Is This 6.7% Yield Too Good to Be True?

-

Kelly Green

Kelly Green

- |

- July 5, 2023

- |

- Comments

I always keep an eye on Dividend Aristocrats and Dividend Kings, as these companies have proven dividend track records.

They prioritize returning value to shareholders through dividends and, more important, have delivered increased payouts for an extended period through a variety of markets and macroeconomic landscapes.

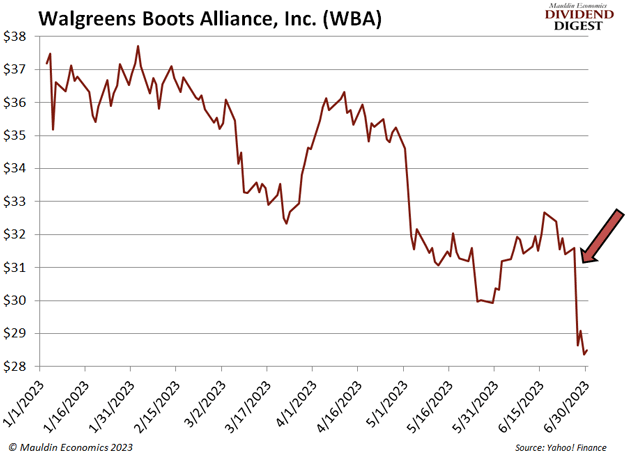

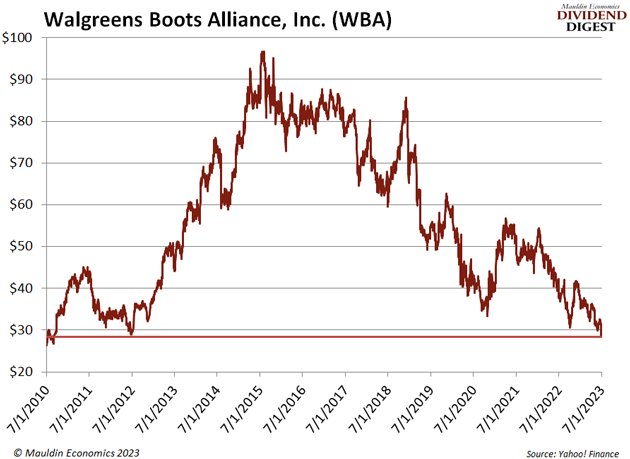

Well, last Tuesday, Walgreens Boots Alliance, Inc. (WBA)—a Dividend Aristocrat with 47 years of dividend increases—was the worst-performing stock in the Dow and the S&P 500 after shares dropped 9%.

And after one of my readers, Robert, wrote in to ask me if it was time to buy WBA, I had to take a closer look…

The Highest Yield Among Dividend Aristocrats

Shares of Walgreens haven’t traded this low since 2010.

This isn’t the kind of price movement we usually see from Dividend Aristocrats. These are generally big, boring, stable dividend payers that move little day in and day out.

WBA has the history of dividend stability, and the plunge in stock price could be creating a once-in-a-decade buying opportunity.

Remember, if the amount of the dividend stays the same as the stock goes down, the yield goes up.

At today’s numbers, we’re looking at a 6.7% yield. That’s the highest yield among Dividend Aristocrats.

What Happened Last Week?

Although many companies align their fiscal calendars with the Gregorian calendar, that’s not always the case. WBA’s fiscal year ends on August 31, meaning its quarters would end November 30, February 28, May 31, and August 31, respectively.

Last Monday, the company announced its Q3 results.

CEO Rosalind Brewer set the tone for the call immediately:

I’d like to start today’s call with an acknowledgement that our performance in the third quarter did not meet our overall expectations, and we are disappointed to have to change our fiscal 2023 guidance.

For the quarter, sales were solid, growing almost 9% in constant currency. And US retail digital sales were still growing, with 3.7 million same-day pickup orders. Ultimately, however, WBA is still struggling with margin pressure and external factors.

The company saw lower-than-expected demand in both COVID vaccines and testing. And it saw a weaker allergy season as well. Even though many of the products and services provided by the retailer are considered consumer staples, WBA is seeing a pullback on discretionary and season spending.

The worst part about these headwinds is that they’re likely to extend into future quarters… even into 2024. As a result, management slashed the full-year earnings-per-share guidance to $4–$4.05. This is down from the previous $4.45–$4.65.

Like what you're reading?

Get this free newsletter in your inbox every Wednesday! Read our privacy policy here.

Source: Walgreens Boots Alliance

This plan was originally announced in October 2021. Yes, the headwinds have changed slightly, but I would expect to see this effort paying off a little more by now.

Is Now the Time to Buy?

Walgreens has been around since 1901 when Charles R. Walgreen purchased the Chicago drugstore where he had worked as a pharmacist. The brand has evolved into the current global innovation in retail pharmacy.

There are currently about 13,000 locations under the portfolio of Walgreens, Boots, Duane Reade, the No7 Beauty Company, Benavides, and Ahumada. Around 75% of all Americans live within five miles of a Walgreens store.

There’s something to be said about surviving and thriving through the events of the last century. And it’s always a positive in my book to have the Dividend Aristocrat or Dividend King title.

That said, there is never a 0% chance of a dividend cut. Earlier this year, we saw both Intel Corp. (INTC) and VF Corp. (VFC) cut their dividends and lose these royal titles. This was after continuing to pay through the pandemic.

There is a point when continuing to pay out a dividend can come at the cost of future growth. And as WBA’s management repeatedly said on the call, it’s committed to paying out the dividend. This could blow up on them in a few years.

We should expect to see the next dividend increase in the September payment, which is usually declared the second week in July, but I’m unsure if the dividend increase will offset the current investor skepticism from the call last week.

Generally, Dividend Aristocrats fall in the Bedrock Income category. Their safety allows for a “set it and forget it” mentality, but that’s not the case here.

Believe me, I know that 6.7% yield looks tempting. If you’re going to add it to your portfolio, make sure you treat it as a Current Yield position. This means you’ll want to keep a close eye on it and potentially use a trailing stop as shares recover to protect any gains.

For more income now and in the future,

Kelly Green

Kelly Green

Kelly Green