has—and will continue to have—with EU members were not going to end overnight.

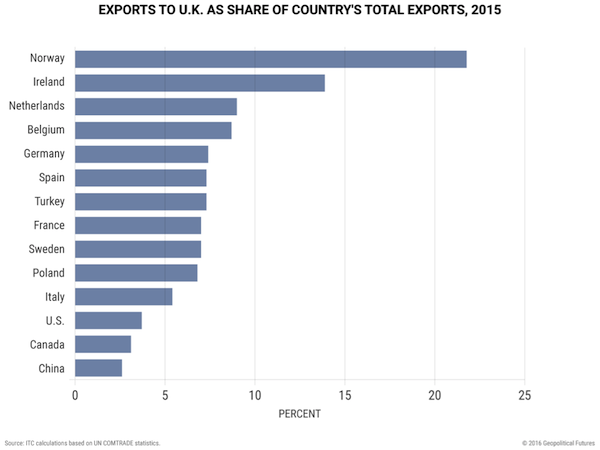

Most crucially, people failed to grasp how economically vital the UK is for Europe. Over 45% of Germany’s GDP comes from exports. It’s not going to malign one of its most important markets.

Indeed, EU leaders agreed to a longer-than-planned timeline to negotiate. This shows that both sides want current economic activity between the UK and the bloc to continue.

The second misunderstanding dealt with why people wanted to leave the EU. Those pushing to remain tried to show that staying in the EU was far better economically than leaving. But the real concerns were first and foremost related to sovereignty, politics and immigration.

The third misunderstanding was how long it would take to exit. The complexity of the negotiating process meant Britain’s exit would not happen quickly. But most people didn’t grasp that fact. The British government still has not triggered Article 50, which would start the withdrawal process. Once Article 50 is triggered, the UK will have two years to negotiate the terms of its leaving.

On July 20, German Chancellor Angela Merkel supported the decision of British Prime Minister Theresa May to wait until 2017 to trigger Article 50. So the earliest the UK might leave the EU is 2019. This extended transition period means a rapid change in business conditions is unlikely.

The broader picture

The result of the Brexit vote has not been all positive. The British pound has lost about 10% of its value. This hurts British companies. There is the potential for decreased growth, lost jobs, and inflation. On the other hand, a weaker pound could boost British exports.

There will be some negative consequences, and some might be quite painful. But as we pointed out, the hysteria around Brexit was overblown. The challenges can be dealt with. That remains our overall position.

But will Britain fall into recession? Of course it will at some point. All healthy economies do. Whether Brexit will be the precise cause of that recession is another story.

There is a very valuable lesson here. One should not pay much attention to short-term responses to unexpected events. This is what helped us see that the reports of Britain’s demise post-Brexit were greatly inflated.

Watch George Friedman's Ground-Breaking Documentary Crisis & Chaos: Are We Moving Toward World War III?

While mainstream media heaped needless hysteria on Brexit, a more ominous destabilization was festering—and engulfing—a region containing 5 billion of the planet’s 7 billion people.

In this provocative documentary from Mauldin Economics and Geopolitical Futures, George Friedman uncovers the crises convulsing Europe, the Middle East, and Asia… and reveals the geopolitical chess moves that could trigger global conflict. Register for the online premiere now.