It’s Time to Get Excited About Gold

- Jared Dillian

- |

- May 4, 2020

- |

- Comments

The average Wall Street trader believes all kinds of crazy stuff.

One long-running theory claims that the federal government has something called the Plunge Protection Team, or the PPT. If the market drops toward the end of the day, the PPT swoops in and rallies the market before it closes.

Or, so the story goes. I’ve never believed a word of it.

There’s a similarly crazy conspiracy theory element among gold investors. But you don’t have to believe a bunch of crazy stuff to own gold.

And you absolutely do want to own some gold, especially right now...

The Gold Standard Is Never Coming Back

Long ago, the US had a gold standard. This meant people could exchange their dollars for a fixed amount of gold.

The US dropped away from a strict gold standard in the 1930s, and President Nixon abandoned it altogether in 1971. Since then, the dollar has been a “fiat currency.” Meaning its value isn’t tied to anything tangible like gold. Those little green pieces of paper, and the digits in your bank account, are only “money” because the US government says they are.

A gold standard is inflexible. So it stops the government from doing things like quantitative easing (money printing), which increases the number of dollars in circulation, and could potentially lay the ground for high inflation. Or so the theory goes.

I’ll be frank: I would like the US to return to a gold standard, but that is NEVER going to happen. So we’re stuck in a world of unlimited quantitative easing (QE) and other Fed funny business.

Which means this is a world where you want to own gold.

Something You Can Rely On

Yes, I think it’s a little weird that people invest in shiny rocks. However, this has been going on for 4 or 5 thousand years. Some people say technology will change that. Yet it keeps happening.

The fact is, gold has maintained its purchasing power over a huge span of history, and that isn’t likely to change.

Over the last 70 years, for example, gold's inflation-adjusted annual return was 2.1%. In other words, gold has held its purchasing power. And that's what it’s supposed to do.

Many investors argue that gold performed poorly at the beginning of the current crisis. Initially, yes, it slipped from around $1,700 per ounce to $1,470 in mid-March. Now it’s back up around $1,700. And it’s likely going higher.

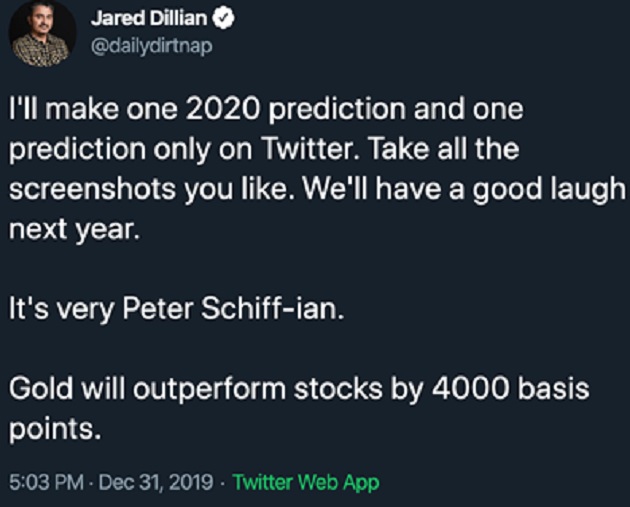

Source: @dailydirtnap

So really, gold has continued to do what it’s supposed to do. It’s performed pretty well. And, given the government’s reckless monetary actions—including its foray into MMT—it’s going to perform well long after the acute phase of this crisis passes.

Inflation Fears Boost Gold

One of the big reasons people buy gold and drive up the price is the fear of inflation. This is why gold shot from roughly $800 per ounce in 2009 to $1,900 in 2011.

The Fed started its very first round of quantitative easing, called QE1, during this period. People thought it would cause a lot of inflation, so they bought a lot of gold.

The inflation never happened, but gold still climbed higher because people feared it was lurking around the corner.

Something similar is happening now. But this time, the Fed isn’t doing a finite amount of quantitative easing like it did with QE1. This time, it’s going to do an infinite amount of quantitative easing.

Once again, people fear this will result in inflation, and reasonably so. I have the same concerns myself.

Gold is bound to keep rising in this environment. Because the Fed can print an infinite number of dollars, but it can’t print gold.

Gold Also Rises During Budget Deficits

The price of gold also goes up when the federal deficits grows, as it’s doing now. This was the other reason gold more than doubled between 2009 and 2011: The government’s annual budget deficit soared into the $1.8 trillion neighborhood.

Now the government is talking about running the biggest deficit in the history of the United States. Even bigger than we had in World War II.

And that bodes well for gold.

The Biggest Reason to Own Gold

Gold has a lot going for it: QE, inflation fears, and a giant budget deficit, to name a few.

However, the biggest reason to own gold is that it smooths out the volatility in your investment portfolio. Add a little bit of gold, and you’ll pretty much get the same overall returns. But you’ll cut your volatility in half.

This is why I encourage my readers to allocate 20% of their investment portfolios to gold.

It’s not about conspiracy theories or other nutty stuff. It’s about better risk-adjusted returns. And that is something to get excited about.

Jared Dillian is an investment strategist at Mauldin Economics and a former head of ETF trading at Lehman Brothers. Subscribe to his weekly investment newsletter, The 10th Man, and listen to his daily radio program, “The Jared Dillian Show.” And follow Jared on Twitter @dailydirtnap. Get Jared's and other thought leaders’ take on the post-coronavirus economy and markets at Mauldin Economics’ first-ever live virtual conference May 11-21. Details here.