The Global Economy Is Not Recovering—Just Look at the Data

- John Mauldin

- |

- May 3, 2018

- |

- Comments

BY JOHN MAULDIN

Central banks think the US and global economies are about to break from the post-recession doldrums. They believe their aggressive monetary policies—along with tax cuts and other factors—are finally bearing fruit.

As a result, the Fed is now tightening policy to prevent this inevitable growth sparking too much inflation. My friend Lakshman Achuthan of the Economic Cycles Research Institute (ECRI) is not convinced.

He recently sent some slides I want to share with you.

Economic Growth Is Slowing Down

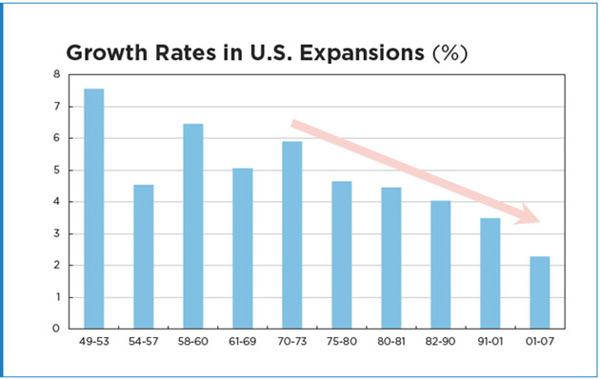

The first one shows that the present, low-grade expansion phase is the slowest in a series. By the way, the ECRI is as close as we have to an “official” economic cycle watch service in the country.

Source: Economic Cycles Research Institute

This is growth during times when the economy is not in recession, which should be considerably higher than the full-cycle averages. It has been falling steadily since the 1970s and is now below 2%.

If the best we can do is 2% (not counting recessions), it’s hardly time to proclaim victory.

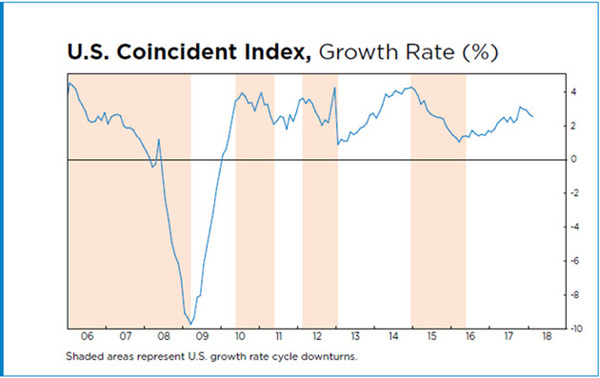

The next chart looks at the ECRI US Coincident Index, which is their alternative growth measure. The shaded areas are cyclical downturns, the three most recent of which did not reach recession status.

Source: Economic Cycles Research Institute

The important point here is we see little or no improvement in the growth rate. Since 2010, it has moved sideways in a tight range. In the last two years, it moved up to about the middle of the range, which is positive but doesn’t mean the US economy is off to the races.

GDP Growth Stalled in the Largest Economies

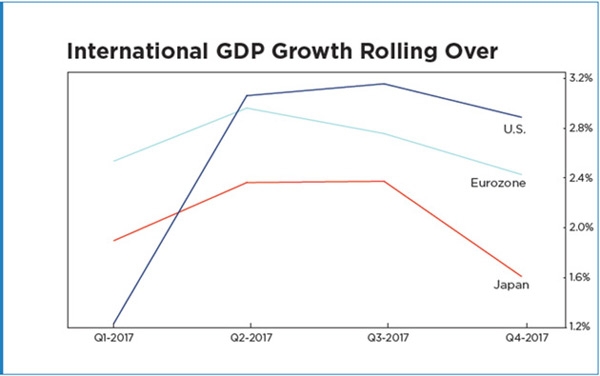

Finally, and most ominously, Lakshman shows this chart of quarterly GDP growth in the three largest developed market economies.

Source: Economic Cycles Research Institute

We see in all three places that quarterly growth peaked in mid-2017 and then fell in the last quarter. Yet the experts tell us a synchronized global recovery is forming. Really?

What I see here is a synchronized downturn. Granted, it’s just a couple of quarters but early data makes Q1 2018 look lower still.

If a recession is coming, GDP growth will decline from its present level to 0% or below. That process will likely unfold over a few quarters—and may already be beginning.

The Debt Gap Means Higher Interest Rates

On top of all this, we have a fast-growing federal debt. Yes, we owe this money to ourselves and maybe it will all balance out eventually. But we must get there first, and the road is not necessarily smooth.

Let’s look at some data from my friend Luke Gromen, who runs a unique advisory service called Forest for the Trees. The most recent letter from him had some fascinating points on the debt.

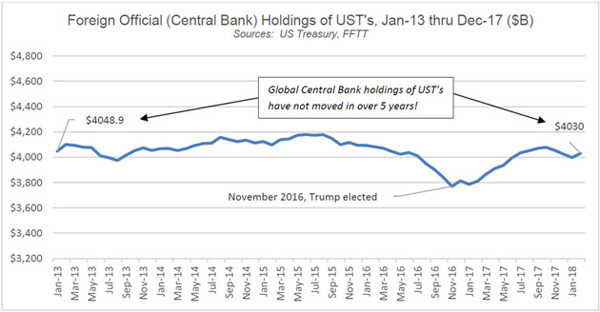

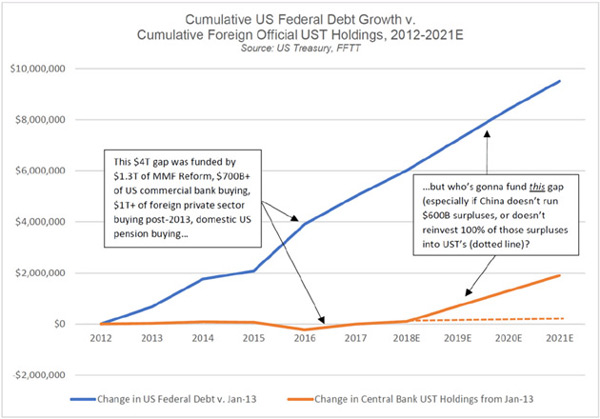

First, Luke says one of the least-noticed recent developments is that foreign central banks stopped net purchases of US government debt about five years ago.

Source: Forest for the Trees, LLC

This is important because someone has to fund our deficit spending and the job is not getting easier. It’s getting harder, in fact, as Luke’s next chart shows.

Source: Forest for the Trees, LLC

To this point, the Fed and Treasury have filled the gap with assorted contrivances such as forcing banks and money market funds to buy more Treasury bonds. These have run their course and no replacement tools are obvious.

That leaves one option: higher interest rates.

People will loan their money to the government if it gives them enough incentive. And higher yields will do it.

How much higher? We don’t know, but it won’t take much to further reduce bank lending activity, which will reduce M2 and push the economy closer to recession.

Investors will further extend their maturities, inverting the yield curve.

Watch Out

By now, everybody knows we are in the slowest recovery on record.

Lacy Hunt blames ever-increasing debt, which is a drag on growth. He has tons of academic literature to support his position, and I agree with him. That the next recovery will be even slower.

Go back to what Richard Duncan said earlier. When credit growth drops below 2%, a recession almost always follows. Lacy tells us that bank credit growth is down to 0.6% since the beginning of the year. That is ugly.

In short, there is not enough data to have me predict a recession and the consequent bear market. But there’s enough data bubbling up all around me that it makes me very nervous, and I am paying close attention.

You should be, too.

Join hundreds of thousands of other readers of Thoughts from the Frontline

Sharp macroeconomic analysis, big market calls, and shrewd predictions are all in a week’s work for visionary thinker and acclaimed financial expert John Mauldin. Since 2001, investors have turned to his Thoughts from the Frontline to be informed about what’s really going on in the economy. Join hundreds of thousands of readers, and get it free in your inbox every week.