You Don’t Have to Trade Your Yield for Safety

-

Kelly Green

Kelly Green

- |

- February 1, 2023

- |

- Comments

It happened again. Another road trip expanded my stock watch list.

Last week, my other half competed in the International Blues Challenge in Memphis, Tennessee. So, we loaded up the van, and off we went… and my research was again inspired by “that looks interesting” curiosity.

We stopped for dinner in Tupelo, Mississippi, and drove past this sign:

Source: RoadsideAmerica

Vintage neon gets me every time. And now I had to know the story behind the city’s “first” claim to fame.

Turns out that in 1934, Tupelo became the first city to purchase electric power from the Tennessee Valley Authority (TVA) utility company. The TVA still exists today and electrifies all of Tennessee and portions of six other states. However, it’s federally owned.

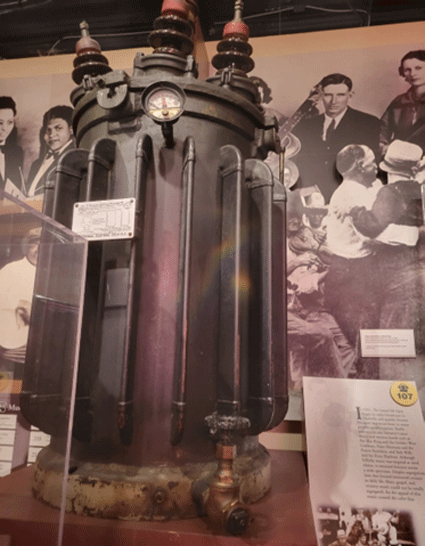

The next day, I was wandering through the Memphis Rock ‘n’ Soul Museum, and staring at this piece of history:

It is a part of the original Grand Ole Opry radio transmitter which was made by General Electric Company (GE). I was drawn to it by my love for classic country music, and the fact that GE is a dividend payer I’ve followed for most of my career.

Although GE has paid a dividend for over 30 years, today’s yield is a meager 0.39%. So meager, it wouldn’t be worth my time to take a deeper dive into GE’s fundamentals.

Regardless, the TVA and GE backstories on these two tourist oddities got my brain thinking about how we could best invest in power generation… and whether there was a way we could collect over 4% from this theme.

Utilities Are Great for Safety—but You Still Gotta Get Paid

Last week, we talked about the concept of “utils.”

It’s a way to measure the value or benefit—the utility—we get from something. When we buy things such as clothing, lunch, or a fancy coffee, it’s a choice partly made because we felt we got our money’s worth.

The same utility applies when buying dividend stocks. We need to collect enough income as a fair trade-off for having our money tied up in a stock.

Utilities are some of the safest stocks to own during a recession. It doesn’t really matter what’s going on in the economy, you will still need water and power. You’ll cut back on other things, but you’re not going to call the power company and cancel your service.

As you’d expect, safety comes with a compromise. Investing in a utility company isn’t going to give you the next triple-bagger.

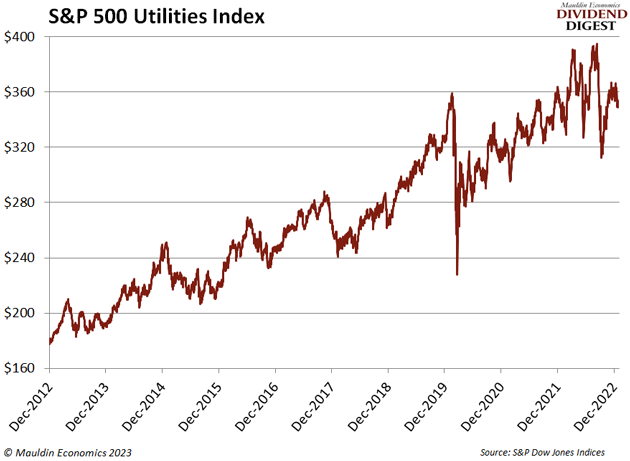

This chart of the S&P 500 Utility Index shows the slow and steady gains you get from this sector.

Like what you're reading?

Get this free newsletter in your inbox every Wednesday! Read our privacy policy here.

-

Because of their low potential for big capital gains, we need to lock in at least a 4% yield on utility companies.

I don’t have a hard-and-fast rule on minimum yield. But I do have rough guidelines I follow to get the “utils” out of my money. Even with my hopes of a higher dividend, I did find two energy companies worth looking at right now.

Two 4% Yielders to Calm Recession Nerves

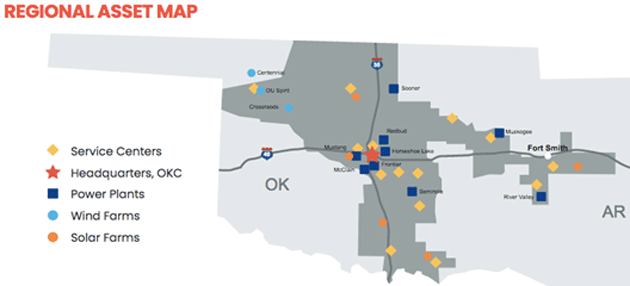

Formed in 1902, OGE Energy Corp. (OGE) was the first to successfully “electrify” Oklahoma. It provides regulated electricity to 900,000 customers in Oklahoma and western Arkansas.

Source: OGE Energy

OGE has a thriving service area and customer growth. Its third-quarter 2022 earnings of $1.31 per share left plenty of room to cover its $0.40 per quarter dividend. At today’s share price, that’s an annualized yield of 4.1%.

My second energy watch list pick is a leader in the renewable energy industry.

Clearway Energy, Inc. (Class A Shares) (CWEN-A) has a diverse portfolio of wind, solar, and conventional energy projects. Over 70% of its energy generation is from renewables. That positions the company as a frontrunner in the transition to a clean energy powered world.

The company cut its dividend in 2019, but then its payment started to climb again in 2021. Today, the quarterly dividend is higher than the one that was paid before the cut. And the company just raised its dividend another 2%.

At today’s share price, the stock yields 4.6%.

Neither company has released fourth-quarter 2022 earnings. We probably won’t see them until the last week of February.

These two companies look like great ways to collect safe income for the foreseeable future.

For more income, now and in the future,

Kelly Green

Kelly Green

Kelly Green