Don’t Miss This Overlooked Watchlist Indicator

-

Kelly Green

Kelly Green

- |

- August 20, 2025

- |

- Comments

Last week, I was reviewing an updated list of Dividend Aristocrats to see if anyone had been added or axed. The official rebalancing happens in January, but S&P Global will announce changes during the quarter if warranted, usually around the time that earnings are released.

If you’re not familiar with Dividend Aristocrats, it’s an elite group of companies officially formalized in May 2025 when S&P launched the S&P 500 Dividend Aristocrats index. To qualify, a company must:

-

Be in the S&P 500 Index (the 500 largest US companies by market cap)

-

Have increased its dividend for at least 25 consecutive years

-

Have a market cap of at least $3 billion

-

Have maintained an average daily trading volume of at least $5 million for the three months prior to the rebalancing date

Those are the minimum requirements. Some Dividend Aristocrats have raised their dividends for over 60 years. Industrial giant Dover Corp. (DOV) has been a member of the club for 70 years!

The current list has 69 companies with current yields ranging from 0.4% to 5.9%. And they cover ten of the 11 S&P market sectors. This is where I found something unexpected.

The missing sector, I would argue, will be one of the most important to the future of technology no matter where it’s headed. Yet, it has no representation on the Dividend Aristocrat list.

|

It’s Not What You Think

The most obvious guess would be the Information Technology sector. Once a tech company pays all of its bills, it then has to decide what to do with the profits. It can save them for a rainy day, reinvest them back into the business, or pay them out to shareholders as a dividend.

A company in any growth phase will reinvest a large chunk of profits back into the business. This is especially true for a tech company that must develop new ideas to stay ahead of its competitors.

International Business Machines (IBM) is the lone tech company in the IT sector with 31 years of higher dividends. We banked a quick 43% gain on IBM in Yield Shark, but its current yield is too low for a closer look. Plus, we sold because I’m concerned its future plans will require big investment that could slow dividend hikes.

So what sector is missing?

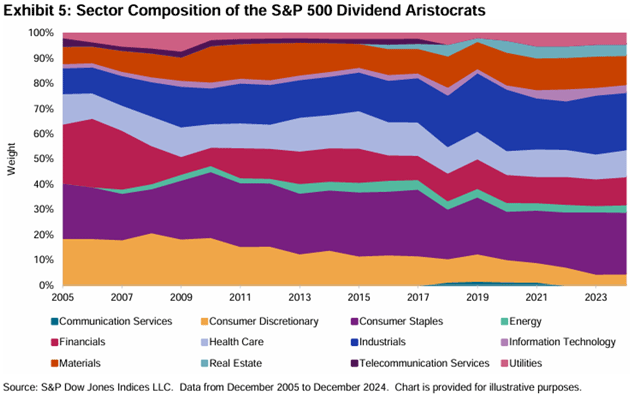

Source: S&P 500 Dividend Aristocrats: The Importance of Stable Dividend Income

Communication Services. This chart shows 12 sectors because Telecommunication Services was renamed Communication Services in 2018.

No matter what the name, Communication Services disappeared in 2022 when AT&T (T) cut its dividend by nearly half following the spin-off of WarnerMedia. Before that, it boasted 36 years of dividend increases. We bought our position in Yield Shark shortly after and are up 97% including dividends.

Like what you're reading?

Get this free newsletter in your inbox every Wednesday! Read our privacy policy here.

Because it’s been in a transformation and growth phase which has diverted cash away from paying higher dividends to investors.

Verizon (V) has taken a different approach. Leaning into customer loyalty, the company has chugged along, raising its dividend for the past 20 years. It’s the most likely to bring a Communication Services company back to the Dividend Aristocrats list.

I’m not sold on Verizon… but this train of thought led me to create a whole new watchlist.

Dividend Aristocrat Contenders

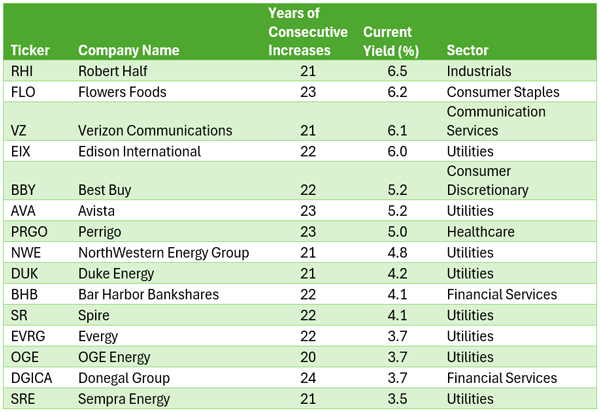

I decided to build a list of companies with at least 20 years—but below the magic 25 years— of dividend increases. It was easier than I first imagined. Rather than digging around on the internet, I asked Claude.ai to create a list for me. The result was 61 companies.

I still don’t have 100% faith in AI, so I can’t say the list is perfect. It does, however, show how quickly you can narrow down a large pool of stocks. In the process, you might discover some companies you otherwise would not.

For this new watchlist, I did not consider the other Dividend Aristocrat requirements. About half of the companies are not in the S&P 500, which would disqualify them from the coveted list. That’s the case for Enterprise Products Partners (EPD), even though it has 26 straight years of higher dividends. Yet, analysts still point out that it has hit the 25 year target.

I then whittled the list down to 15 companies with a current yield above 3.5%.

You’ll see Verizon made the cut. Edison International (EIX), Flowers Food (FLO), and VZ are companies I follow closely. And I’ve been on the fence about Best Buy for the past two years. The rest of the names I only know in passing. Armed with my new watchlist means I need to take a deeper dive into these companies.

What do you all think about this list? Do you have any of these companies in your long-term holdings? Do you have any other “strange” or “unique” watchlist filters? Send me a note and let me know.

|

For more income, now and in the future,

Kelly Green

Kelly Green

Kelly Green