I’m in the Business of Predicting What Will Make Money

- Jared Dillian

- |

- September 29, 2020

- |

- Comments

I was involved in a political discussion recently after the death of Ruth Bader Ginsburg.

The other person, a liberal, said that Republicans should refrain from confirming a Supreme Court justice until after the inauguration.

He asked me, “What do you think they should do?”

I said, “I’m not in the business of predicting what should happen, I’m in the business of predicting what will happen.”

I write investment newsletters—I am not in the business of determining right or wrong. I am in the business of determining what will make money.

Oftentimes, I predict things that I personally disagree with. Most of the time, actually.

Improbable Events

Ninety-nine percent of people conflate what they think should happen with what they think will happen. For example, there are people who believe that Donald Trump will win in a landslide. These people really like Trump.

Who knows—that may, in fact, happen. But it’s yet another example of confusing will and should.

That example is an interesting one because there is zero evidence to support the claim that Trump will win in a landslide. Biden is ahead in the polls.

Now, there is evidence that Trump voters are systematically undercounted—it happened the last time around—but it doesn’t get you to “landslide.”

I figure it’s about a coin toss, which is actually the worst-case scenario—the scenario that I am positioned for in my portfolio.

Speaking of other improbable events, let’s talk about energy stocks.

The Best-Performing Sector

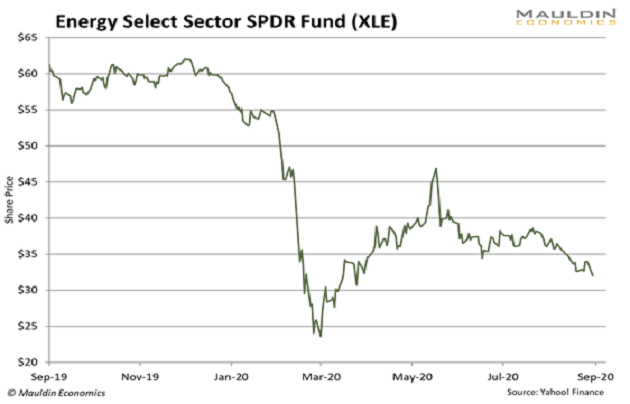

Energy stocks aren’t doing so well, which is a classic understatement.

British Petroleum recently came out with its own very dire predictions for energy demand. The company is rapidly diversifying into alternative sources of energy, as are a lot of other oil majors.

We’ve had newspapers and magazines predicting the death of fossil fuels. And now we have this: an S&P 500 ex-fossil fuels ETF. Interesting time for that product, no? When energy stocks are on the lows?

Also, the CBOE just listed options on something called the CBOE S&P 500 ESG Index. The hits just keep on coming.

I have zero evidence that energy stocks will go up. There is all the evidence in the world that they will go down.

And yet I believe that energy will be the best-performing sector of the next 5–10 years.

Again, I am in the business of predicting what will happen, not what should happen. It’s a simple matter of supply and demand.

Once we get to the other side of COVID, demand—which had dropped by 20%—will pick up dramatically. And supply will be constrained as the entire sector pivots away from fossil fuels. Who knows—if Joe Biden gets elected, he might ban fracking.

But if you dislike fossil fuels because of climate change, you probably think they’ll continue to go down and eventually disappear. But then you would be predicting what should happen, rather than what will happen.

Predicting that energy will rally is a bit like predicting Trump will win in a landslide. There is no evidence for it, but it is the outcome that would surprise everyone the most, which is usually what happens.

The Black Swan

My favorite vignette in Nassim Taleb’s book, The Black Swan, comes from some consulting work he did for a casino.

The casino spent vast sums of money on surveillance trying to catch cheaters. But the PNL swings from a few whales vastly outweighed whatever green chips the card counters were making off with.

All the big risks to the firm came from outside its sophisticated models.

- The casino lost $100 million due to a tiger mauling—remember Siegfried and Roy?

- A disgruntled contractor placed explosives around the casino with the intention of blowing it up.

- A cage employee with the responsibility of mailing in 1099-G forms to the IRS inexplicably hid them under his desk, and the casino almost lost its license.

- The casino owner’s daughter was kidnapped and a ransom had to be paid, which was done out of the casino’s own cash position.

2020 has seen one of the greatest stock market crashes of all time, and perhaps the greatest recovery. None of this, including a killer virus, was in any equity strategist’s end-of-year prediction.

Investors should focus on what will happen, rather than what should happen. And they should pay attention to when the market compensates them with odds for statistically improbable events.

If Trump wins in a landslide, I hope nobody is surprised by it, whether you wanted it to happen or not.

Jared Dillian is an investment strategist at Mauldin Economics, a former head of ETF trading at Lehman Brothers, and the author of The Awesome Portfolio. Subscribe to his weekly investment newsletter, The 10th Man, and listen to his daily radio program, “The Jared Dillian Show.” You can follow Jared on Twitter @dailydirtnap.