America’s reopening… is your money in the right spot?

- Stephen McBride

- |

- March 29, 2021

- |

- Comments

This article appears courtesy of RiskHedge.

“COVID is a hoax”…

I walked past a group of anti-lockdown protesters shouting and holding signs in Dublin last week.

The government here just announced lockdowns will extend into summer... and people are angry.

If you’ve been reading RiskHedge, you know I was born and raised in Ireland.

I used to split my time between my family’s home in Dublin, and America—where my RiskHedge team is located.

But I’ve been locked out of the US for more than a year now... and I sure miss it.

While things are rapidly improving and opening up in America... they’re as bad as ever in Ireland.

You still can’t eat out, or get a haircut. Even home renovations are outlawed.

It’s the same across Europe. Italy just closed its schools again. Germany and France have re-entered lockdown.

- Did America botch its reopening too?

Folks who watch too much cable news will tell you the US blew its COVID response.

But unlike most other countries, America moves closer to fully reopening every day.

More Americans have now received at least one vaccine dose than tested positive for COVID.

Every person in the US who wants the “jab” will be able to get it by May 1.

And Americans are itching to get back to business...

Over one million passengers flew through US airports each day for the past two weeks. The TSA screened 1.5 million flyers last Sunday, the highest mark since COVID hit.

Hotel occupancy stands at its highest level in a year.

Heck… even Disneyland in lockdown-obsessed California is reopening next month.

As I explained in my recent “never bet against America” essay... folks love to hate the US.

Here in Europe, I often hear senior people arrogantly say, “We’ve handled COVID better than America.”

All I can do is chuckle at this nonsense...

The fact is, America will be the first large country to fully reopen. And just like every crisis over the past century, it will emerge from COVID stronger than ever before.

- Post-COVID America will be spectacular.

You’re going to hear about the reopening from every possible angle on CNN and Fox News.

But that’s not the real story.

Ask yourself: Why are folks so excited, even giddy, to put COVID in the rearview?

It’s because there’s a wad of cash burning a hole in Americans’ pockets.

In short, Americans have never had more money than they do today.

This may sound hard to believe, given that we’re still technically in a recession...

But the data is clear: US household net worth hit an all-time high of $130 trillion last quarter.

And it’s not just the rich getting richer.

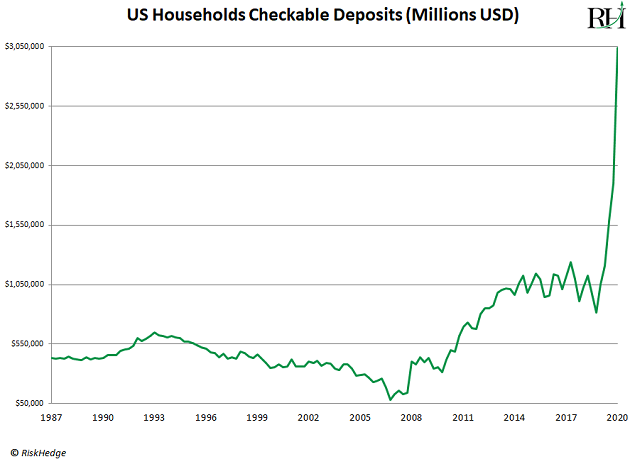

Americans have a record $3 trillion tucked away in checking accounts today.

That’s an unfathomable amount of money. It has no precedent in American history.

The previous record was $1 trillion at the end of 2019, as you can see here:

And get this… Americans owe less credit card debt today than they did in 2007.

In fact, monthly debt payments as a share of income have declined to their lowest levels ever.

In other words: Americans are spending less money paying back loans on houses… cars… and college than at any other time on record.

All while Americans have more money than at any other time on record.

It’s an unprecedented mix. We’ve never seen anything like it.

- Okay Stephen… what does this mean for my money?

Think about what makes you truly happy.

I doubt it’s that new car smell, or a crisp $5,000 suit.

It’s “experiences” like vacations with your kids and laughing over dinner with friends.

Most folks have been deprived of this feeling for a whole year. We’ll likely see the strongest demand ever for vacations this year. And good luck getting a table at your favorite restaurant on the weekends.

The thing is… we all know airplanes and hotels will be packed this summer.

Investors have already bid up these “reopen” stocks in anticipation.

For example, there hasn’t been a live concert in over a year. Ticketmaster owner Live Nation’s (LYV) sales collapsed 85% last year. Yet its stock just hit record highs.

Piling into “reopen” stocks is obvious. It’s what everyone else is doing.

And following the crowd is rarely a good idea in investing.

Instead you should ask: What else will boom as America reopens?

Let me remind you one more time: Americans have never had more money than they do today. They’ve never had more disposable income than they do today.

The largest economy on earth is reopening... with its citizens richer than ever before.

Make no mistake: Many stocks will be left behind. The obvious “reopen” stocks are the wrong way to play this.

But my research shows that one overlooked group of stocks is set to soar in April, May, June, and the rest of this year.

On March 29, at a special event called America’s Final Tech Panic, I’ll walk you through exactly what to do to profit from it.

And I’ll keep it simple. All you have to do is take a small slice of your portfolio and move it into the one investment that’s likely to return 100%, 200%, or possibly much, much more if you’re willing to get aggressive.

This will be—hands down—our most important event of the year.

There’s a lot at stake. I’ll even give you my #1 stock to own in 2021 no matter where the markets go. This is unlike anything we’ve ever done at RiskHedge. So I hope you can join me.

To lock in your spot (we expect more than 15,000 registrants), go here now.

Stephen McBride

Editor — Disruption Investor

Stephen McBride is editor of the popular investment advisory Disruption Investor. Stephen and his team hunt for disruptive stocks that are changing the world and making investors wealthy in the process. Go here to discover Stephen’s top “disruptor” stock pick and to try a risk-free subscription.

|

This article appears courtesy of RH Research LLC. RiskHedge publishes investment research and is independent of Mauldin Economics. Mauldin Economics may earn an affiliate commission from purchases you make at RiskHedge.com