- December 6, 2023

The End of The 10th Man—and a New Beginning

Effective immediately, I’ll be spinning out full-time into my new platform, Jared Dillian Money. Sign up here.

Read moreFundamental investing and technical analysis are vulnerable to human behaviour—but human behaviour itself is utterly predictable and governments' actions even more so.

Jared is no longer writing the 10th Man.

To follow him and all of his musings you can subscribe to The Jared Dillian Letter here.

Effective immediately, I’ll be spinning out full-time into my new platform, Jared Dillian Money. Sign up here.

Read moreWouldn’t it be nice to be making money when everyone else is losing it?

Read moreUp until recently, the housing market was holding up reasonably well, but prices are starting to come down.

Read moreIf you watched the movie World War Z, you’ve heard of "the 10th man." He’s the odd one out, the devil’s advocate, the one who—for the greater good—is obliged to disagree when everyone else agrees.

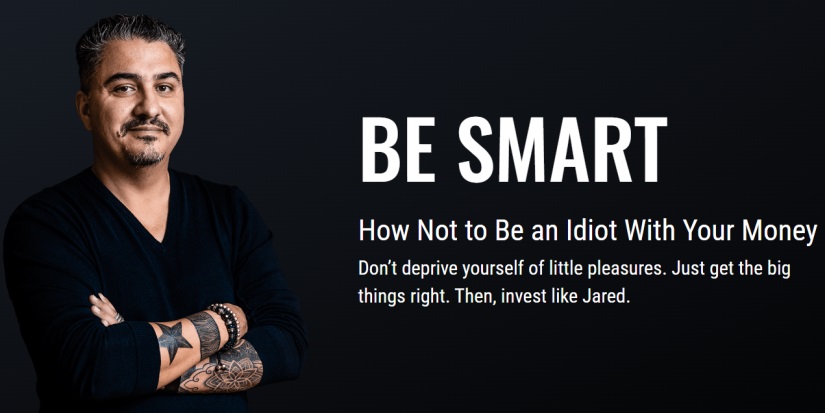

Jared Dillian is that 10th man. He’s "the ultimate contrarian," and following his intellectual adventures is a true thrill ride for every investor. A master in behavioral economics, Jared probes the mind of today’s market to gauge the trends of tomorrow. Sign up for his weekly missive and don’t miss another one of his captivating conclusions.

Published every Thursday.

Jared Dillian is one of the industry's most original, entertaining, contrarian voices. He is a master of market psychology and has been called "the Dr. House of trading," with a staunch following ranging from casual investors to professional traders and hedge fund managers.