Rhyme and Reason

“The significant problems that we have created cannot be solved at the level of thinking we were at when we created them.” – Albert Einstein “Generals are notorious for their tendency to ‘fight the last war’ – by using the strategies and tactics of the past to achieve victory in the present. Indeed, we all do this to some extent. Life's lessons are hard won, and we like to apply them – even when they don't apply. Sadly enough, fighting the last war is often a losing proposition. Conditions change. Objectives change. Strategies change. And you must change. If you don't, you lose.” – Dr. G. Terry Madonna and Dr. Michael Young “Markets are perpetuating a serious error by acting on the belief that central bankers actually know what they are doing. They do not. Not because they are ill-intentioned but because they are human and subject to the limitations that apply to all human endeavors. If you want proof of their fallibility, simply look at their economic forecasts. Despite their efforts to do so, central banks can’t repeal the business cycle (though they can distort it). While the 2008 financial crisis should have taught them that lesson, it appears to have led them to precisely the opposite conclusion. “There are limits to knowledge in every field, including the hard sciences, and economics is not a hard science; it is a social science whose knowledge is imprecise, and practitioners’ ability to predict the future is extremely limited. Fed officials are attempting to guide an extremely complex economy with tools of questionable utility, and markets are ignoring their warnings that their ability to manage a positive outcome is highly uncertain. Markets are confusing what they want to happen with what is likely to happen, a common psychological phenomenon. Investors who prosper in the long run will be those who acknowledge the severe limits of economic knowledge and the compelling evidence that trillions of dollars of QE and years of zero interest rates may have saved the system from immediate collapse five years ago but failed to produce sustained economic growth or long-term price stability.” – Michael Lewitt, The Credit Strategist, Nov. 1, 2014

As I predicted months ago in this letter and last year in Code Red, the Japanese have launched another missile in their ongoing currency war, somewhat fittingly on Halloween. Rather than being spooked, the markets saw it as just another round of feel-good quantitative easing and climbed to all-time highs on the Dow and S&P 500. The Nikkei soared even more (for good reason). As we will see later in this letter, this is not your father’s quantitative easing. The Japanese, for reasons of their own, will intervene not only in their own equity markets but in foreign equity markets as well, and do so in a size and manner that will be significant. This gambit is going to have ramifications far beyond merely weakening the yen. In this week’s letter we are going to take an in-depth look at what the Japanese have done.

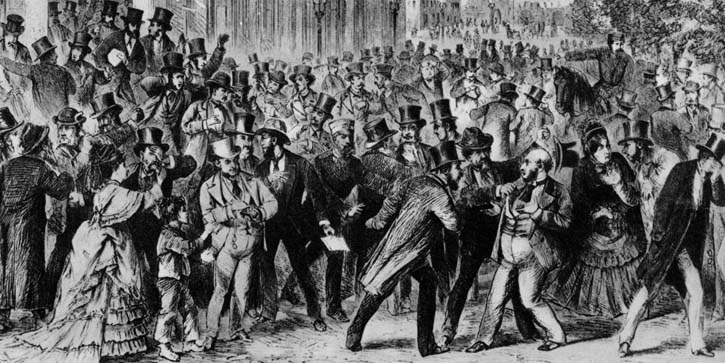

It is something of a cliché to quote Mark Twain’s “History doesn’t repeat itself, but it does rhyme.” But it is an appropriate way to kick things off, since we are going to look at the “ancient” history of Mark Twain’s era, and specifically the Panic of 1873. That October saw the beginning of 65 months of recession (certainly longer than our generation’s own Great Recession), which inflicted massive pain on the country. The initial cause was government monetary intervention, but the crisis was deepened by soaring debt and deflation.

As we seek to understand what happened 141 years ago, we’ll revisit the phenomenon of October as a month of negative market surprises. It actually has its roots in the interplay between farming and banking.

The Panic of 1873

Shortly after the Civil War, which saw the enactment of federal fiat money (the “greenback” of that era, issued to finance the war), there was a federal law passed that required rural and agricultural banks to keep 25% of their deposits with certain certified national banks, which were based mainly in New York. The national banks were required to pay interest on those deposits, so they had to put the money out for loans. But because those deposits were “callable” at any time, there was a limit to the types of loans they could do, as long-term loans mismatched assets and liabilities.

The brokers of the New York Stock Exchange were considered an excellent target for such loans. They could use the proceeds of the loans as margin to buy stocks, either for their own trading or on behalf of their clients. As long as the stocks went up – or at the very least as long as the ultimate clients were liquid – there wasn’t a problem for the national banks. Money could be repatriated; or, if necessary, margins could be called in a day. But this was before the era of a central bank, so actual physical dollars (and other physical instruments) were involved as reserves, as was gold. Greenbacks could be used to buy gold, but at a rate that floated. The price of gold could fluctuate significantly from year to year, depending upon the availability of gold and the supply of greenbacks (and of course, market sentiment – which certainly rhymes with our own time).

The driver for October volatility was an annual cycle, an ebb and flow of dollars to and from these rural banks. In the fall when the harvest was ready, the country banks would recall their margin loans in order to pay farmers or loan to merchants to buy crops from farmers and ship them via the railroads. Money would then become tight on Wall Street as the national banks called their loans back in.

This cycle often caused extra volatility, depending on the shortness of loan capital. Margin rates could rise to as much as 1% per day! Of course, this would force speculators to sell their stocks or cover their shorts, but in general it could drive down prices and make margin calls more likely. This monetary tightening often sent stocks into a downward spiral – not unlike the downward pressure that present-day Fed tightening actions have exerted, but in a compressed period of time.

If there was enough leverage in the system, a cascade could result, with stocks dropping 20% very quickly. Since much of Wall Street was involved in railroads, and railroads were nothing if not leveraged loans and capital, falling asset prices would reduce the ability of investors in railroads to find the necessary capital for expansion and maintenance of operations.

This historical pattern no longer explains the present-day vulnerability of markets in October. Perhaps the phenomenon persists simply due to market lore and investor psychology. Like an amputee feeling a twinge in his lost limb, do we still sense the ghosts of crashes past?

(And once more with Mark Twain: “October. This is one of the peculiarly dangerous months to speculate in stocks. The others are July, January, September, April, November, May, March, June, December, August, and February.”)

It was in this fall environment that a young Jay Gould decided to manipulate the gold market in the autumn of 1873, creating a further squeeze on the dollar. Not only would he profit off a play in gold, but he thought the move would help him in his quest to take control of the Erie Railroad. Historian Charles R. Morris explains, in a fascinating book called The Tycoons:

Gould’s mind ran in labyrinthine channels, and he turned to the gold markets as part of a strategy to improve Erie’s freights. Grain was America’s largest export in 1869. Merchants purchased grain from farmers on credit, shipped it overseas, and paid off the farmers when they received their remittances from abroad. Their debt to the farmers was in greenbacks, but their receipts from abroad came in gold, for the greenback was not legal tender overseas. It could take weeks, or even months, to complete a transaction, so the merchant was exposed to changes in the gold/greenback exchange rate during that time. If gold fell (or the greenback rose), the merchant’s gold proceeds might not cover his greenback debts.

The New York Gold Exchange was created to help merchants protect against that risk. Using the Exchange, a merchant could borrow gold when he made his contract, convert it to greenbacks, and pay off his suppliers right away. Then he would pay off the gold loan when his gold payment came in some weeks later; since it was gold for gold, exchange rates didn’t matter. To protect against default, the Exchange required full cash collateral to borrow gold. But that was an opening for speculations by clever traders like Gould. If a trader bought gold and then immediately lent it, he could finance his purchase with the cash collateral and thereby acquire large positions while using very little of his own cash.

[Note from JM: In the fall there was plenty of demand for gold and a shortage of greenbacks. It was the perfect time if you wanted to create a “corner” on gold.]

Gould reasoned that if he could force up the price of gold, he might improve the Erie’s freight revenues. If gold bought more greenbacks, greenback-priced wheat would look cheaper to overseas buyers, so exports, and freights, would rise. And because of the fledgling status of the new Gold Exchange, gold prices looked eminently manipulable, since only about $20 million in gold was usually available in New York. [Some of his partners in the conspiracy were skeptical because…] The Grant administration, which had just taken office in March, was sitting on $100 million in gold reserves. If gold started suddenly rising, it would hurt merchant importers, who could be expected to clamor for government gold sales.

So Gould went to President Grant’s brother-in-law, Abel Corbin, who liked to brag about his family influence. He set up a meeting with President Grant, at which Gould learned that Grant was cautious about any significant movements in either the gold or the greenback, noting the “fictitiousness about the prosperity of the country and that the bubble might be tapped in one way as well as another.” That was discouraging: popping a bubble meant tighter money and lower gold.

But Gould plunged ahead with his gold buying, including rather sizable amounts for Corbin’s wife (Grant’s wife’s sister), such that each one-dollar rise in gold would generate $11,000 in profits. Corbin arranged further meetings with Grant and discouraged him from selling gold all throughout September.

Gould and his partners initiated a “corner” in the gold market. This was actually legal at the time, and the NY gold market was relatively small compared to the amount of capital it was possible for a large, well-organized cabal to command. True corners were devastating to bears, as they generally borrowed shares or gold to sell short, betting on the fall in price. Just as today, if the price falls too much, then the short seller can buy the stock back and take his losses. But if there is no stock to buy back, if someone has cornered the market, then losses can be severe. Which of course is what today we call a short squeeze.

The short position grew to some $200 million, most of it owed to Gould and his friends. But there was only $20 million worth of gold available to cover the short sales. That gold stock had been borrowed and borrowed and borrowed again. The price of gold rose as Gould’s cabal kept pressing their bet.

But Grant got wind of the move. His wife wrote her sister, demanding to know if the rumor of their involvement was true. Corbin panicked and told Gould he wanted out, with his $100,000+ of profits, of course. Gould promised him his profits if he would just keep quiet.

Then Gould began to unload all his gold positions, even as some of his partners kept right on buying. You have to keep up pretenses, of course. Gould was telling his partners to push the price up to 160, while he was selling through another set of partners.

It is a small irony that Gould also had a contact in the government in Washington (a Mr. Butterfield) who assured him that there was no move to sell gold from DC, even as that contact was personally selling all his gold as fast as he could. Whatever bad you could say about Gould (and there were lots of bad things you could say), his trading instincts were good. He sensed his contact was lying and doubled down on getting out of the trade. In the end, Gould didn’t make any money to speak of and in fact damaged his intention of getting control of the Erie Railroad that fall.

The attempted gold corner didn’t do much harm to the country in and of itself. But when President Grant decided to step in and sell gold, there was massive buying, which sucked a significant quantity of physical dollars out of the market and into the US Treasury at a time when dollars were short. This move was a clumsy precursor to the open-market operations of the Federal Reserve of today, except that those dollars were needed as margin collateral by brokerage companies. No less than 14 New York Stock Exchange brokerages went bankrupt within a few days, not including brokerages that dealt just in gold.

All this happened in the fall, when there were fewer physical dollars to be had.

The price of gold collapsed. Cornelius Vanderbilt, who was often at odds with Jay Gould, had to step into the market (literally – that is, physically, which was rare for him) in order to quell the panic and provide capital, a precursor to J.P. Morgan’s doing the same during the Panic of 1907.

While many today believe the Fed should never have been created, we have not lived through those periods of panics and crashes. And while I think the Fed now acts in ways that are inappropriate (how can 12 FOMC board members purport to fine-tune an economic cycle, let alone solve employment problems?), the one true and proper role of the Fed is to provide liquidity in time of a crisis.

“People Who Live Too Much on Credit”

At the end of the day, it was too much debt that was the problem in 1873. Cornelius Vanderbilt was quoted in the epic book The First Tycoon as saying (emphasis mine):

I’ll tell you what’s the matter – people undertake to do about four times as much business as they can legitimately undertake.… There are a great many worthless railroads started in this country without any means to carry them through. Respectable banking houses in New York, so called, make themselves agents for sale of the bonds of the railroads in question and give a kind of moral guarantee of their genuineness. The bonds soon reach Europe, and the markets of their commercial centres, from the character of the endorsers, are soon flooded with them.… When I have some money I buy railroad stock or something else, but I don’t buy on credit. I pay for what I get. People who live too much on credit generally get brought up with a round turn in the long run.The Wall Street averages ruin many a man there, and is like faro.”

In the wake of Gould’s shenanigans, President Grant came to New York to assess the damage; and eventually his Secretary of the Treasury decided to buy $30 million of bonds in a less-clumsy precursor to Federal Reserve open-market operations, trying to inject some liquidity back into the markets. This was done largely as a consequence of a conversation with Vanderbilt, who offered to put up $10 million of his own, a vast sum at the time.

But the damage was done. The problem of liquidity was created by too much debt, as Vanderbilt noted. That debt inflated assets, and when those assets fell in price, so did the net worth of the borrowers. Far too much debt had to be worked off, and the asset price crash precipitated a rather deep depression, leaving in its wake far greater devastation than the recent Great Recession did. It took many years for the deleveraging process to work out. Sound familiar?

The Panic of 1873 started one of the longest depressions in American history – sixty-five straight months of economic contraction. In the next year, half of America’s iron mills would close; by 1876, more than half of the railroads would go bankrupt. Unemployment, hunger, and homelessness blighted the nation. “In the winter of 1873–74, cities from Boston to Chicago witnessed massive demonstrations demanding that authorities ease the economic crisis,” Eric Foner writes. The irony is that the fall was far more severe because of the rapid rise of the previous decade. The expanding, increasingly efficient railroad network had created a truly national market. The fates of farmers, workers, merchants, and industrialists across the landscape were tied together as never before. New York had cast its financial net across the country, which meant that credit flowed to remote regions far more easily than before – but also that financial panics affected the entire nation. As Vanderbilt pointed out, railroad overbuilding was an underlying economic problem, and it was exacerbated by Wall Street’s craze for railway securities. When the bubble burst, the consequences were felt across the country with devastating suddenness and severity.” (From The First Tycoon)

Can you hear the rhyme? This almost eerily echoes our own time and the interconnectedness of international markets. The growth in global markets has been funded by debt, fueled by quantitative easing. Yet, for the moment, the markets believe that central banks can control any panic or crisis. Somehow this time is different. Our central bankers have come up with all sorts of new tools and techniques, so there is nothing but upside – rainbows and unicorns.

I cannot recommend highly enough The First Tycoon, the book on Cornelius Vanderbilt by T. J. Stiles. It is incredibly well-written and researched and won a Pulitzer Prize as well as a National Book Award. My only real problem with the book is that there was so much fascinating detail and useful trivia that I could not skim through but had to slow down and absorb it all! While Vanderbilt is the central character, the book is far more than a biography. It is a compelling history of the rise of steam engines and railroads, and just as important, the beginning of the invention of the idea that a corporation is something separate from its shareholders. This was a truly radical concept and took decades to play out. Insider trading was legal and was done all the time. It was a true laissez-faire, buyer-beware market. Self-dealing, price collusion, and other corporate practices that we would consider repugnant today were standard fare.

But you have to understand that there was no precedent for the circumstances of autumn, 1873. The country was embroiled in a great and contentious conversation over what money and banking and corporations and business should be, all of this happening as new technologies turned millennia-old social processes on their heads. Railroads would have been impossible without corporations, and railroads vastly emancipated and enriched the West (and the rest of the world, wherever they went). Even in an era of price collusion, railroads brought the cost of shipping products down dramatically. The McCormick reaper greatly enhanced the productivity of farms just as a market for their produce appeared by means of cheaper transportation to growing Eastern seaboard cities and Europe. Agriculture went from producing 53% of total national commodity output to less than 33% as manufacturing became dominant, spurring mass labor movement from the country to the cities with their factories. Meanwhile a new wave of immigrants poured into the US.

The new technologies made everything less expensive and more abundant. Steam engines went from small and inefficient to massive and powerful, capable of driving huge ships and trains with less fuel cost. Transportation went from being a small part of the economy to being the very heart, employing hundreds of thousands. The period of time from 1870 to 1900 was one of general price deflation of almost everything. But in general, it was the good deflation that comes from increased productivity and lower prices – once the asset deflation of the Panic of 1873 was worked out.

Businesses, professionals, government, and society in general were all having to learn new rules for everything, and then scrapping the new rules for even newer rules. There was no playbook, no organizing principle for building a new society. They had to create entirely new institutions from whole cloth. They were literally inventing modern society from the ground up – a task somewhat akin to building an airplane while it is trying to taxi down the runway.

And that’s the point we need to fully understand. They were making it up as they went along. I should note that the crises of that era were not just financial. Government was constantly running behind the rather messy process of transformation, trying to contain the damage. Like generals fighting the last war, the bureaucrats were always trying to make sure the last crisis or bad policy would not be repeated. All sorts of new laws needed to be enacted in order to level the playing field for average citizens. Farmers felt put upon by the railroads and the vast wealth of the railroad magnates (even as freight prices generally fell). Price fixing among monopolistic cartels was the norm. Unions were brutally suppressed time and time again and in turn were often violent. Politicians were openly bought and sold. The journalists of those times had all the gentility of the current denizens of the internet, which is to say, generally none.

Income inequality? When Vanderbilt died, he was worth an estimated $100 million (multiple trillions of dollars in current buying power) and was the richest man up to that point. He was just the first of a number of contemporaries who would go on to amass even greater fortunes. Wealth disparity from top to bottom was far worse than it is today, and the poverty at the bottom was devastating. There was no social safety net of any kind.

And let’s not kid ourselves: much of the social and financial mess of the 19 century is still with us today. In fact, if you read deeply enough, you find that we have been trying to solve these large societal problems for hundreds of years. Somehow each generation thinks they have finally got it figured out.

Reading the commentary from the papers of that time, you are struck by the level of optimism that the leaders of society expressed – they certainly believed they had figured it all out. Nothing but upside. Until, of course, the next crisis ensued.

We live in an era that does not repeat the latter part of the 19 century – things have changed – but there is a rhythm and a rhyme that seem hauntingly familiar. There is the enduring belief that this time is different. Each unfolding generation feels that it will solve the problems of the previous generations, even as each older generation in turn despairs of the wisdom and probity of its youth. We play Minsky’s old tune, “Stability Leads to Instability,” over and over again. You would think we could figure out how this song ends and come up with a different, less tumultuous tune.

And our “generals” do indeed go on trying to fix the problems of the last war, missing the entirely new problems that are developing. Until a crisis steers our common vehicle into the ditch, we cling to the illusion of control. We look at the rampant corruption of the Gilded Age and believe we have made progress. And we have: we have progressed to new levels of problems, some of which are altogether unappreciated and certain to produce their own unexpected and unintended consequences and eventual crises.

The Link Among All Crises

But we have not dealt with the primary cause of nearly all financial crises throughout modern history and throughout the world: too much of the wrong kind of debt – debt which is nonproductive. Paul Krugman, the most visible spokesman for those who think it is old-fashioned and foolish to worry about the debt, recently wrote:

On the Chicken Little aspect: It’s actually awesome, in a way, to realize how long cries of looming disaster have filled our airwaves and op-ed pages. For example, I just reread an op-ed article by Alan Greenspan in The Wall Street Journal, warning that our budget deficit will lead to soaring inflation and interest rates. What about the reality of low inflation and low rates? That, he declares in the article, is “regrettable, because it is fostering a sense of complacency.”

It’s curious how readily people who normally revere the wisdom of markets declare the markets all wrong when they fail to panic the way they’re supposed to. But the really striking thing at this point is the date: Mr. Greenspan’s article was published in June 2010, almost three and a half years ago – and both inflation and interest rates remain low.

And he is right, up to a point: too much debt is not a crisis today. Too much debt is never a crisis, right up until the moment it becomes a crisis. Too much debt was not widely recognized as an issue in the US in 2006 or in Europe in 2010, but then – boom! – it became an issue. And throughout the developed world and China, today’s levels of debt, an ever-increasing amount of which is unproductive, are staggeringly high.

The currently fashionable way to deal with too much debt is to punish savers and enrich the already rich, prolonging a situation in which even more debt can be accumulated. Markets believe in the effectiveness of central bank actions precisely because they want to, not because there is any well-established basis for that belief. Yes, we have dealt with some of the problems that gave rise to the last crisis, but we have still not dealt with the underlying, fundamental problem of too much nonproductive debt. At some point, some nasty cousin of subprime debt will come along to prick our bubble. And because debt levels are now even higher than they were in 2007 and there is less scope for the Federal Reserve to intervene with interest rates, the next crisis will not be a repeat of the Great Recession but its own calamitous variant. Which will bring yet more monetary and fiscal intervention, which will produce its own unintended consequences.

And speaking of unintended consequences, let us now turn to Japan.

Japan: The World’s Largest Hedge Fund

In a (reputedly) passionately contested 5 to 4 vote, the board of governors of the Bank of Japan voted essentially to become the world’s largest hedge fund. Not only did they raise the level of quantitative easing by over 15%, to the equivalent of $720 billion a year, they are aggressively allocating and increasing portions of that money to Japanese equity markets and REITs. In a (supposedly) uncoordinated but almost simultaneous announcement, the $1 trillion+ government pension fund announced a move to sell Japanese bonds in size and increase their equity holdings in Japanese and foreign stocks by 20%, divided equally between Japanese and foreign markets. This is the equivalent of $200 billion being injected into global equity markets from one pension fund alone. We can expect that nearly every other Japanese pension fund will follow suit, meaning that potentially hundreds of billions of dollars will be thrust into global equity markets.

Bank of Japan Governor Kuroda said that the move was necessary to achieve their inflation target of 2%. Core Japanese inflation fell to 1.2% last month (after adjusting for the sales tax increase) and has been falling for the last six months. He has a target of 5% nominal GDP growth, by which we assume he means 2% inflation and 3% real GDP growth. The fact that nominal growth has been almost literally zero for the last 20+ years doesn’t seem to impact his optimistic target.

In his comments after the announcement, Kuroda-san said, “[However,] it is important for the BOJ to strongly commit to achieving its price target to get its price target firmly embedded in people's mindset.... [Thus] we have pledged to do whatever it takes to achieve our 2 percent inflation target at the earliest date possible.... It won't do much good in trying to shake off the public's deflation mindset if you just say inflation will reach 2 percent someday.”

I guess using the phrase whatever it takes is working so well in Europe that Kuroda decided to try it out in Japan. At least the currency market believes him: the yen is getting thrashed as I write this.

Local analysts give him almost no chance of approaching 2% inflation in the first part of next year. Household spending fell another 5.6% in September, and another round of consumption tax increases is due to kick in next year. The consumption tax was raised from 5% to 8% last April, which resulted in a 7% contraction of the economy in the second quarter. The tax will rise another 2% (to a total of 10%, or double the original amount) next October. Seriously, if you are in the middle of a recession, the general prescription is to cut taxes, not double the national sales tax over a period of a year and a half. Taking away 5% of Japanese consumption is not going to be good for GDP or the inflation rate, especially when so much of your aging nation is living off fixed incomes that essentially pay them no interest.

Real wages have been falling for well over a year and are now down 3% year-over-year. I’ve written extensively on the deflationary impact of Japanese demographics. All of this data, taken together, is not the stuff of which inflationary fears are made.

And thus Kuroda’s ostensible reason for increasing the money supply: we need more inflation, and economic theory says quantitative easing is the way to get it. The argument from the Bank of Japan is that it is simply applying the same strategy that the United States, Great Britain, and Europe have used to such stunning effect.

Except.

Japanese debt-to-GDP is approaching 250%. This year the government deficit is 7.6% – or the US equivalent of a deficit of about $1.3 trillion. (The actual US deficit in 2014 was $463 billion.) And Japanese government budgetary requests amount to a spending increase of about 6% for 2015 … although Prime Minister Abe assures us that Japan will be close to a primary balance by 2020. Rots o’ ruck on that one, Abe.

Ten-year Japanese bonds are now yielding 0.45%, and five-year JGBs yield a minuscule 0.11%. The Bank of Japan has essentially become the Japanese bond market. The balance sheet of the Bank of Japan will rise about 1.4% of GDP each month for the foreseeable future. That is easily more than twice the amount of debt the government of Japan will issue. That means they will have to go into the market and buy already-issued bonds. Thus, the government pension fund announces that they will serendipitously sell their bonds (at a profit, of course) to the Bank of Japan and purchase equities. Such fortuitous timing for the Bank of Japan.

Marcel Thieliant of Capital Economics notes that the BoJ already owns a quarter of all Japanese state bonds and a third of short-term notes (The Telegraph).

The actual Japanese strategy, over time, is to move the bulk of government debt off the books of banks, insurance companies, and pension funds, so that when, in some distant future, the Bank of Japan allows interest rates to rise, it will not devastate the balance sheets of Japan’s most important institutions.

Head ’Em Up and Move ’Em Out

And this is where the move by the Japanese pension funds is so important. At the end of the day, the pension funds are moving out of JGBs and into equity and especially foreign equity precisely because they have lost faith in their ability to meet their obligations in an environment of continual and rising QE. The pension funds have forced the Bank of Japan to boost its QE support in order to absorb the amount of JGBs that will be put back on the market.

This is precisely what I predicted in both Endgame and Code Red and in this letter over the past four years. Investors, and that includes pension funds and insurance companies, have no choice but to diversify outside of Japanese bonds. Not to do so would be a dereliction of duty, but their shift forces the BoJ to increase its quantitative easing perhaps faster than it would like to.

This dynamic has the potential to spiral out of control. The more the yen falls, the more apparent it becomes that Japanese individuals and institutions are fleeing the Japanese bond market, and the greater will be the move to sell bonds. Unless the Bank of Japan can absorb all those bonds, interest rates will have nowhere to go but up, which would be devastating to the government of Japan.

Will the current level of JGB absorption, which is about 4% of total government debt per year over and above newly issued debt, be enough one year or two years from now? If it isn’t, I fully expect another announcement increasing QE to an even more stratospheric level. Japan is still behaving in a gentlemanly fashion, to be sure. The pension funds will give the Bank of Japan a heads-up as to their plans, and it is likely there will be some give and take, but the direction is certain. This is not something that can happen overnight, as moving hundreds of billions of dollars into equity markets without radically roiling the markets is not possible. But this cattle drive is getting rolling – “head ’em up and move ’em out.”

The debt-to-GDP ratio of Japan will rise another 25% in the next few years, but the amount of that debt on the balance sheet of the BoJ will increase by over 50% in just the next three years. By comparison, that would be the equivalent of the Federal Reserve’s purchasing $8 trillion worth of government bonds and equities. That amount of money beggars the imagination … but it will still leave the Japanese government owing just a shade under 200% of GDP.

Since the government of Japan simply cannot survive in an environment of significantly rising interest rates without serious intervention by the Bank of Japan, QED, the BoJ is going to go on quantitatively easing well into the next decade. They will literally need to monetize 200% of GDP (or more!) while the government of Japan somehow manages to get into an actual surplus, so that the BoJ can withdraw from the markets and allow interest rates to rise to market levels. And if that debt-to-GDP ratio is pulled down to a more normal 40 to 50% (70%? – pick your favorite level for “reasonable”) and they have a balanced budget, then interest rates will actually remain reasonable from the perspective of the government.

But if the Bank of Japan withdraws anytime soon from the bond market, there will be no Japanese bond market for the foreseeable future. Interest rates will rise with the same market force brought to bear by Jay Gould’s corner on the gold market. I know I’ve been beating this drum for a number of years, but you can see this coming. Japan’s past reckless spending leaves them with no other choice than to monetize their debt and destroy their currency.

The Bank of Japan is now the Japanese bond market. There is no one else. Japanese pension funds and investors are fleeing the Japanese bond market and putting money into “hard” assets like the local stock market or real estate if they want to keep the money in Japan, or they are moving it into investments denominated in other currencies.

The chart below shows the fall of the Japanese yen against the dollar in the last two years. Note that the dollar has risen some 40% against the yen. Since its recent high, the yen has dropped a similar amount against the euro and the Korean won. It is even 50% lower against the Chinese renminbi. That is a breathtaking move for a currency in so short a time.

The yen is now almost 114 to the dollar as I write early Monday morning, continuing its drop of last Friday. Expect to read about pushback from many countries over the next few weeks. They will become even more vocal when the yen crosses 120. And then 130 and at every point until the yen is at 200 to the dollar. The only question in my mind is, will the Bank of Japan monetize enough Japanese debt so that it can withdraw its quantitative easing before the yen reaches 200? I actually have real money in 10-year yen put options that says they can’t. But then again, that assumes that a response by the Federal Reserve for QE4 doesn’t develop. Please note that I’m not saying that the yen will go straight to 120, much less 200, from here. It will probably do so in an uneven and volatile manner similar to what we’ve seen in the past few years. But it is my belief that the overall direction is for an ever-depreciating currency.

If the yen depreciates only 10% a year, that exerts an inflationary force of less than 0.5% a year. Given the market dynamics already at work in Japan and given the stated goal of 2% inflation, that is nowhere near enough. There will come a time in the not-too-distant future when inflation again starts to recede uncomfortably below 1%, and the only way Governor Kuroda will be able to maintain his credibility will be to double down on even more aggressive QE. Whatever it takes, indeed!

These are not simple men at the helm of the BoJ. They fully will understand that they are eroding the value of their currency – and that, in fact, is part of their intention. In his comments after the meeting, Gov. Kuroda came right out and said, “Overall, a week yen is positive for Japan’s economy.” He hopes that by weakening it he will put some competitive zing back into Japan’s exporting industries. By targeting equities, Japanese leaders hope to alleviate much of the pain to investors and their pension funds by fomenting a rising market. And Japanese corporate profits are up significantly – far more than those of their European and US counterparts – over the last two years as the yen has fallen.

I am sure the “unintended” consequences of Japanese actions are discussed at the monthly meeting of central bankers at the Bank of International Settlements in Basel. Perhaps they are even discussed aggressively. But at the end of the day, all Kuroda-san can do is shrug his shoulders and tell the other members he has no choice.

And he doesn’t. If he does not continue in his present course, he will face a deflationary depression of the first-order, and that would have an even greater negative impact on the world than what he is attempting to do now.

But it is remarkably naïve for the market to believe in the illusion that the central bankers of the world have it all under control, that they have this all thought out, that they have modeled it perfectly, and that these new Japanese actions are simply part of the plan.

The Japanese are attempting to export the one Japanese product the world does not want: their deflation. It is not clear how the central banks of the world will react to the yen at 130, let alone 140 or 150. With proper fiscal, regulatory, and tax reform, the United States can cope with a rising dollar. I’ve been writing for a long time that the dollar is going to become stronger than any of us can possibly imagine. And not just against the yen. But monetary policy alone is not enough to deal with the challenges that a strong dollar presents.

I am not sanguine about Europe, where QE is still streng verboten. Neither is it clear what the proper course for China should be. Allowing the renminbi to strengthen along with the dollar would create deflationary impulses in China and weaken their own export competitiveness. But to allow their currency to fall would threaten the dollar relationship of their internal debt financing. Properly understood, Chinese government debt may be approaching 200% of GDP (when total government obligations are taken into account). That is a staggering sum for an emerging, growing economy, even one with China’s dollar reserves. My guess is they’re going to need every penny of those reserves. The good news, I suppose, is that they have them.

To think that the Japanese are not busy triggering a major currency war is to favor hope over political reality. It is true naïveté. Politicians are going to want to be seen doing something about currency fluctuations that hurt their local businesses. This will put pressure on their central banks and prompt urgent calls for protection. The bad news is that we’re sliding into this currency crisis at a time when debt is at nosebleed levels and still rising, when Europe seems ineluctably headed for another phase of its crisis (and another recession), and China is struggling to balance a most unbalanced economy.

In the same way that we connected farmers and bankers in every corner of the United States back in the 1870s, we have now connected businesses at every level in every corner of the world. To think that we can somehow manage our Brave New World economy with any greater success than President Grant and his Treasury Secretary achieved is to rely on a huge dollop of hope, and hope is not an economic management strategy.

How do we recognize where and when the serious problems will develop? We’ll close with a slightly edited version (from Endgame) of Michael Pettis’s timeless list of “five things that matter”:

1. Debt levels matter. The best way to measure them is as total debt to

GDP or external debt to exports. As a general rule, the more debt you have, the more difficulty you are going to have servicing it. Coupons matter, too. Low rates are much more serviceable than high rates.

2. The structure of the balance sheet matters, and this may be much more important than the actual level of debt. Not all debt is equal. An investor has to distinguish between inverted debt and hedged debt. With inverted debt, the value of liabilities is positively correlated with the value of assets, so that the debt burden and servicing costs decline in good times and rise in bad times. With hedged debt, they are negatively correlated.

Foreign currency and short-term borrowings are examples of inverted debt. This makes the good times better and the bad times worse. Long-term fixed-rate local-currency borrowing is an example of hedged debt. During an inflation or currency crisis, the cost of servicing the debt actually declines in real terms, providing the borrower with some automatic relief, and this relief increases the worse conditions become. Highly inverted debt structures are very dangerous because they reinforce negative shocks and can cause events to spiral out of control, but unfortunately they are very popular because in good times, when debt levels typically rise, they magnify positive shocks.

3. The economy’s underlying volatility matters. Less volatile economies are less subject to violent fluctuations, especially if the performance of the economy is correlated with financing ability. This is especially a problem for countries whose economies are highly dependent on commodities. Typically, commodity prices go down in bad times, making it that much harder to export profitably.

4. The structure of the investor base matters. Contagion is caused not so much by fear, as most people assume, but by large amounts of highly leveraged positions, which force investors into various forms of delta hedging, that is, buy when prices rise, and sell when they drop.

5. The composition of the investor base also matters. A sovereign default is always a political decision, and it is easier to default if the creditors have little domestic political power or influence. Unless foreign investors have old-fashioned gunboats or a monopoly of new financing, for example, it is generally safer to default on foreigners than on locals. It is also easier to default on households via financial repression than it is to default on wealthy and powerful locals.

As you can see, the structure and ownership are almost more important than absolute debt levels themselves. This has very important implications, which we will go into as we go country by country around the world.

The insight that it is better to borrow in local currency versus foreign currency is critical. The United States and the United Kingdom, for example, are able to borrow exclusively in their own currency. This acts as an important shock absorber in bad times. It also creates an incentive to use devaluation and inflation as a means of financial repression. Devaluation hurts foreign bondholders, and inflation eases payments in your own currency in the short run.

Currency wars will create massive havoc in emerging markets with dollar-denominated debt. Think 1998 on steroids.

Markets are creatures of emotion and leverage. If either one turns negative in a world where deflationary pressures are building, then the only inflation we have seen – asset price inflation – will be threatened. Even with Godzilla-sized Japanese QE. Stay tuned.

New York and, well, New York

I look at my calendar and marvel that I only have one scheduled trip, to New York November 12-14, for the rest of the year, though it seems likely that I may go back to New York in early December. I’m sure that my reduced travel schedule will change (it always does), but for now I’m looking forward to enjoying the coming holiday season at home.

Even more so because this last road trip, while providing lots of fascinating conversation and new information, was exhausting. Normally jet lag is not that hard for me, but for some reason this trip just drained the batteries. I look forward to recharging them in the next few weeks.

In the past week I had conversations with between 40 and 50 serious market participants: investors and numerous hedge fund managers (some quite large), household-name economists (at least in my household), political leaders, central bank types, and so on, from all over the world. I’m struck by the fact that there is no single takeaway – no theme or meme that seems to dominate the current conversation. Perhaps that’s due to the diverse nature of my conversational partners and differences in venues, but there seems to be more confusion and frustration than you would expect as the market goes on making new highs.

During the week, in several venues (where, under Chatham House rules, I can discuss what was said but not the names of the participants), I was somewhat taken back by the level of confidence exhibited by the central bankers and major economists with regard to their ability to generate inflation when they so desire and to keep things on an even keel. They generally dismissed the notion that there has been inflation in asset prices, because that is something they desired; and as long as it is not general price-level inflation that is affected, they don’t worry. We all like it when our stocks and real estate go up. They almost seemed to assume that the recent asset price rises were the norm and that anything else would be an aberration. Has anyone noticed that margin debt in the US is at all-time high just as the markets hit an all-time high? Shades of 1873.

The level of complacency was somewhat unnerving, given my level of general alarm and concern. The present situation strikes me as being eerily similar to 1999 and 2006. And when I point to the data, the markets seem to tell me that I am too much concerned about the wrong things and not focusing on all the good things that are happening. But that’s also what the market was telling me in 1999 and 2006. As I keep saying, the market is not as smart or prescient as it is given credit for. In fact, the market missed just about every recession up until it became clear that recession was inevitable. Still, the market has a better track record than Federal Reserve economists do!

On a personal note, I really hate writing letters like this. I am actually an irrational optimist, at least in regards to the course of human affairs in technology and society. I am merely bearish on governments. I much prefer dwelling on the ethereal and fantastical visions of the future reality that we seem to be creating even faster than our human counterparts did in the 19 century. I think the potential for economic growth after we have hit the debt reset button is at least as great as we’ve seen in the past century. The trend toward “cheaper and more abundant” is a dominant force that we should all be cognizant of. Maybe after the next crisis we can decide to do something about debt and keep it from building up so that our children won’t have to deal with another debt supercycle crisis.

I will be hosting a small gathering this coming Tuesday on election night. I don’t know that much will change after this election, but perhaps it will be a preview of changes to come. Have a great week. And if you’re in the US and haven’t already done so, go vote. Unless you’re in Chicago, where no voter identification or proof of residency is needed, and then you should vote twice. I’m told that is the ancient and usual custom.

Your preparing for a sea change analyst,

John Mauldin

P.S. If you like my letters, you'll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.

Put Mauldin Economics to work in your portfolio. Your financial journey is unique, and so are your needs. That's why we suggest the following options to suit your preferences:

-

John’s curated thoughts: John Mauldin and editor Patrick Watson share the best research notes and reports of the week, along with a summary of key takeaways. In a world awash with information, John and Patrick help you find the most important insights of the week, from our network of economists and analysts. Read by over 7,500 members. See the full details here.

-

Income investing: Grow your income portfolio with our dividend investing research service, Yield Shark. Dividend analyst Kelly Green guides readers to income investments with clear suggestions and a portfolio of steady dividend payers. Click here to learn more about Yield Shark.

-

Invest in longevity: Transformative Age delivers proven ways to extend your healthy lifespan, and helps you invest in the world’s most cutting-edge health and biotech companies. See more here.

-

Macro investing: Our flagship investment research service is led by Mauldin Economics partner Ed D’Agostino. His thematic approach to investing gives you a portfolio that will benefit from the economy’s most exciting trends—before they are well known. Go here to learn more about Macro Advantage.

Read important disclosures here.

YOUR USE OF THESE MATERIALS IS SUBJECT TO THE TERMS OF THESE DISCLOSURES.

Thoughts from the Frontline

Follow John Mauldin as he uncovers the truth behind, and beyond, the financial headlines. This in-depth weekly dispatch helps you understand what's happening in the economy and navigate the markets with confidence.

Let the master guide you through this new decade of living dangerously

John Mauldin's Thoughts from the Frontline

Free in your inbox every Saturday

By opting in you are also consenting to receive Mauldin Economics' marketing emails. You can opt-out from these at any time. Privacy Policy