The wealth of the top 1% hit a record $44 trillion at the end of 2023. That was an increase of over $2 trillion due to the year’s stock market rally. Yes, $2 trillion in added wealth simply from owning stocks.

Now, at the end of the first quarter of 2024, the S&P 500 is up another 11%. And it has hit 22 new record highs so far this year.

The wealth of the middle class and lower-income Americans is generally tied to wages and home values. Households in the top one-third of the income distribution own the bulk of stock holdings. But really no matter where you fall on that income spectrum, you should have money in the market.

I know that some of my readers have a lot of money in the market. But I also know that we have some beginners here as well. And this issue of Dividend Digest is aimed a little more at my beginners. (It’ll also be a good one to forward to anyone you know making this excuse to not invest.)

Put Money in the Market When You Can

I have a lot of hobbies and interact with a lot of different people within the scope of a week. And what I do for a living comes up in conversation. After I’ve assured them that I don’t specialize in cryptos, mutual funds, or small caps, they all ask me similar questions. The most common is how much money they need to get started.

I’m not sure where people get the idea it takes $10,000 or even $1,000 to get started. Most people want to get in the market, but they think they can’t until they have some arbitrary amount of money.

I’ve shared a few of my favorite tickers here in Dividend Digest. They include Enterprise Products Partners (EPD), AT&T (T), and LyondellBasell (LYB). They currently trade at $29.37, $17.50, and $102.07, respectively. When you know you can buy one share of stock to get started, the first two become incredibly affordable.

So, you could start investing with as little as $17.50. I know it sounds cliché, but that’s less than 2 Starbucks lattes or a sit-down lunch here in South Florida. It’s a lot easier to find this amount in your budget than a three- or four-figure sum.

Of course, you’ll earn more in dividends the more money you have invested.

On that one share of AT&T, your payout will be 28 cents every quarter. That’s an annual yield of 6.3%. As you put more money in, you’ll see those dividend payouts get bigger. But you have to take the first step to get started. And you can do that with just one share.

A Proven Strategy

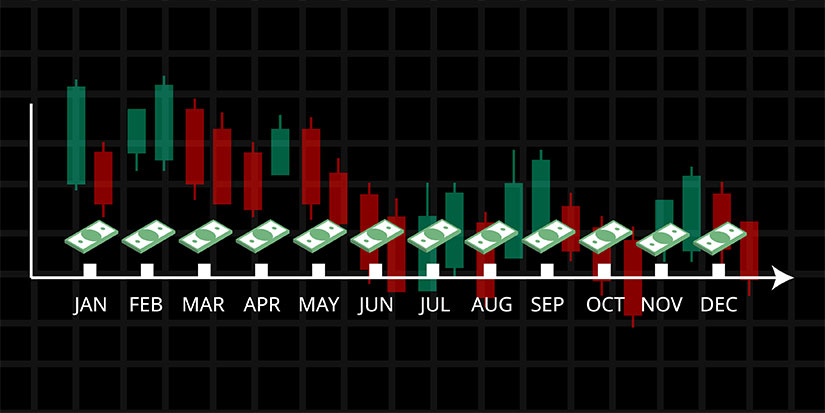

We all know the best time to invest is when prices are low. But trying to time the market can be a full-time job. And the market can stay irrational longer than you can stay patient. There is no guarantee you’ll be successful.

Instead of worrying about second-guessing stock prices, there’s a better way to play. The strategy is called dollar-cost averaging (DCA).

It’s the practice of buying multiple, fixed-dollar amounts of the same stock spread over regular time intervals. Investors like Warren Buffett have successfully used DCA for decades. But it can work over many different periods of time.

As the markets go up and down, sometimes you will pay a little more for shares, and sometimes you’ll pay a little less. Let’s use AT&T as an example.

Last year, on April 20, AT&T shares slid $2, and you might have been tempted to think that was a good entry price. But shares would go even lower… sending its dividend yield higher.

If you had bought one share every Thursday since then you’d now have 50 shares that cost you roughly $800. Had you bought those 50 shares on April 20, it would have cost you $882.50. And spending less on shares means you’re earning a higher dividend yield.

So how does this help you?

Set a goal for yourself to invest on a regular schedule. Maybe it’s 1 share every week. If you get paid every other week, maybe it’s two shares every payday. It’s more manageable this way than saying you can’t invest until you have some arbitrary amount of money.

Getting started and sticking to a routine are the most important steps. Buy one share of AT&T a week, and before you know it, you’ll have 52 shares for a total investment of almost $1,000—now that’s a great start!

Another hurdle to getting started is feeling unsure about what stocks to own and when to own them. Investment education is as important as starting your investing journey. Attending our 20 anniversary Strategic Investment Conference will equip you with the knowledge to buy and sell with confidence. You can learn about all our presenters and featured sessions here. I hope to see you there.

For more income, now and in the future,