The Best Sector for 2024: Consumer Discretionary

-

Kelly Green

Kelly Green

- |

- December 6, 2023

- |

- Comments

Were you standing in line to grab a new television on Black Friday? How about sitting at your keyboard on Cyber Monday?

The five days from Thanksgiving through Cyber Monday separated $38 billion from the wallets of consumers. Some of the top sellers were Hot Wheels, Xbox, televisions, and small kitchen appliances.

On Cyber Monday, sales hit a record $12.4 billion. That’s up 9.6% from last year, making it the biggest online shopping day ever. Online shopping is a huge part of Black Friday as well, raking in a record $9.8 billion online this year.

A closer look at the data shows sales growth would have been even stronger had it not been for aggressive price reductions this year. Over the five-day shopping bonanza, buy-now-pay-later (BNPL) options contributed $940 million to online spending. That’s a 42% jump above last year. This tells us that shoppers are on the lookout for deals. And when they find them, they are willing to buy.

Even if shopping doesn’t continue at this pace, it’s probably going to be a better-than-expected Christmas season. Here’s why that matters to us.

Follow the Consumer Dollars

Yes, we have to follow the money.

Consumers only have a finite amount of money to spend. Even using credit and BNPL has its limits. Spending can only go so far. When we buy a stock, we are buying a piece of a business, and we want businesses with customers ready to spend. That is why consumer sentiment is as important as investor sentiment.

-

Investor sentiment is just consumer sentiment as it relates to buying stocks.

We have to follow the consumer dollars to know where the money is flowing—then invest in companies that are collecting that money and are solid businesses themselves.

As I’ve been saying for the entirety of 2023: I really need to get more consumer discretionary exposure in my portfolio. I do have a few names in my personal portfolio in smaller amounts, but I don’t have a strong favorite right now.

If you asked me for my favorite consumer staple, I’d have a quick answer. The same goes for my favorite real estate and oil exposure. But with consumer discretionary, I’d point to my ever-growing watchlist and rattle off some reasons why it’s not quite the time to buy.

Analysts are still throwing around the R-word (recession). High mortgage rates are slowing housing demand. And the dollar just doesn’t stretch as far as it once did. All of this argues for consumer dollars used for staples and less for discretionary items. But there is a larger story for this group of stocks.

|

Upgrade your subscription to Yield Shark: Collect income, build a legacy of wealth, and invest stress-free with Dividend Digest editor, Kelly Green. |

Perspective Is Everything

I thought we would see the post-COVID new normal emerge this year. As we sit on the cusp of 2024, I can say we’re still in the process of getting there. And I can say that it’s still important to look at what has happened in the markets over the past four years.

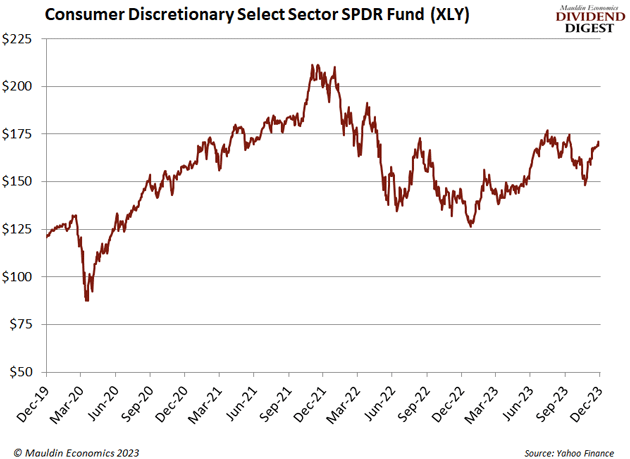

To do that, let’s look at a chart of the Consumer Discretionary Select Sector SPDR Fund (XLY). It’s an ETF that holds US large-cap consumer discretionary stocks. Here’s what the fund did before, during, and after the pandemic:

Like what you're reading?

Get this free newsletter in your inbox every Wednesday! Read our privacy policy here.

By 2022, kids were headed back to school and everyone had new couches. Discretionary spending slowed as the world began to settle into a new normal. Retailers struggled to find the right levels of inventory, and producers struggled to maintain their margins as costs were rising.

So far, the sector is up 31% from its 2022 lows. We are now at the point where we will start to see the winners separate from the losers. As this happens, there is money to be made.

It’s time to get out your watchlist and make sure it’s up to date. Start looking at the holiday sales your companies are offering. We know that’s where the dollars are heading right now. And make sure you’re ready for those Q4 earnings. This is the moment to read between the lines and pick our winners for 2024.

For more income, now and in the future,

Kelly Green

Kelly Green

Kelly Green