Felix Zulauf: “A Decade of Roller Coaster Markets”

-

Ed D'Agostino

Ed D'Agostino

- |

- December 9, 2022

- |

- Comments

Dear Reader,

This week, I spoke with Felix Zulauf, one of the top macro investors of our era. At Zulauf Consulting, he publishes a research service read by investment firms and family offices around the world. At our Strategic Investment Conference, he’s always one of the top-rated speakers.

In this week’s Global Macro Update, Felix and I talk about how the unstable geopolitical landscape is disrupting supply chains and setting markets up for dramatic changes... how to navigate the coming decade of roller coaster markets... the failed policies that could doom the US dollar as the world’s reserve currency (and what may replace it)… why 2024–2025 could usher in a calamity in our financial and economic systems... and much more.

You can access the full transcript of this week’s interview by clicking here.

The video of my full conversation with Felix Zulauf is below.

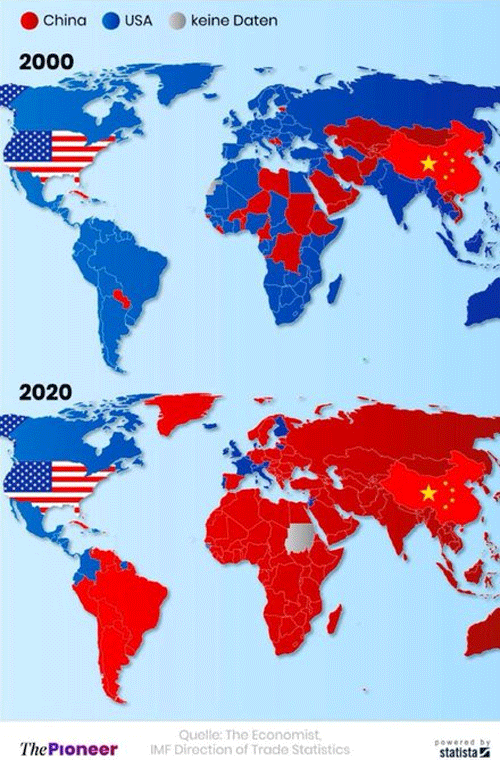

From Blue to Red: Striking Supply Side Shifts

At the turn of the century, America was the dominant supplier for the world, but in just 20 short years, China has taken that title. And, despite the naysayers, the trend continues.

In the last two decades, China’s trade with Latin America and the Caribbean has grown 26-fold, from $12 billion to $315 billion. It also overtook America as the top supplier in Africa, Asia, Australia, Europe, and South America.

The visual is truly staggering:

Source: https://www.nakedcapitalism.com/2022/11/chinas-making-new-big-moves-in-latin-america.html

How will this affect the US dollar hegemony? Is China the new Japan? Get the answers to these and many more questions in this episode.

But first, our market recap…

A Quick Look at the Markets This Past Week…

Gold was up .29% at $1,801.

Mortgage rates were down 2.47% at 6.33%.

The 10-year Treasury was down .43% at a 3.49% yield.

The S&P 500 was down 2.66% at 3,964.

Bitcoin was up .57% at $17,186.

Oil was down 10.37% at $71.69/barrel for WTI.

And now...

This Week’s Global Macro Update Interview

Click here or on the screenshot below to watch now…

Click the image above to watch Global Macro Update now

Alternatively, you can click here to read the transcript of this week’s interview.

For more details on Felix’s unparalleled macro insights, visit his website.

Thank you for reading Global Macro Update.

Sincerely,

Ed D’Agostino

Publisher, Mauldin Economics

If you prefer to listen to Global Macro Update, you can do so here:

Ed D'Agostino

Ed D'Agostino