Small Caps Are Starting to Work—and We’re Likely Still Early

-

Thompson Clark

Thompson Clark

- |

- Smart Money Monday

- |

- June 19, 2023

Over the past month, the S&P 600 Index has jumped over 8%—a sign that small-cap stocks are finally starting to work.

That’s slightly ahead of the S&P 500, which is up 7.6% over that same time frame.

I believe this is just the beginning. If history is any guide, the S&P 600 has a lot further to run.

That’s because small caps are still cheap—on both a relative and absolute basis.

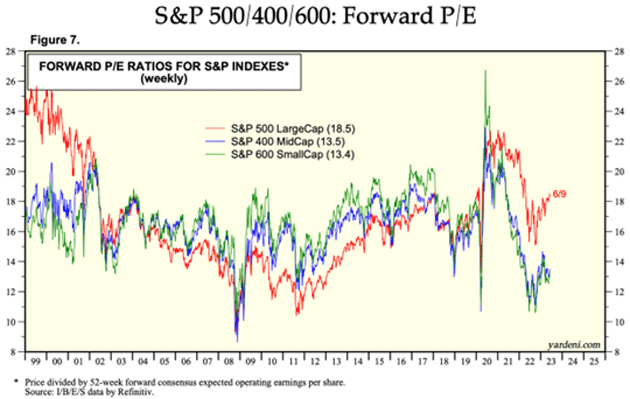

On an absolute basis, the S&P 600 trades for just 13.4X forward earnings. On the other hand, the S&P 500 trades for 18.5X forward earnings—a massive spread in valuation.

Looking back over the past 20 years, it’s quite rare for the S&P 500 to trade at such a steep multiple compared to the S&P 600.

Source: Yardeni Research

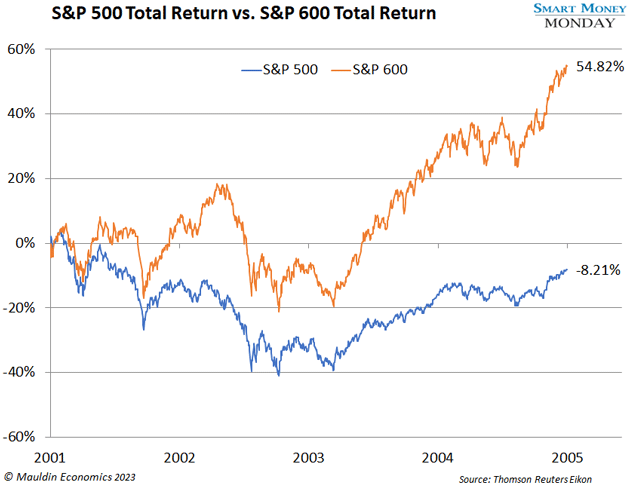

The last time the spread in valuation was this blown out (with large caps benefiting) was right around the dot-com boom.

Following the dot-com bust, small caps outperformed large caps in a dramatic fashion:

So, here we are. And again, if history is any guide, small caps are the place to be.

But why is the valuation spread so blown out?

Indices: Looking Under the Hood

The main culprit for the valuation disconnect is tech. Or, as it’s formally called, information technology (IT).

Information technology makes up 28% of the S&P 500 and trades at a lofty 27X earnings. For the S&P 600, IT has a 14% weight (half its S&P 500 weight) and trades for 20X earnings.

The other issue is the top-heavy nature of the S&P 500. Seven stocks make up 27% of the entire index:

Source: Thomson Reuters Eikon

In 1999, right around the peak of the dot-com boom, the situation was somewhat similar. In the top 10 of the S&P 500, you had companies like Microsoft, Cisco, Intel, Lucent, IBM, and—yes—America Online.

So, the S&P 500 is top-heavy with a handful of fully valued tech stocks, and the broader index is heavily weighted toward high-multiple tech companies.

Like what you're reading?

Get this free newsletter in your inbox every Monday! Read our privacy policy here.

Specifically with financials: We know what’s happened so far this year. There have been multiple bank failures, and sentiment remains poor… probably for good reason.

As for industrials, these are quality businesses but, by their nature, can be cyclical and lower-growth. So, with the higher weight, it drags down the S&P 600 multiple, as these companies are not typically highly valued.

|

Thompson Clark recently told readers of his investment newsletter to double their position in one of his favorite ideas. The company is returning tons of cash to shareholders with buybacks and dividends, and the future is extremely bright. This is only the third time in his career in the newsletter business that he’s told readers to double down on an existing name. His hit rate on the prior two calls is 100% and he’s hoping to keep that trend going. |

Check Your Small-Cap Allocation

I’m not suggesting you short the S&P 500 and go long the S&P 600.

What I am suggesting is that, regardless of what happens to the S&P 500, its small-cap cousin—the S&P 600—is quite cheap.

Again, it trades for 13.4X forward earnings. If you invert that, that implies a 7.5% earnings yield. The US 10-year Treasury yields 3.8%, giving you a nice spread over a risk-free asset with further earnings upside from earnings growth.

Most investors I speak with are under-allocated to small caps. The view is that small caps are riskier than large caps. But at just 13.4X earnings, which is a historic anomaly, it seems you’re getting well compensated for taking this risk.

Are they really riskier? Well, companies in the S&P 600 must make money—it’s one of the criteria for entry. These aren’t profitless tech companies. They’re moneymakers.

And these moneymakers are cheap right now.

So, check on your investment allocation. Small caps deserve a look. As for the specific weight you should put into small caps, that’s totally up to you and your financial situation. But from my perspective, the weight certainly shouldn’t be 0%.

Thanks for reading,

—Thompson Clark

Editor, Smart Money Monday

Thompson Clark

Thompson Clark